The Complete Chart of Accounts for Therapists

The IRS still counts bartering dollars as regular dollars, so it’s important to keep track of these exchanges. Planners and organizers designed specifically for the massage therapist to be more efficient in the business of bodywork. Heard is the financial back-office for therapists in private practice. Streamline your bookkeeping and spend more time with clients.

Bookkeeping Best Practices For Massage Therapists

And then I just, I clean out my desktop. I just trash everything in the desktop because now it’s stored in Wave, and now it’s stored in Google Docs. So if you’re mobile, you want to find an option that works better for you mobile. That’s up to you to figure out because that’s how you do things.

Episode 451

ABMP’s five Minute Muscle and ABMP’s Pocket Pathology apps. It’s the January, February 2023 article. And I just want to bring it up so I can give you the exact title properly. How Solo MTs Can Pay Themselves a Wiving wage. It’s one of our better columns, I think. So if you’re like, “My, she sits down every week and pays herself, that’s insane.” We also have a podcast episode, episode 347 about why you should pay yourself.

Appointment Books for Massage Therapists & Body Workers

If I have paid the electric bill, it goes into utilities. If I have bought Jojoba, it says massage product or massage supplies, pardon me. And when I bought my massage table, it went into massage equipment. If I buy paper clips, it is general office supplies. I make sure that every transaction that has happened since the last time I sat down and did bookkeeping is correctly categorized.

You want to make sure everything is in there. So you literally select what category this gets applied to. So if I accept money for massage, it goes into my massage income category. If I have accepted money for consulting that week, it goes into consulting income. This episode is sponsored by the Original Jojoba Company.

This is from personal experience. So in the past 24 hours, one of our members, thanks, Leslie, invited us to take a look at the recent e-book that Allissa launched, the Communicating with Healthcare Provider’s book. And for some reason, something went wrong on it. I think we’re still trying to figure it out.

But I’m personally making more of an effort to be less performative and more substantial in my support and in the change I’m looking to make in the world. And that’s what I’ve been reading this week. So this particular article is called, Is It Meaningful Action or is it Virtue Signaling? And this is from Time Magazine, Time.com. And this kind of hit home to me because I’ve been making more of an effort lately to make my actions meaningful and not performative.

Playing catch-up once a week/month/quarter is stress-inducing, so we’ve come up with a few small ways to ensure good habits are created. Bookkeeping may not be the most fun part of a massage therapist’s job, but it is paramount to growing (and sustaining) a healthy small business. We have spoken with many of our massage professional clients who have had issues in the past, so we wanted to compile a list of common mistakes to avoid. After working with thousands of therapy practices, we’ve created the complete chart of account for therapists. You can spend a little more time on the apps when you’ve got the time and watch palpation videos. There are also the ABMP Massage and Body Work Magazine, which is an award-winning magazine included imprint for ABMP members.

I talked about how I love paying myself, and that motivates me to sit down and do my bookkeeping. If all of this feels like crazy and too big for you, maybe start with that column and that episode. Start to recognize why and how you can pay yourself more regularly and in a way that makes you feel rewarded for the work that you’re doing.

Software like Quickbooks or Xero can help you organize all your numbers into profit & loss reports, balance sheets, and more. Couple this with sales reports from ClinicSense, and you’ll never need a spreadsheet again. The software tracks and organizes all the numbers for you.The reports created with accounting software correspond with the tax forms you must fill out for your business.

Use this cheatsheet to maximize your deductions and save money on taxes for your therapy practice. Trying to set up a chart of accounts? Read our article on how to set up a chart of accounts for your therapy practice. I’ve seen them a little bit here and there.

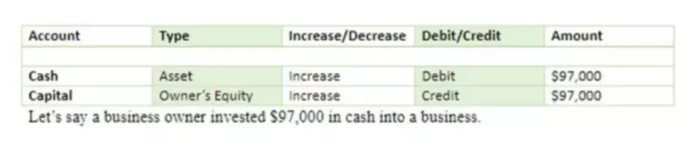

Don’t choose a program that’s too complicated for you to use. And I’m not just talking about QuickBooks. There’s other ones out there that people try and they’re like, “Oh, good lord.” They’re based on double entry accounting, and it can be very confusing.

- However, for most massage therapists, tracking daily income and expenses is something you can do yourself.

- That is what I have to say about Jane.

- S-corps and partnerships must file taxes by March 15.

It’s recommended to seek professional help if you need guidance, especially at tax time. However, for most massage therapists, tracking daily income and expenses is something you can do yourself. Bookkeeping for massage therapists involves tracking your daily sales and expenses.