How Do You Calculate Operating Income?

Content

The company saw operating income rise by 37%, when compared with the same period in the previous year. While Company Red’s first-quarter sales did fall by 3%, its operating income growth could potentially give Company Blue shareholders confidence in voting to merge the two companies. However, Linda needed to pay $700,000 for inventory and hourly staff. This was her cost of goods sold, which left her with a gross profit of $300,000.

Thus, Bill analyzes his accounting system and discovers that he sold $200,000 of subs during the year and had the following expenses. Operating income is used to measure the efficiency of the company. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

Can EBIT be negative?

A positive EBITDA means that the company is profitable at an operating level: it sells its products higher than they cost to make. At the opposite, a negative EBITDA means that the company is facing some operational difficulties or that it is poorly managed.

Even in the same industry, one business owner may classify certain expenses as everyday expenses, while another might classify them differently. Operating income, operating profit, and earnings before interest and taxes are all terms that relate to the earnings of a business. These terms are sometimes used interchangeably as they generally refer to the same concept, though there are slight differences in how each of these terms may be interpreted. To get an accurate amount on the bottom line, it’s important to keep records of all sales and expenses and create income statements for each period. Operating income is equal to the amount of revenue earned by the business minus operating expenses. Net income is also referred to as net profit, net earnings, net income after taxes and the bottom line—because it appears at the bottom of the income statement. A negative net income—when expenses exceed revenue—is called a net loss.

Where Would I Find A Company’s Operating Income?

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Some small businesses start tracking expenses and revenue with a simple spreadsheet—but even small businesses and startups can benefit from business accounting software. And there are multiple important metrics you should track that can offer valuable insight. But perhaps the most important is net income, which indicates whether your company has made a profit. But it’s more complicated to calculate than just looking at your bank account balance.

How Do You Calculate Percent Change In Operating Income?

Operating income reports the amount of profit realized from a business’s ongoing operations. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Kiran Aditham has over 15 years of journalism experience and is an expert on small business and careers. Full BioKristen works as a freelance writer for The Balance covering small business topics and terms pertaining to entrepreneurship, business finance, and more. With a background in business, marketing, SEO, and news media, Kristen has experience in management at a Fortune 100 company and writing and editing content for education, news, and business websites. Management is well aware of this fact and can try to fraudulently change the ratio by accelerating revenue recognition or delaying the recognition of expenses.

Operating expenses include direct and indirect costs incurred from running the business such as rent, utilities, inventory, and wages paid to employees. And total revenue minus company paid the cost which can be direct cost or indirect cost to result in operating income.

Learn The Difference Between Gross Margin And Operating Margin

Operating income excludes items such as investments in other firms (non-operating income), taxes, and interest expenses. In addition, nonrecurring items, such as cash paid for a lawsuit settlement, are not included. Operating income is required to calculate theoperating margin, which describes a company’s operating efficiency. Here’s an example of a net income calculation for ABYZ Candy Co. The cost of manufacturing the candy during the period was $39,500, leaving a gross income of $35,500. The company’s operating expenses came to $12,500, resulting in operating income of $23,000. Then ABYZ subtracted $1,500 in interest expense and added $1,700 in interest income, yielding a net income before taxes of $23,200.

If you’re looking to sell your company, then download the free Top 10 Destroyers of Value whitepaper to learn how to maximize your value. Below is an income statement of the company for three years to calculate the Operating Income. Also, EBIT is not an official GAAP measure while operating income is an official GAAP measure. Divide this number by last year’s operating income and multiply by 100.

Operating Expenses

Operating income measures a business’s income from core operations. It’s calculated by subtracting operating costs from gross income. These costs include the salaries of sales and administration personnel, investments in marketing, office space and other expenses required to run the business that are not included in COGS. Operating income excludes non-operating expenses, such as capital expenditures, interest payments and taxes. The amount of profit a business makes after considering all expenses from operating the business is known as operating income. It is the income reported after the total operating expenses are subtracted from revenue, which is the total income a business earns from sales and non-sales activities such as investments.

One of the overall advantages of using operating income over other financial ratios is in the simplicity and standardization of calculation. Though interest and taxes play an important role in the financial health of a company they do not, generally, make or break the model for success. When evaluating operating income vs net income, ask whether you need a measurement of company operations as a whole or company operations as they lead to profit.

Relevance And Uses Of Operating Income Formula

In fact, many investors consider operating income to be a more reliable measure of profits than net income (bottom-line profits). Operating income is also called income from operations or operating profit. However, it’s important to note that the labor and materials costs for some industries are higher than others. This is why it’s meaningful to compare the operating income among companies within the same industry. To calculate the percent change in the operating income, will need income statements for the current year and prior year. Now that we have the information, the first step in calculating operating income is to calculate gross income.

