Wage Garnishment Laws Vary By State

Content

- Adp Named Among Fortune Magazines worlds Most Admired Companies For 15th Straight Year

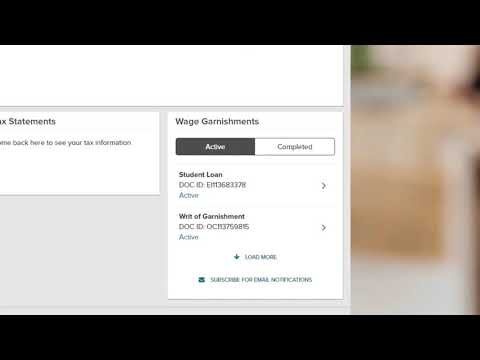

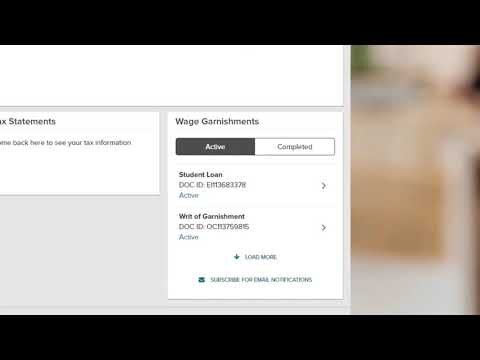

- Adp Smartcompliance® Wage Garnishment Module

- How Much Of Your Wages Can Be Garnished?

- Trademarks Of Intuit Inc Terms And Conditions, Features, Support,

- Q: For One Of My Employees, I Have Received A Garnishment Order For Child Support And A Federal Tax Lien What Happens Now?

Sure, businesses may have more methods of recourse against delinquent customers in states that are indifferent to struggling debtors. But as an employer, the creditor’s morale and productivity may suffer if employees with debt problems aren’t allowed to retain essential minimum assets to get back on their feet. Moreover, weak consumer protection laws could motivate struggling debtors to steal from their employers and commit other white collar crimes.

This can mean significant additional stress and work for the employer. So wage garnishments are often both financially and emotionally stressful for employees. Since that stress can impact workers’ morale and productivity, it can impact their employers in turn. Wage garnishment can be an intensive process — one that, when not handled properly, can cost organizations thousands of dollars. The complexity of the process is due to the various types of garnishments that exist, including IRS and state tax levies, court ordered wage garnishment for consumer debts and child support. For enterprises operating in multiple states, this complexity increases even further thanks to the variation in wage garnishment laws across states. Wage garnishments are court-ordered deductions taken from an employee’s pay to satisfy a debt or legal obligation.

Why did my wage garnishment stop?

There are many reasons the wage garnishment might stop such as the judgment being fully satisfied, a bankruptcy or the court granting a claim of exemption.

Despite these numbers, creditors and debt collectors say they only pursue lawsuits and garnishments against consumers after other collection attempts fail. “Litigation is a very high-cost mechanism for trying to collect a debt,” said Rob Foehl, general counsel at the Association of Credit and Collection Professionals. “It’s really only a small percentage of outstanding debts that go through the process.” ADP’s study, the first large-scale look at how many employees are having their wages garnished and why, reveals what has been a hidden burden for working-class families. Wage seizures were most common among middle-aged, blue-collar workers and lower-income employees. Nearly 5 percent of those earning between $25,000 and $40,000 per year had a portion of their wages diverted to pay down consumer debts in 2013, ADP found. The recession and its aftermath have fueled an explosion of cases like Evans’.

Adp Named Among Fortune Magazines worlds Most Admired Companies For 15th Straight Year

Because of this, many myths have developed in recent years about how to process wage garnishments, ways to remain compliant when dealing with them and the availability of useful wage garnishment data. Join us in this session as we provide insight into five of the most common wage garnishments myths and misconceptions that have developed throughout today’s business world. Using the most current wage garnishments data and trends, we will examine how electronic processes can benefit businesses and explore the various types of garnishments that affect employers and employees today.

Failure to properly comply with garnishment orders can result in costly penalties. In some jurisdictions, an employer can be held liable for the full amount of the employee’s judgment.

Adp Smartcompliance® Wage Garnishment Module

It also doesn’t protect consumers who voluntarily agree to assign wages to creditors to repay debts. Experts in garnishment say they’ve seen a clear shift in the type of debts that are pursued. A decade ago, child support accounted for the overwhelming majority of pay seizures, said Amy Bryant, a consultant who advises employers on payroll issues and has written a book on garnishment laws.

