Payroll Conversion Specialist Jobs, Employment

Content

Your employees can clock in and out from their mobile devices, and you can review anytime you want. In the two examples we just reviewed, the difference between converting minutes to decimals the wrong way versus the right way is that you short pay an employee for $3.52. If you make the same mistake 5 days a week for 52 weeks of the year, that could lead to a $915.20 liability you will owe in wages, not to mention the additional payroll taxes you will need to pay. Calculating employee pay isn’t difficult if you know how to express minutes as decimals. Once time worked is converted into decimal form, such as 4.35 hours, you can multiply by the pay rate and find total wages due. Failing to convert minutes when calculating pay causes errors and creates more work on the back-end.

After the interims-only payroll cycle is completed through the Final Update step, detail and summary history tables are populated with the uploaded history amounts. You must have a record in the F table for each employee for whom you convert payroll history. Each employee is assigned a unique address book number in the F table. Converting minutes for payroll can take little to no time depending on whether you use rounded or actual hours worked, how you track working hours, and what tools you use to calculate.

- By using interim payments, you can create history records with as much detail as necessary for each employee.

- The whole process gets a little trickier when you have to translate the hours and minutes to decimals.

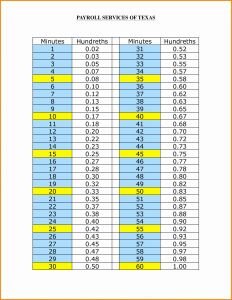

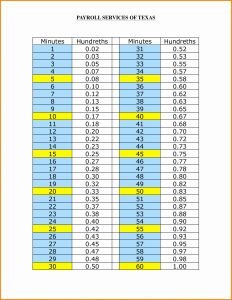

- Quickly convert hours and minutes to decimals with our time clock conversionfor payroll chart.

- When you convert payroll history, you use interim payments to transfer DBA and tax history information to the summary and detail tables for DBA and tax history.

- Accurate payroll requires tracking the hours your employees work, and converting those hours to dollars and cents.

After you’ve decided whether to pay employees based on actual hours worked or rounded hours worked, you can sum your employees work time for the week and prepare to convert minutes to decimals. To calculate actual time worked, you need to total the hours and minutes between your employee’s starting and ending times for each work day.

What Is 1 Hour And 15 Minutes As A Decimal?

For example, if someone works 2 hours and 39 minutes, they worked a total of 2.65 minutes during their shift. To calculate minutes for payroll, you must convert minutes worked to decimal form. Then, multiply your answer by the employee’s hourly rate to get the amount you need to pay for those minutes. Add the amount you owe for hours worked to the amount you owe for minutes worked to get a total of what is due. The impact of rounding can be inconsistent each week, depending on your employees’ work habits, so it’s not the best idea to adopt a policy of rounding hours worked in hopes of manipulating it in your favor.

With so many considerations and regulations, payroll processing and payroll tax preparation are often outsourced to a payroll bureau. Payroll Management, Inc. was founded in 1989 and now serves businesses across Maine and New England with local, personalized service. Extra processing time and unexpected results might occur if the history conversion interims are merged into a regular payroll cycle. Before you can complete the payroll history conversion process, you must enter or import employees DBA information into the F07991 table.

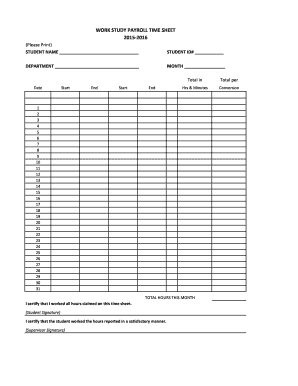

The timesheet provides a good example of the information you’ll start with before converting minutes to decimal form. When I Work has time and attendance software that automatically converts minutes worked into decimal form in addition to calculating gross pay.

Every employee for whom you want to upload DBA and tax history must have a record in the F06116Z1 table. If no record exists in this table, then no tax or DBA information is converted into the JD Edwards EnterpriseOne system for that employee. You must convert minutes worked into a decimal to be sure you’re not over or underpaying your employees. To perform the conversion, you can use payroll software, like Gusto, an online time calculator, a minute conversion chart, or a spreadsheet application. But when is the right time to switch to a new payroll provider?

Time Clock Conversion For Payroll: Hours To Decimals

It’s crucial that your provider can assure a secure, compatible exportation of data from one system to another. If you aren’t switching at the beginning of a year, consider the start of a fiscal quarter or the middle of the year as the ideal times to convert solutions. These periods allow for a more seamless transition of data and can significantly lower your risks of transitioning payroll and tax information during implementation. If your payroll solution isn’t measuring up, it may be time for a mid-year payroll conversion. After all, there’s no better time than the present to invest in a new solution and a strong finish to the year.

This value represents the amount of the DBA that is loaded into the payroll history. Payroll ID Specify the interim payroll ID to use to process the interim payments for history conversion. You use the Pay Cycle Workbench program to create the interim payroll ID. You generate interim header records so that you can transfer the original payment numbers for the imported payment information into the payroll history tables in the JD Edwards EnterpriseOne system. You use the Payroll Conversion – Create Interim Header Records program to update the F07350 table. The system creates one record in the F07350 table for each address book number and EDI line number combination in the F06116Z1 table. When you run the Interims Only payroll, the system uses the information in the F07350 table to update the payroll history tables.

