Reporting Ira And Retirement Plan Transactions

Content

Simplified Employee Pension plans are a type of tax-deferred retirement savings plan for the self-employed and small business owners. With a simplified employee pension plan, a business can make tax-free contributions to an individual retirement account for each of its employees. SEPs are funded solely by the employer using tax-deductible dollars. Unlike other retirement plans, SEP plans do not offer Roth or post-tax contributions. taxpayer made a $250,000 contribution to her traditional IRA, consisting of a $7,000 deductible regular contribution, a nontaxable rollover contribution of $163,000, and an excess contribution of $80,000.

I also confirmed the SEP is set up under the business name of the S-Corporation to conform with the requirements of pub 560 regarding SEP IRAs. Current tax law permits the S-Corporation to contribute up to $54,000 or 25% of the compensation of the employee, whichever is less.

I Already Enrolled In A Simple Ira, How Do I Consolidate Other Retirement Accounts?

So the SEP account does belong to the shareholder-employee, who has 100% ownership of the company. Since the same person is the onIy shareholder and the only employee, there was no employee matching of the employer contribution. Technically there is no other liability, since it has been sent to the brokerage already by the 100% shareholder-employee. The expense for retirement plan has already been recorded against the bank account. The Department of Labor rules that govern SIMPLE IRA plans are different from the Internal Revenue Service requirements.

The excess contribution was unintentional, and the taxpayer subsequently overlooked the opportunity to make a timely corrective distribution. Further, an ordinary distribution from a traditional IRA will normally be taxable, whereas the taxpayer may deduct an excess contribution that is absorbed by a traditional IRA.

Nonelective Contributions

The techniques for eliminating the excess contribution part of a failed rollover are generally the same as those discussed above for excess contributions not involving a rollover. However, most of those techniques do not solve the problem of the taxability of the distribution part of a failed rollover. transfer of the original contribution from her SIMPLE IRA to a traditional IRA. Thus, the taxpayer recharacterizes the contribution as if originally made to the traditional IRA. Because the contribution is within the normal statutory limitations on regular contributions to traditional IRAs, the contribution is deductible and is no longer an excess contribution. taxpayer made a $19,000 contribution to his Roth IRA on Jan. 1, 2019. The first $7,000 of the contribution was a nondeductible contribution to the Roth IRA for 2019, and the remaining $12,000 was an excess contribution.

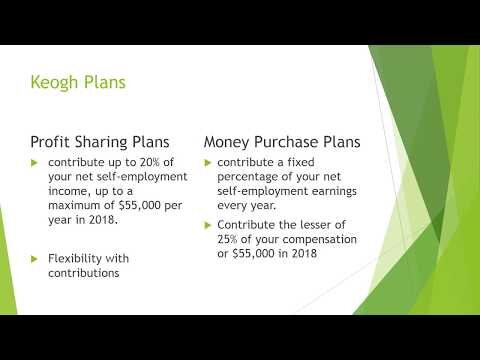

SIMPLE IRAs, like many retirement plans, require immediate vesting of all contributions for employees. It’s not uncommon for some employers to use vesting schedules to deter employees from leaving early, but these vesting schedules aren’t available for use in SIMPLE IRAs. Contributions are broken into two categories, with employee salary deferrals limited to $13,000 and another $13,000 potentially coming from matching employer contributions. Ultimately, the total amount will depend on the employer’s matching formula. Remember that business owners are required to match between 1% – 3% of employee deferrals. SIMPLE IRAs are ideal for business owners who have more than 5-8 employees but want to avoid the cost of administering a 401 plan.

The value of the traditional IRA immediately before the contribution was $150,000. Thus, the IRA was valued at $400,000 immediately after the excess contribution. On April 1, 2020, when the IRA was worth $420,000, the trustee made a corrective distribution to the taxpayer of the $80,000 excess contribution plus $4,000 of allocable net income. The trustee computed the allocable income as shown in the chart “Computation of Allocable Income in Example 1.” Because there are limitations on the number of employees who can participate, only small businesses can offer these plans. With a SIMPLE IRA, your company works with each eligible employee to establish a SIMPLE IRA into which you can make salary-deducted contributions.

For employers, there’s the advantage of flexibility for contributions. They can choose to either match the employee contributions to their individual SIMPLE IRA accounts, or the company can contribute a fixed percentage of all eligible employees’ pay to each account. Specifically, the employer can either match their employees’ contribution dollar-for-dollar up to 3% of pay, or they can choose to contribute a regular, nonelective 2% for each eligible employee. Employees may elect to terminate their salary reduction contributions to a SIMPLE IRA plan at any time. If they do so, the SIMPLE IRA plan may preclude them from resuming salary reduction contributions until the beginning of the next calendar year.

The contribution part of the failed conversion usually results in an excess contribution in whole or in part. The techniques for eliminating the excess contribution are basically the same as those discussed above for an excess contribution to a Roth IRA not involving a Roth conversion. However, most of those techniques do not change the continuing taxability of the distribution part of a failed Roth conversion. That is where recharacterizations might play a more significant role. distribution may be particularly useful in eliminating the excess contribution part of a failed rollover. In addition, for a few types of failed rollovers, recharacterizations may be particularly effective at both eliminating excess contributions and making the distribution part of the failed rollover nontaxable. The taxpayer made no other contributions to his traditional IRA during the years and received no distributions from the IRA during those years.

SIMPLE IRAs can also benefit small business owners who want to encourage employee saving through salary deferrals rather than through the employer-only contributions of a SEP IRA. Employers must deposit employees’ salary reduction contributions to the SIMPLE IRA within 30 days after the end of the month in which the employee would have received them in cash. They must make matching contributions or nonelective contributions by the due date of their federal income tax return for the year.

