Payroll Processing Checklist

Content

By the end of January, employees should have access to a W-2 or 1099, which is a record of payment received and taxes paid. You will also need to submit wage and tax information to the Social Security Administration and the Internal Revenue Service . Your entire workforce will rely on the data you just compiled to conduct their own operations. From branch managers to department leaders, these employees may use the information reflected in your payroll records to make important decisions for their respective teams. Keeping a copy of these records is also essential for making tax payments, processing financial documents, and setting budgets by the end of each year.

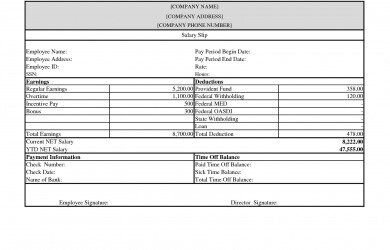

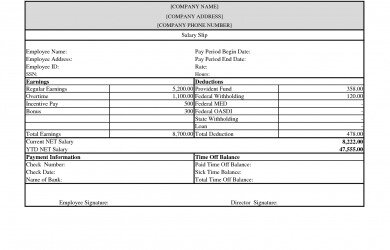

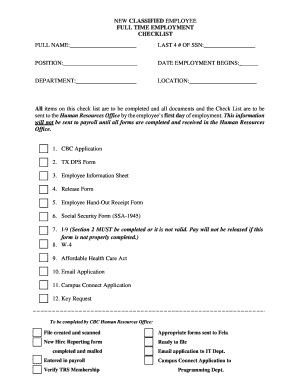

If a deduction is suppose to happen on a particular employee, but doesn’t, you can detect and correct it beforehand. The checklist’s first step should be to check for–and make–the necessary adjustments to employees’ payroll record. This includes address changes, pay raises and deductions, payroll deduction changes, setting up new hires and processing terminated employees.

Now, imagine having to manage a significant portion of those numbers in your workforce. A business thrives when it knows how to care for its employees, as well as the needs of each individual. But anyone who does payroll knows the struggles of this detail-oriented process. Fortunately, using a payroll checklist can help you get the job done with little to no mistakes. This instrument will get you through the tedious task of payroll processing to keep employee satisfaction levels at an acceptable degree. At a minimum, you will need to provide your employees with end-of-year tax statements via IRS Form W-2.

Once you’ve calculated the total, it’s now time to apply taxes and payroll deductions to one’s salary. Check for any inconsistencies in this data to see if you need to clarify a few things before proceeding to the next step. It’s especially important when you need to tax employees who live in another state or country. If you have an employee working for you from California, you have to know the tax deductions that apply in that particular state, or you could face some hefty fines that could have been avoided. Hourly workers are paid according to hours worked in the pay cycle. Therefore, payroll processing includes figuring the hours to pay them.

If your end of year payroll tax return shows that you owe taxes, these must generally be paid online via the IRS business tax website. While individuals generally have until April 15thto file personal income taxes each year, business tax returns and any taxes owed are generally due by March 15th. At Genesis, we can partner with you to ease the burden of payroll processing. You track the hours and we’ll do the rest—from payroll processing to tax filing to benefits administration. Once compiled, we can set up your company payroll to allocate across departments, for example, or, if one of your employees is working in a different state, we can allocate time across work locations. The steps for doing payroll with software are very similar to doing it without; it’s just much easier and faster.

Before finalizing your payroll for the current year, give one last review to ensure everything looks accurate for each employee and your company as a whole. Total each employee’s wages, taxes paid, and benefits earned throughout the year, then calculate summary figures for your business to use on the applicable year end tax forms.

The most common mistakes are misclassifying employees and paying the wrong wages or taxes, according to software provider Patriot. As the end of the year draws near, you’ll need to prepare to distribute year-end payroll tax reports. Employees must receive their W-2 forms by Jan. 31 of the following year, and the forms must show their total earnings and taxes paid. If you’re paying independent contractors, you’ll need to prepare 1099 forms instead; this will show earnings but no taxes. For most small business owners who don’t want to take on the various steps involved in how to do payroll such as calculations or tax deductions, we recommend using a service such as Gusto. It not only makes employee onboarding much faster but lifts a huge burden when it comes to calculating payroll taxes and sending funds to government agencies. You can also use it to pay employees via direct deposit at no additional cost.

It’s a smart way to do your pay run with higher speed and accuracy to prevent costly mistakes that could put you under a bad light with current and potential employees, not to mention the authorities. It’s important for users not to omit any key aspects of the payroll checklist to prevent drastic changes from affecting your operations. So whether you decide to automatize your payroll system or stick with manual processing, using a payroll checklist offers a ton of advantages that could keep your team on the right track.

For example, you’ll find key information like YTD wages, YTD CPP contributions, and other items such as RRSPs. If you’re switching mid-year, these reports will be necessary to set up your employees, both active and terminated, with your new payroll provider. You can set up and start running payroll with Patriot in 10 steps; follow along with our article and video. Before you can start paying employees, you’ll need to adjust your account’s payroll settings to align with your payroll process. You’ll also have to give Patriot written authority to file payroll taxes on your behalf. Doing payroll with Gusto is easy—our video will show you just how simple it is. You can set up your account and run your first payroll within a week if you have all of the information you need available.