The whole process gets a little trickier when you have to translate the hours and minutes to decimals. You must enter the value of each tax into the Gross Pay field. This value represents the amount of tax that is loaded into the payroll history. Typically, the end of the calendar year is one of the best times to undergo payroll conversion as it allows you to start the new system off fresh regarding balances. You can also convert payroll at the end of a quarter, but you’ll have to enter historical data like employee earnings, taxes, and deductions based on the time of the year. If you decide to convert in the middle of a quarter, you’ll have to make sure everything matches up on the exact dates, which can leave you open to a greater potential for errors and a longer conversion process. Converting employee hours from minutes to decimals is one part of a very complex process.

After you have created the interim header records, you must run the Batch Time Entry Processor in final mode. This populates the F06116 table with the time entry records that you uploaded to the F06116Z1 table. You must have records in the F06116 table to process through an interims-only payroll cycle, which updates the payroll history files.

The data selection for the report includes only those records for which you are converting payroll history. The system provides a conversion process that you can use to import payroll history records from a legacy system and convert them into the format that is used by the JD Edwards EnterpriseOne Payroll system. The system uses these payroll history records to calculate the information that appears on employees year-end forms. Small business owners as well as Payroll, HR and Timekeeping professionals constantly need to be converting minutes to decimals to properly calculate hours worked.

Implementing A Payroll Conversion System

Your main goal is to translate time worked into decimal form, so you can multiply by your employee’s pay rate and find how much you owe in wages. To calculate payroll, you can convert minutes to decimals in three steps, but you’ll have to decide whether to use actual hours worked or hours rounded to the nearest quarter as allowed by federal law.

APS has been providing payroll and tax compliance services since 1996. Our solutions experts are here to help with your year-end processing, including W-2s, 1099s, payroll taxes, and ACA reporting.

Here’s a breakdown of the payroll features your business needs and how to confidently convert to a new solution this summer. The Payroll module must be converted at the same time you convert Employee Data. If you have previously converted Employee Data only DO NOT convert a second time. Instead you’ll make a Year to Date Payroll entry for each employee to bring their payroll history up to date. After you update the F0709 table and the F07353 table with the records that you need to include in payroll history, you must run the Process function over those records using the Work With Interims Workbench program . Create a time entry record for each employee whose payroll history you need to convert. After interim payments have been processed, you can update payroll history by running a complete interims-only payroll cycle.

Use this simple Minutes to Decimals Conversion Chart to easily identify the correct decimal value for each unit of payroll time, a necessary step when processing payroll. When using payroll software, like Payentry, you must first convert minutes to decimals. Make sure you bestow a full history of employee payroll data to your new provider, including changes that may have occurred up to this point. Doing so ensures your critical data is transferred and that your new vendor comprehends any unique payroll and tax management needs moving forward. It can also be used to facilitate things like job costing right from the start. This section provides an overview of interim payments for payroll history conversion and discusses how to process the interim payments. You must enter the value of each DBA into the Gross Pay field.

When you convert payroll history, you use interim payments to transfer DBA and tax history information to the summary and detail tables for DBA and tax history. By using interim payments, you can create history records with as much detail as necessary for each employee. Quickly convert hours and minutes to decimals with our time clock conversionfor payroll chart. Accurate payroll requires tracking the hours your employees work, and converting those hours to dollars and cents.

At GMS, we know that the process of switching to a new payroll partner and online payroll softwarecan be stressful. In fact, you may find that some payroll partners can take on some of the responsibilities and liabilities involved with payroll taxes. This not only can help simplify the payroll conversion process by lowering the number of tasks you need to manage, it can save you time and energy for years to come. There is more to converting hours and minutes to decimals than simply adding a period between those hours and minutes. For example, if your employee works 40 hours and 23 minutes one week, you can’t multiply 40.23 by the hourly pay to get the correct wage. Converting minutes to decimals is simple enough by dividing the minutes by 60. A great way to track employee hours and convert minutes to decimals is by using payroll software.

How much is .50 of an hour?

Converting Hours

For example, 50 percent of an hour equals 30 minutes, because 0.50 * 60 equals 30.

If you have already imported the information, you can review it and make any necessary corrections. Before you can convert payroll history, you must enter or import employees tax information into the F07992 table. Check Number Specify the payment number with which to populate all of the payroll history records that you are converting. Leave this processing option blank if you do not need to track payment numbers for the payroll history records that you are converting or if you are using the F06116Z1 table to convert the original payment numbers. To convert payroll history into the JD Edwards EnterpriseOne Payroll system, you must first upload time entry information into the F06116Z1 table.

So let’s talk about the mechanics of a successful mid-year payroll conversion and how making a change may be the best thing you accomplish this year. This is the total amount of tax that was deducted from the employee’s pay in the previous system for the current year. For example, if on July 1, you stop using the previous system to process payrolls, the amount that you enter or import into this field should be equal to the amount of tax that the employee paid from January 1 through June 30. To maintain the integrity of the employee’s payroll history, do not leave this field blank.

No matter what time of year works best for you, APS will handle your year-end processing and tax filings for a seamless payroll conversion. Mid-year payroll conversions can seem intimidating if you’ve never gone through the process before. For starters, making a change as big as choosing a new payroll and HR provider can seem like more trouble than it’s worth. You may also be worried about potential disruption to your payroll processing. However, if your year-end processing was challenging, it may be time to finally consider switching payroll providers.