Payroll Basics For Adp Workforce Now

Content

Customer Support deserves lots of credit – they are helpful, professional & supported us with difficult HR & technical questions passing along problems & ideas effectively. Finally, ADP has listened to suggestions & continuosly improved its software since 2010. ADP must be the only software company in the world that hasn’t resolved what is a very simple issue. If one of my employees forgot their password and could not log in to see their paystubs, I, the administrator, had to call ADP to get it resolved. Their is no option for employees to call customer service themselves to fix it. ADP always stated that this was for “security reasons,” which I find hard to believe, as every other company has figured this out.

Can I view my pay stubs online?

Many businesses will give their employees access to an online payment website. You’ll be able to view pay stubs for each payment you’ve received, and you’ll also be able to print out these pay stubs yourself. This way, you can print out pay stubs when you need them.

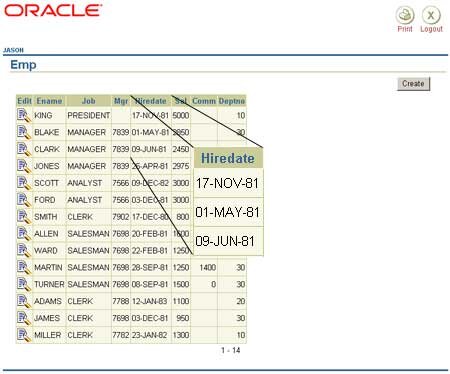

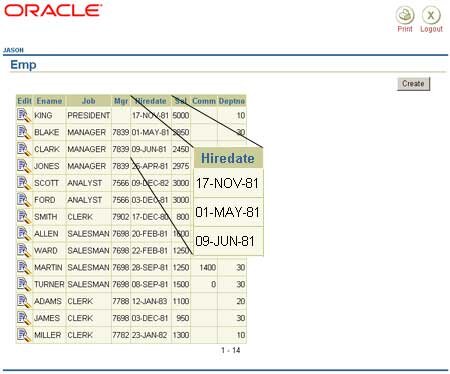

Also, though it’s very easy to export any report to Excel, they are formatted to be viewed, not necessarily used for analysis. For example, a report might have multiple occurrences of column titles in the same column as numerical data, in addition to having subtotals in the same column as data. Employee name and date appear above each data set and not on the same row as the data. I really enjoy the multiple options ADP offers for employees.

From an administrative side, we have many different positions that incur their own payscale and ADP allows us the flexibility to customize each employees information. With multiple event pay rates available, we can easily choose which rate is appropriate for the shift completed. Setting up employees is beyond easy and we have the ablilty to have W2 employees and 1099 employees separated yet all accessed in one convenient location come payroll time. Editing existing employees is just as easy and setting them up. Additionally, several states require payroll reports to include the hours worked by your employees.

You must set up QuickBooks for manual payroll before importing the ADP payroll file. the software seems very secure and has a lot of measures that are taken.

Employees Reported In The File

The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes.

Simply put, this software integrates nearly all financial and human resource aspects I need as a small business owner, other than banking. It even makes it easier to offer retirement benefits for my employees. It’s not the cheapest software out there, but it is 100% worth the money. Once you submit a payroll, you can’t edit it. It would be nice if you could complete a payroll, then view some of the resulting reports to identify an errors, then submit it. But, once you click submit, you have to get support involved to change anything.

This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. Intuit QuickBooks is marketed as a full-service financial application for small businesses. This means that you can complete all of your company’s financial tasks, including payroll, with one program. However, if you are already using ADP for your payroll needs, you don’t have to switch to Intuit payroll service for QuickBooks. Use the ADP InfoLink General Ledger Interface website to create a payroll report that you can import into QuickBooks.

Activating The Adp Canada Workforce Now Export

Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees.

- The Run software integrates with the ADP Time and Attendance software which is how my employees clock-in and out each day.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- Once set-up, this system is a good way to easily manage my payroll.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

Best of all at the end of the year the taxes and forms paperwork is all taken care of for you. They will automatically send out the W2s to the employees. This relieves a lot of stress at the end of the year when it comes to taxes. I had to call customer service a few times for questions and help. Their customer service is top notch and very helpful. They have logged into my computer and showed me everything I needed to know.