The 8 Steps To Small Business Payroll

You’ll enter all the information for your company and employees electronically, and the paycheck amount and deductions calculate automatically. Most payroll software will even allow you and your employees to complete payroll forms completely online—some will even submit them to the IRS for you. If you run payroll yourself or if you do not have a payroll provider that manages your W-2s, you will need to order paper forms from the Internal Revenue Service. Paper forms take 10 business days to mail, so plan ahead and order these in December.

The checklist should include all time-keeping tasks, such as ensuring time cards/time sheets are submitted appropriately, time computations and printing time sheet registers . Payroll processing requires performing many tasks to ensure accurately processed paychecks and payroll tax and benefits compliance. Having a checklist helps the payroll staff to stay on schedule and ensures no chore is undone. The checklist may vary according to the size of the payroll and the system being used. Another important aspect of this item on the payroll processing checklist is to make sure you’re keeping clear and complete records. There are a lot of ways to track records that show hours worked, and you should maintain these records carefully.

Everything You Need To Know About Small Business Payroll

Paying for payroll software and payroll processing does cost money, but that cost is also a guarantee that you are providing that ultimate benefit to your people accurately and on time. It’s also a way to minimize your own risk, as the responsibilities for withholding and paying taxes, overtime, and benefits premiums are often handled by the payroll provider, who should be insured. Even a seasoned business owner can get overwhelmed when they want to learn how to do payroll. That is why simple software solutions are the easiest and most time-saving options for business owners overall.

If an employee questions your recordkeeping, or makes a complaint against your business, you want to make sure you have kept good records. As an employer, your documentation protects you—employers have the burden of proof. Get totals for all employees for gross pay, federal, state, and local withholding, FICA taxes, and any other deductions. You’ll need these amounts for your payroll tax deposits and reports. A payroll register report essentially provides a recap of the payments made to employees as part of payroll. In other words, the payroll register includes all the Year to Date amounts of employee and employer incomes and deductions.

You can get these necessary forms directly from your payroll service provider, printed from your payroll management system, or directly from the IRS. Once you process the payroll a few times, you become familiar with which deductions affect which employees. Furthermore, including deductions in the checklist helps when you are verifying the payroll before printing paychecks. The verification report shows the deductions that will occur on employees’ paychecks.

It contains key requirements of a standard payroll to ensure you get all the specifics right for every pay period. That should keep you consistent and organized as you prepare for your company’s payroll on a bimonthly, monthly, or yearly basis. For the most part, it also gives you the chance to reward employees in a timely manner—that is, before they begin to resent you for your poor efforts and mismanagement issues in processing their pay. Tax obligations will vary by state, business size, industry, and several other factors. Most businesses, however, will be required to file an annual business tax return, W-2 forms for each employee, and W-3 forms for employees.

Businesses that aren’t ready for paid payroll software can save time and money doing payroll with Excel. You can get started with our free template, and all you’ll need to do is add your business’ and employees’ information.

Step 5: Make Sure Your Employer Information Is Up

Once you have everything in check, you can begin issuing your payroll checks or processing your direct deposits just in time for the salary release. You can also produce payslips that present the breakdown of individual accounts so that your employees have an actual record that they could use as a reference. You can opt to have it printed or emailed to employees individually, depending on which approach your company chooses to follow. Running payroll is arguably one of the trickiest parts of being an employer. According to Statista, there was an average of 128.57 millionfull-time employeesaround the U.S. in 2018.

So for many organizations, a payroll checklist appears to be an effective solution to their problems. A payroll checklist is an instrument that can assist you in setting up payroll easily and quickly for the benefit of those involved.

Accurate and correct payroll is just as important to you as it is to your employees. Many organizations fail to recognize the consequences that come from poor payroll management, mainly how it influences employee engagement with the company. But with a checklist, you can process payment confidently to meet the demands of the state, industry, and the company’s workforce.

- The checklist should list statutory deductions and voluntary deductions to look for when processing the payroll.

- With the right formulas in place, tax and check payment calculations are done automatically.

- Total each employee’s wages, taxes paid, and benefits earned throughout the year, then calculate summary figures for your business to use on the applicable year end tax forms.

- You can get started with our free template, and all you’ll need to do is add your business’ and employees’ information.

- Before finalizing your payroll for the current year, give one last review to ensure everything looks accurate for each employee and your company as a whole.

- Businesses that aren’t ready for paid payroll software can save time and money doing payroll with Excel.

Year-end payroll is about checking that the numbers to ensure your payroll reports add up to the money you’ve given and withheld during the calendar year. This is the last opportunity before you file your taxes and year-end forms to reconcile any discrepancies, change or update information, or adjust payroll choices for the new year. Year-end payroll is all about balancing your books, ensuring you’ve paid people the right amount of money, and double-checking that you’ve sent the right amount of taxes to the government.

Payroll Processing Checklist: A Template

With the right formulas in place, tax and check payment calculations are done automatically. The checklist should list statutory deductions and voluntary deductions to look for when processing the payroll. Design a code for each deduction type, such as GARN for wage garnishments, CH SUPP for child support orders, FED for federal income tax, SS for Social Security tax and MED for medical deductions. To help you be more confident with your payroll processing, we’ve created this payroll processing checklist. With everything you have to do at the end of the year, don’t forget to process your last payroll before the end of 2020. For example, if you’re paying employees for hours worked between December 16–31, 2020, on January 7, 2021, those wages will be included on their 2021 tax forms. Doing payroll management entails a lot of responsibilities to make sure you get the right values.