How To Write A Profit & Loss Statement

Content

Both profit and loss statements and balance sheets are important for running your small business or corporation. Learn about these two different statements and about how they help your company’s future. It’s also valuable to compare those profit margins to competitors. If one competitor produces much higher profit margins, it may be worth exploring. A big company with stable revenue producing a strong operating margin may indicate the potential profitability of a small company in the same industry that’s still growing rapidly. On the other hand, a company with much higher gross margin may have a unique competitive advantage that competitors won’t be able to copy.

Save time, cut costs, and connect with more customers all over the world, with Wise. Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow. Are you invoicing clients overseas, or working with suppliers based abroad, but waiting around for slow international transfers to finally reach your account? Wise can cut down on the cost and time of international transfers into your multi-currency account.

Primary Activity Expenses

The most important financial statement any business needs is a profit and loss statement(called a “P&L”). Both the profit and loss statement and balance sheet are important financial statements – but each has a different function for business owners and investors. Revenue is usually accounted for in the period when sales are made or services are delivered. Receipts are the cash received and are accounted for when the money is actually received.

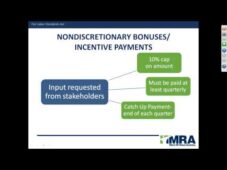

Here’s what stock market beginners need to know to make sense of all the numbers. Are Variable Pay or Performance Incentives Right for Your Business? Are variable pay or performance incentives right for your business? Here’s a closer look at what to consider when embracing this compensation model. In this example, the net profit margin is 26.5 percent ([$1,325 ÷ $5,000] x 100). This type of analysis is also referred to as series analysis. It looks at changes over time within a particular line item.

What Is A Profit And Loss P&l Statement?

The difference, known as the bottom line, is net income, also referred to as profit or earnings. Overview From an accounting perspective, hiring outside managers is cheaper than employing an individual full time. Such additional costs aren’t required for external managers. A P&L is arguably the most important financial sheet your small business has. It shows the company’s net income over a period of time, which can be monthly, quarterly, or yearly.

You may not have to file a profit and loss statement for your business with any regulatory agency, but there are very good reasons for a self-employed individual to keep one. Many small business owners benefit from looking at their monthly Profit & Loss (P&L) statement. Taking the time to look over a company’s P&L statement is an essential step in determining whether a company’s stock will make a good investment. At the top of the statement, the company shows how much revenue it generated during the statement period. Companies with several business segments may break out revenue for each separate division. Here are seven financial ratios to help you know whether it’s a good time to buy or not. List taxes on net income (which usually has to be estimated because a return typically hasn’t been filed when a P&L is being prepared) and subtract this from the balance left in Step 7.

The small business owner can then focus on what needs to be done to improve the business’s net income. Under the cash accounting method, revenue and expenses are only recorded when payment changes hands.

Microsoft had a 68% higher net income of $16.571 billion compared to Walmart’s $9.862 billion. It indicates that Walmart incurred much higher cost compared to Microsoft to generate equivalent sales.

Profit And Loss Statement Example

Contact your financial advisor or accountant to help you if you’re unable to prepare these statements on your own. Many companies turn to their accountants to prepare these statements because they can be complicated and take a lot of time and effort. Don’t be afraid to call your accountant if you think you’re getting in over your head. The financial health of your small business depends on your being able to see and interpret these critical financial details. There are many documents a small business needs to operate its business, including a variety of tax forms and financial statements. It’s easy to get confused with all the information your business needs to track.

- These are not your day-to-day fixed expenses (like rent, salaries, etc.), but rather the expenses that vary depending on how much business you’re doing.

- The other two are the balance sheet and the cash flow statement.

- Learn how to create and read P&L statements that can help grow your business.

- A P&L statement compares company revenue against expenses to determine the net income of the business.

- The gross margin is simply how much profit a business makes on each sale.

For instance, a customer may take goods/services from a company on 28 September, which will lead to the revenue being accounted for in the month of September. Owing to his good reputation, the customer may be given a 30-day payment window. It will give him time till 28 October to make the payment, which is when the receipts are accounted for. An income statement is one of the three major financial statements that reports a company’s financial performance over a specific accounting period. Also known as the profit and loss statement or the statement of revenue and expense, the income statement primarily focuses on the company’s revenues and expenses during a particular period. A company’s P&L shows its income, expenditures, and profitability over a period of time.

