Logins

It can be a flexible solution for your business, and customers frequently praise it for being user-friendly. + To obtain full forgiveness, loan proceeds must be spent during the Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within 8 to 24 weeks immediately following disbursement of the loan, whichever is earlier. Spend the loan proceeds, or incur qualifying costs, within applicable Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within to the 8- to 24 week period immediately following disbursement of the loan .

To determine whether staffing levels have been maintained, the average number of full-time equivalent employees during the applicable Covered Period or Alternative Payroll Covered Period will be compared to one of two time periods. Borrowers may either use the period from February 15 through June 30, 2019 or January 1 through February 29, 2020. If the number of FTEEs during the Covered Period or Alternative Payroll Covered Period is lower than the time period chosen, the amount of loan forgiveness may be reduced proportionately.

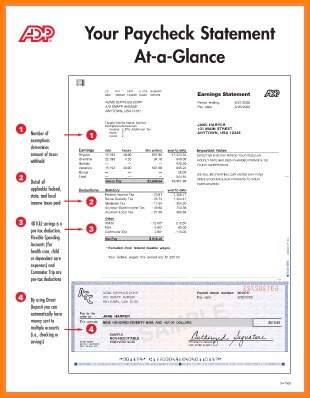

The ADP© Mobile Solutions app is available to employees of ADP clients in the US using these select ADP Services. Does ADP have online payroll tools or a mobile app for employees? ADP mobile solutions give employees access to their payroll information and benefits, no matter where they are. Employees can complete a variety of tasks, such as view their pay stubs, manage their time and attendance, and enter time-off requests. Beyond payroll, Workforce Now can provide solutions for HR, time tracking, talent management, and benefits management. Additional add-ons with the Workforce Now plan include PTO management, insurance services, and Microsoft Outlook integration. The first time you log into your account, you will be directed to the Company Setup Wizard.

Yes, the amount of the loan can be fully forgiven as long as certain conditions are met. The specific amount will generally depend in part on what portion of the loan is used on eligible payroll costs and whether the employer has maintained staffing and pay levels during the covered period. From 1985 onward, ADP’s annual revenues exceeded the $1 billion mark, with paychecks processed for about 20% of the U.S. workforce. In the 1990s, ADP began acting as a professional employer organization .

Square Payroll offers a suite of payroll and tax administration features for your business. Square Payroll lets you to pay a variety of workers, from contractors to employees, while allowing for benefits distribution, direct deposit, timecard syncing with the Square POS software, and tips distribution.

The Treasury Department has indicated that at least 60% of the loan forgiveness amount must have been used for payroll costs. My company previously laid off an employee, but later offered to rehire the employee. If the employee declined the rehire offer, will my PPP loan forgiveness amount still be reduced? When calculating the amount of loan forgiveness, how will the determination of whether my business has maintained pay levels be made? In addition, the COVID-19 relief law passed by Congress in December 2020 provides that the forgiven portion of a PPP loan can be excluded from gross income. Borrowers have 10 months from the end of their covered period to apply for forgiveness before they would need to start paying back any portion of their loan.

You will need to complete the PPP loan application, which your lender will provide, and submit the application with your payroll documentation. If you are applying for a second PPP loan, remember to run new PPP loan application reports from your ADP system. The ADP reports are updated frequently to reflect the latest government guidance. You should always run the applicable PPP report as close in time to submitting your PPP loan application as possible. For your reference, click here for application form provided by the SBA. Understanding the full impact of taking out a loan from your retirement account is an important decision in determining an overall planning strategy for your future retirement needs.

Payroll

What happens if I use less than 60 percent of the PPP loan on payroll costs? The Paycheck Protection Program Flexibility Act provides that at least 60% of the covered loan amount must be used for payroll costs. If less than 60% of the loan amount is used on payroll costs, the amount of the loan that is forgiven may be reduced.

