What Are Payroll Costs

Content

In Brazil employers are required to withhold 11% of the employee’s wages for Social Security and a certain percentage as Income Tax . The employer is required to contribute an additional 20% of the total payroll value to the Social Security system. Depending on the company’s main activity, the employer must also contribute to federally funded insurance and educational programs.

In Bermuda, payroll tax accounts for over a third of the annual national budget, making it the primary source of government revenue. The tax is paid by employers based on the total remuneration paid to all employees, at a standard rate of 14% (though, under certain circumstances, can be as low as 4.75%).

- The Federal Insurance Contributions Act tax is a federal payroll tax imposed on both employees and employers to fund Social Security and Medicare —federal programs that provide benefits for retirees, the disabled, and children of deceased workers.

- The charges paid by the employer usually cover the employer’s funding of the social security system, Medicare, and other insurance programs.

- The second kind is a tax that is paid from the employer’s own funds and that is directly related to employing a worker.

- These can consist of fixed charges or be proportionally linked to an employee’s pay.

- These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers.

- Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers.

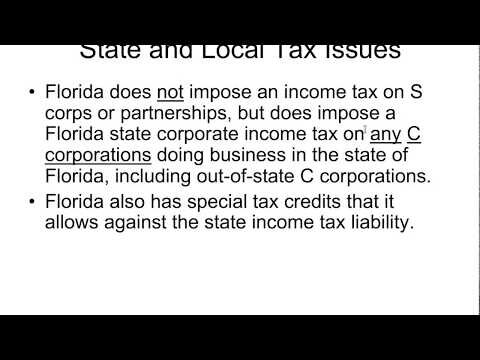

These taxes are based on where your employees work and/or live. Certain types of local taxes are only imposed on employers doing business in a locality.

Withholding For State Disability Insurance Taxes

Only the employer pays FUTA tax; it is not deducted from the employee’s wages. The federal government doesn’t pay unemployment benefits but does help states pay them to employees who’ve been involuntarily terminated from their jobs. To fund this assistance to the states, there’sFUTA, which is a tax created by the Federal Unemployment Tax Act. The tax applies only to the first $7,000 of wages of each employee. The basic FUTA rate is 6%, but employers can receive a credit for state unemployment tax of up to 5.4%, bringing the net federal rate down to 0.6%, or a maximum FUTA payment of $42 per employee.

If employment taxes are not sufficient to cover these required payments to employees, then employers can fileForm 7200to obtain an advance credit of employment taxes. States have the responsibility of paying unemployment benefits to eligible workers who are involuntarily terminated . To fund this liability, states impose unemployment tax on employers. The tax is figured more like insurance because the rate that employers pay is based on their claims experience. The more claims made by former employees, the higher the tax rate on such employers. Each year, the state informs an employer of its tax rate, which can never be below a minimum amount.

Sales And Use Tax

Payroll taxes are federal, state and local taxes withheld from an employee’s paycheck by the employer. If an employee earned $4,000 a month in gross wages and $500 was withheld for federal taxes, then the total $4,000 would count as payroll costs. The employee would receive $3,500, and $500 would be paid to the federal government. However, the employer’s federal payroll tax obligation for the $4,000 in wages is excluded from payroll costs under the statute. The Medicare tax is a flat tax on all compensation income, which is located in box 5 of your W-2. Medicare tax is also deducted from an employee’s total compensation as payroll withholding each pay period. Employers must comply with many different types of local payroll taxes.

The charges paid by the employer usually cover the employer’s funding of the social security system, Medicare, and other insurance programs. These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers. Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers.

The Social Security tax is divided into 6.2% that is visible to employees (the “employee contribution”) and 6.2% that is visible only to employers (the “employer’s contribution”). For the years 2011 and 2012, the employee’s contribution had been temporarily reduced to 4.2%, while the employer’s portion remained at 6.2%, but Congress allowed the rate to return to 6.2% for the individual in 2013. To the extent an employee’s portion of the 6.2% tax exceeded the maximum by reason of multiple employers, the employee is entitled to a refundable tax credit upon filing an income tax return for the year. As employers, state agencies and institutions of higher education must deduct federal income tax from wages of a state officer or employee. FIT is computed based on current tax tables and on the designations and exemptions claimed by the employee on his or her W-4 form. Generally, most types of payments paid to employees by the state of Texas are considered to be subject to FIT, including base salary, longevity, hazardous duty, overtime and benefit replacement pay. Federal, state, and local withholding taxes are required in those jurisdictions imposing an income tax.

