How a General Ledger Works With Double-Entry Accounting Along With Examples

Content

Cost centers setup with flexible structure contain unlimited levels. Unlimited sub-codes setup, e.g. customers, suppliers, employees, banks, etc. Create unlimited number of journal types. Simple way to record the journal with a proper control and validation . Ability of recording description per account level and/or per transaction level . Controlling in available work period for transactions insertion or amendment . Setup periodical transactions, then trigger insertion for those transaction in regular basis .

Following the accounting equation, any debit added to a GL account will have a corresponding and equal credit entry in another account, and vice versa. The reconciliation process is a matter of double-checking important accounts. Reconciliation involves checking each account within a general ledger to verify accuracy. The process begins by gathering the information for each account in review, then examining any journal entries which have been made to correct errors in the ledger. Combining machine learning enabled financial processes and real-time recording of transactions, traditional accounting functions such as closing the books can occur in a fraction of the time it used to.

Boss your finances with Sage 50cloud

The net result is that both the increase and the decrease only affect one side of the accounting equation. The general ledger acts as a central depository for accounting information collected from subledgers, for example, stock, cash on hand, accounts receivable, customer deposits, accounts payable, etc. In the event of an audit, balances on financial statements should link back to all of the posted transactions that make up that balance. The income statement will also account for other expenses, such as selling, general and administrative expenses, depreciation, interest, and income taxes. The difference between these inflows and outflows is the company’s net income for the reporting period.

They are sometimes broken down into departments such as sales and service, and related expenses. The expense side of the income statement might be based on GL accounts for interest expenses and advertising expenses. A general ledger is the master set of accounts that summarize all transactions occurring within an entity.

How a General Ledger Functions With Double-Entry Accounting

Other GL accounts summarize transactions for asset categories, such as physical plants and equipment, and liabilities, such as accounts payable, notes or loans. Broadly, the general ledger contains accounts that correspond to the income statement and balance sheet for which they are destined. In a computerized system, the general ledger will be an electronic file of all the needed accounts.

The general ledger also contains information used to calculate the financial performance of an organization. Understanding an organization’s finances is essential for creating budgets and business strategies, as well as for assessing the financial health of a business. For many people, the idea of a general ledger might conjure up images of visor-wearing accountants wielding quill-and-ink pens, scribbling numbers and notes in large, dusty parchment books. While many fundamentals of the general ledger remain intact more than 500 years after it was established as a cornerstone of modern accounting, technology has moved it light-years into the future.

How to use the right performance metrics to make business decisions

The debit and credit accounts are then totaled to verify that the two are equal. If they aren’t, the accountant looks for errors in the accounts and journals. These transactions can include cash payments against an invoice and their totals, which are posted in corresponding accounts in the general ledger. In accounting software, the transactions will instead typically be recorded in subledgers or modules.

A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. Transactions are posted to individual sub-ledger accounts, as defined by the company’s chart of accounts. That means the financial information, as well as the more detailed journal entries that feed into it, provide a picture of the past. A general ledger can have any number of subledgers, sometimes also known as journals.

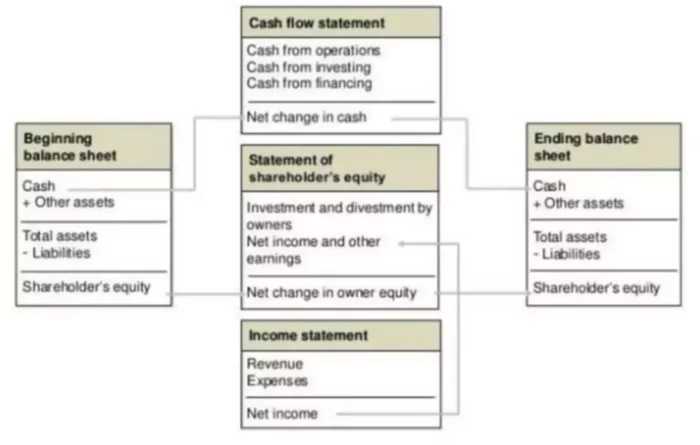

Periodically, all transactions made within a company are posted to the general ledger. Since the GL is comprised of a company’s total financial accounts, it is instrumental in the preparation of key financial reporting documents such as the balance sheet and income statement. The transaction details contained in the general ledger are compiled and summarized at various levels to produce a trial balance, income statement, balance sheet, statement of cash flows, and many other financial reports. This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis.