Here, you will provide some basic business information, arrange your payroll calendar, enter tax, earnings, benefits, deductions, and workers’ compensation information, and link your business bank account to the software. The 3508S form eliminates the need for borrowers to demonstrate that they maintained wage and employment levels during the applicable covered period. Instead, borrowers will need only to demonstrate that they spent the loan proceeds on covered payroll (at least 60% of the forgiveness amount) and non-payroll costs. Borrowers can download the PPP Loan Forgiveness Payroll Costs report from their ADP system to submit to their lender with the 3508S form. How will the determination of whether my business has maintained staffing levels be made?

I used payroll cost and headcount reports for the PPP loan application. Can I use the same reports for purposes of loan forgiveness reporting? No, the ADP payroll cost and headcount reports that were developed to support PPP loan applications cannot be used for PPP loan forgiveness purposes. ADP has reports available to support clients that are navigating the forgiveness process. See below for more information about PPP loan forgiveness reports that are available. The new round of PPP funding includes other important changes to the PPP loan forgiveness process, some of which may apply to loans issued previously in 2020.

How To Start A Payroll Company

Stock Checks wants to be your one-stop source for ADP blank check paper and related check product. Another ADP Payroll customer, Todd Hinson, the founder of Tod.d, highlighted that he really likes the new ADP TotalSource service that the company offers.

- We offer direct deposit and mobile payroll solutions that integrate with time and attendance tracking.

- ADP provides customized payroll services, solutions and software for businesses of all sizes.

- We also automatically calculate deductions for taxes and retirement contributions, and provide expert support to help make sure you stay compliant with all applicable rules and regulations.

- Essential Payroll is ADP’s basic payroll solution for small business.

This plan comes with ADP’s core payroll processing features, including tax calculations, withholdings, and filings. You’ll also get check delivery, access to reporting features, integration options, new-hire reporting tools, yearly W-2 and 1099 delivery, and account access for your employees to view their paychecks and update tax information. ADP Workforce Now is designed for businesses with 50–1,000 employees.

Payroll Services For Your Business

We also automatically calculate deductions for taxes and retirement contributions, and provide expert support to help make sure you stay compliant with all applicable rules and regulations. Essential Payroll is ADP’s basic payroll solution for small business.

ADP provides customized payroll services, solutions and software for businesses of all sizes. We offer direct deposit and mobile payroll solutions that integrate with time and attendance tracking.

When the next pay period comes, log into your account dashboard and select the “Run Payroll” option. From here you can view employee time cards and make any manual adjustments. Each employee’s pay should calculate automatically based on the information provided in their profile. The software also calculates deductions for things like tax, health benefits, and retirement contributions. What is the period within which I must spend my loan proceeds to obtain full loan forgiveness? To obtain full forgiveness, loan proceeds must be spent within the 8- to 24-week period immediately following disbursement of the loan.

Borrowing from your savings may provide solutions in the near term but could negatively impact investment growth over time and cost you in loan fees. In most cases, if you leave your employer prior to paying off the loan, your loan will default and cause a taxable event. This calculator can help you estimate the impact a 401 loan can have on your savings. In early August, President Trump signed an executive order deferring the collection of payroll taxes from employees through the end of 2020. The payroll tax is a 6.2% tax on an employee’s salary (up to $137,700 for 2020) that is withheld from their paycheck to fund Social Security, and the employer pays another 6.2%. Not only is Stock Checks the best company for ADP compatible checks, but we also are known for having a variety of check related products. We have corresponding ADP envelopes for your business checks and payroll check paper, so you don’t have to shop elsewhere for matching product.

This product offers a variety of core features beyond just payroll, as well as additional add-on features. When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t. Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app. Once all this information is entered, you are ready to begin processing payroll.

