Hsa Contribution Limits 2019 And More Hsa Rules You Need To Know

Content

And now that the limits have increased you can help your employees accelerate the process of saving and investing. You can contribute up to $3,600 in 2021 if you have self-only coverage or up to $7,200 for family coverage. If you’re 55 or older at the end of the year, you can put in an extra $1,000 in “catch up” contributions. However, your contribution limit is reduced by the amount of any contributions made by your employer that are excludable from your income, including amounts contributed to your HSA account through a cafeteria plan.

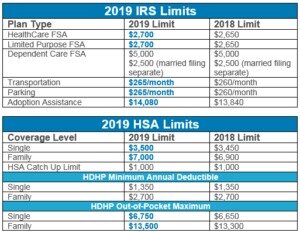

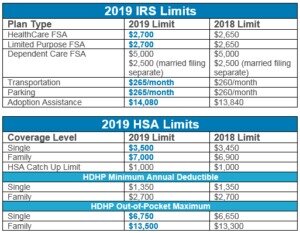

They apply to the amount you can contribute to an HSA for the year, the minimum deductible for your health insurance plan, and your annual out-of-pocket expenses. If you or your health plan are not in compliance with the restrictions in place for any particular year, then you can say goodbye to the HSA tax savings for that year. The 2019 HSA contribution level maximum will be $3,500 for individual coverage, and $7,000 for family coverage.

- HSAs must pair with a qualified high-deductible health plan and they have an annual contribution limit.

- Contributions, other than employer contributions, are deductible on the eligible individual’s return whether or not the individual itemizes deductions.

- A health savings account is a tax-advantaged savings account an individual or family establishes to pay for qualified medical expenses.

- An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual.

- The IRS adjusts both the guidelines for HDHPs and the contribution limit every year.

- Distributions from an HSA that are used to pay qualified medical expenses aren’t taxed.

To qualify for an HSA and the triple tax savings, your employees need an HSA-qualified policy, which is a plan with a higher deductible. In order to qualify for 2019, the employee must have a health insurance policy with a deductible of at least $1,350 per year for individual coverage, and $2,700 per year for a family plan.

Recovering Mistaken Contributions

If you and your spouse each have a family plan, you are treated as having family coverage with the lower annual deductible of the two health plans. The contribution limit is split equally between the two of you unless you agree on a different division. A Medicare Advantage MSA is an Archer MSA designated by Medicare to be used solely to pay the qualified medical expenses of the account holder who is enrolled in Medicare. Distributions from a Medicare Advantage MSA that are used to pay qualified medical expenses aren’t taxed.

Can you have too much in your HSA?

The short answer is that it’s unlikely, largely because HSAs have generous features around withdrawals. In a worst-case scenario where your HSA account balance exceeds your expected healthcare costs, you have two key ways to get your money out sooner without negating the tax benefits of the HSA.

If your insurance started in the middle of April , April doesn’t count. Any employer contributions count toward your respective limits.

What Insurance Plans Qualify For Hsa?

A Health Reimbursement Arrangement must be funded solely by an employer. The contribution can’t be paid through a voluntary salary reduction agreement on the part of an employee. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. An HRA may be offered with other health plans, including FSAs.

I would be depositing the money myself as this is an individual plan that is not through my employer. I am not sure of the requirements on contributing myself and reimbursing myself for medical expenses. So, if you’re someone looking for the most pertinent information on HSA contribution limits and other need-to-know items to prepare for OE, then you’ve come upon the right guide. When used for qualified medical expenses, there is no tax on your HSA funds, and the funds in the account are exempt from capital gains and other investment2 related taxes. These savings create a triple tax advantage for participants.

Hsa: 2019 Limits And Frequently Asked Questions

The new limits for health savings accounts for 2020 are going up $50 for individual coverage and $100 for family coverage, the IRS announced last week, bringing them to $3,550 and $7,100, respectively. The catch-up contribution limit for those over age 55 will remain at $1,000. The second method to deal with this is to leave the excess contributions in the HSA and pay a 6% excise tax on this amount. The problem with this approach is that the 6% excise tax is applied annually, quickly wiping out any tax-advantaged benefits HSA accounts provide. If employees choose to go this route, they can opt to have the HSA contribution in excess of the annual limit applied to the following year’s contribution. That said, they will have to pay an excise tax any year that amount leads to a contribution overage.

Here you and your employer contribute to the savings account, before payroll tax kicks in, until you hit the annual contribution limit. A new year and increased HSA contribution limits is a great reason for your employees to increase their contributions to their HSA. The funds in their account can be used to pay for qualified medical expenses, and any unused balance automatically rolls over and can be saved all the way to retirement and beyond.

