Topic No 751 Social Security And Medicare Withholding Rates

Content

These plans typically require vesting—working for 5–10 years for the same employer before becoming eligible for retirement. But their retirement typically only depends on the average of the best 3–10 years salaries times some retirement factor (typically 0.875%–3.0%) times years employed. This retirement benefit can be a “reasonably good” (75–85% of salary) retirement at close to the monthly salary they were last employed at.

These contributions and earnings are held in a trust fund that is invested. The retirement benefits are much more generous than Social Security but are believed to be actuarially sound. Short term federal government investments may be more secure but pay much lower average percentages. Nearly all other federal, state and local retirement systems work in a similar fashion with different benefit retirement ratios.

It is possible for railroad employees to get a “coordinated” retirement and disability benefits. The U.S. Railroad Retirement Board (or “RRB”) is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country’s railroad workers. Railroad retirement Tier I payroll taxes are coordinated with social security taxes so that employees and employers pay Tier I taxes at the same rate as social security taxes and have the same benefits. In addition, both workers and employers pay Tier II taxes (about 6.2% in 2005), which are used to finance railroad retirement and disability benefit payments that are over and above social security levels. Tier 2 benefits are a supplemental retirement and disability benefit system that pays 0.875% times years of service times average highest five years of employment salary, in addition to Social Security benefits. Some federal, state, local and education government employees pay no Social Security but have their own retirement, disability systems that nearly always pay much better retirement and disability benefits than Social Security.

Self-employed persons pay both the employee and employer share for a total 12.4 percent. (Half of this contribution, the employer share, is a deductible business expense for income tax purposes.) Also, higher-income Social Security beneficiaries pay federal income taxes on their benefit income, and these taxes help pay for Social Security. These taxes are paid into special trust funds that should only be used to pay current and future Social Security retirement benefits, as well as disability benefits and benefits for widows and widowers. Today’s workers contribute their percentage, which in turn is paid to today’s beneficiaries—those workers who have retired and who are now collecting Social Security benefits.

Social Security: Just The Facts Video

Many employees and retirement and disability systems opted to keep out of the Social Security system because of the cost and the limited benefits. It was often much cheaper to obtain much higher retirement and disability benefits by staying in their original retirement and disability plans.

For example, if a person joined the University of California retirement system at age 25 and worked for 35 years they could receive 87.5% (2.5% × 35) of their average highest three year salary with full medical coverage at age 60. Police and firefighters who joined at 25 and worked for 30 years could receive 90% (3.0% × 30) of their average salary and full medical coverage at age 55. These retirements have cost of living adjustments applied each year but are limited to a maximum average income of $350,000/year or less. Spousal survivor benefits are available at 100–67% of the primary benefits rate for 8.7% to 6.7% reduction in retirement benefits, respectively. UCRP retirement and disability plan benefits are funded by contributions from both members and the university (typically 5% of salary each) and by the compounded investment earnings of the accumulated totals.

How To File For A Social Security Tax Overpayment Refund

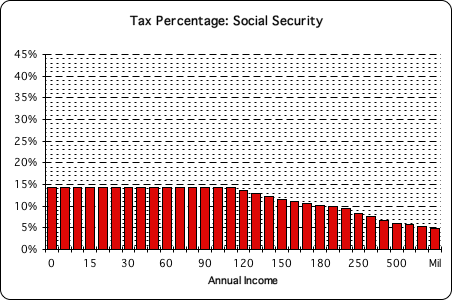

According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth. The largest component of OASDI is the payment of retirement benefits. These retirement benefits are a form of social insurance that is heavily biased toward lower paid workers to make sure they do not have to retire in relative poverty. The OASI accounts plus trust funds are the only Social Security funding source that brings in more than it sends out. Workers pay 6.2 percent of their earnings up to a cap, which is $127,200 a year in 2017. (The cap on taxable earnings usually rises each year with average wages.) Employers pay a matching amount for a combined contribution of 12.4 percent of earnings.

How much money can you make without paying taxes?

Single: If you are single and under the age of 65, the minimum amount of annual gross income you can make that requires filing a tax return is $12,200. If you’re 65 or older and plan on filing single, that minimum goes up to $13,850.

As in private insurance plans, everyone in the particular insurance pool is insured against the same risks, but not everyone will benefit to the same extent. Critics of Social Security have said that the politicians who created Social Security exempted themselves from having to pay the Social Security tax. When the federal government created Social Security, all federal employees, including the president and members of Congress, were exempt from having to pay the Social Security tax, and they received no Social Security benefits. Many state and local government workers, however, are exempt from Social Security taxes because they contribute instead to alternative retirement systems set up by their employers. A separate payroll tax of 1.45% of an employee’s income is paid directly by the employer, and an additional 1.45% deducted from the employee’s paycheck, yielding a total tax rate of 2.90%. This portion of the tax is used to fund the Medicare program, which is primarily responsible for providing health benefits to retirees. The FICA taxes are imposed on nearly all workers and self-employed persons.

What Is Payroll Tax? Are Fica Tax And Payroll Tax The Same Thing?

Employers are required to report wages for covered employment to Social Security for processing Forms W-2 and W-3. Internal Revenue Code provisions section 3101 imposes payroll taxes on individuals and employer matching taxes. Section 3102 mandates that employers deduct these payroll taxes from workers’ wages before they are paid. Generally, the payroll tax is imposed on everyone in employment earning “wages” as defined in 3121 of the Internal Revenue Code. Retirement benefits depend upon the “adjusted” average wage earned in the last 35 years. Wages of earlier years are “adjusted” before averaging by multiplying each annual salary by an annual adjusted wage index factor, AWI, for earlier salaries. Adjusted wages for 35 years are always used to compute the 35 year “average” indexed monthly salary.

