How To Handle Payroll For Quickbooks Using Adp

Content

Using a third-party payroll service requires that you enter the payroll information twice. Once for entering and sending it to ADP and again for entering it into QuickBooks. Many of these providers claim to have a feature to directly download the payroll information into a QuickBooks file. Downloading anything directly into QuickBooks can have some serious consequences, however. QuickBooks provides support to import payroll information from other services, such as the ADP payroll service. Managing your ADP payroll within QuickBooks requires you to set up the manual payroll option and enable payroll features within the program.

Select the desired pay period and click “Download” to export the data to your computer. ADP is a payroll service that takes care of paying your payroll expenses on your behalf, both to your employees and to government agencies. ADP allows you to export your payroll data using its general ledger interface. This data can then be imported into QuickBooks, allowing you to include all the data as part of your financial statements. Wave helps small businesses and freelancers manage double-entry accounting. It features a simple UI and applications for payroll and online payments and includes 2 months of free chat support.

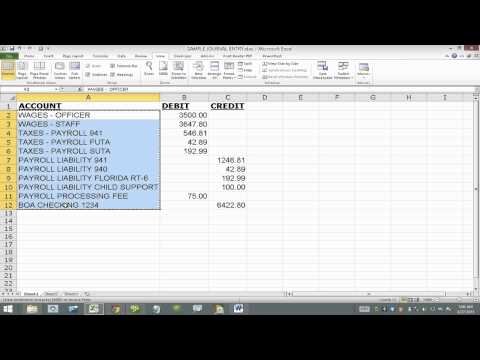

Finally, I show you how to reconciled the labor distribution to your payroll register. Now that you have your file exported and saved on your computer, you can either manually key in or import the file into your accounting software.

Known for its construction-specific functionality, strong payroll module and powerful construction reporting, FOUNDATION construction accounting software has been helping contractors with their job cost accounting since 1985. Then the job costing and general ledger modules are automatically updated with labor and burden data. If you are running the report for the first time, it will setup multiple mappings for you since none existed before you ran the report. When the system setups a mapping record it will map the items to one of our default accounts. A default account is an account that is not on your Chart of Accounts.

Support

There is a bit of setup to make sure your GL account names match between ADP and QuickBooks Online but once aligned this solution can batch process large volumes of payroll data. They would need to provide you with an importable file ( . qbo). For most outside payroll services, the client generally has to make the entries via a journal entry. To add the data to QuickBooks, export it from ADP’s general ledger interface. Click “Define G/L File” and select “Use a Predefined G/L File for Map Assistant.” Then choose QuickBooks from the drop-down menu. You are then prompted to “map” the payroll items; you must identify the corresponding general ledger account name or number for each payroll item. This allows you to seamlessly integrate your payroll data into the general ledger.

- This latest effort allows users to access complete GLI mapping through QuickBooks as well as “many other popular accounting software platforms,” ADP said.

- In ADP’s world, the online GLI converts payroll data to a general ledger file for import into a company’s accounting software.

- If you use ADP’s payroll services and QuickBooks accounting software, you can easily transfer your payroll data to your accounting software digitally.

- Manually entering data is a long, tedious process when you are doing the books for your small business, particularly if you have several payroll accounts.

- This cuts back on the time it takes to do your books, allowing you to concentrate on managing your business.

Manually entering data is a long, tedious process when you are doing the books for your small business, particularly if you have several payroll accounts. If you use ADP’s payroll services and QuickBooks accounting software, you can easily transfer your payroll data to your accounting software digitally. This cuts back on the time it takes to do your books, allowing you to concentrate on managing your business. In ADP’s world, the online GLI converts payroll data to a general ledger file for import into a company’s accounting software.

Select A Country

If you are adding new accounts to an already existing JE Export setup, you will need to set your hierarchy level to the same level your GL accounts are currently configured at. You will receive an error message if you choose the wrong hierarchy level for an existing GL account.

Provided you have a payroll summary report downloaded from the ADP website, the payroll information can be imported directly into QuickBooks after processing payroll within the ADP interface. In order to help accounting professionals add a payroll revenue source to their practice, ADP offers solutions such as RUN Powered by ADP. ADP-powered RUN provides a simple setup and seamless QuickBooks connection to help you easily deliver high-quality payroll services while saving you time and money. After you export the data from ADP, adding the data to your QuickBooks general ledger is a simple process. In QuickBooks, click the “File” menu and select “Import.” Then choose the file that you have just saved to your computer.

Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. The system will only setup mapping for an item that has been processed. This means that the system will not create a a GL account mapping for a payroll tax or a worker comp code that is setup in the system but has never been used. When the report is run, the system will look at taxes, adjustments, pay codes, worker comp codes, etc. that were processed in the week you ran the report for. The system will setup GL account mappings for all of the different processed items if there isn’t a GL account mapping already for it.

Services

The point is to simplify the process of creating payroll journal entries and updating the general ledger after each payroll run. This latest effort allows users to access complete GLI mapping through QuickBooks as well as “many other popular accounting software platforms,” ADP said. Those other platforms are nice, but remember QuickBooks controls some 80 percent of the market for small-business financial software.

It is a system account that the system uses as a place holder when setting up new account mapping. Some third-party payroll systems have a feature that can be used to directly download all the payroll information into QuickBooks with the click of a few buttons. The partnership provides a simpler and more accurate General Ledger Interface mapping experience, eliminating the need for offline customer service assistance to activate and manually set up the integration.

Transferring From Adp To Quickbooks

Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. I start by reviewing payroll systems and discuss the differences between Quickbooks Desktop payroll and an outside payroll services. The differences between a payroll register and a labor distribution is reviewed. If an outside payroll service is used, I show how to create of a “mock” payroll and the labor distribution report and discuss the need for the payroll journal entry. If Quickbooks payroll is used, I discuss the need for a month-end journal entry for accrued wages and a sample is provided.

Intuit, the company that makes QuickBooks accounting software, has an excellent payroll service. Still, for whatever reason, some companies choose to use a third-party payroll processor like ADP for their payroll services.

The data is automatically added to your general ledger, integrating with the pre-existing general ledger accounts. Now you can create any number of financial reports, such as balance sheets and income statements. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

Within TempWorks users will have the ability to setup journal entry exports by charting accounts, mapping bank accounts, running reports and more. This will guide you through a step by step process to setup a Journal Entry export.

Once set up, the need to manually generate general ledger files and download data for each pay period is eliminated. In addition, accountants will also be able to use the tool for their internal firm needs, providing compensation data points such as overtime, bonuses and job tenure – most often, very difficult to find. Currently, we’re unable to import ADP General ledge .xls files to QuickBooks Online . Most users of payroll services outside QBO will manually enter the data using Journal Entry.

Uploading General Ledger Payroll Iif File Deleted My Manual Entries ?

If you need to setup branch specific GL account mappings please contact our support department and get in touch with one of our GL Technicians. In order to import your chart of accounts you may need to change your hierarchy level.