New Jersey Paycheck Calculator

Content

Your employer matches your Medicare and Social Security contributions, so the total payment is doubled. Any wages you earn in excess of $200,000 is subject to a 0.9% Medicare surtax, which is not matched by your company. Enable limited access for your employees to save your time and theirs. The employee payroll login includes a paycheck calculator and instant access to employee handbooks, and benefits calculators. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. Does calculating payroll taxes by hand sound like a hassle?

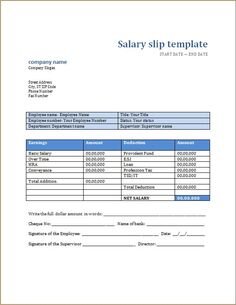

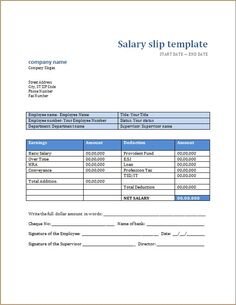

No one would call payroll taxes the easiest part of paying employees, but the right tools can make the process a little less, shall we say, taxing. For instance, a paycheck calculator can calculate your employees’ gross earnings, federal income tax withholding, Medicare and Social Security tax, and final take-home pay.

Medicare and Social Security taxes together make up FICA taxes. Your employer will withhold 1.45% of your wages for Medicare taxes each pay period and 6.2% in Social Security taxes.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year. If you’re an employee in Newark, it’s important to know that while the city has a 1% payroll tax, it applies to employers, not workers.

HR managers can review the payroll before processing it and can then approve the payroll for payment. In other words, it’s the amount of money the employee takes home each pay period after the employer withholds taxes and other deductions from their gross wages. With unlimited payroll runs and automatic tax filing, Gusto helps small-business owners worry less about payroll and put more time into growing their business. Some employees might ask you to withhold an additional amount in state income tax. If so, have that information on hand so you can deduct the right amount from your employee’s gross pay. Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account .

Be aware, though, that payroll taxes aren’t the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due. Payroll taxes in Texas are relatively simple because there are no state or local income taxes.

The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf. If you have questions, the company’s professional payroll staff is available 24/7 to provide answers. To run payroll, start by reviewing all of your employee hours. If you utilize the Time and Attendance component, employees can log in from their smartphones, and the data will automatically be added to the company’s payroll files. The basic idea behind the ADP experience is simplicity and automation. Once the initial data is entered into the system, payroll can be processed easily with a few clicks. Rather than manually inputting an employee’s worked hours, pay rates, tax rates and deductions into a spreadsheet, the ADP software performs each step quickly and automatically.

Our intelligent HR solutions will help you make informed business decisions in less time. You can align performance and incentives with business goals to ensure the company is not overspending and investing resources wisely. This lowers your administrative burden by streamlining payroll, time and labor, and benefits. You should feel confident that your payroll is accurate without having to spend countless hours checking it. ADP allows you to easily add employees and review their data in a centralized dashboard.

Running a small business is challenging and ADP is here to help you succeed. Outside of payroll, taxes, HR, and benefits, there are many other obstacles to climb. Reach out to our customer service team, we’re online 24/7. Gross-Up Calculator Use the gross up pay calculator to “gross up” wages based on net pay.

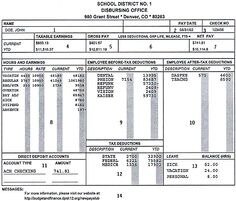

It has several packages and add-on features from which you can choose. Learning how ADP services work will help you decide which services are the best for your business. As an employer, you withhold these taxes from your employees’ wages each pay period and remit them to the IRS quarterly. Get an accurate read on your salaried employees’ withholding amounts and net pay using our free paycheck calculator below. This free salary paycheck calculator can help you determine how much to send your employees home with at the end of the day—and how much to remit to the IRS each quarter. However, employers will need to convert full-year deduction amounts over the standard deduction to a per-payroll period adjustment to taxable wages in withholding calculations.

Gusto’s payroll software automates the entire process for you, from filing payroll taxes to direct-depositing your employees’ paychecks each payday. If you want to boost your paycheck rather than find tax-advantaged deductions from it, you can seek what are called supplemental wages. That includes overtime, bonuses, commissions, awards, prizes and retroactive salary increases. These supplemental wages would not be subject to taxation in Texas because the state lacks an income tax. Use the free payroll calculators below to estimate federal and state withholdings on wages and bonuses,”gross up” wages based on net pay, or calculate take-home pay based on hourly wages. These calculators provide general guidance and estimates about the payroll process and should not be relied upon to calculate exact taxes, payroll or other financial data. If you have questions about tax withholdings or filing, contact your professional advisor or accountant.

Explain Hris Payroll Systems

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. By using the Paycheck Calculator, you waive any rights or claims you may have against Gusto in connection with its use. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Since a company’s needs are based on its size as well as on the structure of its HR department, ADP services differ from company to company. Every business needs to purchase what it truly needs or wants.

Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. As a business owner or a human resource professional, you may be looking for an automated solution for your employee payroll needs. ADP payroll is one of the most popular choices on the market for payroll software.

Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county. Over the last few years, withholding calculations and the Form W-4 went through a number of adjustments. If you were hired before 2020, you don’t need to complete the form unless you plan to adjust your withholdings or change jobs. All employees hired on or after Jan. 1, 2020 must complete the updated version.

Popular Locations For Automatic Data Processing, Inc (adp)

If you need to calculate an employee’s take-home pay in a jiffy, our paycheck calculator can help you out. Federal income taxes are also withheld from each of your paychecks. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Several factors – like your marital status, salary and additional tax withholdings – play a role in how much is taken out from your wages for federal taxes. Your New Jersey employer is responsible for withholding FICA taxes and federal income taxes from your paychecks.

You can include this on their pay stub or provide a separate document on payday. This means that it must be accrued and tracked in your payroll process. You can limit the amount of vacation time each employee can accrue, but you can’t have a “use it or lose it” policy that requires employees to forfeit unused earned vacation time. The date, time, and location that employees are paid must be posted for all employees to see. Any employee that works overtime must be paid no later than the next regularly scheduled pay date after the overtime was worked.

Paycheck Calculator Faq

Using take-home pay, calculate the gross that must be used when calculating payroll taxes. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only. It is not a substitute for the advice of an accountant or other tax professional.

But if your employees do qualify, just enter yes when the calculator asks if your employees are exempt or not. Salary paycheck calculators aren’t the most foolproof way to calculate employees’ take-home pay. After all, since you’re entering numbers by hand, you can’t rule out the possibility of typos and miscalculations. The IRS recommends that taxpayers access the online W-4 Calculator to check their payroll withholding and adjust withholding allowances, if needed, as early as possible. The IRS calculator asks about income and marital status, as well as estimated deductions and tax credits, to determine whether any additional withholding is necessary. At the time of hire, all employees must complete the Form W-4 so their employer can withhold the correct federal income tax from their pay. The Internal Revenue Service has released a draft of the 2020 Form W-4 that includes major revisions.

If you have over 49 employees, tax regulations and filings can become more complicated. Our software offers complimentary tax filing and compliance support. Additionally, ADP offers employee and manager self-service to save time. Use Gusto’s salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Calculate Your Paycheck In These Other States

Here is an overview of the proposed changes and what they would mean for you and your employees. Most people want a bigger paycheck, and you can certainly take steps toward that – for instance, by asking for a raise or by working extra hours . But while it’s always nice to increase your earnings, there are times when it might be smart to shrink your actual paycheck. If you elect to put more money into a pre-tax retirement account like a 401 or 403, for instance, you will save for the future while lowering your taxable income. The money that you put into a 401 or 403 comes out of your paycheck before taxes are applied, so by putting more money in a retirement account, you are paying less money in taxes right now. So, while you will receive a smaller paycheck each month, you will actually get to keep more of your salary this way. Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

These accounts take pre-tax money so they also reduce your taxable income. Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax. First, we calculated the semi-monthly paycheck for a single individual with two personal allowances. We applied relevant deductions and exemptions before calculating income tax withholding.

- Federal income taxes are also withheld from each of your paychecks.

- No one would call payroll taxes the easiest part of paying employees, but the right tools can make the process a little less, shall we say, taxing.

- If you need to calculate an employee’s take-home pay in a jiffy, our paycheck calculator can help you out.

- For instance, a paycheck calculator can calculate your employees’ gross earnings, federal income tax withholding, Medicare and Social Security tax, and final take-home pay.

This eliminates the possibility of costly human errors in time tracking. ADP’s software also tracks overtime and absence to ensure your staffing levels are always optimal for your needs. You can also give your employees real-time mobile access to schedules, hours worked, and vacation balances.

You can do that and worry about HR, retirement, and insurance benefits down the road. Our software also seamlessly integrates with many accounting and POS systems so the transition will be smooth. As part of your payroll process, you’ll need to inform your employees of the number of sick time hours they have available.

Both you and your employees also need to pay a variety of federal payroll taxes. You’ll need to pay FICA and FUTA, and your employees will need to pay FICA, federal income tax, and possibly the Additional Medicare tax. We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. Finally, some employees are eligible for exemptions from federal and state income taxes and FICA taxes . Very few employees qualify for these exemptions, so you probably won’t have to worry about it.

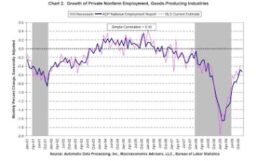

How You Can Affect Your Texas Paycheck

To better compare withholding across counties, we assumed a $50,000 annual income. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden, or greatest take-home pay. Based on up to eight different hourly pay rates, this calculator will show how much you can expect to take home after taxes and benefits are deducted. COVID Wage Growth Report How the pandemic has affected wages across the U.S.Pay Transparency Report Does pay transparency close the gender wage gap? College Salary Report Which alumni earn the most after graduation? Automate your time and attendance procedures through a biometric or online punchcard system.