Net Income NI Definition: Uses, and How to Calculate It

Content

Income statements—and other financial statements—are built from your monthly books. At Bench, we do your bookkeeping and generate monthly financial statements for you. Net income is a good starting point for determining the profitability of a company but free cash flow is often a focal point for determining if a company is a good investment. Cash flow measures may also detect business problems like growing inventory balances, or troubles with collecting Accounts Receivable.

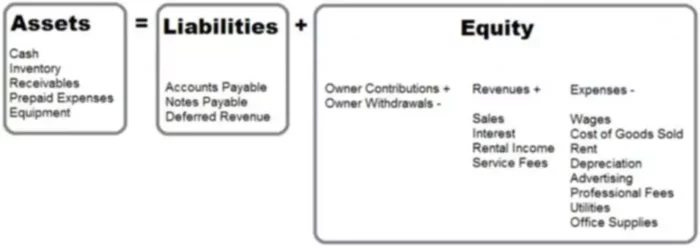

Under absorption costing, $3 in costs would be assigned to each automobile produced. When your company has more revenues than expenses, you have a positive net income. If your total expenses are more than your revenues, you have a negative net income, also known as a net loss. The first part of the formula, revenue minus cost of goods sold, is also the formula for gross income. FIFO will report higher gross profit and net income when the assumption is made that the products that make up COGS are lesser in value since they were purchased in the past.

Free Cash Flow vs. Net Income

As a result, it is an important metric in determining why a company’s profits are increasing or decreasing by looking at sales, production costs, labor costs, and productivity. If a company reports an increase in revenue, but it’s more than offset by an increase in production costs, such as labor, the gross profit will be lower for that period. Net income is the profit that remains after all expenses and costs have been subtracted from revenue. Net income—also called net profit—helps investors determine a company’s overall profitability, which reflects how effectively a company has been managed.

Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings. As profit and earnings are used synonymously for income (also depending on UK and US usage), net earnings and net profit are commonly found as synonyms for net income. Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity. In most cases, companies report gross profit and net income as part of their externally published financial statements. Consider the image below, which shows Best Buy’s income statement for the fiscal years ending in 2020, 2021, and 2022. Net income (NI) is known as the “bottom line” as it appears as the last line on the income statement once all expenses, interest, and taxes have been subtracted from revenues.

What is the Definition of Net Income?

If gross profit is positive for the quarter, it doesn’t necessarily mean a company is profitable. For example, a company could be saddled with too much debt, resulting in high interest expenses. These can wipe out gross profit and lead to a net loss (or negative net income). Net income can be misleading—non-cash expenses are not included in its calculation. Net income is far more helpful in determining the financial position of a business.

In Excel, we’ll compute each profit metric using the historical data points of Apple in fiscal year 2021. The taxes owed to the government are based on the corporate tax rate and jurisdiction of the company among various other factors (e.g. net operating losses, or NOLs). Using the figures from our earlier section, we’ll list the inputs below with the proper formatting, where the hard-coded numbers are entered in blue font and calculations are left in black font. Despite not actually having retrieved the payment from customers, the sale is recognized as revenue under accrual accounting.

Limitations of Gross Profit and Net Income

Compared to other non-levered metrics like operating income (EBIT) and EBITDA, net profit is used far less often in relative valuation. Once the company’s pre-tax income has been reduced by its tax expense, we’ve arrived at the company’s net income. Analyzing a company’s ROE through this method allows the analyst to determine the company’s operational strategy. A company with high ROE due to high net profit margins, for example, can be said to operate a product differentiation strategy. In many cases, the primary difference between gross profit and net income is the different user bases and their intentions with the information. Comparing the net incomes of two different businesses doesn’t tell you much either, even if they are in the same industry.

Looking further down the financial statements, you’ll notice that’s a far cry from the $2.4 billion of net income the company reports. Though most of this difference is due to selling, general, and administrative (SG&A) expenses, Best Buy also paid $574 million of income tax. Business owners and managers use gross profit information to assess the profitability of their core business operations. Though business owners use net income, select department leads will be more specifically interested in how the actual product manufacturing and sales perform without considering administrative costs.

- Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.

- An up-to-date income statement is just one report small businesses gain access to through Bench.

- While it is arrived at through the income statement, the net profit is also used in both the balance sheet and the cash flow statement.

- Net income is one of the most important line items on an income statement.

- Your company’s income statement might even break out operating net income as a separate line item before adding other income and expenses to arrive at net income.

The term “income statement” is used in the financial statements that a business prepares at the end of an accounting period. It is a number that is useful to the business owner for the purpose of analysis and study. The business owner uses the net income figure and the other line items on the income statement to know how well the firm has performed in meeting the standards it has set. The net income metric, i.e. the “bottom line” on the income statement, represents a company’s residual earnings, inclusive of all operating and non-operating expenses incurred in a given period. Net income is the amount of accounting profit a company has left over after paying off all its expenses.

Net income

But even net income is limited in that it is only useful for evaluating one company’s performance from year to year. However, some companies might assign a portion of their fixed costs used in production and report it based on each unit produced—called absorption costing. For example, say a manufacturing plant produced 5,000 automobiles in one quarter, and the company paid $15,000 in rent for the building.

- The result would be higher labor costs and an erosion of gross profitability.

- For example, a company might increase its gross profit while borrowing too much.

- Net income is found by taking sales revenue and subtracting COGS, SG&A, depreciation, and amortization, interest expense, taxes and any other expenses.

- It is a number that is useful to the business owner for the purpose of analysis and study.

- Net income is far more helpful in determining the financial position of a business.

To help you gain a better understanding of this key financial figure, we’ll discuss what net income is, how to calculate it, and why it matters to your business. Once standardized into percentage form, Apple’s net profit margin can now be compared to its historical periods and to its comparable peers to better understand its profitability in 2021. Net income also refers to an individual’s income after taking taxes and deductions into account. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The bookkeeper or accountant must itemise and allocate revenues and expenses properly to the specific working scope and context in which the term is applied. For example, a company in the manufacturing industry would likely have COGS listed. In contrast, a company in the service industry would not have COGS—instead, their costs might be listed under operating expenses.

How Do You Calculate Business Net Income?

Net income, on the other hand, is the actual amount of money you make in an accounting time period. As the gross margin grows, so may net income—although that is dependent on whether or not items like selling and administrative expenses increase. Net income is one of the most important financial metrics you can calculate for your business.

What is the Difference Between Net Income vs. EBIT vs. EBITDA?

Net profit, however, indicates the profitability of the business for a specific time period. Some small businesses try to operate without preparing a regular income statement. It’s not enough just to take a look at your bank balance and expenses on your check register.

Put simply, cash flow reflects money coming into and going out of a business. Cash Flow from Operations (or CFO) reflects the cash flow attributed strictly to a company’s business operations. Free cash flow represents what’s remaining from CFO after expenses necessary to maintain the equipment and operations of the company. Both net profit and net income are important financial metrics and should be calculated each accounting period for the business firm.