What Are Functional Expenses? A Guide to Nonprofit Accounting

Content

The U.S. Internal Revenue Service (IRS) requires some tax-exempt nonprofit organizations to file Form 990 or Form 990-EZ each year. Program expenses represent costs related to the operations of an organization’s programs, which are aimed at fulfilling the organization’s mission. Because of this, the majority (75% is a good benchmark) of an organization’s expenses should show up in this category. The Statement of Activities looks at the entire organization and reports on the revenues and expenses of the nonprofit during a specific reporting period. That means that we’ll have to allocate an additional $29.16 in utility expenses to each of the three functional expense categories.

Plus, nonprofits are required to present their expenses in this natural and functional classification per the Financial Accounting Standards Board. And if that isn’t enough, if you have (or want to have) c3 or c4 tax-exempt status, you’ll need to report these classified expenses on your annual 990. Fundraising expenses are also supporting expenses and consist of costs incurred in raising funds for the organization. Natural expenses in this category could be related to fundraising events, mailers, and employees’ time spent fundraising. A nonprofit organization can have each employee record how they spend their time– looking specifically at how much time is spent between fundraising, general management, and programs.

The easiest costs to allocate are those that can only be allocated to a single category. For example, a grant that Sam receives allows him to purchase a variety of canned and non-perishable foods for his community food pantry. This cost can be directly allocated to programs since the grant and resulting expense both directly relate to the cost of the community food pantry program. Budgeting for nonprofits can become complex when it involves several overlapping categories, such as grants, programs, function, and nature. While the statement of cash flows, or cash flow statement, may be a bit difficult to prepare, it is an important financial statement to be read. The FASB requires every nonprofit to present expenses by function and nature in one place (statement or notes).

Now, having said that, your statement of functional expenses is more than a Grade A report card for the IRS. It’s also a handy tool for you to see how the nonprofit’s resources are being used. Just because you’re not operating “for profit” doesn’t mean we don’t care about the money. Nonprofits still need to know how much money it costs to run and what the money is being spent on. We want to be good stewards of our funds and pursue our missions in the best way possible.

Statement of Functional Expense

Nonprofit accountants should have a basic understanding of nonprofit fundraising software, and how to help their clients keep up-to-date records of expenses through the use of these software solutions. Capital Business Solution’s nonprofit fundraising software training assists in understanding how to prepare financial reports for nonprofit organizations. The statement of functional expenses assists readers of the NFP’s financial statements in associating expenses with the service efforts and accomplishments of the organization. Users of this information include donors, volunteers, rating agencies, creditors, and constituents of the NFP. A well-designed expense allocation system and corresponding statement of functional expenses is of utmost importance for successful reporting in the NFP environment. If you are new to nonprofit accounting, your first step is to understand the basic principles and needs of statements of functional expenses.

- Check out Mission Guardian Toolkit, a legal resources program that allows even the tiniest orgs access to self-service legal tools like online courses, document automations, and live Q&A webinars.

- Natural expenses are categorized by their natural classifications– for instance, employee salaries, rent, utilities, maintenance, and the cost of supplies are all examples of natural expenses.

- The easiest costs to allocate are those that can only be allocated to a single category.

- Together, the three employees spend 60% of their time in programs, followed by 25% in G&A and 15% in fundraising.

Program expenses are any costs related to running the various programs and services offered by a nonprofit organization, as per its mission. For established nonprofits, program expenses often make up the majority of their overall costs. Part of building trust with the community, donors, board of governors, and other stakeholders is to be transparent in how the nonprofit organization’s expenses drive support for its missions and programs. For very small nonprofits, it might be easier to base costs on total employee headcount. This method uses the total salaries of each employee, combining them into one total and then allocating the total based on the amount of time spent in each functional expense area. Offers examples and case studies that will help you allocate costs and accurately prepare the statement of functional expenses.

For subsidiaries in other countries, customize this report as needed to adjust the layout to meet local requirements. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. We would then add the additional $29.16 to that total to have the complete allocation for the month. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Budgeting is also complicated when sources of support are not secured at the time the budget is prepared for the upcoming year.

It’s crucial that nonprofit organizations understand how to properly record functional expenses to ensure they’re acting in accordance with federal regulations. Operating expenses distribution involves the system by which an accountant or bookkeeper of a non-profit entity classifies each cost according to its functional classification. For Non-profit organizations, it is necessary to report their expenditures by role to help understand the functional distribution of expenses. The functional expenses are listed as functional and reported in their Functional Expenses Statement.

