View And Print Payroll Reports

If you need to use projected payroll, see the Projecting Payroll section instead. You must perform these steps for every pay cycle used by your company. To avoid losing employee time data, you must perform these steps before the end date of the next pay period. To help you remember to complete these steps on time, you can have a notification sent to you for each pay cycle. If you enable this option, a warning is displayed on the Home and an e-mail reminder is sent to an individual you select (if you enter an e-mail address). Payroll processing is important because paying employees late or filing taxes incorrectly may result in penalties and interest on back taxes.

Do all payroll costs need to be paid within the Covered Period or Alternative Payroll Covered Period? Payroll costs are considered paid on the date of distribution of paychecks or origination of an ACH credit transaction. Payroll costs are considered incurred on the day that the employee’s pay is earned.

Use Percentage Payments

Additionally, borrowers who previously received loans of $50,000 or less may be exempt from reductions in loan forgiveness amounts based on reductions of full-time equivalent employees or in salaries or wages. If eligible, borrowers would use the SBA Form 3508S, or their lender’s equivalent form, to submit their loan forgiveness application. ADP has put together a Loan Forgiveness Checkup which outlines important steps to take before year-end to maximize loan forgiveness. You will need to complete the PPP loan application, which your lender will provide, and submit the application with your payroll documentation.

If the number of FTEEs during the Covered Period or Alternative Payroll Covered Period is lower than the time period chosen, the amount of loan forgiveness may be reduced proportionately. How will the amount of loan forgiveness be determined? Yes, the amount of the loan can be fully forgiven as long as certain conditions are met. The specific amount will generally depend in part on what portion of the loan is used on eligible payroll costs and whether the employer has maintained staffing and pay levels during the covered period.

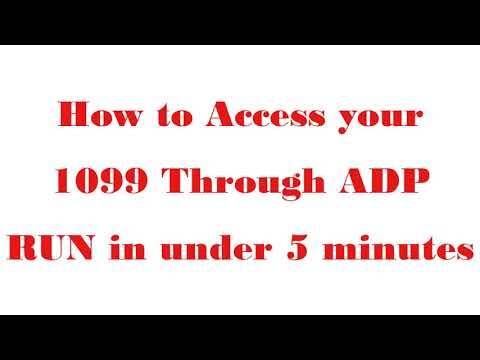

The 3508S form eliminates the need for borrowers to demonstrate that they maintained wage and employment levels during the applicable covered period. Instead, borrowers will need only to demonstrate that they spent the loan proceeds on covered payroll (at least 60% of the forgiveness amount) and non-payroll costs. Borrowers can download the PPP Loan Forgiveness Payroll Costs report from their ADP system to submit to their lender with the 3508S form.

Paid And Nonpaid Employee

If you are applying for a second PPP loan, remember to run new PPP loan application reports from your ADP system. The ADP reports are updated frequently to reflect the latest government guidance. You should always run the applicable PPP report as close in time to submitting your PPP loan application as possible. For your reference, click here for application form provided by the SBA. The employee continues to appear with your active employees until payroll is run for the pay period containing the employee’s termination date and the pay period is moved forward. After the appropriate pay period is closed, you can view the employee on the Terminated Employee Positions page instead of the Employees page. The employee also no longer appears in your normal list of employees throughout the application.

- Borrowers can download the PPP Loan Forgiveness Payroll Costs report from their ADP system to submit to their lender with the 3508S form.

- What is the period within which I must spend my loan proceeds to obtain full loan forgiveness?

- The 3508S form eliminates the need for borrowers to demonstrate that they maintained wage and employment levels during the applicable covered period.

- To obtain full forgiveness, loan proceeds must be spent within the 8- to 24-week period immediately following disbursement of the loan.

- Instead, borrowers will need only to demonstrate that they spent the loan proceeds on covered payroll (at least 60% of the forgiveness amount) and non-payroll costs.

These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes. You can manually input these changes in the paydata grid.If an employee is set up for Automatic Pay but you need to change their salary or hours for this pay period, include the employee in the batch. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period.

Adp Accountant Connect®

I used payroll cost and headcount reports for the PPP loan application. Can I use the same reports for purposes of loan forgiveness reporting? No, the ADP payroll cost and headcount reports that were developed to support PPP loan applications cannot be used for PPP loan forgiveness purposes. ADP has reports available to support clients that are navigating the forgiveness process. See below for more information about PPP loan forgiveness reports that are available.

How will the determination of whether my business has maintained staffing levels be made? Borrowers may either use the period from February 15 through June 30, 2019 or January 1 through February 29, 2020.

Payroll costs incurred but not paid within the Covered Period or Alternative Payroll Covered Period must be paid by the next regular payroll date to be counted for forgiveness purposes. My company previously laid off an employee, but later offered to rehire the employee. If the employee declined the rehire offer, will my PPP loan forgiveness amount still be reduced? When calculating the amount of loan forgiveness, how will the determination of whether my business has maintained pay levels be made? If you use this feature, you must still perform all of the End of Period Operations and close the pay period in a timely manner. However, the timing and exact procedures are different from those described in this section of the Help.

Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible.

You must also ensure your calculations are correct and remember to file all the necessary taxes and paperwork with government authorities on time. As you add more employees, the more challenging payroll becomes and any mistakes you make can result in costly tax penalties. If the pay reduction was made outside the February 15 to April 26 timeframe, the forgivable amount may still be reduced even if the pay reduction is later reversed.

+ To obtain full forgiveness, loan proceeds must be spent during the Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within 8 to 24 weeks immediately following disbursement of the loan, whichever is earlier. Spend the loan proceeds, or incur qualifying costs, within applicable Covered Period or Alternative Payroll Covered Period. To obtain full forgiveness, loan proceeds must be spent within to the 8- to 24 week period immediately following disbursement of the loan . If you’re a small business with only a few employees and choose to process payroll manually, you will need to keep precise records of hours worked, wages paid and worker classifications, among other details.

For example, the CAA 2021 provides that the SBA will issue a streamlined forgiveness application form for loans of $150,000 or less. This one-page form would require borrowers to certify certain information related to loan forgiveness, list the amount of the loan, number of employees retained and estimated amount of the loan spent on payroll costs. Borrowers would be required to retain – but not submit – documents substantiated their forgiveness application for 4 years for employment records and 3 years for other records. To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

Loan Forgiveness Reports

What is the period within which I must spend my loan proceeds to obtain full loan forgiveness? To obtain full forgiveness, loan proceeds must be spent within the 8- to 24-week period immediately following disbursement of the loan. The new round of PPP funding includes other important changes to the PPP loan forgiveness process, some of which may apply to loans issued previously in 2020. ADP is actively evaluating these changes and will update the guidance below and in the PPP Loan Forgiveness Reports as additional guidance is issued by the Treasury Department and Small Business Administration.

If this option is selected, the holiday is awarded (entered on employees’ timecards) when it first falls in either the current or next pay period. If this option is not selected, the holiday is not awarded until the actual day of the holiday. At the time when Barbara wants the transfers to start, she adds an electronic funds transfer payment method for her savings account and sets the amount to 100 . Before the holiday season, when Barbara decides to stop the transfers to her savings account, she deletes the payment method. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. Click the Year-End Tasks and Tips button on the RUN homepage banner, then selectCalculate Checksto begin the Guided Walk Through.