How do you calculate the payroll accrual?

Businesses that offer employees defined vacation and sick time need to track how much they’d walk away with if they left the company. With every payroll accrual, update how much your employee earned in vacation and sick time. Every time you pay employees, you and your employee both owe Uncle Sam. Your business and its employees might also contribute to employee health and retirement plans. She said, “I’ve got red in my ledger.” Though she might be talking about having blood on her hands from being a double agent, she’s referring to accrued expenses. In accounting, when you owe someone money — including your employees — you record it in your books.

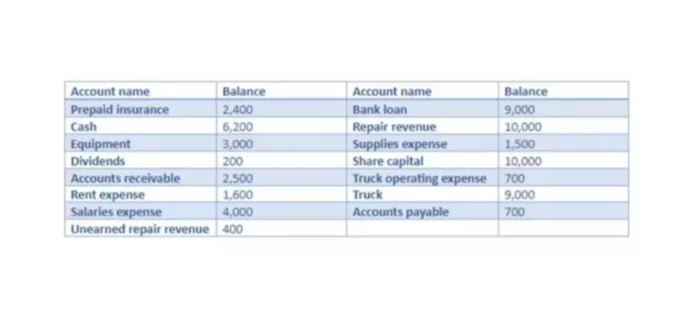

With a well-organized system for income statements, taxes, insurance, etc., it is possible for small businesses to stay on track. This way, the management can draw up a budget for other projects and investments with confidence, because they don’t have to worry about pending payroll liabilities. The information on how much the company has accrued in payroll costs is also important when creating a balance sheet, as shown in the example above. Businesses that don’t keep track of their payroll liabilities risk being surprised by an unexpectedly high payroll sum at the end of the payroll run.

The pay period runs Wednesday through Tuesday, with payday falling on the Friday of the same week. The business has five employees, each of whom has an hourly wage of $20. Record employer-paid payroll taxes, such as the employer’s portion of FICA, FUTA, and SUTA. As I mentioned, I don’t owe FUTA and SUTA on Susie’s wages since I’m accruing payroll at the end of the year, after she’s earned more than $7,000 for the year. You’ll notice I’m not accruing anything for FUTA and SUTA, two employer-paid payroll taxes.

Overtime usually needs to be compensated with a wage supplement, which is why pay for additional hours needs to be calculated separately. Once you’ve calculated overtime pay, you can add this to the sum of what you owe your employee. At my company, full-time employees earn four hours — one half-day — in PTO with every weekly paycheck.

Medicare Tax

Divide the totals by the number of days in the period (either 10 or 14) to find the estimated daily cost. Be sure to confirm whether or not weekends should be included in the calculations. Be sure that you add together only the hours that they’ve worked that they have not been paid for. That way, they know when to expect a paycheck, and you know the period to calculate their pay for. Plus, most states have a required pay frequency—make sure you’re familiar with these laws. If your employees received any bonuses, commission, or other forms of payment in addition to your usual wage expense, it’s smart to record it too.

This differs from cash accounting, which only takes into account money that has actually come in or actually gone out when updating a general ledger. Accrued payroll is the process in which the amount of money a business owes or is owed accumulates over time. For example, you may have heard of accrual accounting, which differs from cash accounting.

Training Pay

If any bonuses, cash prizes, or commissions were awarded to employees immediately, then these will not be counted in accrued payroll. It’s smart to keep a close eye on the payroll expenses that have accrued over a pay period, even if the checks haven’t gone out yet. That way, no matter when in the month it is, you know where your payroll situation stands, and you won’t be blindsided by unexpected expenses later. When an accountant records accrued salaries and salary expenses into a general ledger, this is called a journal entry. He’s paid once a month (payday comes on the last workday of the month) and works 40 hours per week, five days a week.

The accruing payroll methodology tells you to record compensation in the accounting period — a month or year — it’s earned, even when it’s not paid until the next period. Using timeclock data, it is possible to calculate the actual amounts that will be recorded when payroll is processed the following month. Thursday and Friday may be spent collecting the time and attendance information, calculating what the gross pay would be, and preparing the November accrual entries. Just like earnings, deductions may need to be accrued for financial purposes as well.

Joining the American Payroll Association (APA) and getting her CPP certification in 2011, Christine has thrown herself head-first into volunteering for the APA at the local, state and national levels. For those of us who are not accountants, not part of the finance team, and don’t create journal entries on a regular basis, accruals can be a difficult concept. Accrued payroll shows the amount of money due for employees and independent contractors, which helps decision-makers set the course of action regarding company spending. If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. You can avoid accruing vacation and sick time — and paying departing employees for unused time off — by adopting an unlimited PTO policy.

Biweekly Pay

If there is an amount to be paid to an employee in a future month, the amount, or pro-rated parts of the amount, needs to be recorded on the financial statements as an expense in the month it was awarded. Since payroll can account for up to 30% of a company’s total expenses, precise accounting is necessary for accurate financial forecasting and decision-making. As the employer, payroll tax expenses and the withholding amounts are your responsibility. It’s essential to account for payroll taxes in order to remain in compliance with the IRS.

- Be sure to confirm whether or not weekends should be included in the calculations.

- Only businesses that follow the accrual method of accounting need to accrue payroll on their books.

- When there is an amount to be paid to an employee on a future date, i.e. a retention bonus, the amount needs to be recorded on the financial statements as an expense in the month it was awarded.

- In most countries of the world, social security contributions are shared between employee and employer.

- In accounting, when you owe someone money — including your employees — you record it in your books.

- After all, you still owe this to your employee, so it’s still part of the accrued liabilities that your business has on record.

Or, if you’re new to managing employees, read up on how to do payroll. To illustrate the example, let’s say you have an employee named B.B. Finally, record the amount put aside for the paid leave your employee accrued during the pay period. Unless your company lets employees roll PTO days into the new year, you need to reverse the accrual at the end of the year with an adjusting entry. Businesses with a use-it-or-lose-it policy start every January with a clean slate because they’re no longer responsible for paying out PTO. Accrued payroll helps business owners and payroll managers to think in terms of “what do we owe?

Types of accrued payroll

QuickBooks Payroll makes managing payroll accounting easier for everyone from small business owners to larger-scale organizations. Sign up today to see how you can get started managing employee payroll for your enterprise with much more efficiency. First is the employee-paid taxes, which come out of your employee’s paycheck.

The retailer will accomplish this by preparing an accrual adjusting entry dated as of December 31. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

Step 1: Determine Your Basis

Lastly, be sure to add the total amount that you offer your employees in monthly PTO to your accrued payroll costs. Because you are accounting for accrued payroll—rather than payroll that’s been paid out—PTO that hasn’t been used yet still counts. After all, you still owe this to your employee, so it’s still part of the accrued liabilities that your business has on record. You may wonder why it’s important to account for paid time off in accrued payroll.

From a financial perspective, it is better to have twelve months of $1,000 in expenses than to have one month with $12K in expenses at the very end of the year. With every month they work for you, your employees earn a certain amount of paid time off, for example 2 days for each month worked. Labor costs can account for up to 70% of a business’s overall operating expenses, a major part being direct payroll costs. Since payroll has a significant impact on an organization’s cash flow, it’s crucial to keep track of payroll expenses as they accrue over the course of a pay period.

Employee Time Clock

Under the cash method of accounting, you record transactions when cash enters or leaves your business. The more precise accrual accounting method has you record transactions when you earn revenue and incur expenses, not necessarily when cash flows. Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out. It is one of the ways that a business can track its expenses over time to help plan ahead, better understand its liabilities, and forecast financial planning into the future.