Allocation Method #4: Direct Cost

Understanding the statement of functional expenses may take a bit of time, but it is an important part of managing your nonprofit properly. Fund accounting software can make managing and allocating expenses an easier process, while consulting with a CPA who specializes in nonprofit accounting can also help. This section includes the program expenses that are related to operating your nonprofit’s programs. Because they’re part of fulfilling its mission, most of your expenses will likely be in this category. This would include staff salaries, supplies, rent, or any other direct costs to running your program.

- For Non-profit organizations, it is necessary to report their expenditures by role to help understand the functional distribution of expenses.

- Nonprofit organizations are businesses that do not operate with the goal of making a profit as a for-profit business would, but nonprofit businesses have many ways that they earn as well as spend money.

- Non-profit accounting is separate from corporate accounting, as no non-profits work to make a profit.

- The investing section also reports the amount received from the sale of long-term assets.

Direct costs refer to expenses that can only relate to one classification– for example, grant payments are costs related to one department or specific program. By default, accounts beginning with 72 are classified as functional expense accounts. If your implementation does not use 72 series accounts by default, update this report manually. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. The operating activities section reports the changes in cash other than those reported in the investing and financing sections.

Functional Classifications vs. Natural Classifications:

As you can see, the column headings highlighted in green show the expenses by function. We highlighted the column headings for learning purposes, showing expenses by function. In the first column, we have highlighted the words as they reflect the essence or expenses. Since Form 990 is public information, you can learn much about a nonprofit by reading the information it provided on Form 990. The website guidestar.org is a resource one can use to obtain financial (and other) information reported on nonprofits’ Form 990.

This can be done by the area used by each category or by the number of people in each department, whichever is easier. Nonprofit reporting is different from that of a for-profit business, with nonprofits issuing the following financial statements. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. The notes to the financial statements are an integral part of the statement of financial position, the statement of activities, and the statement of cash flows. The FASB Accounting Standards Codification Topic 958 requires important additional disclosures regarding liquidity, restrictions, etc. for creditors, donors, and others. The statement of cash flows (SCF) for a nonprofit organization is similar to that of a for-profit business.

Management and General

For example, if you’re paying your insiders a huge and uncalled-for salary, you can expect the government to give you a closer look. The Statement Of Cash Flows reports on all cash flowing into and out of the nonprofit organization. Specifically, the statement demonstrates the extent to which the organization’s programs and activities generate and use money. It also includes the nonprofit’s net assets, which demonstrates the overall value of the organization, similar to the equity reported by businesses. If we take the salary portion of the statement of functional expenses above and combine it with the other expenses, you’ll have a complete accounting of expenses for October.

If an organization is set up with adequate nonprofit accounting software, the process of creating a statement of functional expenses can be quite simple. The Financial Accounting Standards Board requires that all nonprofit businesses report their expenses based on both nature and function. In other words, nonprofit organizations must provide an analysis of how their resources were spent and for what purpose(s).

Resources for Your Growing Business

Looking at the area, the organization sees how the total square footage of the office space compares to the number of offices occupied by specific departments. For example, depending on how much of the office space is used by the fundraising department, the organization can see how much of its rent expenses should be allocated toward the fundraising department. While you can allocate expenses as needed, the following allocation methods are the ones most frequently used by nonprofit organizations.

The Statement of Functional Expenses contains information on the expenses incurred for each area of the company. The classifications include programs, management and general, and collection of funds. In the non-profit sector, the financial statement has a similar position to a company’s balance sheet. The Financial Statement lists all the debt’s values and valuation due to all the company’s properties. It also contains non-profit net assets, which display the organization’s total worth, equivalent to the business’s equity.

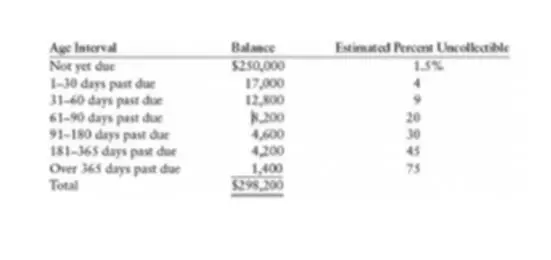

Thus, it is not necessary (unless demanded by a recipient of the financial statements), but can contain useful information. The statement of functional expenses is described as a matrix since it reports expenses by their function (programs, management and general, fundraising) and by the nature or type of expense (salaries, rent). For instructional purposes we highlighted the column headings to indicate the expenses by function. We also highlighted the words in the first column as they indicate the nature or type of expenses.