Payrolls

Content

The need to keep accurate payroll records is largely the result of payroll taxes. Distributing pay stubs is often an important part of the payroll process. To stay compliant, you need to know the pay stub requirements by state. In most states, your employer must supply you with paycheck stubs. They also provide information on deductions for income tax, Social Security, and more.

There is no federal law that requires that employers provide pay stubs to employees. However, the Fair Labor Standards Act requires that employers keep payroll records. Under the FLSA, employers need to retain each employee’s hours worked and wages received. Download timecard templates for your employees to complete. Timecard templates greatly minimize the need to closely monitor and record employee comings and goings. Best of all, data from timesheet templates can be easily imported into payroll templates.

Once you’ve paid your employees, these documents become your records. Reports can then be generated for specific pay runs or as summaries of several payroll cycles over a set period of time. If federal law doesn’t require that you provide pay stubs to your employees, what records do you have to keep? Just about all of the information that you’d find on a pay stub. You need a record of the employee’s full name and social security number, address, the employee’s work hours each day.

Business Types

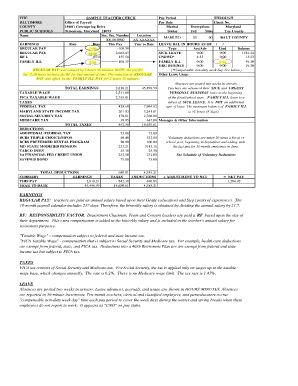

Taxes are often listed as deductions on employee pay stubs. Most commonly, they include FICA taxes that go toward Medicare and Social Security, and federal and state income tax withholdings. Tax amounts tied to the employee’s Form W-4 might be changed at the employee’s request, especially if they’ve indicated additional withholdings. These resources are available free of charge and commitment to anyone wanting to learn more about these topics.

It’s your go-to document for all questions about how payroll works. If you use payroll software, the system generates a pay stub each time you run payroll. That way, you can distribute them to employees and keep digital or physical copies for your records. While paycheck stubs are important for verifying proof of income, they’re not one of the financial documents you need to hold onto permanently. As a general rule of thumb, it is a good idea to hold on to pay stubs for at least one year. You’ll need your paycheck stubs every year when you pay your taxes. They are important for reconciling your W-2 form and Social Security Contributions.

Pay stubs are written pay statements that show each employee’s paycheck details for each pay period. Pay stubs are also called paycheck stubs, wage statements, or payslips.

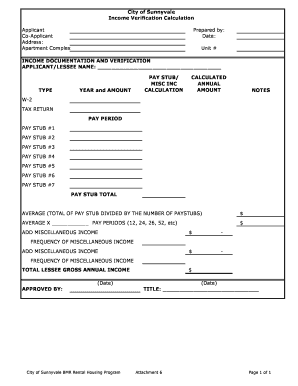

Who Needs To Prove Income Using A Pay Stub?

If your business provides physical paychecks, typically, the pay stub is attached or included with the check. If your business uses direct deposit, employees may have to access their pay stubs via an online portal.

You can print employee pay stubs or allow employees to access pay stubs online through the employee portal software included with Patriot Software’s online payroll. According to the state rules listed previously, the first best practice is to ensure employees can access their pay stubs. In most cases, that means printing out a paper copy, though you may be able to provide them electronically through your payroll portal. Typically, pay stubs for hourly workers show the number of hours the employee worked. Salaried employees’ pay stubs may also show the number of hours they recorded working if they track their time.

It also files quarterly and annual returns for the Social Security Administration, the IRS, and your employees. A pay stub includes information both employers and employees can use. By reviewing their pay stubs, employees can make sure they were paid correctly and understand their deductions. If your employment tax records are kept in another place, you would still want to hold on to pay stubs and payroll records for at least three years. That’s according to both the Fair Labor Standards Act and the Age Discrimination in Employment Act . Employers must also keep at least two years of records showing wage rates, job evaluations, seniority and merit systems, and collective bargaining agreements. These would explain the basis for paying different wages to employees of opposite sexes in the same establishment.

