The Cares Act Employee Retention Tax Credit

Content

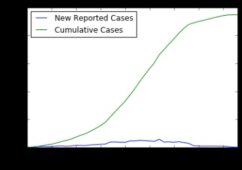

Lautenberg continued in his roles as Chairman and CEO until elected to the United States Senate from New Jersey in 1982. The Coronavirus Aid, Relief, and Economic Security Act (H.R. 748, “CARES Act”) was signed into law on March 27, 2020. The CARES Act is the third stimulus bill aimed at providing relief to employers and individuals affected by COVID-19. Below is a high-level summary of the provisions related to small business assistance, tax, retirement, paid leave, unemployment insurance, and direct payment to individuals. Small businesses should work with an experienced financial advisor to carefully assess available assistance programs to determine the interplay and best option for their specific circumstances. The tax credit effectively offsets the amount of federal employment taxes that must be deposited with the IRS, usually within a few days of the payroll date. This is intended to provide the funds needed to pay sick and family leave benefits under the Act.

Although the tax credit only applies to employers, the WOTC program may benefit employees by making career opportunities available to those who otherwise might have had a hard time landing a job. Such individuals include ex-felons, veterans and food stamp recipients. The amount of the tax credit available under the WOTC program varies based on the employee’s target group, total hours worked and total qualified wages paid. As of 2020, most target groups have a maximum credit of $2,400 per eligible new hire, but some may be higher. Hiring certain qualified veterans, for instance, may result in a credit of $9,600 per eligible new hire. Any business, regardless of size or industry, may be eligible to claim tax credits under the WOTC program. And because there’s no limit to the number of individuals employers can hire as part of the program, there’s also no cap on the amount of credits that they can claim.

Tax Exclusion For Employer Student Loan Repayment Benefits (section

In 2021, employers with 500 or fewer employees during 2019 may elect to receive an advance payment of the credit in an amount up to 70 percent of the average quarterly wages paid by the employer in 2019. ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation.

Employers may pay amounts over such limits, but the tax credit is limited to those amounts. In addition, the aggregate number of days available to an individual is limited to 10 for 2020.

Simple, Secure And Flexible Card

Under the Act, all non-governmental employers with less than 500 employees are allowed a credit against employer Social Security tax liability equal to 100 percent of the qualified sick leave wages paid by the employer, subject to the limits discussed above. A regional merchandising company identified and secured tax credits of more than $375k over the partial Q1 20 and Q2 20 period. The company remained open throughout the COVID-19 global health event, but experienced partial operational impacts across the country that qualified for the ERTC. Upon further consultation and analysis, they were able to leverage payroll data to maximize their ERTC in a way that was compliant with the CARES Act. A multi-national retailer qualified for and captured over $50M in employee retention tax credits over the partial Q1 20 and Q2 20 periods. One challenge was accurately calculating eligible wages under the CARES Act that aligned to the definition of impacts due to mandated governmental closures.

What does surcharge free ATM mean?

We don’t charge a fee for ATM usage, but you may be charged by the institution that owns the ATM.

A global hospitality company secured more than $5M in employee retention tax credits over Q2 20, which allowed existing staff to remain actively employed, avoiding further furloughs. Initially, the company didn’t see a path towards eligibility due to a lack of insight into governmental orders. But after further discussions, they analyzed their locations against mandated government closures to identify specific operations and facilities that were qualified. The process from analysis to filing took less than two weeks, allowing them to pursue an advance payment of the credit using the IRS Form 7200 (Advance Payment of Employer Credits Due to COVID-19).

Identify Tax Credit Savings, Including The Work Opportunity Tax Credit (wotc), And More

Covered sick and family leave payments under the Act are taxable wages for income and employment tax purposes, except that such wages are exempt from Employer Social Security taxes. ADP’s tax credit services, for example, include full IRS and state taxing authority audit support.

At the same time, unlike other tax credits that depend on payroll data to determine eligibility, the ERTC requires employers to dig a level deeper to determine not just when employees were paid but whether they were actively working or on some form of paid leave. Healthcare costs and paid time off factor into the determination as well. As guidance on these questions evolved, legislation evolved too, making a complex activity even more challenging.

The tax credits addressed elsewhere generally apply to employer Social Security taxes, potentially reducing or even eliminating such taxes for the balance of 2020. As a deferral, these taxes will become collectible by the IRS starting in December 2021. Employers should keep careful track of amounts accrued and be prepared to pay the amounts when due. For wages paid from January 1, 2021 through June 30, 2021, the credit equals 70 percent of the qualified wages that an eligible employer pays in a calendar quarter. The cap on wages taken into account also increases to $10,000 per calendar quarter. Therefore, the employer’s maximum credit for qualified wages paid to any employee is $14,000 for this time period.