Run Payroll

Then click “Enter Paydata” and select “Paydata” from the popup menu. Once set-up, this system is a good way to easily manage my payroll. The Run software integrates with the ADP Time and Attendance software which is how my employees clock-in and out each day. I hit 1 button and the software automatically brings in the total hours worked for each person and auto calculates if there is overtime due. The software also allows me to have a file for each employee. Finally, the system captures everything so pulling reports is simple.

There is also a nice break down of everything. I like the idea of having all the employee perks that can be added on and will maybe be implementing more in the future. Lastly I liked being able to change some of the other employees banking information without too much of a hassle. Reports at your fingertips and if you cannot find a report just call the customer service line and they will create or walk you through pulling the report. Their customer service team has always been top notch and helpful.

I kept ranting at them and finally they gave me a code to give to any employee that was locked out to prove they had permission to see their paystubs. Next time it happened, I gave the code to the employee, and ADP still called me to make sure they had permission. I am a business owner and administrator, my time is too valuable to be calling them all the time when this is absolutely resolvable.

This is a great option for payroll for businesses. We’ve been using ADP RUN for a few years now and have enjoyed our experience with the system. Errors within the system are rare, and the ADP customer service team is extremely responsive if any issues do arise. W-2 forms are generated automatically for us to mail out and ADP also helpfully files tax and employment reports, which saves a ton of time. We’ve also found the HR411 feature to be useful for basic HR queries, particularly when certain forms are needed. Scalability, portability, reliability, ease of use, security, reporting & customer support are the most valued features when it comes to RUN powered by ADP. Our payrolls can grow or shrink very rapidly.

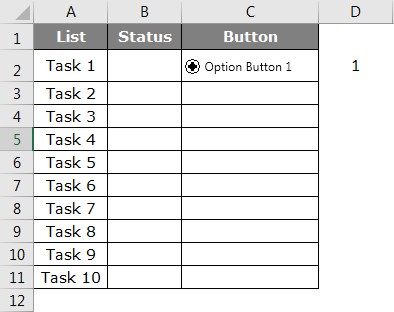

Type a name for the file and enter the date, then click “Export” to download the file to your computer. Run is a overall a good software because it allows me to focus on running my business and not keeping track of time and submitting tax reports. Before using this software I was spending hours each month capturing time accurately, saving it into spreadsheets, paying my team and filing reports. As an employee I liked being able to log in and view my W-2s quickly as well as the employee handbook and PTO. As a person who also runs the payroll its nice being able to see an excel type form of all the employees across the board. I like being alerted when money is coming out so I know exactly whats going on especially since the funds came out earlier than what I thought.

Very easy to use, even for technologically inept people like me. The rep that sold me the software was extremely thorough. Has a lot of features for payroll processing, tax reporting, and human resources features, and even workers comp integration.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

I can run payroll reports for the whole team or individual employees with the blink of an eye. I used RUN powered by ADP with a company I previously owned with 5 employees. For probably all business owners doing payroll, withholding, and taxes is the biggest stress. RUN was a simple and easy to use for my payroll. You can change employees hours or wages each week by logging into their web portal. It takes no time at all to process the payroll.

This platform allows us to quickly transition our staff size & allows an international team to onboard, process payroll and terminate employees easily & efficiently. We can work anywhere that there is an internet connection & can focus on our core business and rely on ADP to handle taxes and garnishments. The application is well organized & easy to navigate. Security has greatly improved empowering employees & administrators. Central database is secure while always at my finger tips. Standard reporting & Adhoc reporting features are great!

Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. Log into your ADP InfoLink account, then download the payroll report from ADP for the pay period that you want to use in QuickBooks. You can select the dates for the pay period from within the ADP InfoLink report utility and the fields you want to map. For example, select the “Social Security Number” field in the report if there is a corresponding field in your QuickBooks company file.

For the salary employees it was simple to have a reoccurring payroll payment to them every two weeks. It will send the employees all of their information for their direct deposits. The employee can also login to see all his or her information.