Garnishment is also a burden to employers that have to navigate different laws depending on which states their employees live in. If an employer botches up a garnishment order against an employee, it may be fined — or even become liable for the employee’s debt, depending on the applicable federal and state wage garnishment laws. Additionally, wage garnishments require determining, calculating, withholding then delivering the appropriate amount to the appropriate party. All of this must be done in compliance with the garnishment order and applicable state and federal laws and regulations.

Child support, unpaid taxes or credit card debt, defaulted student loans, medical bills and outstanding court fees are common causes for wage garnishments. Garnishments are typically a percentage of an employee’s compensation rather than a set dollar amount.

The federal wage garnishment law protects an employee from being fired if pay is garnished for only one debt. However, the CCPA does not prohibit discharge because an employee’s earnings are separately garnished for two or more debts.

How Much Of Your Wages Can Be Garnished?

For example, the alleged debtor in a “sewer service” scam was never served a summons about an impending collections lawsuit and, therefore, never disputed the creditor’s phony claim. With the defendant absent, a court issued a default judgment, and the victim didn’t learn about the fraudulent claim until after his or her paycheck was garnished, was months after the judgment date. Currently, debtors’ fates depend significantly on where they happen to live. Four states — Texas, Pennsylvania, North Carolina and South Carolina — largely prohibit wage garnishment stemming from consumer debt. Most states, however, allow creditors to seize a quarter of a debtor’s wages — the highest rate permitted under federal law. This chart shows the age of the original lawsuit for garnishments filed in Missouri in 2013. However, it’s vitally important to understand an employer’s responsibilities when an employee has his or her wages garnished, and it is often a complicated, multistep process.

- In the Green Mountain State, creditors can only garnish 15 percent of the debtor’s weekly disposable income, or 40 times the federal minimum wage — at least in some situations.

- Also, keeping employers on their toes, Vermont’s laws refer to this process as “trustee process against earnings” rather than wage garnishment.

- If your company is issued a court order to withhold a portion of an employee’s wages, immediately contact an attorney or a payroll adviser who’s familiar with the applicable federal and state laws.

- If you have employees in Vermont, you should know that the state limit only applies to consumer credit transactions, such as credit cards.

- While the CCPA restricts creditors from garnishing more than 25 percent of an employee’s income, or any amount that exceeds 30 times the federal minimum wage , Vermont is more protective of its debtors.

But many businesses and their employees have difficulty tracking wage garnishments and understanding their significance. As creditors increasingly turn to court-ordered wage garnishments to recoup delinquent accounts, it’s important for consumers and their employers to understand how the process works. Here are answers to some common questions about wage garnishment. The recent study, which ADP completed at the request of public news agency ProPublica, covers about 13 million ADP payroll records. When its findings are extrapolated over the entire U.S. population, it suggests that 4 million workers were docked for consumer debts in 2013. These garnishments were most common among middle-aged, blue-collar workers and low-income employees who may lack the education or financial resources to effectively fight creditor claims in court. Another unfortunate trend related to wage garnishment is fraudulent debt claims.

Creditors and collectors have pursued struggling cardholders and other debtors in court, securing judgments that allow them to seize a chunk of even meager earnings. The financial blow can be devastating — more than half of U.S. states allow creditors to take a quarter of after-tax wages. But despite the rise in garnishments, the number of Americans affected has remained unknown. There’s no centralized system employers can tap into for help with handling wage garnishments.

In certain states, failure to garnish wages for child support may result in the employer’s having to make up the missing payments. As your business expands, you’ll need to invest in research, strategy and legal counsel help you to stay in compliance with local laws, wherever your employees and contractors are located. Mishandling wage garnishment can lead to your organization to becoming liable for your employee’s debt. Help reduce your compliance risk by working with a third party provider skilled in managing all aspects of your wage garnishment processing. According to data from the ADP Research Institute®, 7.2 percent of U.S. employees have had their wages garnished.

