Proposed Changes To The Fair Labor Standards Act Regarding Exemptions Of Overtime Pay

Content

The U.S. Department of Labor (“DOL”) has proposed significant changes to the overtime pay regulations of the Fair Labor Standards Act (“FLSA”). As employers begin evaluating the impact of these proposed changes on their workforce, many are reexamining how they pay employees and whether their compensation plans should change with the new proposal. This summer the DOL published its Notice of Proposed Rulemaking revisions to the FLSA’s white collar exemption regulations. The DOL focused primarily on updating the salary and compensation levels for white collar workers. If adopted, the DOL estimates that the revised regulations will eliminate exempt status for millions of employees.

The DOL proposed to set the standard salary level at the 40th percentile of weekly earnings for full-time salaried workers. Using 2013 data, the proposed salary amount would increase from $455 per week to $921 per week (which is $47,892 annually for a full year worker). The DOL is also proposing to set the highly compensated employee annual compensation level equal to the 90th percentile of earnings for full-time salaried workers ($122,148 annually). Additionally, DOL is proposing to automatically update the salary level on an annual basis. Although the DOL did not propose changes to the duties portion of the white collar exemption tests, it did request public comment on several aspects related to the duties tests and, thus, regulatory language that was not initially proposed may be added into the Final Rule.

Employers should also consider other options such as hiring more staff to spread out hours and limiting employees to working 40 hours or less. If the proposed rules are adopted, the minimum salary for an exempt employee would increase from $455 per week to $921 per week ($47,892 annualized). As a result, executive, administrative and professional employees who are currently treated as exempt, but who earn less than $47,892, would be entitled to overtime pay. The Department of Labor estimates that in the first year after the proposed rule is adopted, 4.6 million workers will be affected. An “automatic updating” provision in the proposed rules, which would annually adjust the minimum salary level, would continue to add more executive, administrative and professional employees to the ranks of those eligible for overtime pay.

In order for employees to fall within one of the white collar exemptions, they must perform executive, administrative, or professional duties (the “duties” test) and make a certain weekly salary (described in the NPRM as the “salary level” requirement). The regulations also exempt “highly compensated” employees who “customarily and regularly” perform one of the exempt duties of an administrative, executive or professional employee, but who do not otherwise meet the duties test. Generally, the FLSA requires employers to pay non-exempt employees an hourly rate of at least one-and-a-half times their regular rate of pay for time worked in excess of 40 hours in a workweek. Certain “white collar” workers, namely those employed in a “bona fide executive, administrative, or professional capacity,” may, under certain circumstances, be exempt from this overtime requirement.

What The Proposed Flsa Regulations Mean For Employers

For the exemption to apply, certain tests must be meet, one of which is a minimum weekly wage of no less than $455 ($27.63 per hour for certain types of work in the computer field). The Department of Labor has proposed new minimum weekly salary requirements for a worker to be considered exempt from overtime requirements under this exemption.

The weekly wage would be raised for 2015 to $921, increase to $970 in 2016 and thereafter salary thresholds would be adjusted each year to be equal to the 40th percentile of weekly earnings for full-time salaried workers. Given what is at stake, employers should consider the consequences of the proposed changes, potential responses based on business needs, and effects the proposed changes may have on related federal, state, and local laws. Should the proposed rules become final, the choice for many employers will be to meet the new thresholds by increasing the salaries of currently-exempt employees or converting currently-exempt employees to a “non-exempt status” and paying overtime. Rather, it is more likely that employers will offset projected costs by reducing the wages, discretionary compensation, and hours of full-time workers.

Proposed Changes To The Fair Labor Standards Act Regarding Exemptions Of Overtime Pay

The FLSA does, however, exempt certain categories of “white collar” workers—including certain executive, administrative, and professional employees—from its minimum wage and overtime requirements. Most employees earning less than $23,660 are automatically subject to FLSA minimum wage and overtime pay requirements and do not qualify for any exemption.

The proposed changes would more than double the minimum salary threshold for EAP exempt workers, requiring compensation of $50,440 per year or $970 per week. The proposed changes would also increase the annual salary threshold from $100,000 to $122,148 for exemption as a highly compensated employee (“HCE”), as well as increase the motion picture producing industry exemption base rate from $695 to $1,404 per week. Currently, executive, professional and administrative employees who meet job-related duties tests and who earn a salary of at least $455 per week—$23,660 annually—are exempt from overtime under the FLSA. Under the proposed regulations, the minimum salary threshold for the white collar exemptions increases to $921 per week, and is set at the 40th percentile of weekly earnings for full-time salaried workers. The DOL calls for annual updates to the minimum salary threshold, and in commentary on its website, it estimates that the minimum salary level in 2016 will be $970 per week, or $50,440 annually. The DOL also proposes to increase the salary level required to satisfy the “highly compensated employee” exemption. The proposal does not include changes to the duties tests, although the DOL is seeking comments on whether the tests are working as intended.

