R&d Tax Credit

Content

• Proven successful experience with and understanding of Private Client and High Net Worth credit business. • Proven experience and expertise with broad range of credit products and with credit portfolio management and collateral monitoring.

• Provide focus and clarity in establishing individual goals, driving performance management, supporting career development and rewarding strong performance. • Identify inherent value/strengths/benefits of team, department, and enterprise to develop better solutions and achieve a cross-enterprise mindset. • Accept and successfully execute change while supporting employees through the process, and keeping them focused on business priorities. About RBC Royal Bank of Canada is Canada’s largest bank, and one of the largest banks in the world, based on market capitalization.

Nor does the IRS specifically define “sufficient documentation” to claim an R&D credit—but it’s important to note that the IRS strongly prefers contemporaneous documentation. We often find clients have misconceptions about what constitutes important documentation for the R&D tax credit. A simple general ledger account from one department that says “research expenses” will not do. Most companies build financial systems to prepare financial statements or for tax return preparation, but such record keeping often fails to correlate qualified research activities to back up the qualified research expenses the company is attempting to claim.

R&d Tax Credit

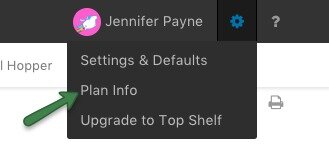

Tax advisors need to know the knowledge and effort that went into the development of your product or solution for which you’re claiming the credit (not all the details!). With that, we can help determine if each technology and research activity has qualified research expenses under Internal Revenue Code Section (“Sec.”) 174, and then if those expenses meet the more stringent criteria of Sec. 41 for the R&D tax credit. Conducting a review of any mechanical computation in the R&D tax credit plays a vital role in the examination process.

Diversity and Equal Opportunity Employment RBC is an equal opportunity employer committed to diversity and inclusion. We are pleased to consider all qualified applicants for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, age, disability, protected veterans status or any other legally-protected factors.

This includes federal taxable wages reported on Form W-2, including bonuses and stock option redemptions. Nontaxable items – such as 401 contributions, health insurance contributions, other pretax benefit deductions and non-taxed income – must be excluded, even if they were compensation for qualified services performed by an employee.

- • Provide assistance and guidance to credit specialists as needed with review of documentation and drafting letters in connection with credit facilities.

- • Review entity documentation for Trusts, corporations, LLCs, partnerships or other borrowing entities both onshore and offshore.

- • Gather, with guidance from Group Law and outside counsel, additional information on requirements for international entities and foreign jurisdictions, and legal opinions as may be required.

- • Review proposed transaction structure and/or make recommendations for changes to structure to protect RBC interests/mitigate unnecessary risks • Preparation of supplemental/amending documentation as needed.

- • Responsibility for the integrity of information transcribed from approved eTR’s to loan and security documentation.

- • Required to exercise excellent judgment to ensure that credit has been properly approved, documentation is complete and collateral can be perfected under existing lending policies.

• Displays sound independent judgment with strong understanding of legal/documentation risks as well as well-versed in WM credit control requirements and processes with ability to deliver results under pressure. • Strong understanding of Wealth Management credit business including interrelationships between the business, functions and Group Risk Management. • Advanced knowledge with Microsoft Office applications including Outlook/Excel/Word/PowerPoint and proven ability to learn and adapt to in-house credit and other workflow systems. • Demonstrated ability to proactively manage deadlines and work within a dynamic and fast-paced environment. Managerial Excellence • Ensure that employees understand RBC vision, as well as support and reinforce targeted behaviors that contribute to RBC goals.

, the court disallowed QREs related to executive employees due to lack of substantiation of qualifying time and lack of credible testimony. Several taxpayers don’t use a time tracking system, or the time tracking system being used is insufficient to establish qualified research time. The method employed by these companies to quantify qualified wages is to rely on estimates through oral testimony or via time questionnaires. In Cohan v. Commissioner of Internal Revenue, 39 F.2d 540 (2d Cir. 1930), the court allowed for the use of reasonable estimates through credible testimony.

What Is The Allowable Age For Credit Documentation?

