Payroll Administrator Ii Job Description

Content

As the payroll administrator works in a small company, she also performs the duties of a payroll coordinator. She collects health insurance benefit forms, timesheets and all documents related to payroll. She enters the employee hours and adjusts the payroll system information as needed. While a payroll administrator handles the same responsibilities as a payroll coordinator, the coordinator does not have the same level of responsibility for an organization’s entire payroll. She is only responsible for the accuracy of the payroll documents for her department.

How do I become a payroll administrator?

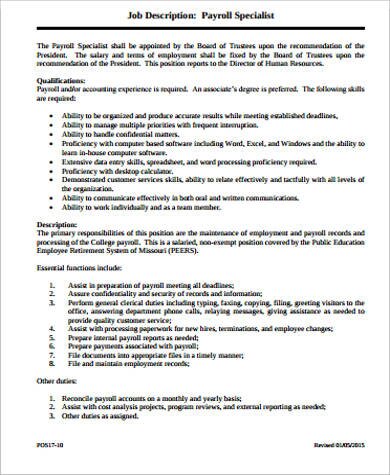

Most employers require payroll administrators to have related post-secondary education or work experience, or both. Some only seek applicants with a diploma or degree related to accounting, business administration, commerce, human resources, industrial relations, or psychology.

Get started in a rewarding career in human resources by joining our team as a payroll administrator. Our company is seeking motivated individuals who have a knack for numbers and a flair for details to join our payroll processing department.

Therefore, if the requirements are not clearly set forth in a payroll administrator job description, then you will spend more of your own time sorting through applications that don’t match the position’s criteria. Those payroll administrators who do attend college, typically earn either a accounting degree or a business degree. Less commonly earned degrees for payroll administrators include a human resources management degree or a finance degree. First the amount paid to employees for the work provided to a business during a certain period of time. Second, the financial records of the salary and wages, including bonuses and deductions. Although duties normally follow established procedures, responsibilities may include routine, minor corrections to make documents acceptable for processing. Requires 1 to 2 years of related experience and normally requires specific bookkeeping/accounting/payroll training.

How Paycor Supports Payroll Departments

Tasks are generally routine and require little or no deviation from established procedures. Usually requires a high school diploma or equivalent and a good math/accounting aptitude. This entry-level position requires office experience plus knowledge of calculator and word processing and spreadsheet programs. This position is generally found only in payroll departments of 3 or more people. While their salaries differ, payroll administrators and payroll bookkeepers both use similar skills to perform their jobs like payroll, human resources, and adp. Let’s say you’re currently a payroll administrator, but maybe you’re looking for a new opportunity.

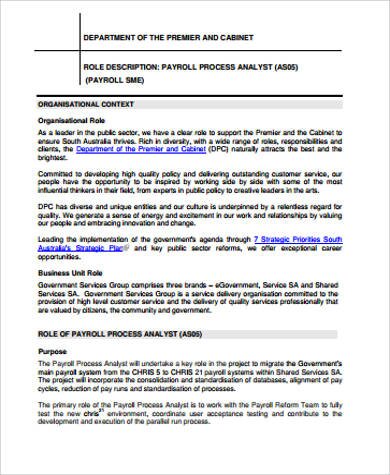

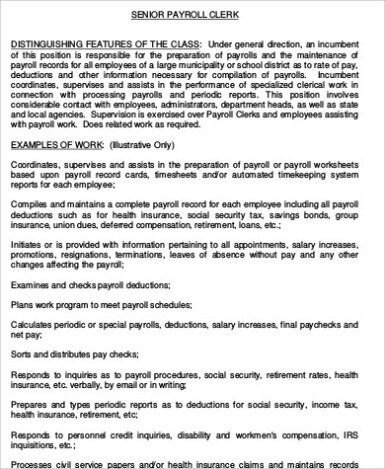

Now, many organizations task payroll clerks with a full spectrum of payroll processing duties, including wage calculations, payroll accounting, and payroll inquiry resolution. Creating a payroll administrator job description necessitates a list of payroll administrator job responsibilities. When compiling this information, focusing on the expected daily tasks of the position could prove useful to potential applicants. Be as thorough as possible when writing this section, tailor the information to fit the specific needs of your particular company and ensure the content is well written. As mentioned, these two careers differ between other skills that are required for performing the work exceedingly well. For starters, payroll administrators are more likely to have skills like customer service, data entry, special projects, and child support orders. But a payroll/human resource manager will probably be skilled in procedures, ensure compliance, federal laws, and benefit plans.

