How To Find & Calculate Adp 401 2020

Content

Traditional pensions are defined-benefit plans in which a company contributes a defined amount to an employee’s retirement. But through the years, more and more employers have decided to shift the employees’retirement savings and risk to the employees themselves. Some plans include “traditional” after-tax contributions by employees. This feature dates back several decades and is different from the Roth feature. Very few plans offer it, but for those that do, any such after-tax contributions must be added to the company match when performing the ACP test. The great thing about a 401 plan from American Funds is that it can be tailored to fit almost any type of business, from start-ups to mergers to well-established entities.

When it comes to their 401k offerings, employers have several plans to choose from. Fidelity, one of the top mutual-fund management companies, frequently administers 401 plans for major corporations. It offers consultants to help business owners choose a plan, and provides access for employees and owners via the internet once the plan is established. The company also offers, like many, a mobile app that allows employees to monitor individual accounts.

Adp Encourages Payroll Integration

SIMPLE IRA and SEP are offered through ADP Broker-Dealer, Inc. , Member FINRA, an affiliate of ADP, Inc, One ADP Blvd, Roseland, NJ 07068. Only registered representatives of ADPBD may offer and sell such retirement products and services or speak to retirement plan features and/or investment options available in any ADP retirement product. Fidelity Investment is a privately-owned company and a competitive 401 plan provider. It offers a variety of consulting services including plan administration, record-keeping services, trading advisement services, and investment advisory services. The plans administered by Fidelity Investments are ideal for public and private companies with more than 20 employees. For employers looking for a full array of services (plan administration, record-keeping, mutual fund expense ratios), Fidelity Investment is a good choice to consider.

SPS affiliates may also receive fees paid by manufacturers or distributors of the investment options included in this product in connection to other professional services provided by the applicable SPS affiliate. The advice provided by SPS is in no way related or contingent upon the payment received for these other services. SPS and its affiliates do not offer investment, tax or legal advice to individuals. SPS is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any plan beneficiaries. It is strongly suggested that any prospective client obtain independent advice in relation to any investment, financial, legal, tax, accounting or regulatory issues discussed herein.

For an employer with 1,000 employees or less, the company’s 401 plans are worth considering. Like Paychex, ADP is another 401 provider offering combined services for small employers including administration services, payroll, HR, insurance, and tax filing. ADP’s 401 plans specialize in companies with one to 49 employees. Also, employers who switch from another provider to ADP have the option of letting employees transfer their existing plans as well. According to Schwab, this saves about 60% to 85% of operating expenses. The plans have no annual fees, and participants get full access to all of Schwab’s brokerage and banking services.

ADP offers numerous plans for small businesses, and also handles all the annual compliance tests with the IRS and the Department of Labor. If you choose to use ADP for your payroll as well, the integration with its 401 plan is seamless. Plans have tax-deferred growth potential and contributions are tax-deductible. Employers may choose to match contributions and participants loans are available. In addition, communication and education programs are available to help employees make the best retirement plan choices. Those choices for 401 plans include mutual funds, ETFs, stocks, bonds, and target date funds.

American Funds:

When considering which 401 plan provider to choose, employers have several factors to take into consideration including funding options, customer service, financial stability, and financial structure of the company. Small business 401 plans are tailored to meet the specific needs unique to small business owners and their employees. Whether your business is a sole proprietorship, corporation, Limited Liability Company or a partnership, there is a 401 plan available for you to help provide affordable retirement solutions to your employees. Investment options are available through the applicable entity for each retirement product. Nothing in these materials is intended to be, nor should be construed as, advice or a recommendation for a particular situation or plan. Registered representatives of ADP Broker-Dealer, Inc. do not offer investment, tax or legal advice to individuals.

American Funds has more than 360, plans available including traditional IRA, Roth IRA, individual mutual funds and objective-focused mutual funds. These plans offer many of the same benefits as a traditional 401 including tax-deferred growth and tax-deductible contributions.

The Adp 401k Doesnt Have Set Pricing

Not many names come with as much recognition with the retirement planning industry as Charles Schwab. Charles Schwab offers Index Advantage 401 plans with low administrative costs, as well as some ETF options. This program comes with advisor services and also has an interest-bearing feature through the Schwab Bank. Plans have no annual fees and employees will enjoy full access to all of Charles Schwab’s brokerage and banking services. As the administrator and record-keeper, ADP provides documents related to the plan and prepares IRS Form 5500 for tax filings.

A small-business retirement specialist is on-call to help individuals select the right self-employed 401 plan. Rowe Price offers 403 plans for nonprofit and tax-exempt organizations such as hospitals, churches, and schools. The 403 offers these employees and an effective and cost-efficient way to save for retirement. There is a Vanguard investment fund available for nearly every investor, including more than 100 mutual funds , low-cost and diversified ETFs, and target date funds . The target date funds are very cost effective and are designed to maximize retirement earnings.