The research tax credit rewards taxpayers with a credit for engaging in qualified research activities by providing a credit for a portion of their qualified research expenditures incurred in these activities. ADP’s team of tax credits experts are well-equipped to assist you with R&D tax credit documentation. Given the new permanent nature of the federal tax credit, now is the time to consider whether activities performed by your company qualify for major cash-saving tax credit opportunities. Current regulations have expanded the definition of experimental expenditures and thus what can be included as QREs in the R&D tax credit calculation. For example, prototypes that are created and used in R&D and subsequently sold to customers can be included in the tax credit calculation. 2d 688 (N.D. Tex. 2010), the taxpayer successfully argued that first-in-class ships in the millions of dollars were in fact prototypes eligible as QREs. Expenditures for supplies or the use of personal property that are indirect research expenditures or general and administrative expenses don’t qualify for the R&D tax credit.

We are one of North America’s leading diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis. We employ approximately 78,000 full- and part-time employees who serve more than 16 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 39 other countries.

Likewise, supply and contract research expenses should be reviewed to ensure they’re classified correctly and documented appropriately. Many pre-packaged R&D credit studies provide the study methodology, but lack information to help substantiate the credit.

Estimation methods are permitted in cases where the sole issue is the exact amount paid or incurred in the QRA. Accordingly, taxpayers should maintain factual support for the assumptions underlying the time estimates to meet the IRS burden of proof. The aforementioned Cohan Rule doesn’t have to be applied if sufficient evidence isn’t produced.

Credit Administration And Documentation Overview

However, it is not discovering new information or eliminating technological uncertainty, but rather building a knowledge base of existing technological information available in the public domain. Under normal circumstances, expenses associated with this activity do not qualify for the research credit. But, although not a QRA in its own right, the documentation created from Activity Imay help substantiate Activities III, Modeling, and IV, Prototyping and Trialing. Although there is no guidance from the IRS on what is sufficient documentation to establish that a taxpayer is entitled to a claimed research tax credit, taxpayers can use a number of court cases as guidance.

Payments made to third parties for conducting qualified research activities are eligible for R&D tax credits. Good sources of documentation for contracted services include invoices and 1099s, which summarize all payments made to a vendor during a year. Many companies that otherwise would qualify for valuable research and development (R&D) tax credits never bother to apply for them. What would cause a business owner to leave thousands or even millions of dollars on the table? The culprit is often the federal government’s requirements for the documentation of a company’s qualifying activities. While the need for documentation is certainly instrumental to the IRS’ approval process, the lack of understanding about what documentation entails needlessly keeps many out of the R&D credit arena.

• Perform searches, filings, registrations and releases of security as needed. • Participate in Credit Management Projects to improve the data integrity of credit reporting and suggest systematic improvements to improve efficiencies within the credit management processes and work flow. • Raise concerns / issues to management surrounding individual credits that present a heightened risk to the firms’ balance sheet. • OR • Credit administration, record management and loan documentation experience within a Private Bank setting. • Sound knowledge of local regulatory and compliance requirements is required.

The creation of nexus between QREs and QRAs generally is most difficult with respect to capturing qualified wages. Taxpayers should attempt to create nexus between QREs and QRAs when possible. Tax Point Advisors writes a bullet-proof, audit-defensible R&D tax credit study report for each of our clients. In fact, our audit rate is under 5% and our industry-leading audit success is unmatched. However, if an audit is necessary, it is essential that a business is able to provide documentation that backs up its R&D activity and eligibility. We advise our clients to keep items including lab reports, prototypes, photos that illustrate the progression of testing and assembly, and additional documentation pertaining to industry-specific testing. Financial documentation plays a significant role in substantiating a taxpayer’s R&D tax credit calculation.

What Is Loan Documentation?