The health plan must also have a limit on out-of-pocket medical expenses that you are required to pay. Out-of-pocket expenses include deductibles, copayments and other amounts, but don’t include premiums. For 2021, the out-of-pocket limit for self-only coverage is $7,000 or $14,000 for family coverage. According to the IRS, only deductibles and expenses for services within the health plan’s network should be used to determine if the limit applies. A health Flexible Spending Arrangement allows employees to be reimbursed for medical expenses. FSAs are usually funded through voluntary salary reduction agreements with your employer. No employment or federal income taxes are deducted from your contribution.

Before retiring I had a HDHP health insurance plan through my employer and covered my son and wife as dependents. My wife and I transitioned to Medicare however our son– who is in law school–is still our dependent, and we pay for our former HDHP, health insurance plan to cover him, and we pay all deductible, co-pays, etc.

In addition, an employer who makes contributions to an HSA of an ineligible individual may also be subject to adverse tax consequences. We recommend that HSA applicants and/or employers contact qualified tax or legal counsel before establishing a Health Savings Account. You can contribute to an HSA if you’re in a qualifying high-deductible health plan. For 2020, that means a plan with a minimum annual deductible of $1,400 for individual coverage or $2,800 for family coverage. 6199, the Restoring Access to Medication and Modernizing HSAs Act, is expected to be reintroduced in the House and Senate in the first quarter of 2019. There are, however, a few HSA limitations and requirements that are adjusted for inflation each year.

Under Sec. 223, individuals who participate in a high-deductible health plan are permitted a deduction for contributions to HSAs set up to help pay their medical expenses. The contribution deduction limit is subject to an annual inflation adjustment. The Internal Revenue Service announced new, higher contribution limits for health savings accounts for 2020 today. HSAs are the best way to save courtesy of Uncle Sam, with triple tax benefits. You put money in on a taxfree basis , it builds up tax free , and it comes out taxfree to cover out-of-pocket healthcare expenses.

Future blog posts will discuss how you can help your employees get excited about their HSA and the best ways for them to take full advantage of the benefits that HSAs provide. For many people, health savings accounts offer a tax-friendly way to pay medical bills. Plus, you can hold on to the account past your working years and use it tax-free for medical expenses in retirement. All-in-all, HSAs can be a great tool for covering your health care costs.

How much can you put in an HSA per year?

Consumers can contribute up to the annual maximum amount as determined by the IRS. Maximum contribution amounts for 2020 are $3,550 for self-only and $7,100 for families. The annual “catch- up” contribution amount for individuals age 55 or older will remain $1,000.

“Employers can do their part by extending HSA contributions as a benefit to their employees.” In that same reply I said he could contribute the family maximum because he had a family plan. If both your employers contribute, you will need two accounts, one in each name. If both of you qualify for and want to contribute the age-55 catch up, you will need two accounts. If you have separate individual plans, you will need two accounts. However, because HSA is in an individual’s name — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name.

An HSA is in an individual account holder’s name, even when used by a spouse or dependents with family coverage to pay medical expenses. When both spouses have self-only coverage, each spouse may contribute up to the annual HSA self-only limit in their own HSA. See HSA Contribution Limit For Two Plans Or Mid-Year Changes. If your husband’s plan only covered himself since January, he can contribute up to the single coverage limit for each month. You can contribute the difference between the family coverage limit and his contribution, prorated by the number of months of your family coverage.

A health FSA may receive contributions from an eligible individual. Reimbursements from an FSA that are used to pay qualified medical expenses aren’t taxed. An Archer MSA may receive contributions from an eligible individual and his or her employer, but not both in the same year. Contributions by the individual are deductible whether or not the individual itemizes deductions. Distributions from an Archer MSA that are used to pay qualified medical expenses aren’t taxed. I have approximately $6500 in medical expenses for my family for 2020. Is it okay to contribute the $7100 and pay myself back for those medical expenses?

Qsehra Funding Limits

An HRA must receive contributions from the employer only. Reimbursements from an HRA that are used to pay qualified medical expenses aren’t taxed.

A health savings account is a tax-advantaged savings account an individual or family establishes to pay for qualified medical expenses. HSAs must pair with a qualified high-deductible health plan and they have an annual contribution limit. The IRS adjusts both the guidelines for HDHPs and the contribution limit every year. An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. Contributions, other than employer contributions, are deductible on the eligible individual’s return whether or not the individual itemizes deductions. Distributions from an HSA that are used to pay qualified medical expenses aren’t taxed. If you go through your employer and choose a high deductible health insurance plan, you are likely eligible for an HSA.

If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account. Bank of America makes available The HSA for Life® Health Savings Account as a custodian only. The HSA for Life is intended to qualify as a Health Savings Account as set forth in Internal Revenue Code Section 223. However, the account beneficiary that establishes the HSA is solely responsible for ensuring that he/she satisfies the Health Savings Account eligibility requirements set forth in Section 223. If an individual/employee establishes a Health Savings Account and he/she is not otherwise eligible, he/she will be subject to adverse tax consequences.