What Are The Best Payroll Service For One Employee Tools?

Content

The basic payroll plan starts at $10 a month, which is quite reasonable. If you want a full-service plan, you need to pay $25 a month, with $4 for each employee. Keep in mind, the more exemptions claimed, the less that the employee has withheld from his or her paycheck. However, that employee might owe money when it comes time to pay taxes. It’s the responsibility of the employer to accurately calculate payroll for his or her employees. Errors can result in employees having too much or too little of their pay withheld for taxes, Social Security, Medicare and other deductions, which causes an inconvenience for them at tax time. Miscalculations can also result in the company coming under review and possibly facing penalties by government agencies, such as the Internal Revenue Service.

This means less data entry work for you, more convenience for them, and an easier time for everyone. Businesses that aren’t ready for paid payroll software can save time and money doing payroll with Excel. You can get started with our free template, and all you’ll need to do is add your business’ and employees’ information. With the right formulas in place, tax and check payment calculations are done automatically. Payroll Software Main Window Payroll Tax FormsUse our payroll forms software to generate, preview, print and export payroll forms 941, 944, 940, W2 and W-3. IRS Tax Form 941 must be filed by employers on a quarterly basis with the IRS and identifies the amount of all wages on which payroll taxes were withheld and the amount of taxes withheld.

It has a free direct deposit option, as well as W-2 printing and an employee portal. Moreover, it takes care of all your taxes, from federal to local ones.

Further, the system stores payroll registers and all the information you need to file your taxes. This is a convenient method if you would like to set up and process payroll for the employee yourself.

How Do I Run Payroll Processing For Contractors?

Intuit Basic, for $20/month plus $2 per employee/month, will run your payroll instantly and calculate your taxes (but won’t go as far as filing those taxes for you). Their most popular package is called Enhanced, $31.20/month, which adds tax form completion, filing, and payment on top of that. And finally, their Full Service option will run payroll entirely, transfer data from other payroll services, and guarantee its accuracy — for just $79/month.

Payroll-related mistakes and delays are potentially costly for and damaging to your business. In general, we don’t recommend free payroll processing systems for employers with more than one or two employees. Paying your employees the right amount—and withholding the right amount in taxes—is a big, complicated deal, and paid software is more secure and effective than free options. With over 400 reviews that give it 5 stars,Patriot is a basic service with plenty of features.

So although you have to pay for payroll software, the return on your investment is, by and large, worth it. By freeing up resources and avoiding legal pitfalls, you can focus your time and energy on growing your business and hiring great employees. However, we recommend using Excel for payroll only if you have 15 or fewer employees and you’re confident in your document organization skills. While spreadsheets can help you calculate payroll taxes, they can’t guarantee that those calculations are accurate. If you can afford it, we recommend using cheap self-service plans from payroll providers like Wave, SurePayroll, or Patriot Software. All three options give you a solid organizational system, accurate tax calculations, and accounting software integration to make bank reconciliation super easy.

Best Payroll Service For One Employee Tools

Employers can also use the employee notes field inside Payroll Mate to track garnishment orders and receipt dates, which is very useful for larger companies. Supports Form 943-A (Agricultural Employer’s Record of Federal Tax Liability). A fringe benefit is a form of pay for the performance of services.

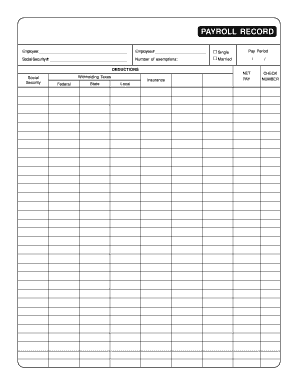

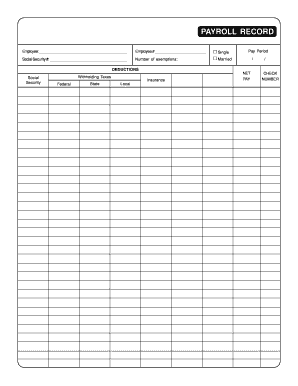

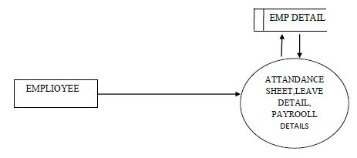

Depending on your business, you’ll need most of the information on this checklist to complete the paperwork and pay your new hire. Your employee will have to provide some information on a Form W-4 and direct deposit request form. The rest will come from your records or federal and state agencies. Payroll Reports New Payroll CheckWhen processing payroll, users of automated payroll system can enter and edit employee hours and other payroll data using the new payroll check dialog. The dialog includes sections of incomes, taxes and deductions along with year to date information for payroll totals.