Private-sector employers may be eligible for a refundable tax credit against federal employment taxes for “qualified wages” paid by employers to employees during the COVID-19 crisis. The tax credit was set to apply to qualified wages paid after March 12, 2020, and before January 1, 2021. However, the Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed by President Trump on December 27, 2020, extends the tax credit to cover qualified wages paid through June 30, 2021. The CARES Act increases the maximum loan amount for SBA Express loans from $350,000 to $1,000,000, until December 31, 2020. The CARES Act also reduces the cost of participation in the program by providing fee waivers, an automatic deferment of payments for up to one year, and no prepayment penalties.

ADP went public in 1961 with 300 clients, 125 employees, and revenues of approximately $400,000 USD. The company established a subsidiary in the United Kingdom in 1965. In 1970, Lautenberg was noted as being the president of the company. Also in 1970, the company’s stock transitioned from trading on American Stock Exchange to trading on the New York Stock Exchange. It acquired the pioneering online computer services company Time Sharing Limited in 1974 and Cyphernetics in 1975.

However, in some cases, such as complete closure of a business, the Treasury Department and IRS will process claims for advance payments of the tax credit. Generally, the legislation affects private-sector employers with under 500 employees. Payroll wages are a critical component of an R&D study, and if you are already using a payroll company that offers tax credit services, they can easily and securely pull information from your W-2s to help find qualified research expenses. ADP’s web-based WOTC screening system improves screening compliance rates and simplifies data collection. It uses plain language and automatically skips sections of the WOTC questionnaire that may be irrelevant, helping applicants complete the form quickly and correctly. We also offer benchmarking and analytics tools that can help employers forecast their tax credits.

Emergency Family And Medical Leave Expansion Act (emergency Fmla Act)

For wages paid in 2020, the credit equals 50 percent of the qualified wages that an eligible employer pays in a calendar quarter. The maximum amount of qualified wages taken into account with respect to each employee is $10,000 for the year, so the employer’s maximum credit for qualified wages paid to any employee is $5,000. Businesses and nonprofit organizations with fewer than 500 employees, sole proprietorships and independent contractors that have suffered economic injury due to COVID-19 may also be eligible for a loan under the existing SBA “Express” Loans program.

- Healthcare costs and paid time off factor into the determination as well.

- As guidance on these questions evolved, legislation evolved too, making a complex activity even more challenging.

- At the same time, unlike other tax credits that depend on payroll data to determine eligibility, the ERTC requires employers to dig a level deeper to determine not just when employees were paid but whether they were actively working or on some form of paid leave.

- Private-sector employers may be eligible for a refundable tax credit against federal employment taxes for “qualified wages” paid by employers to employees during the COVID-19 crisis.

- However, the Taxpayer Certainty and Disaster Tax Relief Act of 2020, signed by President Trump on December 27, 2020, extends the tax credit to cover qualified wages paid through June 30, 2021.

- The tax credit was set to apply to qualified wages paid after March 12, 2020, and before January 1, 2021.

The retailer’s unique organizational structure and different pay types added to the complexity. Working with ADP, they were able to make the right determination for their company and quickly secure tax credits to support their operational needs. In 1949, Henry Taub founded Automatic Payrolls, Inc. as a manual payroll processing business with his brother Joe Taub. In 1957, Lautenberg, after successfully serving in sales and marketing, became a full-fledged partner with the two brothers. In 1961, the company changed its name to Automatic Data Processing, Inc. , and began using punched card machines, check printing machines, and mainframe computers.

Our goal is to help minimize your administrative burden across the entire spectrum of employment-related payroll, tax, HR and benefits, so that you can focus on running your business. This information is provided as a courtesy to assist in your understanding of the impact of certain regulatory requirements and should not be construed as tax or legal advice. Such information is by nature subject to revision and may not be the most current information available. ADP encourages readers to consult with appropriate legal and/or tax advisors. Please be advised that calls to and from ADP may be monitored or recorded. The credit may not exceed the Social Security tax imposed on the employer, reduced by any credits allowed for the employment of qualified veterans and research expenditures of qualified small businesses. Paid sick leave is capped at $511 per day (and a total of $5,110) for employees in categories 1-3 above, and two-thirds of wages up to $200 per day (and a total of $2,000) for employees in categories 4-6 above.