Around this time, the company acquired Autonom, a German company, and the payroll and human resource services company, GSI, headquartered in Paris. In September 1998, ADP acquired UK-based Chessington Computer Centre that supplied administration services to the UK Government. Stock Checks has gained a great reputation as the leading payroll check paper and blank check product company because all of our checks and products are of great quality, especially our ADP compatible checks and ADP check stock. If you are looking to print valid payroll business checks, then Stock Checks blank check stock is right for you because we offer checks for ADP software to make printing checks easier on you. You won’t find a better quality for blank check stock or ADP compatible checks from any other company. However, if you’re just looking for a quick and easy payroll solution without all the bells and whistles, there are probably cheaper options on the market. If you want to compare ADP to other payroll software service providers, check out our list of the best payroll services for small business owners.

Explain Hris Payroll Systems

ADP is actively evaluating these changes and will update the guidance below and in the PPP Loan Forgiveness Reports as additional guidance is issued by the Treasury Department and Small Business Administration. For example, the CAA 2021 provides that the SBA will issue a streamlined forgiveness application form for loans of $150,000 or less. This one-page form would require borrowers to certify certain information related to loan forgiveness, list the amount of the loan, number of employees retained and estimated amount of the loan spent on payroll costs. Borrowers would be required to retain – but not submit – documents substantiated their forgiveness application for 4 years for employment records and 3 years for other records.

In 1957, Lautenberg, after successfully serving in sales and marketing, became a full-fledged partner with the two brothers. In 1961, the company changed its name to Automatic Data Processing, Inc. , and began using punched card machines, check printing machines, and mainframe computers. ADP went public in 1961 with 300 clients, 125 employees, and revenues of approximately $400,000 USD. The company established a subsidiary in the United Kingdom in 1965. In 1970, Lautenberg was noted as being the president of the company. Also in 1970, the company’s stock transitioned from trading on American Stock Exchange to trading on the New York Stock Exchange. It acquired the pioneering online computer services company Time Sharing Limited in 1974 and Cyphernetics in 1975.

Providing Financial Services To Employees Is A Win

Lautenberg continued in his roles as Chairman and CEO until elected to the United States Senate from New Jersey in 1982. As part of this transition to ADP and in accordance with New Jersey State Law P.L. 2013, c.28, which requires all State employees to be compensated via direct deposit, the College will be phasing out the distribution of paper paychecks. On April 1, 2020, when TCNJ transitions its payroll system from PeopleSoft to Oracle Cloud, the College will no longer be issuing paper checks for payroll. The YESS Employee Self Service portal will be open for a limited time so employees can access and manage their direct direct deposit information and tax withholdings ONLY.

How do I set up an ADP app?

To register, do the following. 1. From the Login Page, select First Time User? > Register Here.

2. Begin Registration.

3. Verify Identity.

4. Get User ID and Password.

5. Select Security Questions and Answers.

6. Enter Contact Information.

7. Enter Activation Code.

8. Review and Submit your information.

In 1949, Henry Taub founded Automatic Payrolls, Inc. as a manual payroll processing business with his brother Joe Taub. Frank Lautenberg joined the brothers in the company’s infancy.

These reports can also be filtered by date range or employee and exported to Excel for further customization. For these reasons, it makes a lot of sense to find a good small business payroll serviceprovider to help you manage your payroll. Payroll software is capable of automating a lot of the tasks required for payroll, including calculating payments, withholding taxes, and depositing wages into your employees’ bank accounts. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. Repayment of the corresponding portion of the loan may be required if an employee’s earnings are reduced by more than 25% during the Covered Period or Alternative Payroll Covered Period compared to the period of January 1 through March 31, 2020. If the pay reduction was made outside the February 15 to April 26 timeframe, the forgivable amount may still be reduced even if the pay reduction is later reversed.

For small businesses that don’t employ a ton of people, Gusto Payroll could be a great alternative. It’s not the most sophisticated option out there but it can get the job done. The next level up is ADP Run Complete, which provides you with all your payroll tools plus additional HR perks. This is where you will get ZipRecruiter integration, assistance with creating an employee handbook, a direct line to ADP HR pros, onboarding help, five annual background checks, and access to various HR trainings, toolkits, and documents. From the dashboard, you can generate reports on payroll summaries, earnings records, timecard comparisons, retirement contributions, and more.