The cost of goods sold is also called direct or variable cost because it depends on how much the company produces. Operating expenses are termed fixed or indirect costs because they don’t change strictly based on the company’s output. Operating income is the amount of profit a company has after paying for all expenses related to its core operations. In the current year, business XYZ earned total sales revenues of $200,000. For that period, the cost of goods sold was $40,000, rent was $12,000, insurance was $10,000 and wages was $60,000. The example below highlights how to find and calculate operating income using the income statement for Apple . In another example, we have Company Red, which reports financial results for the first quarter of its fiscal year.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Operating income is recorded on the income statement, and can be found toward the bottom of the statement as its own line item. It should appear next to non-operating income, helping investors to distinguish between the two and recognize which income came from what sources.

Net Income And Business Taxes

It’s important to dig deeper, and examining your operating income on a regular basis helps to shed more light on the overall health of your business. Operating income is the amount of income a company generates from its core operations, meaning it excludes any income and expenses not directly tied to the core business. On an income statement, the operating income is listed after all sales and expenses are calculated. Net income is the first line in the company’s cash flow statement. To calculate EBIT, expenses (e.g. the cost of goods sold, selling and administrative expenses) are subtracted from revenues.

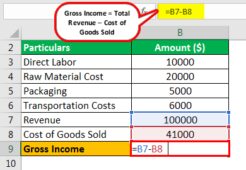

It’s calculated by subtracting the cost of goods sold from the revenue. The operating income is a profitability formula that calculates profits derived from the core business activities. It does not include other income expenses not directly related to the core business operations. Operating income is calculated by deducting operating expenses, such as wages and depreciation, and the cost of goods sold from the gross income.

Revenue is the amount made from sales and services, usually in the form of payments from clients or customers. Operating income is the amount from the revenue after the operating expenses are considered.

- Operating income is calculated by subtracting operating expenses from a company’s gross income.

- But for those that have large incomes or losses from the “other” category, the differences can be substantial.

- Many of these “other” non-operating expenses are outside of a company’s control, and some of them are one-off items that have nothing to do with day-to-day operations.

- Operating income is the amount from the revenue after the operating expenses are considered.

- Regardless of how you classify your business expenses, it’s important to understand how operating income is calculated.

That’s because Berkshire holds a lot of stock in other companies, and the net income is affected by temporary price swings in their stock holdings. Investopedia requires writers to use primary sources to support their work.

The step-by-step plan to get the most value out of your company when you sell. The first thing to do is to identify “destroyers” that can impact your company’s value. Investors and creditors can use this section to evaluate how well the company is doing as well as forecast future performance. Stock Analysis Pro Unlimited access to all our financial data with up to 30 years of history. But for those that have large incomes or losses from the “other” category, the differences can be substantial.

What is Operating Profit Class 11?

Operating profit = Net sales – Operating cost. OR. = Gross Profit – (Office and Administrative Expenses + selling and distribution exp.) Operating Cost = Cost of Goods Sold + Office and Administrative Expenses + Selling and distribution exp.

For example, if your sales for the period totaled $570,000 and your recurring, everyday expenses incurred for running the business was $250,000, then your operating income would be $320,000. Operating income is total revenue minus direct costs minus indirect costs. This formula is used when direct cost and indirect cost is available for the company. When gross profit, operating income, and net income are listed as a percentage of revenue, they are termed gross margin, operating margin, and profit margin. Many analysts and investors pay close attention to operating income and how it changes over time. If it increases, it means that the company is making more money from the core business. Looking at total revenue or the “bottom line” of your income statement alone isn’t enough for most business owners.

It is also one of the most common financial ratios used for valuing a company as a whole. Therefore, it is very valuable, as well, as a measure of the success of a company from period to period. Additionally, it is the measure of the ability of a company to cover costs and make profit. Operating income ratios leaves out interest and taxes, so it does not serve as a net value of the wealth created from a business.

The results of this analysis are subject to manipulation, since a property owner could elect to accelerate or defer certain expenditures, thereby altering the amount of net operating income. Operating Income is the sum of net earnings, interest expense, and taxes. This formula is used when net earnings of the company are available along with interest expense and the tax levied on the company and paid by the company. In some cases, looking at operating income as a percentage of revenue is easier to understand than just looking at the straight dollar figure. When tracking your business’s financial health, there are many financial reports that your business should review. Operating income is one of those numbers you should be calculating. Income from operations is a company’s earnings before factoring of interest, taxes and the sales or purchases or any assets.

How Do You Calculate Net Income?

Investors and creditors also follow this number very closely because it gives them an idea of the future scalability of the company. For instance, a positive trending operating profit can indicate that there is more room for the company to grow in the industry. Depreciation and amortization are often included in this list and always used in the operating income equation. Keep in mind that just because a business shows a profit on the bottom line for the year doesn’t mean the business is healthy. For instance, a business might be losing customers and downsizing. As a result, they are liquidating their equipment and realizing huge gains. The core activities are losing money, but equipment sales are making money.