Liability: Definition, Types, Example, and Assets vs Liabilities

Content

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. Liability may also refer to the legal liability of a business or individual. For example, many businesses take out liability insurance in case a customer or employee sues them for negligence.

For example, a business looking to purchase a building will usually take out a mortgage from a bank in order to afford the purchase. The business then owes the bank for the mortgage and contracted interest. As earlier stated, liabilities aren’t necessarily bad for your business. Having too many liabilities could result in the sale of assets to pay off debt, thereby decreasing your company’s value. One of the critical accounting calculations with the liability account is a company’s debt-capital ratio.

- Since most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid.

- Having too many liabilities could result in the sale of assets to pay off debt, thereby decreasing your company’s value.

- When the supplier delivers the inventory, the company usually has 30 days to pay for it.

A liability is something that is borrowed from, owed to, or obligated to someone else. It can be real (e.g. a bill that needs to be paid) or potential (e.g. a possible lawsuit). Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

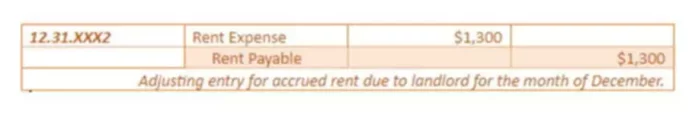

The natural balance of a liability account is a credit, so any entries that increase the balance of a liability account appear on the right side of the journal entry. A liability account is sometimes paired with a contra liability account, which contains a debit balance. When combined, the liability account and contra liability account result in a reduced total balance. Notes Payable – A note payable is a long-term contract to borrow money from a creditor.

Also, liabilities give your business growth opportunities through short or long-term loans that can be used to purchase new assets and increase the owner(s) equity. To calculate the debt-to-capital ratio, take your company’s interest-bearing debt (short and long-term liabilities), then divide it by the total capital. Salaries owed to your workers are classified under current liabilities, as settlement(s) are expected within 30 days. Short-term loans (30 to 90 days) taken from creditors are also listed under current liabilities.

Example of Liabilities

A liability account is used to store all legally binding obligations payable to a third party. Liability accounts appear in a firm’s general ledger, and are aggregated into the liability line items on its balance sheet. Liabilities are reported on the right side of your company balance sheet.

An asset is anything a company owns of financial value, such as revenue (which is recorded under accounts receivable). All businesses have liabilities, except those that operate solely with cash. To operate on a cash-only basis, you’d need to both pay with and accept cash—either physical cash or through your business checking account. For example, if a company has more expenses than revenues for the past three years, it may signal weak financial stability because it has been losing money for those years. Liabilities are often classified into three depending on their temporality or occurrences – Current liabilities / Short-term liabilities, Long-term liabilities, and Contingent Liabilities.

Current (Near-Term) Liabilities

The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities like payroll, taxes will be higher current debt obligations. Expenses and liabilities should not be confused with each other. One is listed on a company’s balance sheet, and the other is listed on the company’s income statement. Expenses are the costs of a company’s operation, while liabilities are the obligations and debts a company owes.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. However, in accounting, the concepts of liabilities and bookkeeping are different. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Liabilities are categorized as current or non-current depending on their temporality. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations.

How Do Liabilities Relate to Assets and Equity?

Companies will segregate their liabilities by their time horizon for when they are due. Current liabilities are due within a year and are often paid for using current assets. Non-current liabilities are due in more than one year and most often include debt repayments and deferred payments. AT&T clearly defines its bank debt that is maturing in less than one year under current liabilities. For a company this size, this is often used as operating capital for day-to-day operations rather than funding larger items, which would be better suited using long-term debt. These debts usually arise from business transactions like purchases of goods and services.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- For a company this size, this is often used as operating capital for day-to-day operations rather than funding larger items, which would be better suited using long-term debt.

- In the U.S., only businesses in certain states have to collect sales tax, and rates vary.

- The debt-to-capital ratio gives analysts and investors a better idea of a company’s financial health by comparing its total liabilities to total capital.

- Also, liabilities give your business growth opportunities through short or long-term loans that can be used to purchase new assets and increase the owner(s) equity.

As a practical example of understanding a firm’s liabilities, let’s look at a historical example using AT&T’s (T) 2020 balance sheet. The current/short-term liabilities are separated from long-term/non-current liabilities on the balance sheet. Unearned Revenue – Unearned revenue is slightly different from other liabilities because it doesn’t involve direct borrowing. Unearned revenue arises when a company sells goods or services to a customer who pays the company but doesn’t receive the goods or services. The company must recognize a liability because it owes the customer for the goods or services the customer paid for. The debt-to-capital ratio gives analysts and investors a better idea of a company’s financial health by comparing its total liabilities to total capital.

Where Are Liabilities on a Balance Sheet?

We will discuss more liabilities in depth later in the accounting course. Money owed to employees and sales tax that you collect from clients and need to send to the government are also liabilities common to small businesses. A contingent liability is an obligation that might have to be paid in the future, but there are still unresolved matters that make it only a possibility and not a certainty.

The balances in liability accounts are nearly always credit balances and will be reported on the balance sheet as either current liabilities or noncurrent (or long-term) liabilities. Accounts Payable – Many companies purchase inventory on credit from vendors or supplies. When the supplier delivers the inventory, the company usually has 30 days to pay for it. This obligation to pay is referred to as payments on account or accounts payable.

As mentioned earlier, liability is an outstanding financial obligation related to an asset, like a loan used to expand your business or buy equipment. At the same time, expenses are recurring payments for items with no physical value to the company. On the balance sheet, a decrease in liability accounts is recorded on the credit side, while an increase is recorded on the debit side.

Some items can be classified in both categories, such as a loan that’s to be paid back over 2 years. The money owed for the first year is listed under current liabilities, and the rest of the balance owing becomes a long-term liability. The liabilities definition in financial accounting is a business’s financial responsibilities. A common liability for small businesses is accounts payable, or money owed to suppliers. Like businesses, an individual’s or household’s net worth is taken by balancing assets against liabilities.

How Do I Know If Something Is a Liability?

For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed may also be construed as a liability. Generally, liability refers to the state of being responsible for something, and this term can refer to any money or service owed to another party. Tax liability, for example, can refer to the property taxes that a homeowner owes to the municipal government or the income tax he owes to the federal government. When a retailer collects sales tax from a customer, they have a sales tax liability on their books until they remit those funds to the county/city/state.

It investigates the amount of debt a business uses to fund its day-to-day operations compared to capital. This metric can help you understand your company’s capital structure and financial solvency. Whenever a business records an obligation in a liability account, it is known as the debtor. The third party to which the obligation must be paid (such as a supplier or lender) is known as the creditor.

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. As the name suggests, it’s the direct opposite of Current liabilities. These cash obligations are not settled at a near time – usually more than an accounting calendar (12 months). FreshBooks’ accounting software makes it easy to find and decode your liabilities by generating your balance sheet with the click of a button.