How To Master Restaurant Bookkeeping in Five Steps

Content

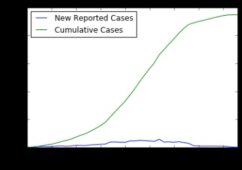

Analyzing your restaurant financial and operational data regularly is one of the keys to a healthy bottom line. By looking at a few essential reports, such as your profit and loss (P&L) statements and your prime cost (food and labor costs), you can accurately track your restaurant. Implementing accounting software can help you and your accountant stay on the same page. The ideal accounting software for restaurants should provide advanced reporting features, be easy to use, and allow you to track and access your data from anywhere at any time. With the many moving pieces involved in a restaurant, a seamless accounting process can be difficult. Add the unique features of the restaurant industry, from short-lived inventory to payroll including wages and tips, and bookkeeping becomes a fast-changing, time-consuming challenge.

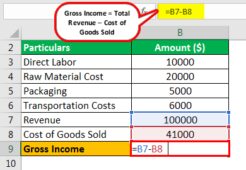

Using your restaurant bookkeeping to stay on top of your food cost numbers helps accurately track Cost of Goods Sold (CoGS). A restaurant bookkeeper oversees the financial reports of the restaurant. They ensure that the figures are accurate, track inventory, and meet tax obligations. The overall goal with bookkeeping is to minimize operating expenses and maximize profits. However, the 5 simple steps above will put down the foundation for a solid bookkeeping system.

Calculating Costs

It’s important to understand the principles behind the food and beverage industry so that you know which bookkeeping method is most tailored to this particular industry. Will your wait staff work for tips, or will you add gratuities to every bill? And if you hire full-time wait staff, you may also need to furnish benefits. Many restaurants rely on part-time or seasonal employees to avoid this expense. Once you can anticipate your busy times, you can schedule your staff members accordingly. Food cost percentage shows how much of your overall sales are spent on ingredients and food supplies.

What is restaurant accounting called?

A restaurant profit and loss statement, also called a P&L, is a financial document detailing the total revenue and expenses over a predetermined period of time. They’re typically run monthly or yearly. P&Ls provide an overview of your restaurant’s revenue, costs, and expenses.

Restaurant bookkeeping is one of the most important aspects of running a restaurant. Your P&L statement reflects the sales and costs of your restaurant during a given time period. The P&L reconciles items such as sales, food and labor costs, operating expenses, and your profits.

Payroll and Taxes

Let’s go over the steps you need to take to set up your restaurant accounting, as well as helpful software solutions that will make this job easier. Point of sale systems are computerized systems that record orders and process payment transactions. These systems are ideal for cash management, processing receipts, restaurant bookkeeping running sales reports, and tracking inventory, methods of payment, and labor costs. When choosing a point of sale system, just make sure it ties in and seamlessly integrates with your accounting software. A POS system really is a life saver in restaurant accounting because it allows you to see data in real time.

- Tracking your inventory and food costs can also help you maintain more accurate inventory management, minimizing waste and theft.

- If you didn’t track sales, then you wouldn’t have a clue as to how your restaurant is performing financially.

- Many restaurants rely on part-time or seasonal employees to avoid this expense.

As a business owner, you won’t have time to keep up with these changes. You must record precise amounts of money for every expense and all revenue. Rounding up or down by a few cents or dollars can add up over the course of a week or month and begin to affect your bottom line. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO.

c. Food costs

The other thing we love about Shogo is the ability to quickly and easily reconcile merchant service deposits. The Shogo journal entry allows you to reconcile your merchant service deposits so you can ensure you are getting all the money you are due. With Shogo, if there are any errors it will hold back the journal entry until you update the accounting mapping. An example of this would be if you started selling a new item like retail, for example.

Financial software is designed to make restaurant bookkeeping simpler and more efficient for you as the business owner. Restaurant bookkeeping can quickly become too complex for restaurant owners to handle. If you are not confident in your ability or lack the time that’s needed for accurate and thorough bookkeeping, consider hiring an accountant. Restaurant accounting software includes financial software and point of sale (POS) systems. These programs are designed to help you organize your inventory counts and transactions quickly and accurately.

Getting your financials right can actually help your business deliver on that very passion that motivates you in the first place. As they say in the business industry, leverage your strengths and outsource your weaknesses. You can attach your statement to the reconciliation in QBO to make it easy to reference.

How many clients can a bookkeeper handle?

Typically, a bookkeeper can handle 20 to 30 clients on their own. But when you’re approaching or exceeding 50 clients, it’s time to hire some help. Hiring help will allow you to maintain more clients, generate more revenue, and keep your customers happy.