[2020] Payroll Basics For Adp Workforce Now

Content

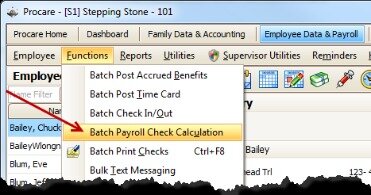

These files will allow you to see the employee’s pay checks and YTD balances within the Enterprise system as well as report off of that information. You can receive and load your files under Step 8 in Pay Cycle. Select Onetime in the Action field and enter the Amount in the Amount Field. This amount will be added or subtracted to any current payroll deductions scheduled to come out this payroll. For the Trans Type field select 1, for Prepaid/Void, and for the Check Number field enter in the A/P check number you used to pay the terminated employee.

This is ADP’s time management and attendance software. You can purchase it with your ADP software package. Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid. You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- However, if the timesheet line maps to one of the other hours or earnings fields , it is included in the external paydata file.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- If the employee is salaried and you selected the Autopay check box, the timesheet line is mapped to regular hours or earnings and is not included in the external paydata file.

ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right. Run this application for each pay period after all timesheets are entered. Send Hours Select this check box to send hours and gross pay to ADP for salaried employees. If no other earnings code exists then just change the effective date to be the correct date within the pay period, enter the earnings code and the amount and click on the Save button. Make sure the Original Hire Date is entered in the Reinstate Date field on the Employment Information tab as this will send a msg. to H&W to reinstate the EE’s benefits based on their original hire date.

Adp File Layouts For Extpaydt Xxx File (adp Version

The pay period code or the pay period start and end dates were not retrieved. The employee must have a pay period code in the Manage Employee Taxes screen.

Can I access ADP after termination?

If you terminate your employment, you will still have access to ADP Self Service for three years from your separation date.

Labor-only timesheets are not included in the paydata file. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name.

Load Payroll Files

Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period.

Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column.

Please remember to Receive and Load your Check Detail – Labor Distribution and Year – To –Date Balances files after accepting the previews. These files are typically available within 2 hours after you payroll is accepted.

You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page.

Map Code

Also, verify the scheduled deductions and special effects for the pay period. If all of this data is correct, click “Continue” in the bottom left-hand corner of the window. If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing.

Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. If the employee is salaried and you selected the Autopay check box, the timesheet line is mapped to regular hours or earnings and is not included in the external paydata file. However, if the timesheet line maps to one of the other hours or earnings fields , it is included in the external paydata file. Field types that map to a bonus pay type are included regardless of the Autopay check box.

In some cases where an employee has had multiple hire, rehire, status change and term events, this date should be the last time they started a benefit waiting period. There is a bit of setup to make sure your GL account names match between ADP and QuickBooks Online but once aligned this solution can batch process large volumes of payroll data. For ADP Workforce Now’s over the air payroll export, Leave has some considerations based on your ADP account configuration. Time Off will automatically deduct from employee Time Off balances in ADP, if the ADP Workforce Now account is setup to have Autopay Benefit Accruals. A selected timesheet cannot be mapped to any of the hours or earnings IDs set up in the ADP Mapping or ADP 2.5 Mapping table. For each timesheet row selected, the program assigns the ADP field IDs, codes, and pay number and inserts the row into the ADP Paydata table. If you select both Send Dollars and Send Hours, ADP pays for hours sent at the hourly rate in ADP and adds the earnings computed by Costpoint to the earnings computed by ADP.

This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu.

In order for timesheets to be selected for the download, you must map the pay type or account to the ADP fields. Use the Manage ADP Mapping Values or Manage ADP 2.5 Mapping Values applications. Errors are grouped by employee and sorted alphabetically for troubleshooting purposes.

Send Hours Select this check box to send hours for hourly employees. Field Description Send Dollars Select this check box to send earnings information for hourly employees. End Enter, or click to select, the ending timesheet date to be included in the transfer. Start Enter, or click to select, the starting timesheet date to be included in the transfer. You can use the retrieved parameters to produce reports and run processes more efficiently and with greater consistency. The saved parameters are also useful and necessary when you want to run the process as part of a batch job. Many users save a unique set of parameters for each different way they run a report or process.

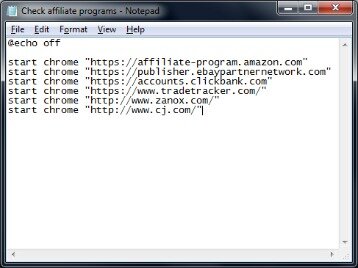

We will still create the payroll batch on GP, send file to ADP to process. What we are looking for is to see if anyone knows of software that will integrate between ADP and GP to bring in the calculated PR data from ADP to GP. ADP will only provide the GL information, we want the payroll information also. This can be a tedious process the first time it is done, but once you have created your first export file using Excel, you can use that file as a base to create future import files. Simply create a copy of the prior month’s CSV file and open in Excel.

However, sometimes you need to make one-time changes. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. The application generates one or more logical paydata records for each check an employee receives.

The integration requires a payroll cycle to be active to send pay period data from When I Work to ADP Workforce now. You must have an active payroll cycle in ADP Workforce Now in order to send pay period hours. You must have manager or account holder access privileges to set up the integration.

Managers must have access to manage timesheets and pay periods. Click “done,” and you will see the column in the paydata grid. Enter the dollar amount in that column for the employee. A popup window will appear that displays dates and deduction information for the upcoming pay period. Verify the week number, pay date and period end date. If you need to change any of this information, click on “Change Starting Week” to update it.

When you select a previously saved parameter ID or parameter description, the associated saved screen selection parameters automatically display as selection defaults. The page setup and print options, if there are any, are also included in the saved parameter ID. You can change any of the associated selection defaults as necessary.

See the documentation for the Suppress Rate 1 check box. Select this check box to send hours and gross pay to ADP for salaried employees. If an error occurs and your payroll data won’t send, make sure you have an active payroll cycle in ADP Workforce now to send the data to.

Then just delete the contents of Column B and replace with the correct date. Delete the contents of Column G and replace with the values contained in the current GLI payroll file. If you entered information into Column F and Column J, then you may need to update those columns with values from the current GLI file if there were any changes to those items. The remaining columns should not change from month to month – but it is always recommended to review the information for accuracy before importing. The ADP WFN Timesheet Export will allow you send approved timesheets from Deputy into your ADP account. This will allow you to process payroll inside of ADP using the Deputy timesheet data.

Field Description Autopay Select this check box if ADP is set up for automatic payment of salaried employees. If you select this check box, neither hours nor earnings are sent to ADP for salaried employees unless the pay type or account is mapped to a field other than regular hours or earnings . Select this check box if ADP is set up for automatic payment of salaried employees. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck.

Timesheet records are rolled up for each employee, field ID, user code, and shift code change. Correcting timesheets are included with regular timesheets to prevent ADP from printing a separate check for the correcting timesheet.

![[2020] Payroll Basics For Adp Workforce Now](https://adprun.net/wp-content/themes/adp/img/logo.jpg)