Quickbooks Payroll Vs Adp

This plan comes with ADP’s core payroll processing features, including tax calculations, withholdings, and filings. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork.

I had to call customer service a few times for questions and help. They have logged into my computer and showed me everything I needed to know. Scalability, portability, reliability, ease of use, security, reporting & customer support are the most valued features when it comes to RUN powered by ADP. This platform allows us to quickly transition our staff size & allows an international team to onboard, process payroll and terminate employees easily & efficiently. We can work anywhere that there is an internet connection & can focus on our core business and rely on ADP to handle taxes and garnishments. Security has greatly improved empowering employees & administrators.

Among the core payroll features are online processing, automated tax services, new-hire reporting, employee self-service, payroll reporting tools, wage garnishment assistance, and a mobile app. We’ve been using ADP RUN for a few years now and have enjoyed our experience with the system. It makes payroll a breeze and provides our staff members with an easy-to-use timecard and information portal, which allows them to see their pay stubs, W-2s, and retirement balances. Errors within the system are rare, and the ADP customer service team is extremely responsive if any issues do arise. W-2 forms are generated automatically for us to mail out and ADP also helpfully files tax and employment reports, which saves a ton of time. We’ve also found the HR411 feature to be useful for basic HR queries, particularly when certain forms are needed.

TheEssential plan allows employee self-service and lets you pay employees via direct deposit, prepaid debit cards or paper checks delivered to your office. It includes new-hire reporting and access to a wide range of other payroll-related reports. This plan also features a general ledger interface that allows you to export journal entries into QuickBooks, Xero, Wave Financial or a generic output file.

Entering employees and processing payroll is a breeze! The payroll reports are thorough and the W-2 processing and mailing is all done by them as well. If you haven’t used ADP before then do yourself a favor and call them, you won’t regret it. ADP must be the only software company in the world that hasn’t resolved what is a very simple issue.

From an administrative side, we have many different positions that incur their own payscale and ADP allows us the flexibility to customize each employees information. With multiple event pay rates available, we can easily choose which rate is appropriate for the shift completed. Setting up employees is beyond easy and we have the ablilty to have W2 employees and 1099 employees separated yet all accessed in one convenient location come payroll time. Editing existing employees is just as easy and setting them up. The ADP Run payroll platform has been making my life as an office manager easier since 2011. I recommend it to anyone asking about payroll platforms and I hope my office never changes.

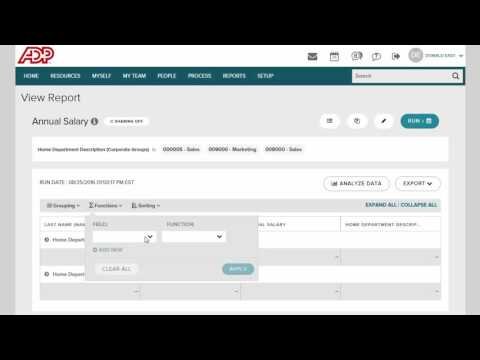

Reports

the software seems very secure and has a lot of measures that are taken. Very easy to use, even for technologically inept people like me. The rep that sold me the software was extremely thorough. Has a lot of features for payroll processing, tax reporting, and human resources features, and even workers comp integration. Simply put, this software integrates nearly all financial and human resource aspects I need as a small business owner, other than banking. It even makes it easier to offer retirement benefits for my employees.

Can payroll be reversed?

The bank can process reversals only up to five days after the check date. Your employer can reverse your wages without telling you during this five-day period. If the reversal fails because you withdrew the funds, your employer cannot go into your account and take any money out.

Department managers can also easily view basic information for employees in their work group, and can then message them via the app. We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. There are two items that I like the least about this software. Most important is the lack of a feature allowing us to import our payroll data into the “Payroll Task”. When we grow it is very time consuming & cumbersome to key in all the data. A feature to import the payroll data would be fantastic!

Compare Payroll Processing Options And Benefits

It shows tax adjustments, too, which can be one of the more complex challenges of payroll for the small business. Don’t forget that integrating QuickBooks Payroll with the accounts system lets you look at the very full range of accounting reports available, too.

Payroll is one of those functions in a business that isn’t sexy, but that needs to be 100% accurate. If you get payroll wrong, you’re in trouble not just with your employees, but with the state – which wants your payroll taxes! So payroll applications and payroll services need to be totally reliable. Let’s take a look at two of the big ones – RUN Powered by ADP, and QuickBooks Payroll. I really enjoy the multiple options ADP offers for employees.

It’s not the cheapest software out there, but it is 100% worth the money. Essential Payroll is ADP’s basic payroll solution for small business.

In addition, the Essential plan includes new-hire onboarding tools and a small business marketing toolkit. Once all this information is entered, you are ready to begin processing payroll. When the next pay period comes, log into your account dashboard and select the “Run Payroll” option. From here you can view employee time cards and make any manual adjustments. Each employee’s pay should calculate automatically based on the information provided in their profile.

Service & Support

Square Payroll offers a suite of payroll and tax administration features for your business. It can be a flexible solution for your business, and customers frequently praise it for being user-friendly.

Does ADP manage 401k?

If you’re already an ADP payroll client, you’ll gain efficiency with seamless integration between ADP’s payroll and ADP’s 401(k) plan record-keeping systems.

I used RUN powered by ADP with a company I previously owned with 5 employees. For probably all business owners doing payroll, withholding, and taxes is the biggest stress. You can change employees hours or wages each week by logging into their web portal. For the salary employees it was simple to have a reoccurring payroll payment to them every two weeks.

What Run Powered By Adp Offers

It will send the employees all of their information for their direct deposits. The employee can also login to see all his or her information. Best of all at the end of the year the taxes and forms paperwork is all taken care of for you. They will automatically send out the W2s to the employees. This relieves a lot of stress at the end of the year when it comes to taxes.

- I used RUN powered by ADP with a company I previously owned with 5 employees.

- You can change employees hours or wages each week by logging into their web portal.

- For probably all business owners doing payroll, withholding, and taxes is the biggest stress.

- For the salary employees it was simple to have a reoccurring payroll payment to them every two weeks.

This product offers a variety of core features beyond just payroll, as well as additional add-on features. When you sign up you can work with an ADP representative to select the features you need, and remove the features you don’t.

The software also calculates deductions for things like tax, health benefits, and retirement contributions. If everything looks good, select “Approve” to run payroll. For these reasons, it makes a lot of sense to find a good small business payroll serviceprovider to help you manage your payroll. Payroll software is capable of automating a lot of the tasks required for payroll, including calculating payments, withholding taxes, and depositing wages into your employees’ bank accounts. QuickBooks produces a thorough payroll summary report that shows such headings as vacation, sick time, pay, taxes per employee, and also shows the totals that you have paid.

Central database is secure while always at my finger tips. Standard reporting & Adhoc reporting features are great! Customer Support deserves lots of credit – they are helpful, professional & supported us with difficult HR & technical questions passing along problems & ideas effectively. Finally, ADP has listened to suggestions & continuosly improved its software since 2010. ADP Workforce Now is designed for businesses with 50–1,000 employees.

I do not want to go to another platform, which allows the data from the proprietary Time Tracking software to be imported. Second point is the capability of a payroll administrator being able to input/review/edit the data in the Payroll Task & save it. Should not be able to add or delete the Task and not be able to RUN the task . But my team could help out in different time zones if this 2nd feature would be implemented. We were pleased with the support we received from ADP. To test the quality of customer service it offers, we contacted the company multiple times by phone and email, posing as a business owner interested in payroll services.