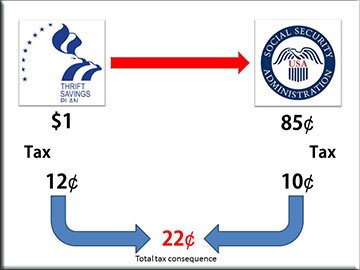

However, these groups also have by far the smallest percentage of American household incomes – the first quintile earns just 3.2% of all income, while the second quintile earns only 8.4% of all income. Higher-income retirees will have to pay income taxes on 85% of their Social Security benefits and 100% on all other retirement benefits they may have. Further, there is no general legal requirement that individuals join the Social Security program unless they want or have to work. Under normal circumstances, FICA taxes or SECA taxes will be collected on all wages. About the only way to avoid paying either FICA or SECA taxes is to join a religion that does not believe in insurance, such as the Amish or a religion whose members have taken a vow of poverty (see IRS publication 517 and 4361). Federal workers employed before 1987, various state and local workers including those in some school districts who had their own retirement and disability programs were given the one-time option of joining Social Security.

When today’s workers retire, they’ll tap into the benefits being paid by tomorrow’s workers. The trustees estimate that, if policymakers took no further action, Social Security’s combined Old-Age and Survivors Insurance and Disability Insurance trust funds will be exhausted in 2035. Alarmists who claim that Social Security won’t be around when today’s young workers retire either misunderstand or misrepresent the projections. The long-term gap between Social Security’s projected income and promised benefits is estimated at 1 percent of gross domestic product over the next 75 years (and 1.4 percent of GDP in the 75th year). Like any insurance program, Social Security “spreads risk” as the program protects workers and covered family members against loss of income from the wage earner’s retirement, disability, or death. For example, a worker who becomes disabled at a young age could receive a large return relative to the amount they contributed in FICA before becoming disabled, since disability benefits can continue for life.

A private pension fund accumulates the money paid into it, eventually using those reserves to pay pensions to the workers who contributed to the fund; and a private system is not universal. Social Security cannot “prefund” by investing in marketable assets such as equities, because federal law prohibits it from investing in assets other than those backed by the U.S. government. As a result, its investments to date have been limited to special non-negotiable securities issued by the U.S.

Social Security Tax: What Employers Need To Know

The Social Security tax is a percentage of gross wages that most employees, employers and self-employed workers must pay to fund the federal program. Certain groups of taxpayers are exempt from paying social security tax. It is the employer’s obligation to withhold the correct amount of Social Security tax from every paycheck and forward it to the federal government on time. Although Social Security is sometimes compared to private pensions, the two systems are different in a number of respects. It has been argued that Social Security is an insurance plan as opposed to a retirement plan. Unlike a pension, for example, Social Security pays disability benefits.

Treasury, although some argue that debt issued by the Federal National Mortgage Association and other quasi-governmental organizations could meet legal standards. Social Security cannot by law invest in private equities, although some other countries and some states permit their pension funds to invest in private equities. As a universal system, Social Security generally operates as a pipeline, through which current tax receipts from workers are used to pay current benefits to retirees, survivors, and the disabled. When there is an excess of taxes withheld over benefits paid, by law this excess is invested in Treasury securities as described above.

Now only a few of these plans allow new hires to join their existing plans without also joining Social Security. Some economists anticipate that if the limit were lifted, employers might respond by shifting taxable compensation to a form of compensation that is taxed at a lower rate. For example, employers could decrease wages but increase retirement benefits, which are deductible under the corporate income tax, in an effort to offset the additional payroll taxes they would owe. Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base ($110,100 in 2012), but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps; because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy.

- Some federal, state, local and education government employees pay no Social Security but have their own retirement, disability systems that nearly always pay much better retirement and disability benefits than Social Security.

- In addition, both workers and employers pay Tier II taxes (about 6.2% in 2005), which are used to finance railroad retirement and disability benefit payments that are over and above social security levels.

- It is possible for railroad employees to get a “coordinated” retirement and disability benefits.

- The U.S. Railroad Retirement Board (or “RRB”) is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country’s railroad workers.

- Tier 2 benefits are a supplemental retirement and disability benefit system that pays 0.875% times years of service times average highest five years of employment salary, in addition to Social Security benefits.

- Railroad retirement Tier I payroll taxes are coordinated with social security taxes so that employees and employers pay Tier I taxes at the same rate as social security taxes and have the same benefits.

Some plans are now combined with Social Security and are “piggy backed” on top of Social Security benefits. The Social Security trust funds are financed chiefly through payroll taxes on workers covered by the OASDI program. Employers and employees each contribute 5.3 percent of the employee’s taxable wages for OASI and 0.9 percent for DI coverage as part of what are sometimes called Federal Insurance Contributions Act taxes. For 2020, up to $137,700 in wages is subject to FICA taxes, a threshold updated for average wage growth each year.

The low income bias of the benefit calculation means that a lower paid worker receives a much higher percentage of his or her salary in benefit payments than higher paid workers. In fact, a married low salaried worker can receive over 100% of their salary in benefits after retiring at the full retirement age. High-salaried workers receive 43% or less of their salary in benefits despite having paid into the “system” at the same rate . To minimize the impact of Social Security taxes on low salaried workers the Earned Income Tax Credit and the Child Care Tax Credit were passed, which largely refund the FICA and or SECA payments of low-salaried workers through the income tax system. By CBO calculations the household incomes in the first and second quintiles have an average total federal tax rate of 1.0% and 3.8% respectively.