The Founders Guide to Startup Accounting

That makes your income more accurate and predictable, and investors prefer to see that regular revenue. Deferred Revenue is when a client pays you ahead of you delivering a service. For example, if you charge a client’s credit card for a 12-month subscription, contracts – you just got 12 months of cash from that client! But you owe them the subscription, so Deferred Revenue gets added to your balance sheet as a liability.

Which Financial Statements Should You Maintain?

A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. To ensure that journal entries have been recorded and posted correctly, small businesses use the trial balance accounting method to double-check account balances for a given time period. A trial balance ensures that the debit and credit balances in the ledger accounts match.

Accounting and bookkeeping options for your startup

- Keeping good records also means that your life will be easier when it comes to quarterly and annual income taxes for your business.

- In essence, these essential financial documents are not just static records; they are dynamic tools that empower startups to navigate the complexities of business.

- The best online bookkeeping for your business depends largely on your startup’s budget, bookkeeping needs, monthly expenses, and additional features you require.

- Their bookkeeping services are done by Certified Public Bookkeepers (CPB) dedicated to each account.

If you do manual accounting, you’ll need to go over every entry in your bank statement and match them with the general ledger entries. Most accounting software has features to reconcile bank statements with the general ledger entries automatically. A 2022 Skynova survey found that 44% of startup businesses failed due to a lack of cash. With this in mind, it’s essential to ensure that your startup doesn’t run out of money before it generates positive cash flow or attracts investors. If your startup operates in multiple locations, consider scalable cloud solutions. Cloud-based accounting systems, collaboration tools, and document management systems ensure that your team can work collaboratively, regardless of geographical location.

Do venture-backed startups need an accountant?

For startups, where every dollar counts, effective budgeting is a linchpin for success. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. You’ll also want to keep track of those smaller expenses such as parking fees, postage, printing, and mileage. Tracking business expenses properly will make sure that your year-end deductions are accurate and that you have the documentation to prove it.

Want More Helpful Articles About Running a Business?

When you have accurate financial statements, like balance sheets, cash flow, and profit and loss statements, you can see where your startup stands financially. It also tells you where you’re making money and helps you plan for business growth. Maintain separate bank accounts and credit cards for your startup to simplify tracking and ensure accurate financial reporting.

What is the best accounting method for startups?

Access real QuickBooks-certified bookkeepers for your startup’s financial needs. Ensure precise financial records with Certified Public Bookkeepers assigned to your account. Get certified bookkeeping, financial reporting, and dedicated support all in one place.

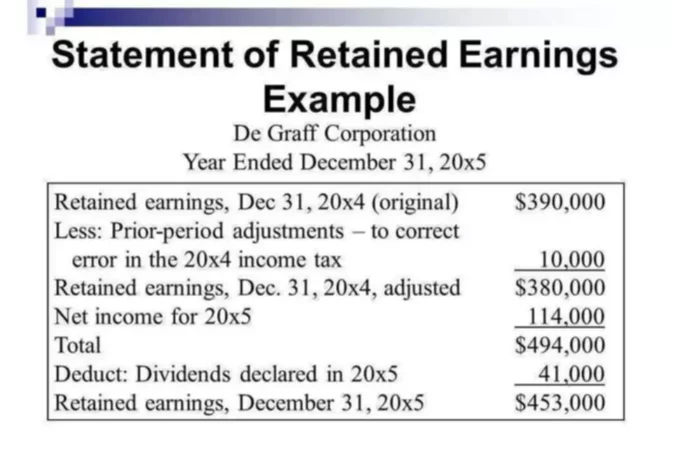

Know more about how to read and analyze a profit and loss (P&L) statement. You should be printing a set of financial statements monthly or quarterly, depending on your business. Using accounting software, running financial statements takes less than a minute, but the details in those reports can tell you a lot about your business. However, if you choose to do your startup accounting manually, you will need to record all transactions in the general ledger.

Their bookkeeping services alone provide valuable, time-saving support from bookkeepers, accountants, and CPAs. Their comprehensive bookkeeping platform offers services for monthly reporting, accounting, bookkeeping, and financial management. Freshbooks accounting software features bookkeeping and accounting tools to help you manage your startup finances. On the FreshBooks platform, you can create invoices, utilize accounting tools, make payments, track expenses, and manage time tracking and project costs. Better yet, Freshbooks offers a variety of plans dedicated to businesses at every stage of their startup journey.

The efficiency of your cash flow cycle depends on the management of accounts receivable and accounts payable. Aging reports provide a detailed breakdown of outstanding invoices, showcasing which clients owe you money and which vendors you need to pay. These reports are essential for maintaining healthy cash flow and managing relationships with clients and suppliers. If you’re still on the fence about handling basic bookkeeping or accounting for your business, you’re not alone.

Standardize bookkeeping processes to ensure consistency and scalability. This standardization aids in training new team members and maintaining efficiency as your startup expands. Automation reduces the likelihood of errors, enhances efficiency, and allows your team to focus on strategic financial planning. Maintain an organized filing system for receipts, invoices, and financial documents. This simplifies the auditing process, ensures compliance, and facilitates easy retrieval of documents when needed. In summary, budgeting and forecasting for startups go beyond numerical exercises; they are strategic imperatives.