Health Insurance Quotes

Content

It made “standalone” HRAs — those that reimburse costs for employees who are not covered by a group health plan — unlawful and assessed them an excise tax of $100 a day per employee. What’s the difference between group health insurance and individual coverage? If you have a business that employs two or more people, you’re eligible to purchase group health insurance for your business.

- This is why many employers opt for a tax-free option, such as a health reimbursement arrangement (for more information, see “How Does an HRA Work?”).

- For small businesses—defined by IRS rules as those with fewer than 50 employees—the QSEHRA offers the flexibility of a health insurance stipend without the tax consequences.

- And unlike a stipend, an HRA reimburses employees only for qualified individual health insurance and medical expenses.

- Employers asking for employee medical records is a HIPAA privacy violation.

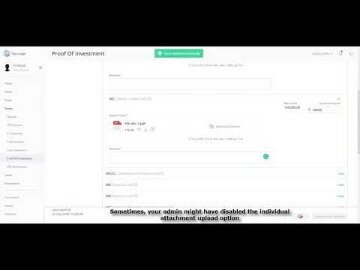

- For reimbursements to be tax-free, employers have to substantiate that employees are using funds to pay for health insurance and medical expenses.

- Employee Privacy – Leveraging an administrator provides a necessary layer of privacy.

And unlike a stipend, an HRA reimburses employees only for qualified individual health insurance and medical expenses. Employee Privacy – Leveraging an administrator provides a necessary layer of privacy. For reimbursements to be tax-free, employers have to substantiate that employees are using funds to pay for health insurance and medical expenses. Employers asking for employee medical records is a HIPAA privacy violation. A common question among small business owners is whether they can offer employees a stipend to help pay for the cost of individual health insurance. Business owners also wonder if a health insurance stipend is a better choice compared to other options, such as a health reimbursement arrangement like the qualified small employer HRA .

Types Of Coverage

A benefit provider is an organization that charges premiums in exchange for health care coverage or other services. From the employee’s perspective, the group benefits provider is often the employer. What is the difference between a Flexible Spending Account and a HRA? Do I have to be enrolled in a Honeywell sponsored health plan to qualify for the HRA incentive? If I am a family member of a Honeywell employee, will I get $500 deposited into an HRA? Can I use the HRA award for any out of pocket medical expense or just the expenses associated with the incentive program? In the past, small businesses and nonprofits have relied on group health insurance to offer employee health benefits.

Examples of traditional benefits include health and dental care, life insurance and retirement savings plans. Unique benefits, on the other hand, consist of education assistance, paid parental leave, telecommuting and more. Employers who succeed in keeping their employees engaged often find the right mix of both types of benefits. Under prior guidance, employers were not permitted to offer HRAs to enable employees to purchase health insurance of their choice in the individual health insurance market. The Departments referred to these arrangements as “stand-alone” HRAs. The Departments were of the view that stand-alone HRAs failed to satisfy certain provisions of the Affordable Care Act , including the “annual dollar limit prohibition” and the “preventive services requirement.”

Choosing a health insurance plan on the individual market is a daunting task, especially if this is new territory for your employees. As an employer, you can provide your employees with tools and information to guide their decision making. Just beware, federal rules prohibit employers from being involved in the actual decision making when it comes to choosing a provider or policy.

Healthcare Reimbursement Arrangements (hra)

This is why many employers opt for a tax-free option, such as a health reimbursement arrangement (for more information, see “How Does an HRA Work?”). For small businesses—defined by IRS rules as those with fewer than 50 employees—the QSEHRA offers the flexibility of a health insurance stipend without the tax consequences.

QSEHRAs can reimburse eligible medical expenses that employees incur, as defined byIRS code 213. This includes the premiums they pay for their health insurance policy bought in the individual market, out-of-pocket medical costs, prescription drugs, and more. However, employers can choose to limit the list of eligible expenses.

Cigna Media Contacts

The business determines the amounts available to each employee monthly for reimbursement of qualified health insurance expenses. The business can offer different allowance amounts to different employees based on family status (self-only or employees with a family).

