Wage Growth Tracker

Content

As unemployment decreases, wages would be expected to increase to attract workers. But we are now at levels of near-record unemployment lows, and stronger wage growth has only recently materialized. Slack in the labor market — which broadly refers to underutilization of the labor force — might be the reason. Prior to the Covid-19 pandemic, wage growth was unusually strong among low-wage workers.

Other measures of wage growth—like average hourly earnings and compensation per hour—show similar spikes. The results in table 1 also point to a sharp contrast in the features of the trend-productivity-growth coefficient and the constant term across the wage measures.

Wages Have Grown Faster For Those With Higher Incomes

In specifications –, we switch the dependent variable to our measure of real (CPS-based) average wage growth. In specification , we find that a one percentage point decline in the unemployment gap is associated with a 52 basis point increase in real average wage growth—a cyclical sensitivity that is nearly 50 percent higher than that of real AHE growth. In specification , we again allow for nonlinear effects of positive and negative unemployment gaps. Similar to the results reported for growth in AHE, the data indicate a strong nonlinearity with respect to positive and negative unemployment gaps. This estimate of the sensitivity of real wage growth to the unemployment rate when the unemployment gap is negative is similar in magnitude to the overall micro estimates from the earlier work of Bils and Solon Barsky, and Parker .

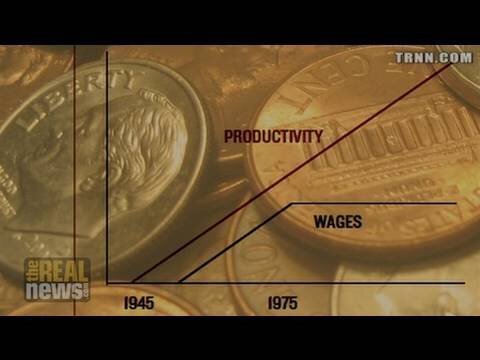

The data do not reject full pass-through of trend productivity growth into real AHE growth, whereas trend productivity growth does not appear to have a statistically significant effect on real average wage growth. Instead, the regressions point to real average wage growth displaying positive, economically meaningful and statistically significant gains on average over the estimation period. Moreover, we can use information on these estimates to examine the implications for the real average wage gains of workers in a neutral labor market—that is, when the unemployment gap is equal to zero. Specifically, we calculate the total effect on wage growth associated with the constant term and the impact of trend productivity growth evaluated at its average in-sample value. On a business-sector-adjusted basis, the results indicate that real average wage growth is approximately 2½ percent in a neutral labor market, about 2 percentage points higher than the value of real AHE growth.

Replicate The Wage Growth Tracker

Recent data show that median usual weekly earnings of full-time workers have grown 10.4% over the four quarters preceding the second quarter of 2020. This is a 6.4 percentage point acceleration compared with the fourth quarter of 2019. The median usual weekly earnings measure that we focus on here is not an exception.

- This is a 6.4 percentage point acceleration compared with the fourth quarter of 2019.

- This is because factors other than increases or decreases in wages paid to individuals can influence whether median earnings rise or fall.

- Median usual weekly earnings and other aggregate measures of wage growth can be useful tools for analyzing how the average worker is progressing economically.

- The median usual weekly earnings measure that we focus on here is not an exception.

- Recent data show that median usual weekly earnings of full-time workers have grown 10.4% over the four quarters preceding the second quarter of 2020.

- Other measures of wage growth—like average hourly earnings and compensation per hour—show similar spikes.

Yet for all the job gains and low unemployment—it was a mere 3.5 percent in February 2020—wages haven’t risen by much.1 While employment has gone up by 15 percent since the trough in December 2009, wage gains have been much lower. Real average hourly earnings—nominal values adjusted for inflation—have gone up by only 6.8 percent in this period.2 And even the current tightness in the labor market was not able to push wages up toward a higher growth trajectory. Wage growth is a rise of wage adjusted for inflations, often expressed in percentage. In macroeconomics, wage growth is one of the main indications to measure economic growth for a long-term since it reflects the consumer’s purchasing power in the economy as well as the level of living standards.

Figure 6 presents the contributions of the various determinants in explaining the fully augmented model’s prediction of average AFE wage growth relative to its mean over . Slower productivity growth is the major contributor to lower wage growth, subtracting more than 1/2 percentage point from predicted wage growth in recent years. This drag has offset the predicted boost from tight labor markets, the red bars, helping to explain why average wage growth has only recently risen above its mean despite very low unemployment rates. Reinforcing these results, while we can reject the hypothesis of no structural change after 2010 in the relationship between wages and labor market slack for the simple model, we cannot reject it for the fully augmented model. Despite the growing labour productivity in the recent five years, Australia has been experiencing stagnated wage growth in both the public and private sectors along with the global low-wage growth compared to the data in pre-GFC. The Treasury Australia argues that the recent flexible work style has contributed to the recent stagnated wage growth. As a result of increasing jobs in the service industries, more employment in part-time and non-routine jobs were created that affected the labour share of income.

What Government Policies Might Raise Wages?

