Payroll Calendar Adp

This includes copies that are provided to employees to report third party sick pay and group-term life insurance. They will not have full visibility of their SSN/TIN once their tax forms are printed and distributed. If your federal tax liabilities for the bonus payroll are over $100,000.00, the taxes must be deposited the business day after the check date. Any fringe benefit your company provides is taxable and must be included in the employee’s pay unless the law specifically excludes it. The benefit is subject to taxes and must be reported on the employee’s W-2. Click here for a list of fringe benefit earnings and where they appear on your employees’ W-2s.

For those employees receiving paper paychecks, your check from ADP will be delivered to the Payroll office. You must come to the Payroll Office during designated pick up times to receive your check. The ADP payroll service also includes quarterly and annual tax reporting, as well as filing taxes on your behalf.

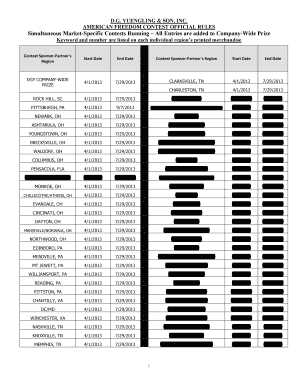

Payroll Calendar Adp – Having a great payroll calendar is important to confirm that you make your payroll on time no matter what may be coming up. This might be anything from a federal vacation to a work stoppage that can occur within the business. By having whatever at your finger tips you can make sure that you fulfill all of the guidelines that might exist in your state, and a lot more crucial, not disturb your crucial asset, your staff members. With a weekly pay period, the employee receives 52 paychecks each year. Weekly paychecks are often paid one week in arrears, meaning that employees are paid for each pay period on the week after it is completed. Paying in arrears gives the employer’s payroll clerk enough time to calculate pay properly.

If you have questions, the company’s professional payroll staff is available 24/7 to provide answers. Some jurisdictions require that you provide an EITC notification to each of your employees with their annual tax forms. If your business is located in one of these jurisdictions, click the link to access and print the applicable notification. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant.

To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year. Christmas Day is Friday, December 25 and New Year’s Day is Friday, January 1. If your check dates fall on either of these dates, please adjust them to avoid delaying your employees’ direct deposits and delivery of your payroll package.

ADP offers unique solutions for medical practices, including payroll processing, insurance verification and medical payment through its Advanced MD service. Federal legislation requires the reporting of both taxable and non-taxable sick payments made to employees from a third party.

ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. Big Businesses.If you use 1,000 or even more individuals and outsource your payroll processing to ADP, you can pick from a few service packages. These range from a solution that is web-based a computer software package hosted by ADP. ADP is a company that delivers payroll solutions to companies of different sizes.

Pricing Based On Size And Services

Organizations can outsource responsibilities such as payroll payroll and processing income tax filing. This benefits business owners by increasing productivity and helps to ensure that workers are paid on time, according to ADP’s website. When there is a vacation that disputes with your standard day to release payroll it is normally necessary to release it early. Naturally this depends on whether or not your staff members utilize direct deposit, a payroll card or receive a check. However, by having a payroll calendar you will receive alerts to be sure that you satisfy any and all due dates that are essential so that Payroll Calendar Adp heads out when it should. When it comes to paying their costs, for many staff members a day or two late might suggest a substantial late charge or worse.

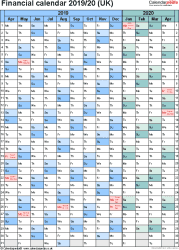

It is also among the most popular choices in the big countries in the business industry. It means that you pay your employees on one set date every two weeks, and this means you are going to give then six paychecks in twelve months. Biweekly payroll calendars help you manage the payroll of employees who are working on an hourly basis. It also makes your employees happier as they are getting regular paychecks. A payroll calendar is a time-saving device that will help you manage your employees’ schedule and the payments for their services.

Management of all this is a serious business, as well as accuracy, is also required. There are online payroll calendars as well as calendar software, where everything can be managed with ease.

How Does Adp Payroll Work?