Computer Exemption:

Though the regulations set a salary floor for exempt employees, employers may still pay their exempt employees additional compensation above and beyond the minimum, such as commissions on sales or additional compensation for hours worked beyond the normal workweek, without forfeiting their exempt status. Effective December 1, 2016, the new Regulations more than double the FLSA’s above-referenced minimum salary threshold to $913 per week ($47,476 annually). Notably, this figure materially exceeds the current minimum salary thresholds for the state-level white collar exemptions in every state and, as such, sets a new, across-the-board minimum salary to even consider whether an employee may be exempt. According to the DOL’s estimates, this change is expected to cause over 4.2 million currently-exempt white collar workers to become entitled to FLSA overtime rights, absent intervening action by their employers. The proposed rules would increase the salary threshold from $455 a week (or $23,660 per year) to $970 a week (or $50,440 per year) in 2016. The DOL’s proposed minimum exempt salary threshold represents the fortieth percentile of full-time salaried employees’ salaries and would include automatic periodic increases. Additionally, highly compensated employees who, under the current FLSA regulations, are exempt if they receive more than $100,000 per year , and would see the salary threshold rise to $122,148.

What are the amendments to the FLSA?

Other significant amendments include the 2000 amendment to exclude stock options and appreciation rights from an employee’s regular rate, the Employee Commuting Flexibility Act passed in 1996, the 1990 amendment to add a computer employee exemption as section 13(a)(17) of the FLSA, the 90-day training wage for youth

Employers should be certain to monitor for the announcement of the Final Rule and begin analyzing what changes, if any, they will need to make in order to remain in compliance with the FLSA. But the key take away is that the WHD did not propose any changes to the duties tests for the white collar exemptions. The DOL invited comments on the proposed salary level and on any alternative salary levels, as well as the methodology for determining the salary levels, that appropriately makes this distinction. To briefly recap, the FLSA generally requires that employers pay employees overtime—at least straight time plus one-half times their “regular rate” of pay for every hour they work in excess of 40 hours in a particular workweek.29 U.S.C. § 207. The FLSA and its interpretative regulations published by the DOL, however, exempt certain groups of employees from the overtime pay requirements. One such exemption, and by far the most commonly used, relates to employees working in jobs that the FLSA describes as executive, administrative, or professional—the so-called “white collar” exemptions.29 U.S.C. § 213.

Department of Labor (“DOL”) unveiled its long anticipated proposed rule that will, if enacted, raise the minimum salary threshold required to qualify for exemption from the Fair Labor Standards Act’s (“FLSA”) minimum wage and overtime requirements. The proposal seeks to increase the current minimum salary requirement for the executive, administrative, professional, and computer employee exemptions from $455 per week ($23,660 per year) to $970 per week ($50,440 per year). The proposed rule also seeks to increase the threshold for exemption as a “highly compensated employee” (“HCE”) from $100,000 to at least $122,148. Both the minimum salary level for exemption and the HCE threshold would be increased on an annual basis after the new regulations become effective, under the DOL’s proposal. The DOL projects that, if enacted, 4.7 million workers will be affected by these changes. As every employer knows the Fair Labor Standards Act requires that covered employees be paid no less than the federal minimum wage and one-and-one-half times the employee’s wage for hours worked beyond 40 in any work week (the “overtime pay rate”). There are certain exemptions from the overtime pay rate requirement, one of which is for bona fide executive, administrative, professional and outside sales employees.

Fact Sheet: Application Of The Fair Labor Standards Act To Domestic Service, Final Rule

While the proposed rules would not go into effect until 2016, employers should, with the help of counsel, analyze their exempt population and identify the positions that would not meet the proposed increased salary threshold. Employers should also analyze the amount of time that exempt employees are spending on exempt and non-exempt work, as the Final Rule could very well include changes to the duties tests.

