Restaurant Accounting: A Step by Step Guide

It’s crucial to have an effective accounting system in place for your restaurant to see the success you’re after. Keeping a watchful eye on the restaurant bookkeeping process is especially important for restaurants because of their slim profit margins. Use this step-by-step guide to restaurant accounting to make your bookkeeping tasks simple and accurate.

Consider Outsourcing Payroll

If your restaurant has more than $1 million in revenue, switching to accrual is best. Accrual accounting records financial transactions as they happen, whether you have received payment or not. R365 offers a fully integrated accounting software that automates accounting procedures such as accounts payable and receivable, payroll, invoices, and inventory. Restaurant owners have many factors to consider when it comes to restaurant bookkeeping. Ideally, your accounting software will integrate with your POS system, and you can track multiple locations, if needed, and update the cost of preparing recipes based on daily food prices. Discretionary tips from customers, whether in cash or added to credit cards, are considered income of the employee and should not be shown on the restaurant’s books.

Menu item profitability

They also help businesses to comply with financial regulations, such as tax laws, and manage potential risks. Reconciling QuickBooks accounts is the single most important piece of the entire bookkeeping process. Reconciling your accounts is the only way to know that you have recorded all of your financial transactions. However, in-house restaurant accounting has some drawbacks, including that they might not be an expert in the area, or you might have to look for someone who specializes in restaurants.

How to do accounting for a restaurant in 5 steps

Employee scheduling, sales forecasting, and electronic data exchange (EDI) with vendors are also key functionalities. Other components include payroll, automated A/P, and inventory management. Depending on your sales volume and the tasks you need help with, your bookkeeper may only work on your records a couple of hours a day or week.

Business Type

While the accrual method can be more complex and time-consuming, it gives a more accurate picture of a restaurant’s financial health as it considers current and future obligations and revenue. Doing restaurant accounting can be as rewarding as creating your favorite recipes when you do it the right way. Keeping track of your financial situation helps you make better financial decisions and future-proof your business. Next, set up a chart of accounts, which is a system that organizes your restaurant’s accounts into categories, such as assets, liabilities, income, and expenses. The cash accounting method is a simpler way to do accounting for your restaurant. With this method, you record income when you receive it and expenses when you pay them.

Cash flow statement

Using Plate IQ, restaurant owners, and managers can automate invoices and accounts payable systems all on one platform. It can be used on its own, integrated with other products, or used in combination with other accounting software for restaurants. POS systems connect every point of your business – from inventory to sales – and integrate with various other systems, such as accounting platforms and employee management software. This means it’s easy to collate all your financial data on your COGS, sales, stock on hand, accounts payable, labor costs etc., to help manage your accounting. Bank reconciliation is essential to ensure your bookkeeping records match your bank accounts, payroll liabilities, lines of credit, loans, and credit cards.

You can either save this receipt in a paper file or upload it to your accounting software with your mobile app by taking a photo. You should also segregate your cash sales and those made using credit cards. Regardless of whether you separate these transactions in your sales record or not, your total daily sales should still be balanced. One of the first steps you should take in your restaurant bookkeeping process is recording your sales daily, ensuring your accounting records are up to date.

The end-of-day sales report gives you your sales by day by category, for food, beverages, sales tax. “For example, you can classify your purchases as the cost of goods sold and lump all purchases together or you can drill down and break it out into wine, meats, fish. This P&L gives you all your income and expenses and whether you are profitable or not,” said Miller. Overhead rates are fixed costs of running your business, such as rent and insurance.

- You can then upload your invoices to Bill.com to allow your accountant to code them properly.

- You should reconcile all bank and credit card accounts, loans, lines of credit, and payroll liabilities.

- It’s also easy to set up, can be integrated with different systems, and offers robust features specific to food truck owners.

- As with anything in your business, it’s crucial to set measurable and achievable goals to keep on track and continuously improve to attain sustainable growth.

There are several factors to restaurant accounting, including important vocabulary, different types of expenses, accounting cycles, and items you have to track. Learning about these will help you understand how restaurant accounting works and what you can expect. It helps you better understand your finances, decrease expenses, increase profits, and gives you insights into your performance. FreshBooks offers a balance sheet, general ledger, COGS report, Account Payable, Chart of Accounts, Journal Entries, and access to professional accountants ready to tackle any problems that arise. You’ll have access to the metric that matter and be able to reconcile books quickly and efficiently.

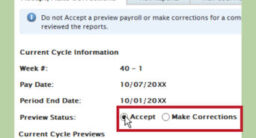

Like most bookkeepers, a restaurant bookkeeper should record sales, track and pay bills, and reconcile cash accounts regularly. They might also run payroll, although it’s often more cost-effective to outsource payroll. A unique job duty of a restaurant bookkeeper is to track employee tips and ensure taxes are properly withheld from base pay to cover tips. There are many good accounting software programs available, but if you are running a restaurant or food-related service, we picked Restaurant365 as our best overall accounting software for restaurants.

The sales tax return is then filed with the state or local jurisdiction and the tax is remitted as a payment. While no one can overnight master the basics of restaurant bookkeeping, remembering these essential steps will always guarantee the accuracy of your financial reports and that they are up-to-date. Restaurants usually—and should—keep the cost of their food to approximately 33% of their total sales. Beverages are additional expenses, and booze is a great way to increase your profit margin. The results were extraordinary—after gaining live access to their labor and sales numbers, they were able to schedule employee shifts smarter. Within four months, they were able to reduce their labor costs from 37% to 24%.

This is one of your core restaurant management responsibilities, especially because you handle lots of inventory in and out of your kitchen daily, including the ingredients you use to prepare your menu. ZipBooks offers a tiered pricing system; the first tier is Starter and is free, while the next tiers are $15 per month, $35 per month, and custom-priced (for the top-tier offering). Pricing for Xero ranges from $12 to $65 per month, and you can try each one with unlimited users free for 30 days. The $12/month plan is called Early and includes 20 invoices and five bill entries; it also reconciles bank transactions and captures bills and receipts.

Now you can type in profit and loss or find it under the business overview section. First, run a profit and loss by going to reports on the left-hand side and selecting reports. Now on the next screen simply mark off your deposits and payments that cleared your bank on the statement until you show a difference of $0. With Shogo, if there are any errors it will hold back the journal entry until you update the accounting mapping.