HVAC Accounting Software

These forecasts consider your estimated income and expenses so you know how much cash you will have left over at the end of each month. Contractors should forecast monthly cash flow requirements and take steps to set aside extra cash and restrain spending during tight periods. Timely payments are one of the key factors in building a good relationship with your suppliers. You can automate your accounts payable process using a cloud-based program called Plooto. As your HVAC business expands, it’s crucial to adapt to the latest technologies available. This is where Bookkeeping Pro Services bookkeeping service can be beneficial.

Best Accounting Software for HVAC Contractors

This eliminates the need for manual data entry, creates a clear audit trail, and allows you to easily manage all of your expenses from one platform. Plus, you don’t have to worry about saving receipts or losing invoices again. A professional bookkeeper will work diligently throughout the year to ensure your books are always current. They will prepare your financial data for tax season and ensure you don’t have to pay any late tax penalties. On top of bookkeeping, some bookkeepers can also help you manage your payroll and ensure that your business complies with the local payroll legislation.

Organize Your Chart of Accounts

Finally, if accounting for HVAC companies is more trouble than actually running an HVAC company, it never hurts to get help from professionals. Licensed, experienced small business accountants and CPAs handle all of the tedious-yet crucial-tasks your business needs to survive. Improperly managed books can result in profit loss and financial headaches at the least, and certain accounting practices can even end in audits and criminal liability.

Useful Features of HVAC Contractor Accounting Software

- Similarly, managing accounts payable is crucial to maintain good supplier relations and creditworthiness.

- Cash flow forecasts are a tool that helps estimate the flow of cash going in and out of your business over a specific period of time.

- Firstly, the bookkeeper brings a high level of expertise to the financial management of the business.

- You want to ensure that you don’t expense your vehicles and equipment upon purchasing them because that will grossly overstate your expenses for that particular period.

Managing your stock in this way will ensure you are never running low on parts and are also not wasting cash on inventory you don’t need. This helps guarantee you won’t have to delay appointments due to inventory shortages. HVAC businesses often deal with multiple contracts and customers, making it easy for unpaid invoices to slip through the cracks.

The Essential Guide to Bookkeeping for HVAC Businesses

With their “done-for-you” service, you can easily access your data from multiple devices, including your computer, mobile phone, or tablet. This service can help prevent tax mistakes and allow you to concentrate solely on your HVAC business. Understanding your business’s performance in the coming months can help you take the necessary steps to ensure financial stability and growth. Accurate bookkeeping is crucial for HVAC businesses, but its importance is often underestimated until tax season rolls around. Failing to keep up with bookkeeping and accounting can lead to anxiety and stress at the end of the year when there are numerous tasks to complete.

Plus, if your technicians paid for the gas out of their own pockets, they would have to fill out an expense report before getting reimbursed. Plus, cloud-based accounting software can integrate with other third-party accounting apps, meaning that data from these tools can automatically be sent to your accounting software. Having your books up to date will give you peace of mind when tax season comes because you won’t have to stress about catching up on your bookkeeping. It will also provide you with insight into how much sales tax you need to pay when the deadline for sales taxes is due. By prioritizing regular bookkeeping for HVAC businesses can enjoy peace of mind during tax season, as accurate calculations will already be in place. This eliminates the stress and worry of inaccurate calculations and potential penalties.

By diligently recording income and expenses, a company can quickly identify its financial position. This clarity assists in making informed decisions about potential investments and cost reduction strategies. Plooto can help you automate your accounts payable process by pulling invoices from your accounting software and allowing you to schedule payments for each invoice. Once payment is made, Plooto will reconcile it with your accounting software and mark the invoice as paid. It easily integrates with most HVAC management software like Jobber and ServiceTitan and can sync your invoicing data from these programs to reduce the need for additional data entry. Using Jobber lets you easily manage your jobs and send invoices to clients.

FreshBooks integrates with your favorite tools to make managing your business finances a breeze. The FreshBooks invoicing feature has a built-in time tracker that allows you or your contractors to measure the exact time you spend working on your clients’ HVAC system. This ensures that you’re billing for the right amount of time, every time. Customize the professional invoice templates with your business’s branding materials by adding your logo, fonts and color palette. Once you’ve created the template that reflects your business, you can have invoices sent automatically or at the click of a button.

HVAC accounting is more similar to bookkeeping for construction companies, in that each job undertaken needs to earn more than it takes to complete. But any HVAC technician, independent contractor, or construction firm owner knows that’s easier said than done. Jobs can come and go depending on the season, and you might encounter unforeseen circumstances that drastically alter your deadline for completion, cost of materials, labor, etc. Managing payroll and employee benefits can be a time-consuming and complicated process.

Keeping current financial records not only allows you to see where your business’s money has gone but also helps you plan where it’s going. A big part of HVAC accounting is planning for future business expenses and workflows, something called a cash flow projection. By checking past payments and income, you can predict what your future expenses might look like for similar jobs and price your labor and materials accordingly. Generating invoices for jobs and tracking the status of payments is essential for any business.

Regular bookkeeping is essential for HVAC businesses to maintain financial health. Keeping the books up-to-date should be a frequent task, ideally, on a weekly basis. This practice allows businesses to track income and expenses with precision, facilitating better financial decisions.

Running a successful HVAC business requires careful financial management. Additionally, it is a good practice to send out invoices promptly after completing a job. This helps to ensure that you receive timely payments and avoid any potential cash flow problems. You can generate Quickbooks’ financial reports, such as the income statement, balance sheet, and cash flow statement, to understand how your business is performing. Use inventory management software that tracks all of your inventory (including spare parts) and prompts you to reorder when they hit a certain level.

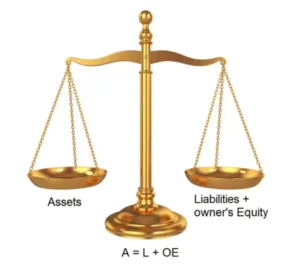

It also eliminates the need for cheque payments and reduces the risk of late payments. Balance sheets provide a comprehensive view of your assets, equity, investments, and debts, including your company’s cash. By studying balance sheets, you can achieve a clear understanding of your HVAC field service financial management. This will help you ensure that you have enough working capital to meet short-term liabilities.