Integrating With Adp Workforce Now 2020

Click the Year-End Tasks and Tips button on the RUN homepage banner, then select Enter Third Party Sick Payto begin the Guided Walk Through. Watch a quick tutorial in Help & Support to learn how to add a new employee to your payroll. Also, the I-9 form is available in the Help & Support section of the RUN platform under Forms & Tools, then Tax & Payroll Forms. You and ADP® can no longer see full SSNs in the RUN Powered by ADP® platform; however, you are able to unmask SSNs on certain reports using the Show Social Security Number field. You can verify that your employees’ names and SSNs match Social Security’s records using the free verification service that the SSA provides on their website.

The amount will be displayed on your applicable employees’ W-2s in Box 12 . View your employees’ 2020 earnings and deductions in the RUN Powered by ADP® or Payroll Plus® platform. Go to the Reports tab, select Misc Reports and click Employee Summary.

You can report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform, but you must first calculate the taxable portion of coverage that exceeds $50,000. If you offer Group Term Life Insurance to your employees, the Internal Revenue Service requires you to calculate and report the cost of coverage over $50,000. Pulling your payroll liability report on a monthly basis and comparing it to your proof of tax deposits can help you keep track of any taxes you may owe at the end of the year. If you want to surprise your employees with the bonus, consider processing an Off-Cycle Payroll after you run your regular payroll. That way, the bonus amount won’t be included in the year-to-date total. Services like company cars and gym memberships are taxable. You can also refer to Publication 15-B, The Employer’s Tax Guide to Fringe Benefits, as prepared by the IRS.

If this option is not selected, the holiday is not awarded until the actual day of the holiday. Be sure to report any changes with your first payroll of 2021. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through. In the fourth quarter, before December 31, you must update missing totals for your employees and run any bonus payrolls.

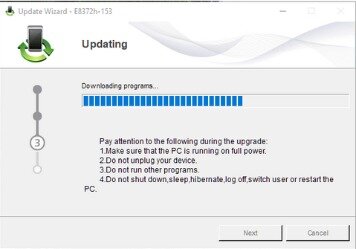

If you have to run an Off-Cycle Payroll after the last day of the quarter, government agencies may charge you with penalties and interest based on their deposit and filing deadlines for taxes. SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC. This includes copies that are provided to employees to report third party sick pay and group-term life insurance. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. Step-by-step Guided Walk Throughs are available in the RUN platform to assist you with recording manual checks using our Calculate Checks tool; reporting third party sick pay; and maxing out retirement. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checks, Enter Third Party Sick PayORMaxing Out Retirementto begin the Guided Walk Through. You can now receive payroll text and calendar reminders 2 days before you’re scheduled to process payroll.

Report Guides

This check box is only displayed if your company allows other Time & Attendance module users to be selected as report recipients. Perfect for those who want to schedule, track time and attendance, and export to ADP for payroll. Time tracking software Record accurate timesheets and attendance to make payroll a breeze. Deputy mobile app Run your teams remotely without missing a thing.

If you have to run another payroll before the end of the year, you will have to review your company, employee, and contractor totals again. The last day you can submit final 2020 payrolls with a check date in December is 12/31. Payrolls submitted after 12/31 may incur penalty and interest charges. This interactive tracking system will guide you through important To-Do items that need to be completed prior to running your last payroll of the year. Completing these tasks will help ensure W-2s and 1099s are accurate for you and your employees BEFORE they are printed. Employers who provide Group Term Life Insurance to their employees must calculate and report the cost of coverage over $50,000, as required by the Internal Revenue Service . This cost is fully taxable and must be reported as additional income for any employee who receives this benefit.