One of the chief downsides to this approach is that the money is treated as taxable income for the employee. Businesses that provide a health insurance stipend must also pay payroll taxes on reimbursements. One way for small businesses to help workers cover health costs is to offer a health insurance stipend, which is simply extra money in an employee’s paycheck. This stipend is the equivalent of simply grossing up wages—it is a flat amount given to all employees, which they can spend however they choose.

Those reimbursements are tax-free to employees, as long as they maintain minimum essential health insurance coverage while they are receiving QSEHRA payments. The health insurance market has changed dramatically for small businesses in recent years due to provisions outlined in the Affordable Care Act . Benefits tend to fall into two categories – traditional and unique.

The final regulations largely adopted the proposed regulations previously issued on October 23, 2018, making two new types of HRAs available. The first HRA can be used in conjunction with individual market coverage obtained by an employee. The second HRA permits an employer to establish a new type of Excepted Benefits HRA that allows employees to pay for Health Insurance Portability and Accountability Act excepted benefits and short-term coverage. A health insurance stipend is one option among many available to employers looking for alternatives to expensive group health plans. Before choosing a stipend, business owners should familiarize themselves with the tax implications associated with stipends and consider other options, such as the QSEHRA. Health insurance stipends may be straightforward to set up, but the fact that they’re taxable is an understandable downside for many businesses and their employees. More than that, employees may not always associate the stipend with health benefits, which can defeat the purpose of offering the stipend in lieu of a group plan or other arrangement.

Hsa Research Affirms Hsa Owners Are Healthcares Savviest Consumers

Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates . Group Universal Life insurance plans are insured by CGLIC. All insurance policies and group benefit plans contain exclusions and limitations. For availability, costs and complete details of coverage, contact a licensed agent or Cigna sales representative. This website is not intended for residents of New Mexico.

ICHRA is a game-changer for employers looking to provide health benefits to their employees. It represents a new, more modern model of employer-sponsored health insurance. ICHRA (we pronounce it “ick-rah”) stands for “Individual Coverage Health Reimbursement Arrangement” and is available for employers to start using in January 2020. To offer a QSEHRA, employers may not be an Applicable Large Employer . This means they employ less than 50 full-time or full-time equivalent employees and are not subject to ACA coverage requirements. These eligible employers also do not offer group health insurance to any of their employees. Employers can reimburse workers with individual coverage up to $5,150 in health costs in 2019, and those with family coverage up to $10,450.

By pooling employees together, premiums for group health insurance plans can be less expensive than buying individual plans for your employees. Group health insurance is an employee benefit provided by an employer that offers medical coverage to employees and sometimes their spouses, partners and/or legal dependents. An HSA is tax-advantaged medical savings account available to employees with a high deductible health plan. They are owned by the employee but can be funded by both employer or employee. Funds contribution are tax-free and can be used to pay for qualified health care expenses. Administered by employers, FSA’s allow employees to set aside pretax dollars to pay their share of medical insurance expenses not covered by the health plan.

HRAs are account-based group health plans funded solely by employer contributions that are generally used to reimburse certain medical expenses incurred by eligible employees and their dependents. An HRA may be designed to allow amounts not expended in one year to carry over to subsequent years.

However, continual increases in healthcare costs have adversely impacted most businesses’ ability to provide health benefits in the traditional way. Small businesses have been particularly hurt, and many have dropped group health insurance plans because they have become too expensive. Small employers who don’t offer group health coverage to their employees can help employees pay for medical expenses through a Qualified Small Employer Health Reimbursement Arrangement . If your employer offers you a QSEHRA, you can use it to help pay your household’s health care costs for qualifying health coverage. ICHRA has several advantages over traditional group plans that may be appealing to some employers. For instance, the reimbursement model (sometimes called a “defined contribution”) gives employers greater ability to control costs and provides employees with more options to choose from. Health reimbursement arrangements have been popular among small companies because they provide employers a tax break for reimbursing employees’ health care costs and can help control overall health care spending.