Losses As Expenses

This information can be derived from invoices, receipts, credit card statements, and bank account transactions. A quick glance at a P&L shows whether the company is making or losing money. This is important when creating acomparative income statement, whether comparing a single business’s performance over multiple accounting periods or comparing one company’s performance to another . The preparation of the P&L and any other financial statement is fairly straightforward. And if the business has an accounting system, it can track revenues, expenses, assets, and other key numbers as they occur and generate these reports at the touch of a button. You can access and modify any P&L template to include company name and logo to create professional-looking documents to share with managers, partners, investors, and financial institutions. Download a free profit and loss template and start tracking your company’s finances today.

What is a P&L spreadsheet?

A profit and loss spreadsheet is a financial statement that displays a business’s financial performance during a given time period. Commonly referred to as an income statement or earnings statement, a profit and loss spreadsheet deducts the business’s expenses from its sales to determine its overall profit or loss.

Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Gross Profit, Operating Profit And Net Income

For income, you will need a listing of all sources of income – checks, credit card payments, etc. Average profit margins vary by industry, but knowing yours can go a long way toward making and keeping your business profitable. This is really the most important number of all, and the main reason for figuring out all the line items above. This number will show if you have a profit or loss after paying all your expenses. Add or subtract these from your operating income, and you are left with your total pre-tax income, or your net profit. Businesses will also show their interest and tax liabilities on the P&L statement. This section provides a snapshot of how much the company is paying to service its debt and its effective tax rate.

If the cash method is used, revenues will be recorded when payment is received. To increase the accuracy of reported income, gross sales may be adjusted based on past experience of customer returns or refund requests by setting up an allowance and netting it against revenues. The P&L statement is one of three financial statements every public company issues on a quarterly and annual basis, along with the balance sheet and the cash flow statement. It is often the most popular and common financial statement in a business plan as it shows how much profit or loss was generated by a business.

How Do Operating Income And Revenue Differ?

Get your free template here, add your branding and create a tailor-made financial statement for your business. P&L statements can be created to analyze and compare business performance over a month, a quarter or a year, and are an effective tool to review cash flow and predict future business performance. Use our free profit and loss statement template to review your business performance, and check out the Transferwise multi-currency business account as a smart way to cut your bank charges. A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year. An income statement provides valuable insights into a company’s operations, the efficiency of its management, under-performing sectors and its performance relative to industry peers. Publicly traded companies are required to prepare P&L statements and must file their financial statements with the Securities and Exchange Commission so they can be scrutinized by investors, analysts, and regulators. Companies must comply with a set of rules and guidelines known as generally accepted accounting principles when they prepare these statements.

Is GST included in profit and loss statement?

As a result, the cost of goods sold and expenses amounts shown in your profit and loss statement will have GST subtracted. … This means that GST is an expense for your business. The cost of goods sold and expenses amounts shown in your profit and loss statement will include GST paid.

Revenues and expenses for non-profit organizations are generally tracked in a financial report called the statement of activities. As such, this report is sometimes called a statement of financial activities or a statement of support. It is important to compare P&L statements from different accounting periods, as any changes over time become more meaningful than the numbers themselves.

Banking Forms Catalog

Operating income looks at profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Let’s look at the most recent annual income statements of two large, publicly-listed, multinational companies from different sectors of Technology and Retail . The cash method, which is also called the cash accounting method, is only used when cash goes in and out of the business. This is a very simple method that only accounts for cash received or paid. No trick question here—accounts receivable is exactly what it sounds like.

The accrual accounting method records revenue as it is earned. This means that a company using the accrual method accounts for money that it expects to receive in the future. A business records transactions as revenue whenever cash is received and as liabilities whenever cash is used to pay any bills or liabilities. This method is commonly used by smaller companies as well as people who want to manage their personal finances. The preparation process and information needed is the same whether you are preparing a statement at startup or to use for tax preparation or business analysis.

All expenses linked to non-core business activities, like interest paid on loan money. David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.

The details of a profit and loss statement may vary from company to company, but they all follow the same basic outline. A short period of time, which is included in it, implies that it will be filed in the month following the reporting period. There are two main categories of accounts for accountants to use when preparing a profit and loss statement. To understand the above details with some real numbers, let’s assume that a fictitious sports merchandise business, which additionally provides training, is reporting its income statement for the most recent quarter. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

It realized net gains of $2,000 from the sale of an old van, and incurred losses worth $800 for settling a dispute raised by a consumer. The above example is the simplest forms of the income statement that any standard business can generate. It is called the Single-Step Income Statement as it is based on the simple calculation that sums up revenue and gains and subtracts expenses and losses.