How To Do Payroll 2020

Content

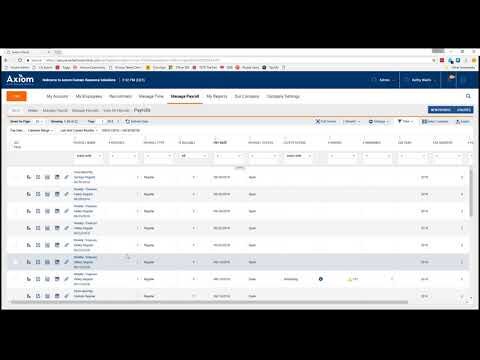

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. While you should already have a business bank account set up, it’s a good idea to open a second account for payroll and payroll taxes. This is the account that your employees would get paid from whether they have direct deposit or you pay them with a check. One of your responsibilities as an employer is to pay unemployment taxes so that employees may have unemployment benefits if they are terminated from employment.

Taxes withheld on those payments must also be reported. You also need to pay federal unemployment tax for each employee. The official rate is 6 percent of an employee’s wages, up to $7,000 a year. To partially offset this amount, however, you get a credit for whatever you’ve already paid for state unemployment. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered.

By Jan. 31, all individuals who received unemployment benefits during 2020 should receive an IRS Form 1099-G from the Division of Employment Security. This statement reports the total amount of benefits paid to the claimant in the previous calendar year for tax purposes. All claimants are notified by DES when filing a claim that unemployment benefits are taxable income and must be reported on federal and state tax returns. Claimants may elect to have state and/or federal taxes withheld from their benefit payments. 1099-G forms will be delivered by Jan. 31 to claimants by mail or email, as preferred by the claimant, and will also be available to download through their DES online account.

Check this month-by-month payroll tax calendar for the current year’s due dates. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible. These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date.

It’s up to your business to calculate employer-paid taxes and send the appropriate amounts to federal, state and local governments. When you send in a payment, keep an eye on your bank account to make sure it’s been received.

Go to the Reports tab, select Misc Reports and click Employee Summary. In the fourth quarter, before December 31, you must update missing totals for your employees and run any bonus payrolls. If you have to run an Off-Cycle Payroll after the last day of the quarter, government agencies may charge you with penalties and interest based on their deposit and filing deadlines for taxes. They will not have full visibility of their SSN/TIN once their tax forms are printed and distributed. Step-by-step Guided Walk Throughs are available in the RUN platform to assist you with recording manual checks using our Calculate Checks tool; reporting third party sick pay; and maxing out retirement. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checks, Enter Third Party Sick PayORMaxing Out Retirementto begin the Guided Walk Through. Go to Reports tab, select Misc Reports and click Employee Summary.

Go to the Reports tab, click on Misc Reports and select Employee Summary. SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC. This includes copies that are provided to employees to report third party sick pay and group-term life insurance. In 2021, employers with 500 or fewer employees during 2019 may elect to receive an advance payment of the credit in an amount up to 70 percent of the average quarterly wages paid by the employer in 2019.

Employment insurance taxes are collected by the IRS and by states, who distribute unemployment benefits to former employees. Private-sector employers may be eligible for a refundable tax credit against federal employment taxes for “qualified wages” paid by employers to employees during the COVID-19 crisis.

Who Pays Unemployment Taxes?

There is no income limit for Medicare tax, so it applies to all of an employee’s wages. When you hire employees, you need to pay several taxes on their behalf.

The IRS says FUTA taxes are calculated on employee “wages,” but this is vague. FUTA tax calculations are most payments to employees, but there are many exceptions. Mileage reimbursements, insurance premiums, and other fringe benefits are not included in FUTA tax.

Below is a high-level summary of the provisions related to small business assistance, tax, retirement, paid leave, unemployment insurance, and direct payment to individuals. Small businesses should work with an experienced financial advisor to carefully assess available assistance programs to determine the interplay and best option for their specific circumstances. Be sure to report any changes with your first payroll of 2021. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification.

Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through. They will not have full visibilityof their SSN/TIN once their tax forms are printed and distributed. View your employees’ year-to-date earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform.

Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name. Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. State unemployment taxes are complicated, and each state’s laws are different. This article is a general overview, not detailed information on Form 940. Get help from a payroll service or from a tax professional to complete this form.

Duration Of State Unemployment Insurance Benefits

Keeping track of all the employer-paid taxes for payroll isn’t easy, and you might not realize you’ve missed one until you get hit with a government penalty. If so, you may want to consider using payroll software to manage payroll, track taxes, and pay your employees. Your EIN is used to pay federal income taxes, while your state ID is used for state taxes, unemployment taxes, and to provide your state with new employee information.

As ADP® files your taxes, you should process these payrolls at least 48 hours before the check date, to allow ADP enough time to debit and deposit the tax amounts timely. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party.

Click here for a list of fringe benefit earnings and where they appear on your employees’ W-2s. Social Security taxes are split between employers and employees, with each party owing 6.2 percent of an employee’s wages. Deduct what your employees owe from their paychecks as part of payroll. The standard FUTA tax rate is 6% on the first $7,000 of an employee’s wages subject to FUTA tax. This 6% is then reduced by up to 5.4% to give a credit to the state where you do business for the state’s unemployment taxes. So the federal FUTA tax after the credit is applied is 0.6%.

Federal And State Payroll Tax Forms Download

Your rate depends on your state and the turnover at your business. An additional 0.9 percent Medicare tax applies to high earners, paid only by employees. It kicks in once an employee has earned $200,000 in wages for the year. So for any wages above $200,000, the employee owes an extra 0.9 percent for Medicare. You do not pay anything for this extra tax but must withhold it from employee’s wages. Medicare taxes are also split between employees and employers. You both owe 1.45 percent on every dollar an employee earns.

Your business will need to set aside an amount each payday and pay the tax when due. You must also submit an annual report on the amounts of unemployment tax due and paid. Employees do not have to pay unemployment tax; businesses pay the tax based on the gross pay of employees each payday.

What You Will Need To Complete Form 940

The CARES Act increases the maximum loan amount for SBA Express loans from $350,000 to $1,000,000, until December 31, 2020. The CARES Act also reduces the cost of participation in the program by providing fee waivers, an automatic deferment of payments for up to one year, and no prepayment penalties. The Coronavirus Aid, Relief, and Economic Security Act (H.R. 748, “CARES Act”) was signed into law on March 27, 2020. The CARES Act is the third stimulus bill aimed at providing relief to employers and individuals affected by COVID-19.

Form 940 is due on January 31 each year for the previous year. If the amount of federal unemployment tax due for the year has been paid, the Form 940 due date is February 10 to file. If either of these dates is a holiday or weekend, you have until the next business day to file.

The tax credit was set to apply to qualified wages paid after March 12, 2020, and before January 1, 2021. However, the Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed by President Trump on December 27, 2020, extends the tax credit to cover qualified wages paid through June 30, 2021. Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. The benefit is subject to taxes and must be reported on the employee’s W-2.

- All claimants are notified by DES when filing a claim that unemployment benefits are taxable income and must be reported on federal and state tax returns.

- By Jan. 31, all individuals who received unemployment benefits during 2020 should receive an IRS Form 1099-G from the Division of Employment Security.

- This statement reports the total amount of benefits paid to the claimant in the previous calendar year for tax purposes.

- Claimants may elect to have state and/or federal taxes withheld from their benefit payments.

- 1099-G forms will be delivered by Jan. 31 to claimants by mail or email, as preferred by the claimant, and will also be available to download through their DES online account.

This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes.

If your check is lost in the mail, the government will count your taxes as unpaid. Every state requires you to pay unemployment taxes for each employee to support the state’s unemployment fund.

How To Process And Run Your Own Payroll

Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year. View your employees’ 2020 earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform.

They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right. Part 3 of Form 940 calculates adjustments for state unemployment taxes including credit reductions. If you paid into one or more eligible state unemployment funds, you should adjust the amount owed to federal unemployment. Payroll adjustments never use rates defined in the employee record, earnings code, job rate, or other areas of the application.