How To Set Up Direct Deposit

Content

Where your employees could lose or have their paper check stolen , direct deposit eliminates this possibility. Additionally, since the payments are sent electronically, your employees have a record of transaction. They can see their pay stubs online and access them at any time. If there ever is a problem, either party can easily refer to this record. that has employee logins, your employees can log in themselves and fill in the relevant information and give the direct deposit authorization directly in the software. In this case, the information will automatically connect to your payroll. If you decide to set up direct deposit through your bank, you can talk to them directly for options, pricing information, and specifics for getting started.

They also might charge you for each employee’s deposit when you run your payroll. These fees range depending on the bank, the size of your business, and your direct deposit agreement. Again, the NFIB averages the fee range to about $1.50 to $1.90 per individual deposit.

A blank direct deposit authorization form can be viewed and printed through QuickBooks. Fortunately, making sure that your employees are paid on time every time is easier than ever with accounting software that boasts payroll capabilities. Millions of business owners rely on QuickBooks Online for balancing the books, tracking inventory, and performing other tasks, including payroll. You can add payroll to your existing QuickBooks Online account for as little as $45 monthly plus $4 per employee, per month. QuickBooks Payroll services include payroll checks or direct deposit, payroll tax payments, and all tax form filings. For your employees, it only takes filling out some basic information for them to get set up into direct deposit.

Direct Deposit Form

With this batch created, you’ll be able to send your payroll to them through direct deposit. Before you run payroll, make sure your direct deposit feature is active and all employee information is entered. If you must run payroll before your direct deposit service is active, you will have to write or print checks for your employees. Also, if you are missing an employee’s bank account information, you will need to issue a check.

Randa specializes in reviewing small business products, software, and services. She has also written for PeopleKeep, Bench, RocketLawyer, Zoho, and KNF&T Staffing, among others. At the end of the day, direct deposit takes a load off of a lot of elements associated with being a small business owner. First, more than likely, you’ll be saving time and money when you use direct deposit instead of physical checks. Cutting physical checks is expensive and time-consuming, where after you set up direct deposit, the cost and time needed to run your payroll are relatively small. Furthermore, not only are the electronic payments safe going through ACH, but they also eliminate safety risks that would be associated with paper checks.

What are the direct deposit processing times using ADP to send direct deposit payments to Canadian employees? They offer payroll in Canada as well, so I need to find out. Canadian payroll was entirely separate and funded from a Canadian bank account in Vancouver. If you have a small amount of employees or don’t have accounting software or software with a NACHA export, you can set up payroll batches in your bank’s online system. You’ll input all of the information for your employees given on their direct deposit authorization form and save it in the system.

Once you’ve got everything set up, and you’ve verified the direct deposit activation with your bank or payroll software, you’re ready to go. You can run payroll on the schedule you’ve determined, and your employees will receive their paychecks via direct deposit. From now on, every time you run payroll, your employees will automatically be paid by direct deposit. If any issues arise when you run your payroll or through the final steps of the process, your payroll provider should be able to help.

You can also set up direct deposit through your account’s online banking portal. Your bank will have you sign their ACH terms and conditions form, which means you’re agreeing to only send these payments to people who have given you approval to do so. Your bank may also ask for recent financial statements, just to verify that you have the necessary finances in place to be setting up this process.

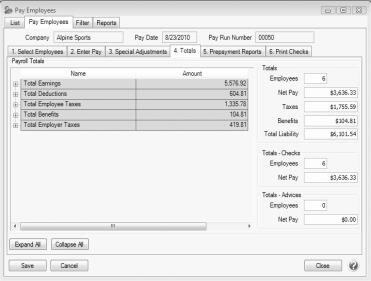

If employees are being paid via direct deposit, funds will be deducted from your connected account and delivered directly to the bank accounts of your employees. If you’re paying via paper check, you can view and print each check before mailing or handing them to your employees. You can also print paycheck stubs and view and export employee and employer payroll reports. Once everything is done, click Finish Payroll and you’ll return to your QuickBooks dashboard. Once you’ve completed the steps in the process and got everything up and running, we’ll wager a guess and say you won’t ever go back.

Do Payroll Calculations

ACH is short for Automated Clearing House, which is the U.S. financial network that oversees these types of transactions. The term ACHis the classification banks use to categorize these types of payments. An ACH payment, therefore, means that it is an electronic, automatic transfer of deposits between banks that are managed by the ACH. Patriot’s small business payroll software comes with free direct deposit. That means you easily reap the benefits of paying your employees with direct deposit. Get a free trial of the payroll software to see how it works.