Save Money With Form Pros

Are you familiar with the legal requirements of pay stub records? The U.S. Department of Labor notes that there are no federal requirements for pay stub records in the Fair Labor Standards Act . Companies are just required to keep accurate records of the number of hours worked and monies paid to employees. The entire process of creating a pay stub online will take you just a few minutes. Our intuitive form will even help you auto-calculate amounts that should be withheld for federal and state income taxes, FICA, Medicare, and Social Security Taxes. The form will calculate all gross, net, and year-to-date balances for the current pay period. Rest assured that your information is kept private and secure.

By keeping your paystubs, you’ll be able to ensure that you’re paying the right amount in taxes. Once you have paid your taxes, however, your tax returns will serve as an accurate record of how much money you made that year. You should hold on to these documents, and discard the paystubs. The federal government does not have a pay stub law that all states must follow.

Excel payroll templates help you to quickly calculate your employees’ income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. Employers should hold on to copies of employee pay stubs or other payroll records for at least four years. Payroll records document anything related to employee compensation, from name and address to hours worked to payroll taxes and deductions. Your payroll software is a record-making factory, churning out a series of documents every time you run payroll.

If the employee works over 40 hours in a week and is eligible for overtime pay, those hours should be on their pay stub. Gross wages are the full amount an employer pays before deductions. This pay often includes more than the employee’s regular wages. Overtime pay and additional income, such as paid time off, bonuses, and payroll advances, are also included under gross wages. Legally, no federal law requires employers to provide pay stubs. Since different agencies have different requirements, the sensible thing to do is make a judgment call based upon all federal, state, and local laws that apply to your business.

The pay stub should also break down the number of regular and overtime hours worked. Most states that require employers to give employees pay stubs have rules saying that the documents must have standard pay stub information. There are a lot of reasons it can be important to hold onto your paycheck stubs. For instance, paystubs can be a handy reference when you need a proof of income letter for apartment rentals. Additionally, you can use your pay stubs to calculate W2 wages when you file income taxes.

You can give your employees an electronic or printed pay stub. The information you must include on a pay stub varies by state.

You can keep a copy of each payroll stub for your payroll records. A pay stub is part of a paycheck that lists details about the employee’s pay. It itemizes the wages earned for the pay period and year-to-date payroll. The pay stub also shows taxes and other deductions taken out of an employee’s earnings. And, the pay stub shows the amount the employee actually receives . While there is no federal law requiring employers to provide pay stubs, only nine states have left the matter unresolved. The other 41 have requirements that include how to distribute pay stubs and who gets to decide—always the employee.

Government agencies require businesses to hold on to payroll records for a specified period of time. Here are the documents you need to keep and how long you need to keep them. Generally, this means they include the beginning and end dates of the pay frequency; gross wages; taxes, deductions, and employer contributions; and net pay.

However, the Fair Labor Standards Act requires employers to “keep employee time and pay records”. Your state’s Department of Labor website determines the pay stub rules for your state. While most states do not require employers to provide pay stubs to their employees, many institutions still request pay stubs as proof of income and stable employment. Finally, consider removing any barriers an employee might encounter when trying to retrieve a pay stub. Moments that require employee pay stubs—like applying for a loan or filling out a rental application—can be stressful. As an employer, you can reduce that stress by making it easy for employees to access necessary documents.

- There is no federal law that requires that employers provide pay stubs to employees.

- However, the Fair Labor Standards Act requires that employers keep payroll records.

- Download timecard templates for your employees to complete.

- Under the FLSA, employers need to retain each employee’s hours worked and wages received.

Ideally, this is also long enough to cover the period in which an employee could file an amendment for the applicable fiscal year. For example, if a mortgage lender ever asks you to verify an employee’s income, you’re not going to share detailed earnings information for all of your employees. A mortgage lender also doesn’t care about how much you paid in employer-paid payroll taxes, like Federal Unemployment Tax Act taxes. They want a pay stub, which shows how much your employee took home. Every time you process payroll, your payroll software produces and saves a copy of each employee’s pay stub, which lists the employee’s gross wages, payroll taxes, and payroll deductions.

Our Top Payroll Software Partners

That said, it can be hard to determine how long to keep paycheck stubs. Keep in mind that older records may not exist any longer either. Employers may be required to keep payroll records and pay stubs for only a certain length of time. If you’re request documents from ten years ago, those records may not exist any longer. Our pay stub generator is a fast and easy way to create pay stubs online. All calculations of deductions and income tax withholdings are based on current tax laws and requirements, which we keep up to date with every new tax year.