States have their own policies and procedures, which can be complicated for employees with orders from different states and employers operating in multiple jurisdictions. However, employers can consult with wage garnishment experts and advisors.They also can automate as much employee- and wage-related data as possible to be able to respond quickly to orders. It’s important for employers to understand how federal and state wage garnishment laws work. In some cases, a garnishment order may contradict federal or state law. It’s the employer’s responsibility not to garnish too much and to let the court know if the company cannot legally comply with the order. If you decide to fire an employee whose wages are garnished several times, check state laws, which could trump the federal rules.

While the CCPA restricts creditors from garnishing more than 25 percent of an employee’s income, or any amount that exceeds 30 times the federal minimum wage , Vermont is more protective of its debtors. In the Green Mountain State, creditors can only garnish 15 percent of the debtor’s weekly disposable income, or 40 times the federal minimum wage — at least in some situations.

You will also learn about the most recent changes related to garnishment processing. An estimated 7% of American workers have their wages garnished every year, according to a recent study by ADP Research Institute. Anyone working in the United States or a U.S. territory has the potential of having earnings garnished for some type of obligation authorized by federal and/or state laws. As your business expands, it is likely that the number of wage garnishments you are called upon to process and must comply with also expands.

Q: For One Of My Employees, I Have Received A Garnishment Order For Child Support And A Federal Tax Lien What Happens Now?

Wage garnishment – the legal seizure of employee earnings to settle child care payments, tax levies, and other forms of debt – impacts many U. While garnishment has a defined impact on each garnished employee, their employers – who by law must manage the costly administration of garnishment compliance – also bear a tangible burden. Employers that fail to comply with garnishment orders can face costly penalties. In some jurisdictions, this may even include being held liable for the entire amount of an employee’s judgment. If you’re buried in debt and can’t pay your basic living expenses, stopping the wage garnishment may only be temporary relief. If you’re struggling with more than one debt, and have multiple creditors filing lawsuits against you, you may need a completely fresh start. In that case, consider the pros and cons of Chapter 7 bankruptcy.

The employer is responsible for calculating the garnishment amount, withholding it through its payroll process, and forwarding payments to the correct agency or creditor. The garnishment must continue until the employer receives a release. For example, South Carolina, North Carolina, Pennsylvania and Texas have passed laws that ban the garnishment of wages in these states for “commercial and consumer” debt. Of course, the most debtor-friendly states might also appear to be the least creditor-friendly .

Regarding bankruptcies, the last consumer bankruptcy law overhaul was in 2005. Although this was designed to make it more difficult for consumers to file Chapter 7 bankruptcies and instead file Chapter 13 bankruptcies, the overall percentage of bankruptcies has decreased since then. This has positively impacted employers because with this reduction, the need to withhold wages to comply with wage garnishment orders issued pursuant to Chapter 13 repayment plans has also decreased. A wage garnishment is generally a court or agency order for an employer to withhold a certain amount of a worker’s wages for the payment of a debt, such as child support.

If you have employees in Vermont, you should know that the state limit only applies to consumer credit transactions, such as credit cards. Also, keeping employers on their toes, Vermont’s laws refer to this process as “trustee process against earnings” rather than wage garnishment. If your company is issued a court order to withhold a portion of an employee’s wages, immediately contact an attorney or a payroll adviser who’s familiar with the applicable federal and state laws. Failure to properly follow the convoluted — and sometimes contradictory — wage garnishment rules can be a costly mistake for employers. There are many reasons why an employee may have their wages garnished, from child support to credit card debt, but they all require adherence to court and administrative orders. Failure to remain in compliance can result in a legal and financial drain for both your own organization and the employee. This means that you’ll need to understand not only the federal laws, regulations and rules, but also state laws, regulations and rules.

Today, only about half the seizures are for child support, she said. In many states, employers are becoming increasingly more liable to creditors. But many organizations still overlook wage garnishments and view them as an obscure and complex aspect of business.

If it makes sense for you to file bankruptcy, know that once your case has been filed, the wage garnishment has to stop. Most wage garnishments start when a creditor – like a credit card company or bank – sues a customer for nonpayment. The judgment in turn gives them the ability to get a garnishment order. To illustrate the rise overall, Bryant provided ProPublica and NPR payroll statistics from a major retailer with approximately 250,000 employees nationwide. The company allowed the data to be used on the condition its name was not used. Since 2007, the number of employees who had their pay seized for consumer debt roughly doubled. As of June of this year, 2 percent — about 5,000 employees — had ongoing garnishments for consumer debt and just under 1 percent for student loan debt.