Adding your account info also allows you to send payments (whether you’re paying bills or paying contractors), as well as e-file and pay your taxes online. You can pay employees via a handwritten check, print checks directly from QuickBooks Online, or submit direct deposit payments. To start processing payroll in QuickBooks Online, navigate to the Employees tab and click the Payroll button to get started. If you’re satisfied that everything is correct, click the “Submit Payroll” button that is located at the bottom right of the screen. You can view all payroll reports by selecting the option at the bottom middle of the page.

You will be able to print payroll checks and/or direct deposit remittance advice to distribute to employees. Now that you’ve got all of your employees set up, the next step is to run your payroll.

How Do I Add Direct Deposit On Adp?

Once the direct deposit service is activated and verified, you’re ready to pay your employees. This process differs slightly depending on whether you’re using a bank or business software provider, but generally takes less than 10 minutes.

Simply select the bank that you use for your business account and input your login information. You also have the option to enter bank information manually, although this process may take several days before your account is connected. If you are paying your employees through direct deposit, you will need to add your bank account information to QuickBooks.

Businesses that aren’t ready for paid payroll software can save time and money doing payroll with Excel. You can get started with our free template, and all you’ll need to do is add your business’ and employees’ information. With the right formulas in place, tax and check payment calculations are done automatically. Once the bank or CU have the funds they will post it to your accounts. Most banks it is at the end of night processing and the funds should be available morning of due date. Credit unions will post the deposit on the due date as their banking systems run 7/24 and have no need to pre-post. Simply click “Submit Payroll” to complete the process.

Decide whether you’re going to use your bank or business software for payroll. If you’re using a bank, you can usually sign up in person or through your online account. With payroll software, signing up for direct deposit will likely be integrated into the process of setting up your account.

Every pay period, they’ll know the money will be coming directly into their bank account and they’ll know when it’s coming. With this predictability, they can better plan their own personal finances and they also don’t have to worry about going to the bank to cash a physical check. If you’re setting up in your payroll software for the first time and initiating direct deposit, then you’ll need to put in your business bank account information. This will be the account that your direct deposits will pull from. , according to the National Federation of Independent Business . Some banks charge ongoing monthly fees for direct deposit, but most do not.

Additionally, some banks charge various transaction fees. Your bank might charge a transaction fee each time your account is affected, which would be every pay period.

When you set up direct deposit for your employees, your payroll process becomes fluid, simple, and you know that your employees will get paid on time. If you’re investigating the process as a business owner, you may not know exactly how to set up direct deposit for employees. Although it may seem daunting on the surface, it’s actually something that you can set up pretty quickly and easily. The steps for doing payroll with software are very similar to doing it without; it’s just much easier and faster. You’ll enter all the information for your company and employees electronically, and the paycheck amount and deductions calculate automatically. Most payroll software will even allow you and your employees to complete payroll forms completely online—some will even submit them to the IRS for you. Let’s say you have a small business bank account with Wells Fargo and are sending 10 direct deposits to pay employees in a one-month period.

You’ll enter payroll hours, and QuickBooks will automatically calculate payroll checks and taxes for you. You can print checks or submit direct deposit payments to employees.

- With this batch created, you’ll be able to send your payroll to them through direct deposit.

- If you have a small amount of employees or don’t have accounting software or software with a NACHA export, you can set up payroll batches in your bank’s online system.

- Canadian payroll was entirely separate and funded from a Canadian bank account in Vancouver.

- They offer payroll in Canada as well, so I need to find out.

- What are the direct deposit processing times using ADP to send direct deposit payments to Canadian employees?

If you’re paying your employees through direct deposit, you must also fill out a direct deposit authorization form, signed and dated. A voided check should also be provided by each employee (although it isn’t required) to ensure that account information is accurate. These documents are kept for your own business records and do not need to be submitted to QuickBooks.

How To Create An Electronic Signature For Putting It On The Adp Direct Deposit Form 2017 In Gmail

Wells Fargo doesn’t charge a setup fee, but it charges $0.50 for direct deposits made to non-Wells Fargo personal bank accounts. Direct deposit is when your business deposits a payroll check directly into your employee’s account. It’s entirely digital and automatic, meaning your employees won’t have to manually accept the money and you won’t have to physically sign a check. For this step, you have the option of signing into your bank account.