Paycheck Calculator Pa Adp

Content

Our software offers complimentary tax filing and compliance support. Additionally, ADP offers employee and manager self-service to save time.

They may be paid weekly, semi-monthly, monthly, or less frequently . However, when calculating the regular rate, it must to done on an individual workweek basis. There are statutory exceptions to the regular rate requirements found in 29 CFR 778.400 through 778.421. The Fair Labor Standards Act requires employers to pay non-exempt employees 1.5 times their “regular rate of pay” for all hours worked over 40 in a workweek.

How Do I Complete A Paycheck Calculation?

Our employee time clock calculator automatically does time clock conversion from hours and minutes to decimal time. It can also calculate military time for payroll with the 24 hour military time clock setting. You can specify how you want to round decimal hours in the calculator settings. Use the free payroll calculators below to estimate federal and state withholdings on wages and bonuses,”gross up” wages based on net pay, or calculate take-home pay based on hourly wages. These calculators provide general guidance and estimates about the payroll process and should not be relied upon to calculate exact taxes, payroll or other financial data.

Additionally, the employee must clearly understand that the salary covers all hours the job may demand in a particular workweek. The employer must pay the salary even though the employee does not work all scheduled hours in a workweek. Other requirement for paying employees on the fluctuating workweek method apply.

- For example, if they work 50 hours and the fixed rate salary is $500 a week, the regular rate for that workweek is $10 per hour.

- For example, one workweek an employee may work 30 hours and another week 50 hours.

- In this situation, the regular rate will fluctuate and is determined based on each individual workweek.

- The regular rate is determined by dividing the salary by the number of hours actually worked in the particular workweek.

- Some employees are paid a fixed salary but work a different amount of hours each workweek.

Some employees are paid a fixed salary but work a different amount of hours each workweek. For example, one workweek an employee may work 30 hours and another week 50 hours. In this situation, the regular rate will fluctuate and is determined based on each individual workweek. The regular rate is determined by dividing the salary by the number of hours actually worked in the particular workweek.

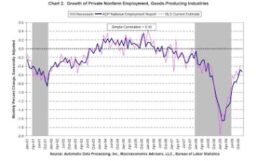

Will Smart Badges Help Employers Strategize?

In workweeks where employees work in excess of 40 hours, they must be paid the overtime rate based on their regular rate for that workweek. For example, if they work 50 hours and the fixed rate salary is $500 a week, the regular rate for that workweek is $10 per hour. To determine how much overtime is owed, the employer would multiply ½ the regular rate ($5 per hour) by the number of overtime hours worked for a total of $50 of overtime pay. Some employees are paid a certain amount of money based on completing a specific task or a certain project.

The employee payroll login includes a paycheck calculator and instant access to employee handbooks, and benefits calculators. Any nonexempt employee who works in excess of 40 hours per week or eight hours in a day must be paid overtime. Managers can discipline employees for not following company overtime policies.

Wages Paid With Alternatives To Cash

To determine the regular rate for pieceworkers, the entire compensation paid to the employees for a workweek, including any bonus, is divided by the actual number of hours worked by the employee. To calculate the total amount of overtime owed, the employer would take the total number of overtime hours worked and multiply it by ½ of the regular rate.29 CFR 778.111 . For example, if an employee earns $400 in a workweek performing piecework, receives a $50 bonus, and works 45 hours, the regular rate would be calculated as follows. The employer would add the $400 piecework compensation and the $50 bonus for a total of $450. Then, it would divide the $450 by the 45 hours worked in the workweek resulting in a $10 per hour regular rate. To determine how much overtime is owed, the employer would multiply ½ the regular rate ($5 per hour) by the number of overtime hours worked for a total of $25 of overtime pay.

What is a overtime rate?

Overtime rate is a calculation of hours worked by a worker that exceed those hours defined for a standard workweek. The overtime rate calculates the ratio between employee overtime with the regular hours in a specific time period.