Instead, they show actual amounts spent or received and not merely projected in a budget. Provide best value to our customers through robust and reliable systems enhance our customers business operation and increase their profitability. What worked well in the past might not serve the business needs of the future. With its focus on past transactions, the information in a general ledger often reflects a point in time (month-end, quarter-end, or year-end). The timing of when information is posted to the general ledger and when the information is reported represents what “has” already happened and limits insight into what’s happening now or what might happen.

For example, a CPA might use a T-account — named because of its physical layout in the shape of a T — to track just the debits and credits in a particular general ledger account. As the finance function continues to evolve in a rapidly changing world, technology has enabled businesses to expect more from their data and far beyond what the general ledger can provide. For instance, the purchase of a $2,000 computer would increase the business’s assets by $2,000 while decreasing its cash position by the same amount. The earliest known accounting records date back more than 7,000 years to Mesopotamia, where traders developed a way to track the exchange of goods and services. Here is an example of an accounting system transaction within a general ledger for a fictional account, ABCDEFGH Software. While the above accounts appear in every general ledger, other accounts may be used to track special categories, perform useful calculations and summarize groups of accounts.

It holds all the data needed to prepare periodic financial statements—such as balance sheets, income statements, cash-flow statements, and other financial reports—on a monthly, quarterly, or annual basis. A general ledger represents the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. It provides a record of each financial transaction that takes place during the life of an operating company and holds account information that is needed to prepare the company’s financial statements. Transaction data is segregated, by type, into accounts for assets, liabilities, owners’ equity, revenues, and expenses. Chart of account setup with flexible structure contain unlimited levels.

An Income Statement Transaction Example

In the latter case, a person researching an issue in the financial statements must refer back to the subsidiary ledger to find information about the original transaction. The general ledger is usually printed and stored in an organization’s year-end book, which serves as the annual archive of its business transactions. Under the double entry system of accounting and bookkeeping, every business transaction will affect two (or more) general ledger accounts. In addition, each transaction’s debit amount(s) must be equal to its credit amounts. As a result, the general ledger is expected to have the total amount of debits equal to the total amount of credits. Further, when the account balances are listed on a trial balance, the totals should be equal.

- With journal corrections in mind, balances in the general leger are compared against financial data, such as bank statements.

- A general ledger is the system of record for an organization’s financial transactions, whether it’s maintained on paper, on a computer, or in the cloud.

- Organizations may instead employ one or more spreadsheets for their ledgers, including the general ledger, or may utilize specialized software to automate ledger entry and handling.

- Transactions in a subledger are periodically recorded in the general ledger.

- Periodically, all transactions made within a company are posted to the general ledger.

- For example, the GL code for an accounts receivable might be account #105.

The income statement follows its own formula, which works as follows. When a company receives payment from a client for the sale of a product, the cash received is tabulated in net sales along with the receipts from other sales and returns. The cost of sales is subtracted from that sum to yield the gross profit for that reporting period. To maintain the accounting equation’s net-zero difference, one asset account must increase while another decreases by the same amount. The new balance for the cash account, after the net change from the transaction, will then be reflected in the balance category. However, in recent decades they have been automated using enterprise accounting software and in enterprise resource planning applications.

However, a separate ledger for the company’s accounts receivable will reflect a credit reduction for the same amount, because ABCDEFGH Software no longer has that amount receivable from its client. In this example, the transaction is for a cash payment from a client account to ABCDEFGH Software. Since the cash account is receiving income, then the debit column will show an increase and display a sum for the amount. A company may opt to store its general ledger using blockchain technology, which can prevent fraudulent accounting transactions and preserve the ledger’s data integrity.

Organizations may instead employ one or more spreadsheets for their ledgers, including the general ledger, or may utilize specialized software to automate ledger entry and handling. When a business uses enterprise resource planning (ERP) software, a financial-features module produces subledgers and the general ledger, with entries drawn from a database that is shared with other processes managed through the ERP. Companies use a general ledger reconciliation process to find and correct such errors in the accounting records. In some areas of accounting and finance, blockchain technology is used in the reconciliation process to make it faster and cheaper. In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200.

The general ledger should include the date, description and balance or total amount for each account. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

A Balance Sheet Transaction Example

During the bookkeeping process, other records outside the general ledger, called journals or daybooks, are used for the daily recording of transactions. The general journal consists of the accounting entries for each business transaction that occurred in order by date. Consider the following example where a company receives a $1,000 payment from a client for its services.