Security Issue Could Impact Adp Customers

Content

In connection with providing payroll, tax and benefits administration, ADP stores tax and salary information, such as W-2s, for each of its customer’s employees. For some ADP customers, employees can view this information themselves by registering with ADP’s self-service portal. They’ve set the standard for modern payroll software, which has virtually eliminated the need for human toil in payroll calculation. ADP’s highly sophisticated and reliable services allow businesses to dramatically reduce the risk of payroll errors and misfilings. However, on rare occasions, there have been incidents in which a service provider collected but failed to pay the employment taxes of its clients. Although rare, these incidents have been very damaging to the affected businesses.

- We offer multiple payroll platforms, from basic to full blown HCM systems, based on the needs of the client.

- Providers must work with financial service firms — who in turn liaise with employee banks — to ensure deposits are made on time and debits are quickly resolved.

- Payroll is an essential part of any company, and a costly one in terms of resources.

- Payroll firms also facilitate retirement savings plans, pretax cafeteria benefit plans and other employee benefits.

- For many businesses, it’s not worth the time and resources required to build in-house payment processing solutions from scratch.

- They often have extensive research organizations to automatically detect and apply frequent regulatory changes.

If a business is unable to pay employees reliably or ensure that tax bills are paid on time, confidence will diminish. Employee engagement will likely suffer, and consumer confidence could also falter if the organization can’t lock down these processes and limit the potential for error. RUN for Partners offers easy integration with numerous ADP add-on modules including ADP Time and Attendance, which includes complete clock-in and clock-out capability. RUN also integrates with third-party time and attendance applications including TSheets, Homebase, Deputy, and ClockShark.

Ask Your Employer For The Registration Code To Set Up A New User Id

All information is delivered using the same safe, secure, world-class technology that ADP uses every day to deliver information and services to approximately 600,000 clients around the world. You can enjoy easy access to pay data and corporate directories from your mobile device. RUN Powered by ADP Payroll for Partners is ADP’s white-labeled payroll processing and HR management solution designed for businesses with 1-49 employees.

Can I access ADP after termination?

If you terminate your employment, you will still have access to ADP Self Service for three years from your separation date.

The option to add additional pay for bonuses and commissions is offered in the application, with contractor payroll supported in the application as well. ADP relies on static data – name, Social Security Number, date of birth, and a unique company identification code – to authenticate new portal registrants. Unfortunately, due to the multitude of breaches that have occurred over time, such personal information is widely available for purchase by malicious actors on the dark web and the black market. Additionally, many companies post unique ADP identification codes publicly for the convenience of their employees. ADP provides payroll, tax and benefits administration for over 640,000 companies.

Strategies For Firing Employees: Lower Business Risk And Preserve The Person’s Dignity

They are still credited with all taxes withheld as shown on their annual Form W-2. Explore our full range of payroll and HR services, products, integrations and apps for businesses of all sizes and industries. By default, you can enter bank account details for existing banks and branches on the Personal Payment Methods page. Similarly payroll managers, payroll administrators, and payroll coordinators can only enter account details for the employees they handle. Pay particular attention to the Complete plan’s dedicated HR support. Customer service for less expensive payroll software companies can answer questions about software problems, but most can’t necessarily offer advice on how your business should handle a delicate situation. In contrast, a dedicated ADP team should be familiar enough with your business to offer clear, specific, on-demand advice whenever you encounter a problem with HR.

In addition, those using other applications can create a generic output file for export to any application. RUN also integrates with employee benefits options, benefits administration, point of sale, and recruiting and onboarding applications.

Running your payroll through us is a cost-effective alternative to having your own payroll team. Our systems can even integrate with HR and benefit functions to manage them more efficiently. As leaders in our respective fields, we have earned a distinguished reputation of providing accurate payroll processing that is efficient and secure. Once payroll is set up, it requires little data entry, with businesses only needing to enter data when regular hours change, such as when tracking vacation, holiday, or sick hours.

Use Percentage Payments

Most importantly, ADP will effectively remove payroll from your list of business-related concerns. Our payroll services also sync your payroll data with other solutions, like time tracking and benefits. Honestly, if you want a software service that blends HR management with automatic payroll tax filing, it’s hard to beat ADP. Finally, ADP’s payroll is designed to grow with your business.

Is ADP a payroll?

ADP — providing solutions that simplify work

We are a comprehensive global provider of cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, tax and benefits, and a leader in business outsourcing services and analytics.

