The Best Accounting Software for Cleaning Businesses of 2024

Growing a successful cleaning service business from the ground up is a series of small steps and wise business decisions. By getting a better and more accurate picture of your business overhead, you’ll be well on your way to establishing the business you’ve always dreamed of. By following these rules, business owners can keep their books accurate and up to date with their latest expenses and payments. Sign up to get this Complimentary House Cleaning Price Worksheet and take the guesswork out of pricing your house cleaning services. You should know how much money you are bringing in each day, week, month, and year.

Before You Choose One of the Best Accounting Software Programs for Cleaning Businesses

These accounts also have no monthly fees, overdraft fees, or minimum balance requirements, making them even more appealing to small-business owners. Also, many top programs offer free trials that allow customers to give the software a test run and see if it’s a suitable option for their cleaning business. Trial periods often run for around 30 days, but this can vary from one software platform to another. During this time, the business owner can learn how to use the different features the software program offers, which is a great way to decide if the software is a good fit without a commitment.

Grow Your Cleaning Service Business With Our Cloud-Based Double-Entry Bookkeeping

Online payments have come a long way in recent years, but a single fraudulent charge can do irreparable damage to your business’ reputation. You have to make sure that the software you work with guarantees data privacy and security, especially when it comes to credit card information. Thanks to its third-party compatibility, generous banking options, and enormous library of resources, QuickBooks is our pick for Best Overall. Xero gets the nod for Runner-Up due to the standard data-capture and bank reconciliation features, along with the advanced AI tools. Sage 50 can easily keep up with the needs of a growing business, making it an accounting software solution worth considering for those who are thinking about business expansion.

Accounting and Bookkeeping Features

You won’t need separate software platforms to communicate with customers if you’re using FreshBooks. FreshBooks lets you chat with customers on their project page, right in FreshBooks, so that you can answer their questions and book a maid service for them without switching apps. This makes simultaneously managing multiple customers and employees a breeze.

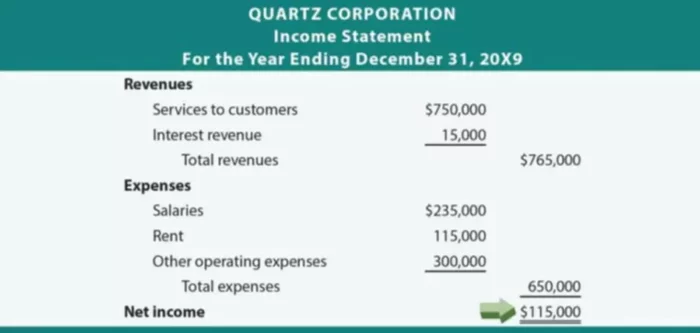

How to Calculate Overhead for Cleaning Businesses

Video tutorials, blogs, forums, and live support are all available to answer questions and help business owners get the most out of the platform. QuickBooks also has standard automated bookkeeping capabilities, sorting expenses for tax purposes and categorizing transactions according to set rules. This level of automation cuts down on the amount of time needed to manually sort and document financial records, which may be a huge boon for small-business owners with little time to devote to these needs.

- An accountant or CPA (Certified Public Accountant) will complete your end-of-year financial statements and tax reports which get submitted to the IRS.

- Budgeting in the beginning requires thinking through all of the stages the employees of your business will go through in the cleaning process.

- Software companies may offer low-cost options with basic accounting capabilities that are suited for small businesses with just a handful of clients.

- In addition, Sage 50 includes cyber security, credit monitoring, and fraud prevention services with every subscription, giving customers even more value from their accounting software.

- Based on your market research, you’ll then need to determine an area of focus for your business.

This is as simple as adding everything together for one grand total. In business, you may hear this total described as aggregate overhead cost. If you’ve ever been frustrated because it feels like you’re constantly working but still not producing revenue, it may be because you don’t have a true picture of your recurring expenses. These are the recurring charges you invest in to run your daily operations.

You can also look into offering incentives on your pricing to encourage repeat customers. Starting any business requires a willingness to learn the essential skills you need to succeed and grow. Owning a thriving company also involves having a foundational understanding of many different areas, ranging from administration and customer service to accounting, and more. When you set out to start a cleaning business, these skills certainly apply. FreshBooks comes with plenty of features that we’re sure you’ll love.

For commercial cleaning services, you’ll be looking into signing larger contracts with property managers. You can start looking into who owns various properties you think are in need of better cleaning services and reach out to the owners to pitch your services. Asking what they need and finding a way to carry out that need will serve you well in the long run. When you’re looking to start a cleaning business, you should research the other businesses in the area and the services they offer. If they’re working in the same market as you, what extra services can you offer?

At a glance, you’ll be able to see client accounts, services rendered, unfinished tasks, and business expenses. And you never have to question if the numbers are updated or not, which can help you make more informed business decisions on the spot. Get paid faster by setting up billing schedules for your recurring clients. This means that you don’t have to micromanage every single job order, and you to get paid automatically for your cleaning services.

The following are some of the most frequently asked questions about bookkeeping software, accounting processes, and expense reporting for cleaning businesses. Another big draw with QuickBooks is that all subscribing businesses have the ability to open a bank account with a 5 percent annual percentage yield (APY). That is a generous APY on a business bank account and could help owners grow their money. Banking services are provided by QuickBooks’ partner, Green Dot Bank, and QuickBooks Checking users can earn APY can on their account’s savings balances.

An accountant will help you make sense of the numbers, reconcile your accounts, prepare financial reports, estimate your quarterly tax payments, and more. Business owners who require additional support and assistance may find that the company’s user resources are somewhat limited. However, they can consult a library of blog articles to learn more about the platform and small-business accounting practices.

Track the expenses for your housecleaning business by creating a simple spreadsheet using a program such as Excel or by using a columnar pad of paper. Designate columns for each type of expense you incur, such as cleaning products, payroll, advertising and business licenses. Enter the amounts of your expenses in each category and tally these amounts month by month. As a cleaning business, you’ll offer a service that is an absolute necessity for people’s daily lives at home and at work.

Late payments can also be a thing of the past thanks to FreshBooks’ automatic late payment reminders and late fee billing. FreshBooks is the ultimate cleaning business software and does everything automatically, using industry-standard double-entry accounting. You can rest easy knowing that each expense, each transaction, and each payment is 100% accounted for, and all info is easily accessible via robust reporting features.