Photography Accounting: Essential Tips for Professionals

The best accounting app for photographers is one that anticipates the needs of people, like you, who have a business to run, and who don’t have a lot of time to spend on accounting. It’s one that keeps the accounting terminology simple, provides an easy user interface, and an in-house customer support team that’s ready to help. Wave’s accounting software and additional features can help shine a spotlight on growth opportunities while keeping your hard-earned revenue safe and secure. Wave’s accounting software can be customized to meet your specific photography business needs. Flexible, cloud-based, and simple to use, you don’t need an accounting background to use the system that’s right for you.

Track All Expenses

Implementing practical bookkeeping tips can help photographers not only manage their current financial situation more effectively but also lay the groundwork for future success. Xero offers a robust cloud-based accounting solution with strong inventory management features, including payroll processing for expanding enterprises. This article delves into the basic financial intricacies of photographers from the point of view of accounting. Zoho Books online accounting software helps businesses manage their finances, automate workflows, and generally automate accounting workflows. Quickbooks Online is an accounting software that helps businesses both small and large to manage their finances in a seamless manner.

Photography Business Expenses

As a business owner, you’ll likely want to get familiar with developing a reliable balance sheet. This is a summarized statement that provides a quick overview or your organization’s financial health at a specific time. You don’t need to be an accountant in order to keep track of your business accounting. A few simple terms and definitions can clarify some of the initial confusion you might feel when first getting your books in order.

Best Practices for Photography Accounting

Given the above picture, photographers can benefit from accounting software for photographers. By using an accounting software, a photographer can make the task of keeping track of revenue and his or her expenses a smooth and seamless one. FreshBooks is available online for both PCs and Macs, as well as through our mobile app on Google Play or iTunes. The FreshBooks’ desktop accounting software will sync automatically with the app, so you can access your small business finances from anywhere in the world. We offer a number of different accounting packages to choose from, with competitive pricing. Explore the incredible features that FreshBooks bookkeeping software can provide to your photography business today!

Quickbooks for Photographers (QuickBooks Online Advanced) – Best Accounting Software for Photographers Overall

By understanding and managing your photography business expenses effectively, you are protecting your business and setting a stage for its future success. FreshBooks is a perfect software for beginners taking their first steps into accounting. The program’s intuitive interface and reliable customer support. Its project-based accounting is suitable for working with many different assignments.

With Netsuite, you can easily get details of your finances using different yardsticks such as inventory, profitability, fixed assets, taxes, and many more. The accounting platform also offers a 50% off for new sign ups for up to 3 months. In terms of usability, my analysis of QuickBooks Online Advanced reveals that it is an easy to use and intuitive solution. The app is well designed, with menus well laid out, and this makes navigation easy.

QuickBooks Online Advanced has a very simple and straightforward pricing billed per month. Our customizable invoice, estimate and proposal templates will impress your clients! You can add your logo, adjust the colours and fonts, and email them instantly to your clients, through FreshBooks.

The new Accounting Software from FreshBooks helps photographers like you to spend less time on bookkeeping and more time capturing the perfect shot. Invoicing is a cornerstone of photography accounting because it is the primary means by which you receive credit card payments, and thus generate income. Your overall tax situation depends largely on your business structure and how you manage your income and expenses.

Accounting in photography deals with more than merely monitoring receipts and payments. To ethically conduct any business, you must know and follow the basic accounting principles. For instance, exploiting the effective and right software, tax application, and tracking of expenses.

- Tracking your expenses is one of the most effective ways to run your business evenly.

- Zoho Books accounting software provides you with a number of reporting metrics to help make informed business decisions.

- They provide the necessary documentation and explanations for your business expenses and income.

- Your overall tax situation depends largely on your business structure and how you manage your income and expenses.

- DO much more with your reports, Email to yourself and your team, customize and filter the data for insights etc.

For photographers, the journey from taking amazing pictures to turning them into a sustainable business demands a comprehensive understanding of photography business expenses and income. This is what determines the longevity and success of the photography business. As good as paper documentation may seem, sometimes, keeping it safe is very tricky. Accounting solutions storage makes storage and retrieval of your data easy and at all times. The only exception to this is in the case of a data breach and server mishap. Most accounting solutions are not stand alone as they allow you to integrate with other third party apps, which increases functionality.

You’ll spend less time crunching numbers behind the scenes, and more time capturing the images that matter most to you and your clients. The cash method in accounting is helpful in the beginning stages when your trackable expenses are still relatively manageable. In this system, you record incoming and outgoing cash when it actually happens, or when payments are made. By doing so, your books and your bank account statements should line up more evenly. Try not to think of accounting as a boring, numbers-based practice that only causes frustration. If you’re a photographer hoping to expand your professional opportunities, good accounting is the vehicle by which you’ll read your end goals.

Instead of focusing on when cash actually exchanges hands, this method pairs revenue with the action that generated it in the first place. In your photography business, assets include anything you own outright. This includes camera equipment, lighting props, backdrops, and even studio space. We provide different levels of support, depending on the plan and/or the add-on features you choose. Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption.

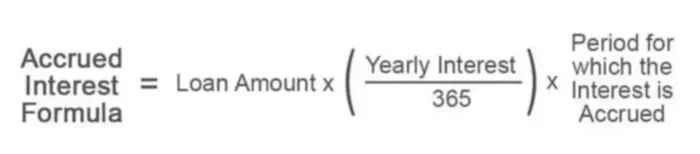

Photographers can leverage this same powerful technology no matter what field they specialize in, or what type of clients they serve. The one thing to keep in mind with expense tracking is that if any costs are reimbursed by a client (such as travel, meals, or lodging), you can’t claim these expenses as deductions. No matter how small you think your business is in the early days, one of the best moves that you can make is to establish a separate business banking account. This might include both checking and savings accounts, but all business bank accounts should function separately from your personal accounts. The accrual method is a bit more complex, as it involves setting up both accounts receivable and payable.