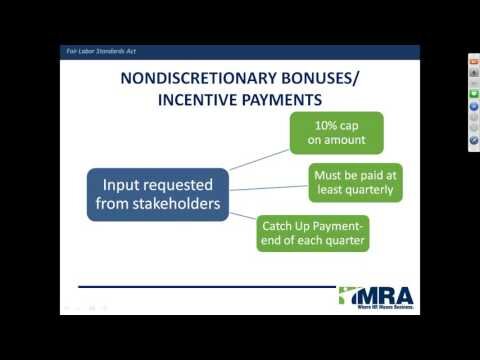

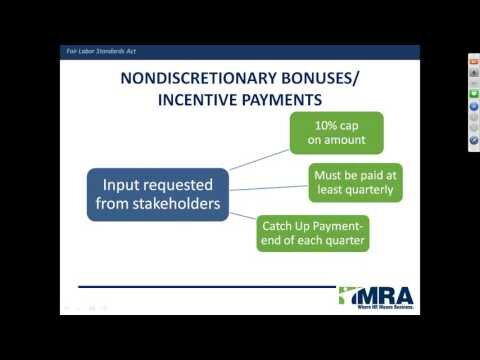

Bonuses, commissions, and other discretionary payments generally do not qualify, as these are subject to variations based on the quality or quantity of work performed. Employers must also exclude board, lodging, and payments for medical, disability, life insurance, or contributions to retirement plans from the calculation.

These “white collar” exemptions have been part of the FLSA since its enactment and the federal regulations interpreting them, codified at 29 C.F.R. Part 541, were revised most recently in 2004. According to the White House, these workers are often “low level” managers or clerical employees who work alongside hourly employees and only have marginally more responsibility than their overtime-eligible coworkers. As stated by the Administration, such a scenario is “unfair” and at odds with the underlying purpose of the FLSA. The proposed rule issued today is the DOL’s response to this Presidential directive. It generally requires employers to pay their employees a minimum wage (currently $7.25 per hour under federal law) as well as an overtime premium for hours worked in excess of 40 per workweek, usually at a rate of one and one-half times the employee’s “regular rate” of pay.

How long does it take for the labor board to investigate?

Typically, a decision is made about the merits of a charge within 7 to 14 weeks, although certain cases can take much longer. During this period, the majority of charges are settled by the parties, withdrawn by the charging party, or dismissed by the Regional Director.

However, shifting employees from salary to hourly or from overtime-exempt to overtime-eligible will have a wide range of operational and legal implications for employers and what employers save in direct labor costs could be lost in decreased morale and production. Accordingly, having a plan to manage employees through these regulatory changes is key. As expected, the proposal calls for raising the minimum salary level for exempt white collar employees. The increase to $970 per week reflects a “standard salary level” equal to the 40th percentile of earnings for full-time salaried workers and more than doubles the current salary requirement for exempt status.

In particular, employers should identify lower to mid-level managers who spend more than 50 percent of their time on non-exempt work. Based on this analysis, employers should consider whether to reclassify the positions that do not meet the proposed salary threshold or to increase pay levels.

- The proposed changes would also increase the annual salary threshold from $100,000 to $122,148 for exemption as a highly compensated employee (“HCE”), as well as increase the motion picture producing industry exemption base rate from $695 to $1,404 per week.

- The proposed changes would more than double the minimum salary threshold for EAP exempt workers, requiring compensation of $50,440 per year or $970 per week.

- Under the current overtime rules – last updated in 2004 – employers are required to pay all employees covered by the FLSA time-and-a-half for any hours they work in excess of 40 hours in a single workweek.

- Certain executive, administrative, and professional workers (“white-collar workers” or “EAP workers”) are “exempt” from overtime if their job responsibilities satisfy the “duties test” and they earn more than $23,660 per year or $455 per week.

As a result, employers will not know the extent of the rule changes until the Final Rule is issued. The 60 day public comment period is now closed and employers await DOL’s Final Rule which will take into account the public comments.

Under the current overtime rules – last updated in 2004 – employers are required to pay all employees covered by the FLSA time-and-a-half for any hours they work in excess of 40 hours in a single workweek. Certain executive, administrative, and professional workers (“white-collar workers” or “EAP workers”) are “exempt” from overtime if their job responsibilities satisfy the “duties test” and they earn more than $23,660 per year or $455 per week.

This latter criterion requires a fact-intensive assessment regarding the nature of the employee’s work and specific job responsibilities. The Fair Labor Standards Act requires most employees to receive the federal minimum wage of $7.25 per hour, and overtime pay for all hours worked over 40 in a workweek. The FLSA exempts several categories of employees from the overtime requirement, including bona fide executive, administrative and professional employees. To qualify for one of these exemptions, an employee must perform certain job duties and be paid a salary no less than the level presently set at $455 per week. Employees classified in the standard executive, administrative, or professional categories must receive a minimum salary (currently $455 per week) in order to be exempt from the minimum wage and overtime requirements of the FLSA. Their pay must be a fixed, predetermined amount “free and clear” for each workweek in which they perform any work.