Salary Paycheck Calculator 2020

Content

Typically, only employers pay unemployment taxes, but in a few states, employees also contribute. The federal rate ranges from 0.6 to 6% , depending on how much the employer pays in state unemployment tax.

This higher-withholding table is intended as a simplified way to adjust for two-earner households. Many taxpayers earlier this year faced surprise tax bills, or refunds that were lower than expected because their withholding wasn’t adjusted for tax law changes that took effect in 2018. Even after 2018, the first full year in which the 2017 Tax Cuts and Jobs Act was in effect, many people are still uncertain as to how the Act changed their income tax situation, and whether they are having enough withheld. Ensuring that you have the most up-to-date state or federal forms can be a challenge—often requiring a significant investment of time and effort. Find copies of current unemployment, withholding, IRS, ADP, and other forms using this extensive repository of tax and compliance-related forms and materials.

Millionwithholding Forms Processed In 2019 Alone

The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding. If they receive pension income, they can use the results from the estimator to complete a Form W-4P, Withholding Certificate for Pension and Annuity PaymentsPDF, and give it to their payer.

Because existing employees will not be required to complete the 2020 Form W-4, they can leave their 2019 or prior Forms W-4 and withholding allowances unchanged indefinitely. Consequently, employers may need to support the past withholding-allowances system for many years. The 2020 version of Form W-4 is mandatory only for new hires and for employees who want to adjust their withholding or change other information on their Form W-4 after 2019. There will also be a separate tax table for employees who check the box for optional higher withholding.

A Payroll Tax Withholding Example

If your state requires withholding, complete the appropriate form and save it as a pdf. All employees are subject to federal tax withholding except nonresident aliens living and working outside the U.S. Employers participating in the president’s plan would stop withholding some Social Security taxes for the rest of 2020, then withhold twice as much as usual early next year to pay the delayed taxes. That would put more money in workers’ pockets temporarily and give them a chance at keeping that money permanently if Congress later forgives the taxes. WASHINGTON — President Trump’s payroll-tax deferral plan started Tuesday, but many employers seem unlikely to adopt the policy, which would effectively give their workers a short-term interest-free loan.

Previously, employees were required to convert estimated deductions into an equivalent number of withholding allowances, so this approach significantly simplifies the W-4 completion process for employees. However, employers will need to convert reported amounts to a per-payroll period adjustment to calculate the income tax to withhold. With all of the numbers to juggle, calculating employer payroll taxes can quickly become complicated. That’s why many businesses hire a dedicated payroll administrator or work with a payroll service provider, who can automate the process and save time.

Employees will be able to enter estimated full-year nonwage income not subject to withholding . Previously, employees with other income sources completed a worksheet to estimate an additional amount to withhold each pay period. The new form simplifies this process for the employee by asking the employee to enter anticipated full-year other income. Employers will add such income to the employee’s wage income to calculate the income tax to withhold. For the latest on how federal and state tax law changes may impact your business, visit the ADP Eye on Washington Web page located at /regulatorynews.

Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. Speak to an expert to see how payroll tax withholding software can make a huge impact when you’re using the right tools. Identify complex tax scenarios, manage W‑4 Forms, track minimum wage rates, or build a payroll platform, with our payroll tax withholding software tools. ADP is making computer changes so employers can start implementing the tax deferral this month and offer employees a choice of whether to participate. As of Tuesday, employers can stop withholding the 6.2% employee share of Social Security taxes for workers earning under $104,000 on an annualized basis. Under IRS guidance issued late Friday, those taxes must be recouped from paychecks in the first four months of 2021.

Calculate every payroll tax imaginable, including federal, FICA, state, local, multi-state, employer taxes, and various other payroll-related withholdings. “In order to achieve relief that is workable for both employers and provides relief to American workers, we urge Congress and the Administration to come together and continue work on legislation.” United Parcel Service Inc. will continue to withhold payroll taxes and send them to the federal government, the company said Monday. Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

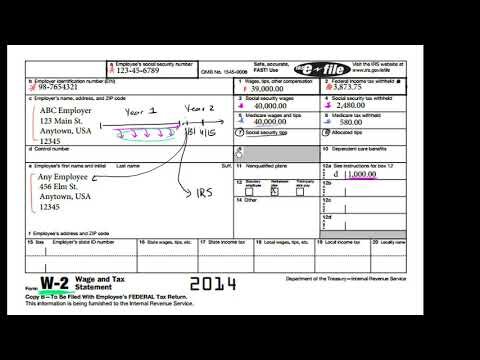

Federal Insurance Contribution Act taxes support the federal Social Security and Medicare programs. The total due every pay period is 15.3% of an individual’s wages – half of which is paid by the employee and the other half by the employer. This means that each party pays 6.2% for Social Security up to a wage base limit of $142,800 and 1.45% for Medicare with no limit. Employees who earn more than $200,000, however, may be charged an additional 0.9% for Medicare, which employers don’t have to match. Before new hires start working, they typically fill out Form W-4 so that their employers can withhold the correct amount of federal income tax from their pay. They may also have to complete a separate withholding certificate for state income tax depending on the state. Some simply use the federal Form W-4 for this purpose and others don’t collect income tax at all.

This guide is intended to be used as a starting point in analyzing an employer’s payroll obligations and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. The IRS 2020 Form W-4 Employer Guide explains the changes to withholding calculations and procedures, and includes a sample letter to send to employees to help them understand the changes. Also included in this toolkit/guide are FAQs for employers and employees, legislative updates regarding the IRS Form and withholding changes, and recorded webcasts about the changes and preparing for year-end. You should review and understand the changes to the forms and instructions for complying with new 2020 withholding calculations and be able to explain the changes to employees.

