How do I enter a bank adjustment?

Content

It is applied as a percentage on top of the base exchange rate, which is calculated as the average exchange rate for the previous three months. Due to this added charge, shippers are now looking to enter into “all-inclusive” contracts at one price, that accounts for all applicable charges, to limit the effect of the CAF. You can record a journal entry to correct the check amount when there is a bank error and the bank will not correct it. When Joe receives the bank statement for the next month, he will see a credit for the check amount.

The bank tells Joe that they will correct the check amount and the corrected check amount will show up on the next bank statement. Adjustment may also refer to a fee charged by U.S. international shippers to cover potential losses from exchange rate volatility involved in international trade. The term may also be used in reference to variable-rate mortgages, where the rate is adjusted periodically, as in the case of ARMs. The adjustment frequency would set this period, for example with a 5/1 ARM, the first five years are fixed but then have a variable rate that adjusts annually.

Santander Bank

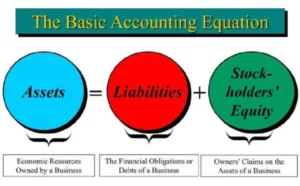

Joe marks the credit as cleared because it was entered as a bank adjustment in the previous month. Because the central bank intervenes in the home currency’s exchange rate to reduce short-term fluctuations, this is considered a managed floating exchange rate. An adjustment is the use of mechanisms by a central bank to influence a home currency’s exchange rate. An adjustment is specifically made if the exchange rate is not pegged to another currency, meaning that the currency is valued according to a floating exchange rate. For example, the bank clears a check for a different amount then the check amount that’s recorded in Connect. Joe from City XYZ finds the error and calls the bank.

A bank adjustment records an entry to correct an error on the bank statement. Before you use a bank adjustment, you will need to contact the bank to confirm the error. The “CAF,” as it may appear on a shipping invoice, varies according to the destination country. For example, if the “basic ocean freight” rate for a particular shipment to, say, Peru is $15,000 and the CAF rate for Peru is 6 percent, then the CAF for the shipment will be $900. The rates are designed to even out fluctuations in exchange rates.

What does mobile deposit adjustment mean?

When reconciling a bank account, it is sometimes necessary to adjust the cash balance in the GL due to adjustments provided by the bank. For example, your company may need to post bank service charges, interest income, check printing charges, and so on. Inconsistent adjustment policies in terms of an exchange rate mechanism (ERM) result in uncertainty on the part of investors and is referred to as a “dirty” managed exchange rate policy. A manual adjustment is a debit or credit that was completed to correct an account transaction that was processed in error. Connect will use the bank adjustment to adjust the proof. Follow these instructions when the bank will correct an amount.

- When Joe receives the bank statement for the next month, he will see a credit for the check amount.

- Adjustment may also refer to a fee charged by U.S. international shippers to cover potential losses from exchange rate volatility involved in international trade.

- For example, your company may need to post bank service charges, interest income, check printing charges, and so on.

- An adjustment is specifically made if the exchange rate is not pegged to another currency, meaning that the currency is valued according to a floating exchange rate.

- For American shippers, the currency adjustment factor rises as the value of the U.S. dollar falls.

- It is applied as a percentage on top of the base exchange rate, which is calculated as the average exchange rate for the previous three months.

Sometimes, the CAF will provide more money than the shipper really needs, sometimes less. The CAF was established to deal with volatile fluctuations between the exchange rates of Pacific Rim countries and U.S. exporters, which led to currency losses for shippers. The CAF was imposed as a sort of insurance to cover the potential for such future losses. For American shippers, the currency adjustment factor rises as the value of the U.S. dollar falls.