Vanguard does not handle its own customer service — that is handled by a 401 administrator. If a small business owner already has a plan administrator, most of Vanguard’s services are easily integrated, making it an inexpensive choice for 401 investment options. The minimum amount required to start a plan is $500 or $1,000 to convert an existing plan. There are more than 377 mutual funds, ETFs and access to brokerage through TD Ameritrade. The fees for 401 plans are low and Employee Fiduciary provides tax return forms, annual report summaries, benefit statements and a toll-free number for participants needing assistance.

It also offers business loans, HR services, and outsourced benefits administration, and coordinates with 401 providers. Small employers are billed based on the number of employees and pay periods per year.

Mostly known for its financial advising services, Edward Jones also offers a variety of options for small employers with its 401 retirement plans. The company offers plans that include stocks, bonds, mutual funds, and government securities, as well as education and administrative support for business owners and employees. After establishing a plan, employees can review accounts online or through mobile apps. ADP is another 401 provider that offers combined services for small employers including 401, payroll, insurance, HR, tax filing, and other administrative services. It specializes in small companies with 1 to 49 employees and offers several 401 retirement plans for businesses this size. Paychex offers 401 plans to small employers in addition to payroll and HR services, outsourced benefits administration, business loans, and other services.

- The company offers plans that include stocks, bonds, mutual funds, and government securities, as well as education and administrative support for business owners and employees.

- ADP is another 401 provider that offers combined services for small employers including 401, payroll, insurance, HR, tax filing, and other administrative services.

- After establishing a plan, employees can review accounts online or through mobile apps.

- Mostly known for its financial advising services, Edward Jones also offers a variety of options for small employers with its 401 retirement plans.

Paychex has more than 100 offices around the country which can be contacted for assistance. Small employers are billed based on their number of employees and the number of pay periods each year. There are some additional fees for processing tax forms and other services. Individuals who are self-employed or have an owner-only business can contribute to an individual 401 plan which offers many of the same benefits as the traditional 401. A great thing about the individual 401 plan is that you can direct how your contributions are invested. This plan has no monthly service fees or maintenance fees and no minimum amount to open an account. All Charles Schwab plans come with retirement planning resources and 24/7 service and support.

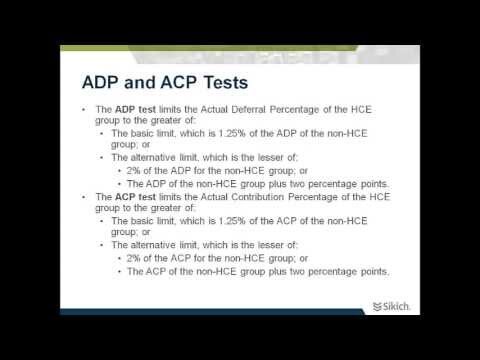

As the NHCEs save more for retirement, the rules allow HCEs to defer more. These nondiscrimination tests for 401 plans are called the Actual Deferral Percentage and Actual Contribution Percentage tests. A nonelective contribution is made by an employer to employees’ qualified retirement plans regardless if employees make contributions. ADP provides payroll, tax filings, insurance, and a variety of other administrative services.

Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument or other market or economic measure. T. Rowe Price is a respected name in retirement planning and has been providing investment and retirement services for more than 80 years. These 401 plans are a great choice if you’re an employer with 1,000 employees or less. It is a common misconception that 401 plans are only for large employers. Even if you have a small business, you still want to offer your employees a sound retirement savings plan that’s also economical.

Automatic enrollment can be used, and employees can get help or use a self-directed brokerage account, according to the company. A SIMPLE IRA is a retirement plan that allows you and your employees to contribute to the plan. Each year, employers must make either a matching contribution or a nonelective contribution. A 403 is a type of qualified retirement plan which is similar to a 401 and is available in certain industries. These plans allow your employees to contribute and save on a pre-tax and after tax basis, with the opportunity for employer matching contributions as well. In the education and healthcare sectors, these plans are the most common retirement vehicle. Investment advisory and management services provided through ADP Strategic Plan Services, LLC, an SEC registered investment advisor .

They offer extra options for additional fees, such as fund performance monitoring and investment advice. These advisory services help employees enrolled in the plan to decide where and how to invest their money. Providing investment and retirement services for more than 80 years, T.

ADP is well-known for the quality customer service it provides both employers and employees. Each employer gets a personal assistant at ADP who helps set up and administer the plan on an ongoing basis.

Login & Support: 401k Plans

So, in theory, the company says you shouldn’t need to contact them very often. For employees, the customer service experience goes beyond just phone support. ADP offers an outstanding website that’s easy to navigate as well a mobile app that allows all employees to research funds and make and/or change investments. It is especially attractive to small businesses, though, because the company provides all-in-one integration for payroll, HR, benefits and retirement services.