As the pay periods go by and tax money is withheld from employees’ paychecks , businesses may eventually have to file quarterly tax returns with federal, state and local governments. The deadline for filing IRS Form 941, Employer’s Quarterly Federal Tax Return is usually the last day of the month following the end of a quarter.

Most business owners probably already use some form of accounting assistance, whether it’s a bookkeeper or software, but even with support, paying employees can be challenging. Those who plan on doing their own payroll and want to avoid payroll mistakes must thoroughly understand employer payroll taxes. Symmetry’s payroll tax software tools allow companies to ensure employee and employer taxes are properly calculated and managed. With tools ranging from electronic withholding forms to federal, state, and local tax lookup tools, we make our customer’s processes more automated, efficient, error-free, and regulatory compliant. The Estimator offers an improved, user-friendly tool to determine whether it’s necessary to adjust income tax withholding.

Payroll Tax Engine

On December 5, 2019, the Internal Revenue Service released the final 2020 Form W-4, Employee’s Withholding Certificate. The IRS had released an early draft in May and a second “near-final” draft in August to enable employers to make software and other changes.

It features the ability to target a specific desired refund amount, which is helpful, as is the option to plan for a tax-due amount close to zero. The Estimator is also designed to help people learn about tax credits and deductions that they may qualify for, and to automatically calculate the taxable amount of any Social Security benefits. There’s a new progress tracker to help users see where they are in the process, and new support for self-employment tax for those with other income in addition to wages. The instructions note that “If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2020 tax return.”

To change their tax withholding, employees can use the results from the Tax Withholding Estimator to determine if they should complete a new Form W-4 and submit to their employer. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount.

Because the new form requires detailed knowledge of the employee’s prior year’s tax return, it may be helpful to give employees additional time to complete the form or allow them to take the form home for completion. Understanding the full impact of taking out a loan from your retirement account is an important decision in determining an overall planning strategy for your future retirement needs. Borrowing from your savings may provide solutions in the near term but could negatively impact investment growth over time and cost you in loan fees. In most cases, if you leave your employer prior to paying off the loan, your loan will default and cause a taxable event. This calculator can help you estimate the impact a 401 loan can have on your savings. In fact if B is not done correctly The amount withheld due to payroll may be perfect but the under withholding could be due to the ESPP’s, RSUs and NSOs. On a related note, most people in finance would argue that your situation where you owe some money at tax time, but not so much that you have to pay a penalty, is actually the best way to go.

The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. Here’s what to know about withholding and why checking it is important. Employees must complete the Form W-4 so their employer can withhold the correct federal income tax from their pay. Enacted in late December 2017, the Tax Cuts and Jobs Act made significant changes to tax rates, deductions, tax credits, and withholding calculations. The IRS released new withholding tables for 2018 and 2019, but the Form W-4 remained largely unchanged, continuing to feature an entry for the number of withholding allowances. Prior to the TCJA, most withholding allowances were based on personal exemptions , but the TCJA repealed personal exemptions while increasing the standard deduction and changing the tax rates and brackets.

It is possible the exemption system failed your friend, but much more commonly people owe penalties because they put the wrong number of exemptions or had other side income. Divide the sum of all assessed taxes by the employee’s gross pay to determine the percentage of taxes deducted from a paycheck. Taxes can include FICA taxes , as well as federal and state withholding information found on a W-4. Many employers choose to work with a payroll service provider for help automating paycheck calculations and navigating compliance rules.

Employees have long used the IRS Form W-4 to establish marital status and withholding allowances to adjust their federal income tax withholding to match their anticipated full-year income tax liability. ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation.

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, it’s also important for anyone whose refund is larger or smaller than expected.

- Most business owners probably already use some form of accounting assistance, whether it’s a bookkeeper or software, but even with support, paying employees can be challenging.

- Symmetry’s payroll tax software tools allow companies to ensure employee and employer taxes are properly calculated and managed.

- The IRS had released an early draft in May and a second “near-final” draft in August to enable employers to make software and other changes.

- Those who plan on doing their own payroll and want to avoid payroll mistakes must thoroughly understand employer payroll taxes.

- On December 5, 2019, the Internal Revenue Service released the final 2020 Form W-4, Employee’s Withholding Certificate.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. IRS Form W-4 is completed and submitted to your employer, so they know how much tax to withhold from your pay. Your W-4 can either increase or decrease your take home pay. If you want a bigger refund or smaller balance due at tax time, you’ll have more money withheld and see less take home pay in your paycheck. If you want a bigger paycheck, you’ll have less withheld and have a smaller refund or larger balance due at tax time.

For Simple Tax Returns Only

Getting a tax refund actually means you paid more tax than you needed to. This is similar to giving an interest-free loan to the government. A few people like your friend may end up owing large amounts due to various circumstances. It is always your responsibility to make sure you pay enough tax throughout the year. While this technically means that you need to do your taxes every quarter during the year to make sure you pay the correct tax during the year, for most people this ends up being unnecessary as the approximation works fine.

By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes. The IRS recommends that taxpayers access the online W-4 Calculator as early as possible to check their payroll withholding and adjust withholding allowances, if needed. The IRS calculator asks about income and marital status, as well as estimated deductions and tax credits, to determine whether any additional withholding is necessary.

Understand Tax Withholding

So, if the first quarter of the year ends March 31, then the first Form 941 would be due April 30. Payments can be made via the Electronic Federal Tax Payment System® .