Logins 2021

Content

Cafeteria plans also can build employees’ loyalty within the company by saving them money and offering benefits they could not otherwise afford. Form 1095-C, under the Affordable Care Act, gives information about health care coverage provided or offered to benefits-eligible employees and their dependents during the previous year.

- Typically, this is over 40 hours worked in a week or over eight hours worked in a day.

- State and federal income taxes are withheld from your gross pay and are forwarded on to local and federal government on your behalf.

- It is used as part of the information required to prepare a personal income tax return for employed individuals.If anything, assuming you are a new employee, he very likely had you fill out a W-9 form.

- It basically is a request for you to divulge your social security number so that a W-2 form can be issued to you at the end of the year.

- A W-2 form is “issued” to all employees at the end of a calendar year, which summarizes all of an employee’s earnings and related income tax deductions made throughout the year.

- This practice is illegal.Normally what happens is that a company paycheck is issued.

Plus, a website is available to provide current and former employees with the ability to instantly access and print their own year-end statements. Also, our call center handles form re-issue requests. But what if you could be confident that your year-end income reporting is timely,provide online access to download current and historical forms and manage correction and re-issue requests without burdening your resources? With the ADP SmartCompliance W2 management module, you can. Depending on the level of service chosen and the size of your employer, W-2s will be available at different times throughout the month of January. However, in general, they are very quick to process them and most have their W-2s available online considerable before the paper copies arrive in the mail.

A W-2 form is “issued” to all employees at the end of a calendar year, which summarizes all of an employee’s earnings and related income tax deductions made throughout the year. It is used as part of the information required to prepare a personal income tax return for employed individuals.If anything, assuming you are a new employee, he very likely had you fill out a W-9 form. It basically is a request for you to divulge your social security number so that a W-2 form can be issued to you at the end of the year. This practice is illegal.Normally what happens is that a company paycheck is issued. State and federal income taxes are withheld from your gross pay and are forwarded on to local and federal government on your behalf.

A 1099-M form may be provided to individuals who receive payments greater than $600 through USC Business Services. Payroll Services does not issue 1099-M forms and cannot answer questions nor provide any assistance. For questions and requests for duplicates, visit the Business Services website at businessservices.usc.edu or The 1042-S will indicate the income code, which describes the type of income. In certain cases, you may receive multiple 1042-S forms or a W-2 form in addition to a 1042-S form.

If you purchased health insurance coverage through the Health Insurance Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible. For more information about the premium tax credit, see Pub. Employers can make Form W-2 corrections on forms sent to employees as well as forms filed with the SSA. Faculty and staff should be aware that around this time of year, many phishing emails start to circulate. When these are identified, ITaP redirects the link on the email to notify the recipient that it is in fact a phishing email. Unfortunately, these emails are becoming more and more authentic-looking. If an employee receives an email and clicks on the link, it may ask for information that could be used to gain access to personal information, so always err on the side of caution and do not provide personal information.

If you find a discrepancy on Form W-2, you should contact your employer immediately to have it corrected. Also, remember that these benefits are paid for with pre-tax dollars so they are not eligible to be used as a deduction on your return. For example, health insurance is a common benefit offered by these plans, but you cannot also use these costs as a medical deduction on Schedule A if you paid for them through your cafeteria plan. The employee advantages of enrolling in cafeteria plans are simple.

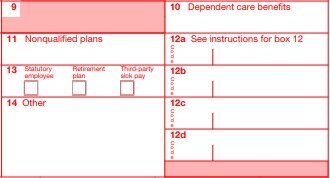

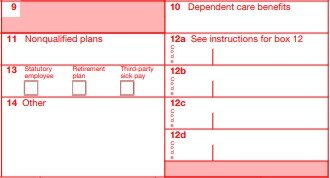

W2 Form

You don’t report taxes in the US because you’re not living in the US and are not a resident or citizen. Further such information is used by an employer when filing form 1040 to the IRS. For convenience, an individual can fill a form template online.

A person on F1-OPT who is faculty will be paid under income code 20, for example. requires certain employers to provide their full-time employees with information about the health insurance coverage offered to them. Form 1095-C Part II includes information about the coverage, if any, your employer offered to you and your spouse and dependent.

The form contains personal information about you and your dependents. As Purdue employees begin filing taxes, the following information may be useful as to when to expect tax information. Wait on all applicable forms before filing a U.S. tax return. Having Cafe 125 reported on your W-2 does not change the way you prepare and file your tax return. The money deferred to pretax plans should already be subtracted from the total amount of your wages reported in box 1 on your W-2. You should verify that this information is reported correctly before filing your tax return.

If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax ewill be. Refund Advance is a loan based upon your anticipated refund and is not the refund itself. To apply for the Refund Advance, you must file your taxes with TurboTax. Availability of the Refund Advance is subject to satisfaction of identity verification, certain security requirements, eligibility criteria, and underwriting standards.

How To File Taxes In 3 Easy Steps With Turbotax Online

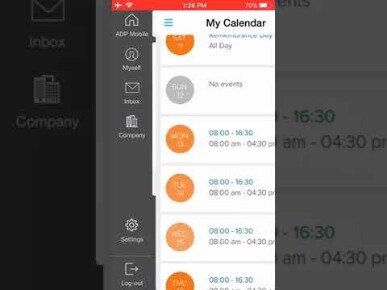

If you exceed the number of login attempts, please contact your employer’s payroll or HR contact for assistance. Your privacy is valued and for your protection, ADP is not authorized to reset your portal access. If your administrator is unsure how to reset your access, please have them contact their service center for help. If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer, you can try and access your information.