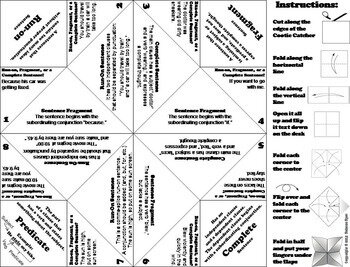

Payroll Taxability

Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. The benefit is subject to taxes and must be reported on the employee’s W-2. Click here for a list of fringe benefit earnings and where they appear on your employees’ W-2s. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party. Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. If this option is selected, the holiday is awarded (entered on employees’ timecards) when it first falls in either the current or next pay period.

We’ll even remind you of upcoming holidays in case you need to run payroll early! Log into the RUN Powered by ADP®/Payroll Plus® platform, click your name in the top, right-hand corner and select Settings to begin setup today. You must assign a holiday pay distribution rule to each holiday. This rule specifies which labor charge categories and earnings codes holiday pay is charged to and how many hours of holiday pay employees receive. Like holiday qualification rules, holiday distribution rules are created and maintained for your company by ADP. If you are unsure which rule to select, contact your ADP Time & Attendance Representative.

Although you can perform an export at any time, exports can only be performed for current pay periods and are usually done as part of end of period/payroll preparation operations. If you export data before the end of a current pay period, the export will not be a complete record of all of the transactions in the pay period. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification. Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package. A step-by-step Guided Walk Through is available in the RUN Powered by ADP® platform to assist you through the process of reporting third party sick pay.

Set Up The Leave Balance Sync

You can either report Group Term Life Insurance costs for your employees per payroll OR in lump sum via an Off-Cycle Payroll. They will not have full visibility of their SSN/TIN once their tax forms are printed and distributed. ADP®will be truncating SSNs and TINs on the Employee and Employer copies of the Form W-2, as well as the Payee and Payer Reference copies of Forms 1099-MISC and 1099-NEC. To pull your payroll liability report, log into the RUN Powered by ADP® or Payroll Plus® platform, go to the Reports tab, select Payroll and click Payroll Liability.

The more employees you have, the more you will have to pay for the ADP payroll system. If your business has 20 employees, you cannot use the do-it-yourself option, but you can get the full-service plans available to any small business. Some small businesses only need two employees, but you should still manage payroll and other employee relations. There are multiple plans for ADP for small business, so you can choose the one that’s right for you. Other ADP programs work well with the payroll system, so you can streamline how you run your business. And if you’re concerned about the cost, consider how many employees you have.

It doesn’t matter if you are just starting your business or have hundreds of employees. Employees and managers can access the service online or with an app, so everyone can check on their payroll and other work-related information. You can integrate it with various business software and time tracking programs. It can take small business ownersup to five hourseach pay period to manage payroll taxes. So if you want to cut down on that time, you need a tool like ADP. check box, you must select at least one person from the list of recipients.

- Click here for a list of fringe benefit earnings and where they appear on your employees’ W-2s.

- The benefit is subject to taxes and must be reported on the employee’s W-2.

- If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s.

- Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party.

- Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it.

The specific cost will depend onthe ADP planyou choose and how often you run payroll. You’ll have to pay a fee each time you pay your employees, so more frequent paychecks can add up. If your business has at least 50 employees, you can use the ADP payroll system for medium and large businesses. They offer a plan with payroll and HR services as well as dedicated support.

If you own a business and only have two employees, you can also do it yourself. You can sign up for ADP, and you can run payroll on your schedule. It will help you with taxes and direct deposit, so you don’t have to worry about those things. If your company exports time and attendance data to a payroll system, it is important to run a payroll export just before closing a pay period. To help you remember to do this, the End of Period interface includes steps that allow you to run a payroll export as you are performing your end of period and payroll preparation tasks. As a further precaution, your ADP Time & Attendance Representative can also configure your pay cycles so that a pay period cannot be moved if a payroll export has not been run for that pay period.

A step-by-step Guided Walk Through is available in the RUN platform to assist you through the process of reporting third party sick pay. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectEnter Third Party Sick Payto begin the Guided Walk Through. If your check date falls on this date, please adjust it to avoid delaying your employees’ direct deposits and delivery of your payroll package.