Employers having contact with the jurisdiction must withhold the tax from wages paid to their employees in those jurisdictions. Computation of the amount of tax to withhold is performed by the employer based on representations by the employee regarding his/her tax status on IRS Form W-4. In 2018, the Swedish social security contribution paid by the employer is 31.42 percent, calculated on top of the employee’s salary. The other type of Swedish payroll tax is the income tax withheld , which consists of municipal, county, and, for higher income brackets, state tax. In most municipalities, the income tax comes to approximately 32 percent, with the two higher income brackets also paying a state tax of 20 or 25 percent respectively. The combination of the two types is a total marginal tax effect of 52 to 60 percent.

State Disability Insurance (sdi) Tax

In some states there are cities, counties, and other local governmental units that impose their own income tax. If you do business in one of these localities, you may very well have an additional income tax withholding obligation. In addition to local income taxes, you may also find yourself paying local taxes measured by your total payroll or withholding local occupational fees from your employees’ wages. Therefore, you do not count any of the employer portion of FICA and Medicare taxes. You also do not reduce gross wages by the employee share of FICA and Medicare costs plus any federal income tax withheld. Form 941, which is an employer’s quarterly tax return reporting withholding and the employer’s share of FICA. For 2020, it’s also used to claim acreditfor employment taxes to cover payments by small and mid-sized businesses of mandatory sick leave and mandatory family leave, due to the COVID-19 pandemic.

There are a variety of payroll taxes, some paid by employers, some by employees, and some by both. Amounts of income tax so withheld must be paid to the taxing jurisdiction, and are available as refundable tax credits to the employees. Income taxes withheld from payroll are not final taxes, merely prepayments. Employees must still file income tax returns and self assess tax, claiming amounts withheld as payments.

The Federal Insurance Contributions Act tax is a federal payroll tax imposed on both employees and employers to fund Social Security and Medicare —federal programs that provide benefits for retirees, the disabled, and children of deceased workers. The definition of “payroll costs” in the CARES Act, 15 U.S.C. 636, excludes “taxes imposed or withheld under chapters 21, 22, or 24 of the Internal Revenue Code of 1986 during the covered period,” defined as February 15, 2020, to June 30, 2020. As described above, the SBA interprets this statutory exclusion to mean that payroll costs are calculated on a gross basis, without subtracting federal taxes that are imposed on the employee or withheld from employee wages. This interpretation is consistent with the text of the statute and advances the legislative purpose of ensuring workers remain paid and employed.

Check with your local tax department to see whether they collect any additional employer-paid taxes. The Federal Unemployment Tax Act , with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax.

Employers are allowed to deduct a small percentage of an employee’s pay (around 4%). That would reduce expenditures that count for forgiveness of debt and would also have impacted the maximum loan amount if the maximum loan measuring period being used included the period after February 15, 2020. All employers are required to withhold federal income tax from employees. The amount of tax is determined by the Form W-4 the employee fills out at hire or when the employee has changed status or wants to change the withholding amount.

Employers are required to deposit employment taxes and report these taxes on a quarterly basis in most cases. Employment taxes include withholding from employees’ paychecks to cover income taxes—federal and where applicable state and local—as well as the employees’ share of Social Security and Medicare taxes . They also include the employers’ share of FICA as well as federal and state unemployment taxes. The failure to properly withhold and deposit taxes can result in significant penalties for employers. The SBA explained that payroll costs are calculated on a gross basis without considering federal taxes, such as the employee’s and employer’s share of Federal Insurance Contributions Act and income taxes that are required to be withheld from employees.

The second kind is a tax that is paid from the employer’s own funds and that is directly related to employing a worker. These can consist of fixed charges or be proportionally linked to an employee’s pay.

Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education. State agencies and institutions of higher education must also honor an employee’s request to withhold more federal income tax than would otherwise be withheld under a given combination of income and exemptions. An amended W-4 filed by an employee must be put into effect no later than the beginning of the first payroll period ending on or after the 30th day after the form is filed with the employer.

All states, other than Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming which have no income tax and New Hampshire and Tennessee which do not tax wages, require employers to withhold state income tax from employees’ paychecks. Some cities, including New York City and Philadelphia, also have income taxes, which means additional wage withholding. Payroll taxes are required to be handled by employers who can be penalized if not done properly.