Organizational skills is also an important skill for payroll administrators to have. Financial clerks must be able to arrange files so they can find them quickly and efficiently. Because payroll touches many parts of a business, payroll administrators are usually expected to liaise closely with other departments, like human resources or information technology . In some cases, such as an audit, they may be required to work with federal, state or local authorities. This information will help you construct the perfect payroll manager job description. The distribution of employee pay is complex, and a payroll administrator is responsible for making sure these transactions are accurate and adherent to legal requirements. In this position, you will prepare tax documents, coordinate and execute tax and benefit withholdings, and handle legal issues such as garnishments.

Do you need a degree to be an accounting clerk?

Many accounting clerks secure jobs with just a high school degree and basic administrative skills; however, employers often prefer candidates who hold at least an associate degree in accounting, business, or a related field.

A two- or four-year college degree in accounting, mathematics, business, or human resources can give job applicants a competitive advantage and could be a requirement for employment at some companies. Before you start writing a payroll administrator job description, it’s recommended to research the job duties. They also calculate the number of hours worked and submit this information to the payroll processing company.

What Is Involved In Payroll Administration?

Payroll administrators review and process each department’s biweekly compensation schedule and ensure each staff member is paid accurately. In this position, you will work closely with other financial personnel to account for wage garnishments, employment taxes and retirement accounts within each employee’s paycheck. If you have the qualities we’re looking for and are committed to learning the business in our training program, we want to meet with you. While their salaries may differ, one common ground between payroll administrators and benefits clerks are their skills. In both careers, employees bring forth skills such as payroll, data entry, and human resources. A payroll administrator is responsible for processing the wages of employees in a company or organization.

- In this position, you will work closely with other financial personnel to account for wage garnishments, employment taxes and retirement accounts within each employee’s paycheck.

- While their salaries may differ, one common ground between payroll administrators and benefits clerks are their skills.

- Payroll administrators review and process each department’s biweekly compensation schedule and ensure each staff member is paid accurately.

- Get started in a rewarding career in human resources by joining our team as a payroll administrator.

- Our company is seeking motivated individuals who have a knack for numbers and a flair for details to join our payroll processing department.

A payroll manager/supervisor is normally CPP-certified with a bachelor’s degree in accounting, finance, HR or business administration. Employers might forego the CPP prerequisite and accept only a bachelor’s degree if you have an extensive track record as a payroll manager/supervisor. Payroll software expertise along with superb leadership and interpersonal skills are essential at this level. Like the job responsibilities section, the payroll administrator job specifications found within the job qualifications and skills section rule out underqualified applicants.

What Is The Pay By Experience Level For Payroll Administrators?

You can earn an associate degree in two years, and many colleges offer online course options. As the highest-ranking employee whose primary responsibility is payroll, incumbent is solely responsible for all payroll and related activities. Responsibilities generally encompass a single payroll for a smaller organization. Typically requires 3 to 5 years of payroll experience and may require an associate’s degree or equivalent training and education beyond high school. Title of this position is irrelevant so long as the position is the only payroll position in a organization. The education requirements are likely more stringent if your aim is to become a payroll administrator/coordinator. Along with a bachelor’s degree or an associate’s degree and/or Certified Payroll Professional designation, you should have a keen understanding of payroll software, accounting practices and payroll administration.

The role of payroll administration is responsible for the payroll and related activities. She must perform the activities required to process the payroll for a company or organization. A payroll administrator is the person who is responsible for ensuring that all employees within an organization are paid in an accurate and timely fashion. This is a position which will generally work in an indoor office environment. This administrator will generally keep weekday, daytime hours, though some overtime or extended hours may be necessary. A payroll administrator will generally work with other office personnel, as well as accounting and human resources personnel.