At Acena Consulting, we know that keeping up with the continuously changing landscape of required research and development documentation is a full-time job. Our experienced tax credit professionals partner with small to mid-sized businesses in every operational vertical to navigate through the seemingly endless piles of paperwork and leverage every tax credit benefit available to them. Contact us today to learn more about how we can create a customized documentation process that helps your business substantiate and sustain its R&D tax credit claim. In practice, this may be documented in a number of records, which vary greatly from one taxpayer to another. With our exceptional experience, technology and resources, we’re well-equipped to assist clients with R&D tax credit documentation and calculations. This allows customers to take a broader, deeper view of incentive opportunities for which they may be eligible, and focus more on potential cost offsets and less on compliance activities.

Businesses that invest in research and development (R&D) and want to reduce their tax liability via the federal R&D tax creditmust be able to properly support claimed, qualified research expenses . So, how can organizations document the nature of claimed activities and provide a reasonable basis for any estimates, while also reducing the time and effort required to calculate eligible expenses? Although there is no mandated standard for recordkeeping when applying for the R&D tax credit, it may be helpful to establish a methodology for capturing and quantifying QREs. This has resulted in controversy between taxpayers and the IRS as to what documentation is sufficient to substantiate expenditures. The recordkeeping requirement in Treasury Regulation 1.41-4 states that a taxpayer claiming a credit under Section 41 must retain records in sufficiently usable forms and detail to substantiate that the expenditures claimed are eligible for the credit. This lack of specific guidance with regard to the types of contemporaneous documentation that would satisfy the requirement offers flexibility, but also can create uncertainty. Business owners may find it helpful to refer to previous court decisions regarding the R&D tax credit for additional guidance on recordkeeping.

In-house research conducted outside the United States (as defined in IRC Section 7701) is also excluded from qualified research (Treasury Regulation Section 1.41-4A). The IRS’s preferred method for capturing QREs is a project-based approach where taxpayers can create nexus between QREs and QRAs. Per the Suder case, taxpayers aren’t required to provide a factual nexus bridge between claimed QREs and specific business components as long as there’s reliable evidence to support the QREs.

To satisfy audit protocol, all required documentation should be available to determine that the taxpayer has properly calculated the credit for the year being submitted. If estimates were used in the computation review, it’s critical to have documentation available that outlines how the estimates were formed. Activity I, Research of Existing Information, is not a QRA as it relates to studies of existing information.63 Through undertaking this activity, Battery Co. does acquire technological information .

• Responsibility for the integrity of information transcribed from approved eTR’s to loan and security documentation. • Required to exercise excellent judgment to ensure that credit has been properly approved, documentation is complete and collateral can be perfected under existing lending policies. • Review entity documentation for Trusts, corporations, LLCs, partnerships or other borrowing entities both onshore and offshore. • Provide assistance and guidance to credit specialists as needed with review of documentation and drafting letters in connection with credit facilities. • Gather, with guidance from Group Law and outside counsel, additional information on requirements for international entities and foreign jurisdictions, and legal opinions as may be required. • Review proposed transaction structure and/or make recommendations for changes to structure to protect RBC interests/mitigate unnecessary risks • Preparation of supplemental/amending documentation as needed.

Companies nationwide use the research and development (R&D) tax credit to generate tax savings based on the resources invested in developing new or improved products and processes. A company’s documentation strategy is one of the most important parts of substantiating the R&D tax credit. This article covers the types of financial documentation needed to help substantiate R&D tax credits.

This often is referred to as the “Cohan Rule.” Furthermore, in Suder v. Commissioner of Internal Revenue, T.C. Memo. , the court stated it was appropriate to rely on credible subject matter expert testimony to support QREs and that it wasn’t required to connect wage QREs to specific business components.

There is a noticeable absence of guidance from Congress, Treasury, and the IRS as to what documentation is sufficient to substantiate research tax credits. The use of high-level estimates can make it difficult to substantiate an R&D tax credit claim. High-level estimates can include the use of interviews to estimate R&D time percentages and judgment samples. A common example is a chief financial officer or chief executive officer making R&D time percentage estimates for everyone in the organization and not consulting with those individuals closer to the QRAs. Taxpayers also should expect to retain additional supporting documentation for high-level employees involved in R&D. The IRS doesn’t have to accept estimates of QREs if documentation exists to verify the actual amounts of such expenses.