More financial compensation for skilled workers not only lifts wage growth but stimulates higher market prices in the economy. To help understand what is generating the persistent difference between the two wage growth measures, we return to the earlier discussion concerning the decomposition of AHE growth and focus on the component related to individual wage growth rates. Using the calculated individual wage growth from the workers matched across a 12-month period from the CPS data, we modify equation and use the worker’s relative earnings share as the weight instead of (1/n). Figure 2 plots this earnings-weighted average-wage-growth series along with the equally weighted average-wage-growth series and the AHE-growth series.

What is real wage in economics?

Real wages are nominal wages adjusted for the effects of inflation. Changes in nominal wages can be expressed as an index, and if we divide this by changes in the price level (and multiply by 100) we can derived an index for real wages.

This stark impact of exits from employment on median wages is not specific to the published headline measure of median usual weekly earnings for full-time workers that we focus on here. They estimate that exits from employment since COVID-19 have raised average wages by 5%. Other headline measures of wage growth, such as average hourly earnings and compensation per hour, also have been pushed up by the recent movements along the extensive margin. As before, we expand the model in specification to allow for speed effects measured by increases or decreases in the unemployment gap over the prior quarter. The data now document a marked difference in the speed effects associated with an unemployment gap that is rising or falling. Controlling for the level of the unemployment gap, a one percentage point increase in the unemployment gap over the prior quarter is associated with a 163 basis point slowdown in real wage growth.

What explains this slow pace of real wage growth amid such a tight labor market during the current economic expansion? Our analysis of occupations data (see sidebar, “Data brief and methodology”) from the Bureau of Labor Statistics reveals that part of the explanation lies in the shifting occupational mix of employment. During , a period that covers the Great Recession, relatively more job losses among lower-paid occupations as compared to higher-paid ones resulted in relatively strong average wage growth. A partial reversal of this trend since then accounts for some of the sluggishness in wages in the recent expansion.

Consequently, the earnings weighting is extremely important in contributing to AHE growth being persistently lower than average wage growth. Viewed through the lens of average wage growth rather than AHE growth, wage growth showed a notable pick-up in the aftermath of the Great Recession, and workers continue to experience significant real wage growth. Average wage growth also displays a more meaningful nonlinear relationship with labor market slack as measured by the Congressional Budget Office’s unemployment gap. While historical low wage growth over the long term cannot be attributed to labor supply and demand, it may be a factor for shorter-term trends.

An increase in wage growth implies price inflation in the economy while a low wage growth indicates deflation that needs artificial interferences such as through fiscal policies by federal/state government. Minimum wage law is often introduced to increase wage growth by stimulating price inflations from corresponding purchasing powers in the economy. Wage growth can also be maximised through the development of industry factors by investing skilled workers in which decision made by businesses.

Earnings information in the CPS is asked in the fourth and eighth surveys—known as the outgoing rotation samples—which are 12 months apart. Salaried workers report their usual weekly earnings and usual weekly hours, which we use to impute their wage. For individuals who work in both periods and who do not move residences between the fourth and eighth surveys , we can compute their 12-month growth rates for wages and hours.

Median usual weekly earnings and other aggregate measures of wage growth can be useful tools for analyzing how the average worker is progressing economically. This is because factors other than increases or decreases in wages paid to individuals can influence whether median earnings rise or fall.

For individuals who do not work in both periods or who change residences surveyed by the CPS between the fourth and eighth surveys , we cannot compute their wage or hours growth. A high percentage of movers also change jobs, either voluntarily or involuntarily. Consequently, average wage growth based on the CPS will likely understate wage growth in an expansion and overstate wage growth in a recession. To arrive at our final estimate of the impact of minimum wage policy, we subtract the difference between the red and blue lines in figure 3, panel A from the difference between the red and blue lines in figure 3, panel B .

We apply this estimate to the share of bottom-quartile workers who live in hike states. Figure 4 displays the results using hike versus no-hike states and high-hike versus all other states . As expected, the estimated impact of minimum wage policy is near zero through mid-2014 and then picks up thereafter. Since 2015, it has averaged 0.54 to 0.62 (based on high-hike states) percentage points per year. Therefore, we estimate that the minimum wage may be responsible for roughly one-quarter of the outsized gains in bottom-quartile wage growth between 2015 and 2019. Applying our approach to all workers irrespective of their position in the wage distribution shows that minimum wage legislation increased aggregate real hourly wage growth by roughly 0.1 percentage points per year between 2015 and 2019. labor market in the United States continued to show strength up until the apparent end of the expansion in March due to efforts to contain the spread of COVID-19.

From specification , controlling for trend productivity growth, a one percentage point decline in the unemployment gap is associated with a 35 basis point increase in real AHE growth. In specification , we allow for nonlinear cyclical effects depending on whether the unemployment gap is positive or negative. The results indicate only a modest effect of unemployment on real AHE growth in slack labor markets . One is immediately struck by the very different implications of the series for the implied real wage gains of workers.

The earnings-weighted average wage growth is always lower than average wage growth. Moreover, the earnings-weighted average wage growth displays a very close correspondence with AHE growth.