Furthermore, a payroll administrator needs to have efficient attention to detail as most of the tasks require accuracy and speed. It is also essential to communicate and coordinate with team members at all times. Many payroll administrators are able to find jobs without a college degree. However, enrolling in an accredited associate degree program in business could be beneficial. Coursework in math, statistics, accounting, computer programs, human resources and business law will prepare you to accurately organize payroll records and understand the legal issues of tax preparation.

Comparison Of The Role Of An Accounting Clerk To A Payroll Analyst

You may even be playing around with the idea of becoming a payroll administrator. If that’s the case, you’ll probably want to know how these roles compare to other positions. Here, you’ll find extensive information on roles such as a benefits clerk, timekeeper, payroll/human resource manager, and payroll bookkeeper just so you can compare job roles and responsibilities. We’ll explain how these different roles compare to the job description for a payroll administrator in a bit. Both the payroll administrator and coordinator perform duties that assist in creating payroll for employees within a company or organization. For the most part, you won’t find a payroll coordinator and administrator working in the same company unless it is a very large company.

If you do not choose to enroll in a college degree program, you can take these computer courses at a business or vocational school. Many employers will require potential payroll administrators to have 3-5 years of experience. Working as an entry-level payroll practitioner may provide you with the necessary knowledge to qualify for an administrator position. You also need to possess strong written and verbal communication skills and be detail-oriented. Regarding payroll administrator education requirements, a high school diploma is a minimum standard for many organizations.

Employers might relax the education criteria if you have significant experience administering payroll and employee benefits. While the salary may be different for these job positions, there is one similarity and that’s the skills they need. Both payroll administrators and timekeepers are known to have skills such as payroll, data entry, and human resources. Payroll administrators perform much of their work on computers, so you should know how to use various software programs, spreadsheets and accounting databases.

The payroll administrator oversees and manages payroll, while a coordinator works for a department within an organization or company. The payroll administrator trumps the payroll coordinator in the payroll job titles hierarchy, and thus the payroll coordinator salary is often higher. According to 2019 estimates from Salary.com, the median compensation for a payroll administrator is $62,961.

The Payroll Administrator performs the international payroll tasks at the employee level and processes the payroll-relevant master and time data. For example, he or she enters absence data for an employee into the system. The payroll administrator also checks the payroll results and identifies, for example, whether an employee received overtime payments in the past payroll periods.

What Are The Job Duties Of A Payroll Administrator?

The average base salary for payroll administrator jobs in the United States is $45,224 per year. Salary estimates are based on 650 salaries submitted anonymously to Indeed by payroll administrator employees, users, and collected from past and present job posts on Indeed in the past 36 months. Payroll coordinators/administrators usually team up with other departments — such as human resources , finance and IT — and external auditors to cultivate sturdy payroll internal controls. They are often found in organizations with large or complex payrolls and are skilled at coordinating payroll with employee benefits.

If necessary, this administrator also runs reports for individual employees, for example, to check the bank details or payments and deductions for an employee. TrainingCenter brings more than a quarter-century of experience and expertise to the payroll certification program process. We have an extensive track record of helping payroll workers, as well as those in human resources, accounting, banking, and other professions, achieve their learning and training objectives. Because of the meticulous nature of the payroll process, administrators should be extremely detail-oriented and possess strong organizational skills. Mathematical proficiency is also essential, as the job involves working with figures and performing calculations. Knowledge of the tax laws as they apply to payroll is crucial for avoiding computation errors and oversights that could lead to issues with the IRS. Digital and technical skills are helpful when working with today’s computer-based payroll administration systems.

Workers in the bottom 10% are making around $56,574 while the top 10% are earning more than $70,075. Your salary may be based on your level of education and the work experience you gained in an entry-level payroll processing job. Get the facts about education and certification requirements, job duties, and salary information to determine if this is the right career for you. For payroll managers/supervisors, your level of experience must be far greater — generally, a minimum of five years in payroll management.