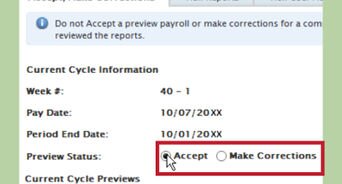

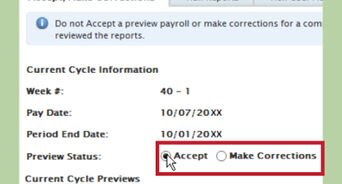

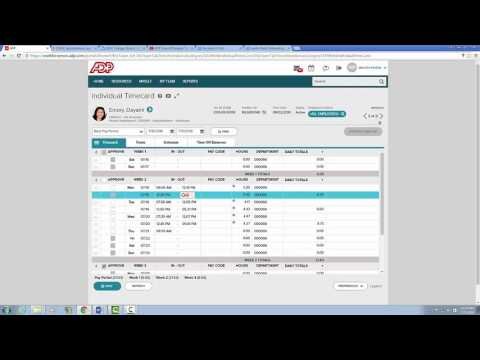

HR managers can review the payroll before processing it and can then approve the payroll for payment. You should feel confident that your payroll is accurate without having to spend countless hours checking it. ADP allows you to easily add employees and review their data in a centralized dashboard. If you have over 49 employees, tax regulations and filings can become more complicated.

Average Payroll Administrator With Adp Payroll System Skills Hourly Pay

For employees paid hourly, their regular rate is typically their established wage rate for non-overtime hours worked. If they work in excess of 40 hours in a workweek, they receive one-and-a-half times their hourly rate. A payroll administrator is the person who is responsible for ensuring that all employees within an organization are paid in an accurate and timely fashion. This is a position which will generally work in an indoor office environment. This administrator will generally keep weekday, daytime hours, though some overtime or extended hours may be necessary.

For example, if an employee is paid $100 per day, works five days in the workweek, and works a total of 50 hours, the regular rate would be calculated as follows. The employer would multiply the $100 daily rate by the five days worked by the employee, which equals $500. Then, it would divide the $500 by the 50 hours worked in the workweek which results in a regular rate of $10 per hour. If an employer pays an employee a weekly salary for working a specific number of hours, their regular rate of pay is computed by dividing the salary by the number of hours in their workweek. For example, if they employee is paid a salary of $400 for working a typical 40 hour workweek, the regular rate is $10 ($400 divided by 40 hours).

How To Calculate Hourly Pay

The employer would be required to pay the employee an overtime rate of $15 per hour for any hour worked over 40 in a workweek. The employee must receive at least 0.5 times their regular rate of pay for overtime hours worked. Since the salary is intended to compensate for whatever hours are worked in the workweek, their regular rate will vary from week to week. To arrive at their regular rate, divide the number of hours worked in the workweek into the amount of the salary to obtain the applicable hourly rate for the week. The federal Fair Labor Standards Act requires employers to pay non-exempt employees 1.5 times their “regular rate of pay” for all hours worked over 40 in a workweek.

Some states require overtime pay in additional circumstances and at different rates. Below, we cover how to calculate overtime in accordance with federal rules. There are some exceptions discussed in 29 CFR 778.400 and 29 CFR 778.415 to 778.421. The FLSA does not require employers to pay employees on a weekly basis.

But business owners can’t deny nonexempt employees overtime pay. To calculate for a single employee, click Calc Weekly OT on their time card. If the total hours for an employee in a week is over 40, an additional adjustment row will be added for overtime hours. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

An employee is paid work week overtime for hours they work in excess of a number you specify , in a single week. However, only hours worked that meet the straight time condition each day count towards that total. The basic idea behind the ADP experience is simplicity and automation. Once the initial data is entered into the system, payroll can be processed easily with a few clicks. Rather than manually inputting an employee’s worked hours, pay rates, tax rates and deductions into a spreadsheet, the ADP software performs each step quickly and automatically.

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Generally, employers must pay employees overtime on the payday which covers the pay period in which the overtime hours were worked. If calculating overtime is too complicated, the employer must pay the overtime as soon as it can reasonably be calculated. If there is a retroactive pay raise, retroactive overtime must be paid when the first increase in compensation is paid. All salaries, no matter the frequency with which they are paid, must be reduced to a workweek equivalent so an hourly rate can be calculated. Enable limited access for your employees to save your time and theirs.

Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. When employees are paid with goods or benefits, such as lodging, the fair market value of the noncash benefit must be calculated and added to the cash wages before determining the regular rate. An employee’s regular rate is the hourly rate an employee is paid for all non-overtime hours worked in a workweek. When calculating an employee’s regular rate, all compensation received by the employee in a workweek must be included, including wages, bonuses, commissions, and any other forms of compensation. Based on up to eight different hourly pay rates, this calculator will show how much you can expect to take home after taxes and benefits are deducted.

A payroll administrator will generally work with other office personnel, as well as accounting and human resources personnel. Include any applicable special rate supplement or locality payment in the “total remuneration” and “straight time rate of pay” when computing overtime pay under the FLSA. Compute the “hourly regular rate of pay” by dividing the “total remuneration” paid to an employee in the workweek by the number of hours in the workweek for which such compensation is paid. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information.