For one, apart from the vague DIY plan , ADP’s pricing is entirely custom. You won’t find any base prices or estimates on ADP’s site, which is a good indicator that starting costs run high. For another, ADP’s HR features are its biggest draw and the main reason for its higher cost. Most small businesses don’t need to pay big money for perks like employee handbook assistance, enhanced and ongoing employee development training, and prepaid legal services. Hackers can then view W-2 information within those accounts and use them to file fraudulent tax returns on behalf of employees. Gusto’s transparently priced, 100% paperless payroll and HR services are quickly rising in popularity among modern-minded small businesses.

But most big businesses do, and the way ADP bundles payroll, HR reports and training, and legal advice into one comprehensive plan is super convenient. ADP’s comprehensive HR features and full-service payroll tax filing make it a good fit for businesses that want to fully automate the most time-consuming aspects of human resources. But its higher cost and frustrating lack of transparent pricing puts ADP’s software out of reach of many small-business owners. ADP can be quite difficult to set up, but once you get it up and running, the platform is actually really intuitive. Their administrative portal makes it easy for managers to keep track of their payroll data, while their employee accounts allow workers to access their personal documents and account information themselves.

More affordable providers like OnPay and Patriot Software are perfect for smaller businesses, but they offer just one full-service plan each. What works for your business when you have only a handful of employees might not meet your needs once you’re working with a hundred-strong workforce. For businesses with 50 or more employees, expansive HR needs, and plans for growth, ADP’s payroll and HR packages can save hours of payroll processing time and HR stress a week. On the other hand, if you’re a solopreneur, self-employed business owner, freelancer, or small-business owner with fewer than 10 employees, ADP is probably outside the scope of your budget and needs. Many companies do not have the resources or bandwidth to manage the payroll process from start to finish.

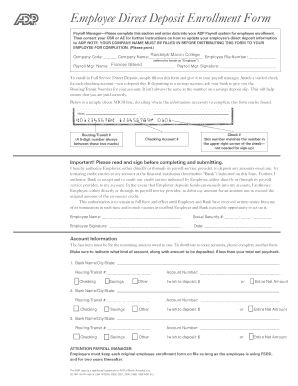

Interfacing with all the major accounting applications, it processes payroll and calculate, deduct and pays taxes on a secure cloud-based platform. Included is ADP Accountant Marketing Toolkit, powered by CountingWorks, for creating custom video and collateral to help accountants market the service and their firm. ADP offers a Certified Partner program for RUN Powered by ADP Payroll for Partners. ADP provides customized payroll services, solutions and software for businesses of all sizes. We offer direct deposit and mobile payroll solutions that integrate with time and attendance tracking. We also automatically calculate deductions for taxes and retirement contributions, and provide expert support to help make sure you stay compliant with all applicable rules and regulations. Organizations depend on payroll services to ensure their workforce is paid, taxes are remitted and adequate records are created to catalog these activities in detail.

More By Adp, Inc

Providers must work with financial service firms — who in turn liaise with employee banks — to ensure deposits are made on time and debits are quickly resolved. For many businesses, it’s not worth the time and resources required to build in-house payment processing solutions from scratch. Payroll firms also facilitate retirement savings plans, pretax cafeteria benefit plans and other employee benefits. They often have extensive research organizations to automatically detect and apply frequent regulatory changes. Payroll is an essential part of any company, and a costly one in terms of resources. We offer multiple payroll platforms, from basic to full blown HCM systems, based on the needs of the client. We will assist from implementation to ongoing payroll support on any of those platforms.

The application also includes an employee self-service option, where employees can access payroll and benefits information including up to three years of paystubs, W-2s, and insurance and benefit data. Does ADP have online payroll tools or a mobile app for employees? ADP mobile solutions give employees access to their payroll information and benefits, no matter where they are. Employees can complete a variety of tasks, such as view their pay stubs, manage their time and attendance, and enter time-off requests. Most small businesses with few employees or contract workers don’t need prepaid, readily available legal services, drop-in consultations, and frequent employee-related legal advice.

ADP offers custom pricing based on your business’ specific needs. To give you a very general idea of what their services cost, a business owner with 10 or fewer employees should expect to pay somewhere between $50 and $150/month .

ADP Run is a payroll management software that is suited for businesses with 50 or fewer employees. ADP Workforce Now and Paylociy are more robust platforms that provide HR and Benefit Management features along with payroll ideal for businesses with over 50 employees. By partnering with ADP, SimcoHR offers you the advantage of combined knowledge, expertise, and advanced technology to bring you better ways of meeting those challenges.

ADP Mobile Solutions is an integrated employee self-service solution that helps employees stay connected to their company’s information at any time, from anywhere. This application revolutionises the way organisations deliver payroll and other vital HR information to employees by providing easy, 24/7 on-the-go access from their mobile devices.