I Set Up Direct Deposit For My Employee I Submitted His Pay A Week Ago, And He Hasn’t Received His Pay Yet? Does It Typically Last This Long?

Content

When the next pay period comes, log into your account dashboard and select the “Run Payroll” option. From here you can view employee time cards and make any manual adjustments. Each employee’s pay should calculate automatically based on the information provided in their profile. The software also calculates deductions for things like tax, health benefits, and retirement contributions. For these reasons, it makes a lot of sense to find a good small business payroll serviceprovider to help you manage your payroll.

ADP Workforce Now is designed for businesses with 50–1,000 employees. This product offers a variety of core features beyond just payroll, as well as additional add-on features. When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t. Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app. Although there are a number of ways to pay employees, most involve banks in some shape or form. As a result, a bank holiday can put a wrinkle in your payroll processing timeline and desired pay date. If a payday falls on a bank holiday, your employees have to wait until the next business day to access their wages—unless you take action.

- When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t.

- This product offers a variety of core features beyond just payroll, as well as additional add-on features.

- Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app.

- Although there are a number of ways to pay employees, most involve banks in some shape or form.

- ADP Workforce Now is designed for businesses with 50–1,000 employees.

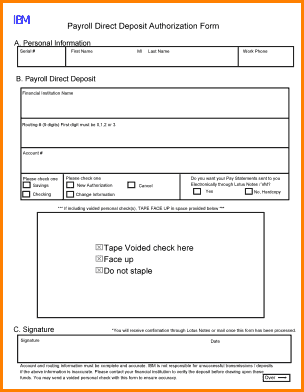

Enable your employees to fill out their direct deposit in the online Employee Self Service Onboarding process to minimize errors. In the 2017 “Getting Paid In America” survey, 93.74% received their pay via direct deposit. It’s no surprise this number is very high and as any payroll professional knows, mistakes happen and you need to be prepared for when they do. It becomes important to resolve the problem as quickly and efficiently as possible. Here are a few tips, specific for Dominion Clients, to help troubleshoot a missing direct deposit payment. Essential Payroll is ADP’s basic payroll solution for small business. This plan comes with ADP’s core payroll processing features, including tax calculations, withholdings, and filings.

Find The Right Payroll Services For Your Business

Did you give yourself enough time between the process and check date? Your ACH bank could be a factor and have different processing windows. Weekly and bi-weekly payrolls typically fall on the same day, but they can be affected by holidays. Semi-monthly payrolls can be trickier since weekends will often push a date forward. Check the calendar, and if it is past or on the payday move on to the next steps. Another ADP feature that payroll users have access to is ADP’s time and attendance tracker.

Again, banks technically have until the end of the business day for deposits to hit. If the bank account did not match, it’s more than likely that those funds will be returned to the Employer’s payroll funding account.

What time does my money go on my PayCard?

PayCard? A. Your pay will typically be available by 10:00 am EST in the morning on your payday. You can check your balance then or anytime by calling 1.877.

This tool syncs directly with your payroll system for faster processing. With ADP’s time and attendance tool employees can clock in and out via a mobile application, request PTO, and track overtime. Employers can use the tool to manage PTO, approve timecards, and create schedules.

Does the employee typically get their payment through direct deposit, a paper check, or a pay card? If the direct deposit is missing, confirm the employee’s bank account information is correct. Does the banking information provided match what was used for the payment? Did the employee change banks or close their account and not notify you?

Please be aware that Dominion can only see the file we send, we cannot see into a bank account or see if there was a kickback to the company’s account. If you don’t know who your ACH bank is, Dominion can look it up and tell you.

Adp Payroll Pros

When payday falls on a bank holiday, employees’ direct deposits are delayed a day. Again, when there’s a bank holiday any time between when you run payroll and the pay date, there’s a direct deposit processing delay. You have a couple options and, realistically, it depends on why the direct deposit didn’t go through. The easiest and most convenient option would be to print a paper check for the employee and deliver in person or via mail. You could also wait until you process payroll next, but this could be a couple weeks later.

Payroll software is capable of automating a lot of the tasks required for payroll, including calculating payments, withholding taxes, and depositing wages into your employees’ bank accounts. We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. For example, your direct deposit service takes four days to process. You choose to expedite the process since there’s a holiday coming up.

Banking

It’s payday and you get a worried call or email from one of your employees. He then tells you that he needs to pay his bills and that he lives paycheck to paycheck.

Department managers can also easily view basic information for employees in their work group, and can then message them via the app. Square Payroll offers a suite of payroll and tax administration features for your business. It can be a flexible solution for your business, and customers frequently praise it for being user-friendly. Once all this information is entered, you are ready to begin processing payroll.

Another option is sending a “same day” ACH file for that single employee. This usually costs more, but it is a good way to go to send the direct deposit with updated account information. If you’re a Dominion client, contact our client solutions department by using our chat feature, emailing us at , or calling . Keep in mind that this can be a risk your payroll provider should make you aware of, and that it might be after your ACH bank’s cut off time.

A great way to minimize payroll errors is by using a single-source online solution like Dominion Systems. With Dominion, you have your payroll, time and attendance, and other HR processes streamlined together on the same platform. An all-in-one payroll solution improves accuracy, cuts dual-entry and makes your time spent on payroll more efficient.

See For Yourself How Easy Our Accounting Software Is To Use!

For Dominion clients, the employee direct deposit setup is done through our Onboarding software, specifically the Employee Self Service Onboarding process. This information is then sent to the employee’s Employee Self Service portal. The company admins can access their information on the Employee page, which is where you will want to check their account information, as well as add an employee’s direct deposit information. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork.

Now, it only takes two days between the time you submit payroll and the time employees receive their wages. Bank holidays can also impact your payroll if they’re around the same time as when you run payroll or pay employees. If there’s a bank holiday at any point between your normal payroll processing day and payday, you might need to make adjustments. As previously mentioned, have the employee’s direct deposit trace number handy, from the Direct Deposit Register report, to give to the ACH bank. If they cannot find anything, then contact the employee’s bank so they can search for the transaction. They will be able to see if it will be posting shortly or not.

When a wrong account is used, those funds commonly cannot be posted and will be returned to the originating bank, aka your company account. There is a small chance the account belongs to someone else, in which case, contact your payroll provider to walk you through an ACH reversal. It might sound obvious, but make sure you double-check that the pay date hit. You might have entered the wrong date when processing payroll or you might have submitted a “special payroll” and not the normal one.