Tax refunds should also be released at a faster rate as well, although only time will tell as to how much faster. Ensuring that you have the most up-to-date state or federal forms can be a challenge—often requiring a significant investment of time and effort. Find copies of current unemployment, withholding, IRS, ADP, and other forms using this extensive repository of tax and compliance-related forms and materials. If your employer has given you online access to access your pay information, log into login.adp.com. Note, not all companies use our online portal so if you are unable to log in, please contact your employer directly to ask about your W2. A lot of graphic design, tech and numbers related work can be done from your own home. They offered developpers who applied for their team a salary between $4,000 and $5,000 USD a month.

Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. To calculate how much you should withhold you need to calculate two things. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don’t worry too much about your state.

Typically, this is over 40 hours worked in a week or over eight hours worked in a day. Each state has different laws, so I’m not sure which applies to you.If you are being paid no overtime and are working 12–14 hours daily for five or more days a week, that is the second law your employer has broken. Offering cafeteria plans to employees can save money for employers. Most cafeteria plans are not subject to Medicare taxes, and by allowing employees to defer income to these programs, employers generally pay less in payroll taxes.

After a document is filled out, check all information provided if it is true and correct. A person can easily fill out a printable template online. When e-filing a document make sure all empty boxes are filled in. On this website you can find various free updated PDF samples of this form which further can be easily saved, printed and submitted to a recipient. Save your time and spend just a few minutes to create a legally binding document. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

A graphic artist has many websites availables to freelance and sell their workThe problem is that many freelancers don’t report self-enployment income tax. And some banks in the US do allow foreigners to open bank accounts just by providing your passport, proof of income and an address.Therein lies the problem.

When You Dont Have To Send Form W

As a strong reminder, Purdue Payroll and Tax Services will not send clickable links regarding employee tax information. Every year Public Partnerships mails W-2 tax forms to all support/care workers. Now workers may also access W-2 forms digitally on our BetterOnline web portal.

If you are unable to log in, your former employer may have removed your online account. You will need to contact your former company HR or Payroll department to request a copy of your W-2. We provide payroll, global HCM and outsourcing services in more than 140 countries. Whether you operate in multiple countries or just one, we can provide local expertise to support your global workforce strategy.

The employer must generate a W-2 form and send it to his employee by the end of the year, so that the employee can use it when filling his yearly taxes to the IRS . The Allstate Corporation is the country’s biggest publicly held personal lines insurance company. Allstate provides insurance items to around 16 million family units. Allstate was established in 1931 as a feature of Sears, Roebuck, and Co. At that point, its first sale of stock was the biggest in U.S. history. On June 30, 1995, it ended up being a completely independent business after Sears divested its remaining shares to Sears’s shareholders. This service is designed to provide year-end statement processing.

Use your virtual card until you activate your physical Turbo® Visa® Debit Card, which will arrive in 5 to 10 business days of IRS acceptance and loan approval. Your virtual card expires in four years or upon activating your physical Turbo® Visa® Debit Card. This offer is available until February 15, 2021, or until available funds have been exhausted, whichever comes first. Availability subject to change without further notice.

You’ll get your maximum refund, guaranteed, every time you use TurboTax, and you’ll never pay until you’re ready to e-file or print your tax return. Check with your previous employer to see if your W2 has been sent out. A simple email or phone call can help resolve the issue of an incorrect mailing address and determine if it was mailed to you at all. Asking your employer how they mailed out the form will help you to gauge where the mail would be coming from and about how long of a wait you should expect. Your payroll department can help indicate when they sent it to you, and if too much time has passed, you can request they resend it to you. reduce errors by giving them more time to check each return. Having the forms sent out earlier will allow for better fraud prevention.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. If you did not receive your 1042-S form or need another one, you may request a duplicate by emailing University Payroll Services , sending postal mail to 3500 S. Figueroa Street, Suite 212, Los Angeles, CA , or inter-campus to mail code 8016. Include your full name at the time of your employment or payment, your date of birth, your employee number AND your USC ID number , and your mailing instructions. The processing time is 3 to 5 working days after we receive your request.

– Keep this form with the materials you give to your tax preparer. However, in most cases, employees know whether they had health coverage and do not need this form to complete their tax returns. If you enrolled in a health plan in the Marketplace, you may need the information in Part II of Form 1095-C to help determine your eligibility for the premium tax credit. IRS Form W-2 reports all taxable wages you received from USC during the calendar year, all taxes withheld from those wages, and a few other required fields. The form serves as an annual statement that enables you to file your personal income tax return with the Internal Revenue Service as well as state and local authorities. Form W-2 reports only wages paid during the calendar year, regardless of when they were earned; that is, it does not include amounts earned but not paid until the next year. The W-2 form is a form that reports the employee’s annual wages, and the summarized breakdown of taxes that the employer withheld from his paycheck for the entire year.

Much like a W-2, which includes information about the income you received, the 1095-C provides information that you may need when you file your individual income tax return. Also like a W-2, USC will file the 1095-C with the IRS. You are not required to file this form with your tax return.

Income allotted to cafeteria plans is taken directly from an employee’s paycheck before taxes are taken out. These pre-tax contributions can save the employee hundreds—possibly even thousands—of dollars in income taxes and Social Security and Medicare taxes over the course of a year. Employees also have the advantage of choosing which programs to enroll in and which to decline to get the specific benefits that are most important to them. Employers can choose to set up “cafeteria plans” under section 125 of the Internal Revenue Code for a variety of reasons. These cafeteria plans allow employees to set aside pre-tax income for certain employer-offered benefits. Benefits provided by plans covered under section 125 include adoption and dependent care assistance, health insurance, 401k and group term life insurance policies. They are called cafeteria plans because employees are given a list of benefits to choose from, similar to a cafeteria-style menu.