Software or applications hold making things easier for HRs and employers. If you are having a business or planning to start a business, then you must pay attention to this section as it has valuable information or you. A company is successful when you are taking your HR payroll, and employees’ administration needs seriously. You must choose the most straightforward system for your HR team, and adp biweekly payroll calendar 2020 is a great option that you can look into.

All former employees can view/print pay statements and annual W-2s through IPay. Our payroll company, ADP, maintains this secured website at ipay.adp.com. Former employees will use their assigned user ID and password to access payroll information whenever it’s convenient. The Office also completes monthly, quarterly and yearly reporting and maintains knowledge of legal requirements and government reporting regulations affecting payroll and all payroll tax jurisdictions.

Pay Period 2021 Feed

The Office also ensures compliance with the College’s policies and practices and federal and state regulations, administers tax issues and payments, and provides payroll information efficiently and accurately. And for payroll processing, ADP provides other HR services to small, mid-sized and big businesses. These include tracking employee some time attendance, determining workers’ settlement payments, and retirement that is establishing such as 401Ks and IRAs.

Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through. In the fourth quarter, before December 31, you must update missing totals for your employees and run any bonus payrolls. If you have to run an Off-Cycle Payroll after the last day of the quarter, government agencies may charge you with penalties and interest based on their deposit and filing deadlines for taxes. SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC.

Payroll Calendar Adp

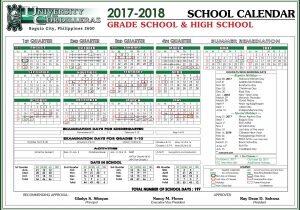

The Payroll Office is responsible for processing the bi-weekly and semi-monthly payrolls for employees of the University. The information on this site is intended to provide guidance to employees regarding payroll processes and procedures as well as the Employee Self Service applications and the Kronos Time and Attendance system. The ADP National Employment Report measures levels of non-farm private employment. The Report is based on the actual payroll data from about 24 million employees processed by the Automatic Data Processing, Inc.

Biweekly Payroll Calendar plays a very imperative role in the business. Student and temporary employees are getting paid on the cycle of bi-weekly. At the part of employers, they must follow the strict timeline for tax payments and filling forms. If the guidelines and deadlines are not followed, there are harsh penalties that companies have to pay. According to the 2020 Biweekly Payroll Calendar, it will show the start /end of every bi-weekly period of work, and also the corresponding pay dates are available. This calendar also tells the cut off deadlines for the hourly employee’s submissions, time sheets, and deadlines for the approval by the supervisors.

- If the guidelines and deadlines are not followed, there are harsh penalties that companies have to pay.

- Biweekly Payroll Calendar plays a very imperative role in the business.

- At the part of employers, they must follow the strict timeline for tax payments and filling forms.

- Student and temporary employees are getting paid on the cycle of bi-weekly.

- According to the 2020 Biweekly Payroll Calendar, it will show the start /end of every bi-weekly period of work, and also the corresponding pay dates are available.

Please note that previous years W-2’s will not be available through this service. The goal of the Payroll Office at Ithaca College is to strive for complete, accurate and timely processing of all payroll related activities. We are responsible for all direct deposits, payroll tax withholdings, and voluntary and involuntary payroll deductions for staff, faculty and students. All administrators, professionals, non-exempt/exempt staff, and students have access to Workforce Now. All employees can securely update personal information, change tax withholding and add/update direct deposit information. Benefit eligible employees also use Workforce Now to request paid time off.

Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. We are pleased to announce ADP W-2 Services, a new benefit for all employees. Starting with your 2020 W-2, you will be able to access your W-2 forms 24 hours per day, 7 days a week.

Step-by-step Guided Walk Throughs are available in the RUN platform to assist you with recording manual checks using our Calculate Checks tool; reporting third party sick pay; and maxing out retirement. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checks, Enter Third Party Sick PayORMaxing Out Retirementto begin the Guided Walk Through. If your check date falls on this date, please adjust it to avoid delaying your employees’ direct deposits and delivery of your payroll package. You can now receive payroll text and calendar reminders 2 days before you’re scheduled to process payroll. We’ll even remind you of upcoming holidays in case you need to run payroll early! Log into the RUN Powered by ADP®/Payroll Plus® platform, click your name in the top, right-hand corner and select Settings to begin setup today.