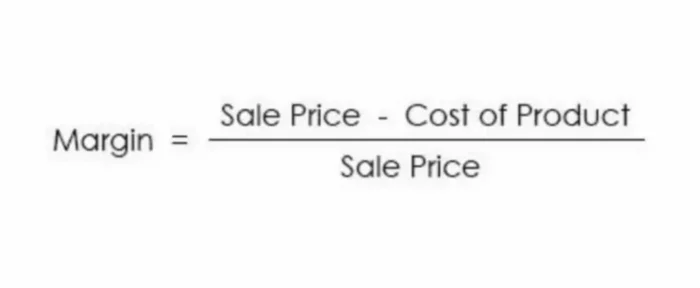

Managing the Business Side: Financial Considerations and Record-Keepin

This is to see their temperament and reaction before purchasing them. These travel costs can also be considered for tax deductions. The second tip is to have a separate bank account for all your dog breeding income. Even if you haven’t made an LLC yet or you are just operating as a sole proprietor, you’ll still want a separate bank account. You can use a second personal bank account at the same bank that you currently have your account, if you like.

#80 – 5 Tips to Manage Your Breeding Expenses

But if I didn’t track it separately, I wouldn’t know that. Another example, to help you understand, comes from our construction company, when Bill was really digging in and getting me to separate receipts. I would often put tools and job materials on the same receipt before I was … err … trained.

Winter Grooming Guide: Tips for Keeping Your Dog’s Coat Healthy and Clean

Although this may feel onerous, completing a tax return means you can record all your expenses to create a tax loss. This can then be used against any money you make in the future and save you tax at this point. The idea is easy, the execution is also pretty easy, but you know what makes it hard? You just have to get the habit down of separating purchases at the register. You know that you can’t cut corners on your breeding, but also on your overall strategy. You know that having an online and social media presence isn’t optional in today’s world.

The Basics of Starting a Dog Breeding Business: A Step-by-Step Guide

Any of these costs could be written off and deducted from your taxable income. I remember back when things were tight how everything was all clumped into one bank account. Rent would feed the dogs, then the dogs would pay the mortgage.

If you keep dogs as part of your breeding operation, you may deduct the cost of dog food for maintaining the dogs as part of the breeding process. BREEDING BUSINESS is a platform dedicated to ethical dog breeding around the world. Our team provides quality posts, in-depth articles, interviews, product reviews, and more. A home office deduction is where you are able to deduct this from your tax. This is due to using a certain amount of home space for your business. This can be applied towards your home rent, costs on expanding buildings, and even repairs.

Tax Tips for Dog Breeders

When you dive into this program, you read modern knowledge and genetics-based information. This is not a get-rick-quickly scheme, but we can assure you that dog breeding when executed rightly, is pleasurable. Seeing that sparkle in your future forever homes will fill you with joy and pride. Too many people affirm that you cannot make a profit if you breed your dogs properly, and it is indeed difficult, but who cares? We are helping you lose as little money as possible while keeping your breeding programme as close to perfect as possible. If you recall from a few episodes back, I spent too much money on dog food last year.

- Another example, to help you understand, comes from our construction company, when Bill was really digging in and getting me to separate receipts.

- This shows validity in the income you are earning and using through dog breeding alone.

- I have a Cheatsheet to help you get a simple list together.

The IRS doesn’t care if you use a personal bank account or a business account. Business accounts are more a “product” of the banks, as opposed to a requirement for business. If you follow Dave Ramsey and the idea of using a credit card is making you cringe, I get it. You could use a debit card, ideally the one connected to your bank account for the business. However, when I look at how much money I spend per year on my dogs, especially dog food, it’s nice to get the 1.5% cash back on the credit card.

Advertising costs are deductible if you market your breeding services or dogs. To take this deduction, you’ll need to keep accurate records of costs with receipts. Travel reimbursements for temporary posts and out-of-pocket travel expenses qualify for tax-free reimbursements. If you must travel for a breeding job, dog show, training, or other travel related to your breeding business, you may be able to deduct travel costs. Possible travel deductions include transportation by plane, car rentals, lodging expenses, and meals.

As for operating expenses, it’s pretty much everything else. Expenses that you would have whether or not you have puppies for sale. For example, you have dog food for your adult dogs whether or not you have puppies. Sure it might be a little more if you are feeding a mom who is nursing, but to me that’s negligible and harder to break apart than it would be to keep it together.

Not all the badges need applying to conclude that a person is in business and should pay tax. And the badges are always used to find a conclusive answer by HMRC. For example, they can decide to ignore their findings here and look at other evidence. However, it is a good place to start if you are trying to decide on your tax status as a dog breeder. I love that quote because it encourages us to take ownership of our taxes and understand the system, so we can pay our fair share, and nothing more. Regardless, my accountant is brilliant, and the sweet thing takes time with me when I talk to her, even when I know she probably finds it ridiculous how many questions I ask her.

Indirect expenses that keep up and running the entire home are deducted based on the percentages as above. Occasional profits, if any, earned in relation to the amount of losses, and in relation to the taxpayer’s investment in the activity, may indicate intent. An occasional small profit in one year, mixed with large losses in other years or large taxpayer investments may indicate the activity is a hobby. Substantial occasional profits mixed with frequent small losses or investments may indicate a business.

Let’s look further into why dog breeders can perform tax write-offs and how to implement them. As VAT relates to turnover, not profit, dog breeders can find themselves needing to register for VAT. This is especially so given the prices puppies are selling at now. Although this represents a milestone for any business, for dog breeders who sell to consumers it can pose a problem. Only registered business can claim back VAT so when you’re VAT registered you’ll need to add the standard rate of VAT 20% to the price of each puppy you sell.

Repairs and maintenance for equipment and vehicles used for your dog breeding business are deductible expenses. Everything from regular maintenance of vehicles and kennels to major repairs can be deducted as a business expense. After starting a dog breeding business, whether you work as a sole proprietor, LLC owner, or in partnership, you can claim business tax deductions relevant to the business. The expenses must be ordinary and necessary for the business to claim them. If you’re a dog breeder, either part-time or full-time, you could have opportunities to save more on taxes. Whether you plan to breed a single litter as a hobby or work full-time will also affect your deductions.