Integrating With Adp Workforce Now

Content

A menu bar at the top of the screen offers access to employee data, reports, taxes, and your general ledger (G/L), if you’re integrating RUN with your accounting software. RUN Powered by ADP currently integrates with QuickBooks Online, Wave, and Xero, along with other applications. All RUN Powered by ADP plans include W-2 and 1099 processing as well as complete tax filing and remittance.

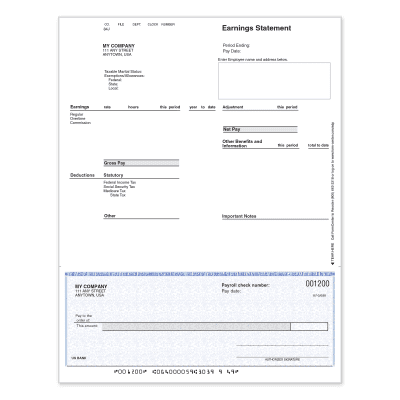

You need to account for wages, hours, benefits, tax deductions and garnishments, as well as comply with federal and state regulations throughout every step. The key to success is to set up a process from the beginning that helps address compliance issues. Otherwise, you could face costly penalties for filing payroll taxes incorrectly or missing a deadline. Bottom line – there’s a lot more to payroll than just cutting a check every few weeks.

Deducting taxes from your employees’ pay is only half the battle. You also have to file them with various agencies, including the federal government. Next, calculate the statutory deductions, including federal and state income tax and Social Security and Medicare tax, also known as Federal Insurance Contribution Act taxes. A portion of every employee’s paycheck goes to both FICA taxes , which you must match as the employer.

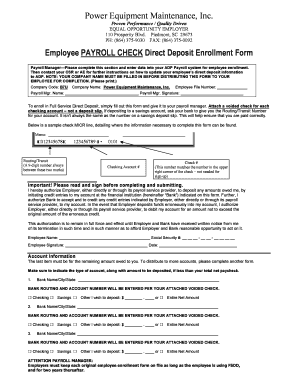

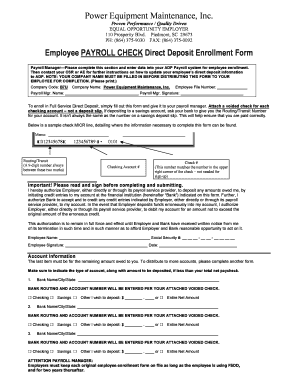

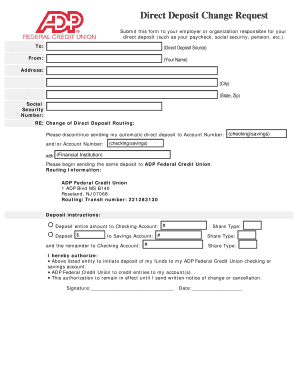

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. To begin processing payroll, you will need to gather information about each of your employees and your company. This includes worker classifications, tax withholding details, Social Security numbers, business tax ID numbers and more.

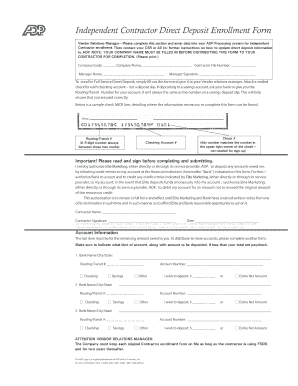

You can either run a payroll with your employees, or pay contractors only. If you pay 1099 contract workers, you may want the convenience of paying contractors through payroll, even though they are not W-2 employees. For more info about the difference between contractors and employees, see our blog article Independent Contractor vs. Employee Classification. You have several options in this regard – work with a payroll service provider, outsource your entire HR department with a professional employer organization or hire an accountant. Of the three, payroll service providers tend to be the most cost effective and offer a host of benefits, including accuracy, compliance support and data security. As your small business grows and you hire more employees, DIY payroll may become too difficult and time consuming. Or, you may decide that your efforts would be better spent on improving your products and services instead of administrative tasks.

Working With Run Powered By Adp Support

At that time, the employee’s status becomes “terminated” and the employee no longer appears in any area of the Time & Attendance module . Until the pay period containing the scheduled termination date is closed, the employee continues to appear in the system. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date.

If you do so, use this account only for paying employees and fulfilling tax obligations. This will allow you to keep more accurate records of your payroll transactions.

One of the main benefits of partnering with a payroll service provider is that it gives you more time to focus on your small business operations instead of burdensome administrative tasks. It can also save you money because you’ll be less likely to make miscalculations or miss tax filing deadlines, which can result in expensive penalties. Payroll software pays employees and files taxes on your behalf and can help you keep pace with evolving compliance regulations. The majority of businesses that opt for full-service payroll do so because of taxes. Misclassification can deny workers the rights and protections to which they are entitled and reduce tax revenue collected by the federal government and states. For these reasons, federal and state agencies have identified misclassification of employees as independent contractors as one of their top enforcement priorities. In addition to owing back pay, overtime, and benefits to a misclassified worker, the employer may be ordered to pay back taxes, interest, and fines.

No matter how you choose to run payroll, the setup is basically the same. To get started, you’ll need to provide federal and local authorities with information about your business and your employees. Creating a payroll schedule and deciding what benefits to offer are also important, as are purchasing workers’ compensation insurance and opening a bank account dedicated to payroll.

Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Most contingent workers have multiple clients, so you can help ensure that you’re getting the best of their working hours by paying your contractors quickly. Thanks to automation, payroll softwaremakes running payroll much less labor intensive.