Traditional IRA laws apply to your SIMPLE IRA regarding investments, distributions and rollovers. The SIMPLE IRA works well as a start-up retirement plan for small employers who do not currently sponsor retirement benefits like a 401 planor a 403 plan. Like other kinds of individual retirement accounts , employees in the program can choose to make salary reduction contributions, and the employer makes matching or nonelective contributions. Then, $7,000 of the contribution was a nondeductible contribution to the Roth IRA, and the remaining $12,000 was an excess contribution. Assume the taxpayer failed to make a timely corrective distribution of the excess contribution. Further, the taxpayer made no other contributions to his Roth IRA during the years and received no distributions from the Roth IRA during those years.

Simple Ira Costs

I think when you mention the “Benefits section” you are talking about QB DESKTOP payroll, rather than QB ONLINE payroll. When setting up company contributions in payroll deductions under payroll settings, QB ONLINE does support SARSEPs, but NOT SEP IRAs established 1997 or later. So although I would love to do this through payroll, it does not seem possible until they update QuickBooks Online Essentials payroll with this option.

Employers that are making nonelective employer contributions must continue to make them on behalf of these employees. One of the chief attractions of the traditional IRA is that you can usually deduct the amount of your contributions when you file your tax return for the year, reducing your adjusted gross income. In case of an audit, you might need to prove to the IRS that you made IRA contributions.

The final step of a SIMPLE IRA involves establishing individual accounts for each eligible employee and making matching employer contribution based on the formula outlined in the plan agreement. New account applications need to be completed for each participating employee, and employer contributions must be made for each employee who elects to participate within 30 days of an employee salary deferral. In a SIMPLE IRA, employee deferrals are excluded from their respective taxable incomes. At the same time, matching employer contributions are tax-deductible to the employer.

While the IRS does not require employees to contribute, it prohibits employees from opting out of receiving non-elective contributions from their employers. Instead, business owners with employees are required to fund contributions for each individual employee proportional to the contributions they make to their own account. SEPs are great for small businesses with few or no employees, while SIMPLEs are better if you have 5-8+ employees or want to avoid the administrative costs of a 401.

How Simple Iras Work

Employees who are age 70 ½ or over may make salary deferral contributions to their SIMPLE IRAs. No, you must base your SIMPLE IRA plan employer matching contribution on the employee’s entire calendar-year compensation, regardless of when the employee starts or stops contributing during the year. The maximum matching contribution is always 3% of the employees’ compensation for the entire calendar year. Matching contributions may be made on a per-pay-period basis, or by the due date of the employer’s tax return . (See page 7 of IRS Publication 560 for the difference.) To date, company contributions are 100%, shareholder-employees contributions 0%.

- Unlike other retirement plans, SEP plans do not offer Roth or post-tax contributions.

- SEPs are funded solely by the employer using tax-deductible dollars.

- With a simplified employee pension plan, a business can make tax-free contributions to an individual retirement account for each of its employees.

- Simplified Employee Pension plans are a type of tax-deferred retirement savings plan for the self-employed and small business owners.

- taxpayer made a $250,000 contribution to her traditional IRA, consisting of a $7,000 deductible regular contribution, a nontaxable rollover contribution of $163,000, and an excess contribution of $80,000.

Though different mechanically, this is essentially the same as SEP IRAs, 401 plans, and Traditional IRAs under current U.S. tax law. A SIMPLE IRA is an employer-sponsored retirement savings plan that some small companies use to provide employees with retirement savings. This tax-deferred plan has the same general rules as a traditional IRA which, as an employee, makes it relatively easy for you to use and understand. Like traditional and Roth IRAs, you must make contributions by April 15 following the end of the tax year. A taxpayer may use an ordinary distribution to eliminate an excess contribution to a Roth IRA if it is too late to make a corrective distribution. Specifically, the entire amount of the ordinary distribution reduces excess contributions. If the distribution is large enough to eliminate all excess contributions, the excise tax will not apply in the current or future years .

If a person contributes more than the allowed amount to a SEP IRA, the excess amount can be carried over and deducted in the subsequent tax year. However, the excess contribution may be subject to the 10% excise tax for over-contributing to a retirement plan. It’s easy enough to avoid over-contributions by performing SEP IRA calculations prior to making any final contributions designated for the tax year. I used the term “owner” because the shareholder-employee of the S-Corp is also the ONLY shareholder, as well as the ONLY employee of the S-Corp. Therefore, this shareholder has 100% ownership, which is usually what the term owner means.

Tax Planning With Simplified Employee Pension (sep) Plans

Contributions made on the part of the employer are due by the business’ filing due date for the tax year—usually April 15, or Oct. 15 if there is an extension. An employers’ matching contributions are tax deductible as a business expense. Compared to many other workplace retirement plans, SIMPLE IRAs are cheaper for employers to set up and easy to administer. A SIMPLE IRA is an excellent tool for small business owners to help their employees save up for retirement. This type of retirement account combines features of both the traditional IRA and the 401. Like both of these plans, the SIMPLE IRA is subject to annual contribution limits.

Excess contributions to an IRA are subject to a 6% excise tax, which applies to the excess contributions each year until they are removed or eliminated from the account. In addition to regular contributions, failed rollover and failed conversion contributions can result in excess contributions to an IRA. A nonelective contribution is made by an employer to employees’ qualified retirement plans regardless if employees make contributions. A SIMPLE IRA is a retirement savings account option worth considering if you’re the owner or employee of a small business. The IRS requires employers to make a contribution on their employee’s behalf, and employees may elect to make contributions. As an employee with a SIMPLE IRA, you can contribute pre-tax dollars to your plan through “elective deferrals,” either in cash or as a salary reduction contribution. The latter can be a specified dollar amount or a percentage of your salary.