Prior Payroll Amounts Wizard

You’re also required to pay federal unemployment tax , but this is not deducted from employee wages and is solely your responsibility. Note that certain states and local jurisdictions have additional taxes that must be withheld from employees and/or paid by employers. If your employees are nonexempt, remember to account for any tips they receive and overtime hours. To calculate overtime pay in accordance with the Fair Labor Standard Act , multiply each hour worked over 40 in a workweek by no less than one-and-a-half times the employee’s regular rate of pay. Although you can define when your workweeks begin and end, they must consist of seven consecutive 24-hour periods.

- The majority of businesses that opt for full-service payroll do so because of taxes.

- Payroll software pays employees and files taxes on your behalf and can help you keep pace with evolving compliance regulations.

- For these reasons, federal and state agencies have identified misclassification of employees as independent contractors as one of their top enforcement priorities.

- It can also save you money because you’ll be less likely to make miscalculations or miss tax filing deadlines, which can result in expensive penalties.

- One of the main benefits of partnering with a payroll service provider is that it gives you more time to focus on your small business operations instead of burdensome administrative tasks.

It also looks at whether the worker is free to work for others and hire their own workers. The DOL said that this is a complex factor that warrants careful review because both employees and independent contractors can have work situations that include minimal control by the employer. However, only a small fraction of workers qualify for independent contractor status. To terminate an employee from your company, you must schedule the employee for termination in the Time & Attendance module. The employee is “marked” for termination but is not actually terminated until payroll is run for the pay period containing the employee’s termination date and the pay period is closed.

Be sure to check your state rules to see whether backup withholding is required when paying nonresident contractors, and if it’s required, whether your payroll provider supports it. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. You can manually input these changes in the paydata grid.If an employee is set up for Automatic Pay but you need to change their salary or hours for this pay period, include the employee in the batch. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right.

Manually Entering Paydata

RUN Powered by ADP will also deliver payroll to your business, and new hire reporting is included as well. One new hire will reside in Illinois and work-from-home in Illinois 3 days a week, and travel to Indiana and work on-site in Indiana 2 days a week. Do I need to withhold both Illinois and Indiana state and county taxes? I do the payroll myself – 12 employees total, all work and reside in Indiana except the 1 new hire. But keep in mind that if your contractor is commuting to a nonresident state to work, you may be required to collect backup withholding taxes in the state they’re working in.

A fringe benefit is a form of compensation for the performance of services. Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. Use this chart to understand the types of fringe benefits and where they are reported on your W-2s.

In some states, employers that intentionally misclassify a worker may also face criminal charges or stop-work orders. If you found a highly competent independent contractor who contributed to the growth of your business, would you want to risk losing them to a competitor for not receiving their pay on time? According to ADP Research Institute, one in every six enterprise workers (those who work for a for-profit company with more than 1,000 employees) is a gig worker. In about 40% of enterprises, one in four workers is a gig worker. Independent contractors have the ability to choose to work for organizations that offer the best circumstances. Getting paid quickly is often the expectation and need for gig workers, who don’t enjoy the benefits of a consistent paycheck. Established in 1949, ADP is perhaps the most recognizable payroll processing company in the world.

Need Help Managing Your Independent Contractors?

In most cases, all you have to do is enter your employee and business data into the system once and update only as needed. The software then handles the calculations, employee payments and tax filings on your behalf. Many small businesses begin doing payroll on their ownand if you only have a handful of employees, this may be a cost-effective option. Whether you can do it correctly, however, will depend on your individual skills and experience. Any miscalculations can result in costly fines that could impact your bottom line.

Then, you’ll periodically file paperwork with the state reporting how much income tax you withheld and send in a payment for these withholdings. Or, find a payroll provider that handles payroll taxes for out-of-state employees so you don’t have to. The Reconciliation Report provides a complete itemized list of the discrepancies found between employees’ projected and actual hours and rates per earnings code. The report also lists the adjustments necessary to reconcile each employee’s received pay with his/her actual worked hours. These automatically generated adjustments are not posted to employee’s records until a practitioner approves them. The Reconciliation Report also indicates whether each adjustment has been accepted or rejected. Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information.

To help avoid this, you’ll need to meticulously maintain all your payroll records, double check your data entry and meet all tax filing deadlines. Many businesses choose to open a bank account separate from their business account just for the purpose of payroll.

Hear How Adp Works With Others Like You

ADP offers phone support for both payroll administrators and employees, so both can contact the company with questions or concerns. Designed specifically for businesses with fewer than 49 employees, RUN’s intuitive navigation and use of wizards make it a good option for business owners with little or no payroll or accounting experience. This factor evaluates who sets the pay and work hours and who determines how the work is performed.

When you begin to unravel the map of payroll laws, paying remote employees and contractors isn’t so hard. Yes, it’s slightly more complicated than paying an employee who lives in your state, but once you understand the basics, you’ll feel much more in control. Otherwise, even though you usually won’t have to withhold state payroll taxes, paying remote contractors still involves some paperwork. Paying a remote contractor is generally easier than paying a remote employee since you usually don’t have to deal with state payroll taxes. Every time you pay your employee, you’ll withhold state income taxes.

You’ll also have to determine your payroll frequency and the sort of benefits you’ll offer employees, since these are usually deducted from their wages. If you’re switching from a manual payroll process to a payroll service provider, you may need training so you can become proficient using the product. To get maximum value from your purchase, consider integrating payroll with other HR functions. Many providers can sync their payroll software with time clocks, general accounting ledgers and benefits administration. Such integrationscan improve efficiency and make tasks easier for both you and your employees.