The user can also specify the new check number, pay date and beginning and end data for this payroll run. Our payroll system gives agricultural businesses everything they need to manage payroll for farm / ranch workers and labor contractors. Through Payroll Mate ranchers and farmers can file IRS annual tax form 943, pay workers a salary / per hour/ per piece or custom add any type of payroll income that fits their business model. Set up a separate bank account for writing paychecks or paying through employee direct deposit. You’ll also need this account for depositing funds you collected from employees for federal and state income tax and for Social Security and Medicare taxes and other amounts.

For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work. Fringe benefits are defined by IRS Publication 15-B (Employer’s Tax Guide to Fringe Benefits). This tax is reported to the IRS through form 940 (Employer’s Annual Federal Unemployment Tax Return). Payroll Mate® calculates, tracks and reports FUTA tax on form 940. By using our payroll database software this time is reduced to a few minutes. Full-service and self-service payroll systems can save small businesses time and effort. In general, paying your employees, managing their benefits, and filing payroll taxes correctly and on time is tricky and time-consuming.

Top 10 States With The Best Pay

You can also use it to pay employees via direct deposit at no additional cost. When choosing payroll software, employers must consider their business needs. Some services are simpler if you’re only paying yourself, while others offer more value if you’re paying additional workers. The business’ structure benefits you want to access, and available software integrations should all be considered when choosing a payroll provider. Although cost is also a top factor—for many, it’s No. 1—so it’s essential to analyze all the needs of a business before making a final decision.

- Please contact us for more details (please remember that 1095-C reporting is mainly needed by employers with 50 or more full time employees).

- Good payroll services make it easy and support employers with tax law compliance.

- Payroll Mate 2021 automatically calculates net pay, federal withholding tax, Social Security tax, Medicare, state and local payroll taxes.

- When processing payroll for yourself vs employees, choosing the right business structure is key to minimizing taxes.

- Determining how much and how often to pay helps with managing profitability and cash flow, which is why setting up a self employed payroll system is important.

The steps for doing payroll with software are very similar to doing it without; it’s just much easier and faster. You’ll enter all the information for your company and employees electronically, and the paycheck amount and deductions calculate automatically. Most payroll software will even allow you and your employees to complete payroll forms completely online—some will even submit them to the IRS for you. For most small business owners who don’t want to take on the various steps involved in how to do payroll such as calculations or tax deductions, we recommend using a service such as Gusto. It not only makes employee onboarding much faster but lifts a huge burden when it comes to calculating payroll taxes and sending funds to government agencies.

Checkout These Payroll Service Features

You can set up payroll for one employee using payroll software, such as Quickbooks or an accounting software with a payroll feature attached. Using payroll software allows you to simply enter the relevant information for the employee, such as name, Social Security number, address, pay rate, pay frequency and tax data.

This will ensure accuracy of W2 forms, W3 forms, 940 forms, 941 forms and all other reports created. Supports wage garnishments where the employer is required to withhold a certain amount of an employee’s income and forward it to a third party. Examples of garnishments include child support , student loan garnishment , federal income tax levy (ordered by the IRS by sending form 668-W) and county tax garnishments. Unlike other payroll systems, Payroll Mate supports multiple wage garnishments for the same employee at the same time.

This software also supports user-defined Income, Tax, and Pre-tax / Post-tax Deduction categories making it very flexible and powerful. Our payroll system works with different accounting software including Intuit QuickBooks, Sage Peachtree , Quicken, Microsoft Accounting and more.

If you’re comparing pricing to features, Gusto offers the best small-business payroll software. Starting at $19 a month, Gusto calculates and files your payroll taxes, helps with workers comp administration, and lets you build paid time off policies for your employees. Gusto’s online payroll service is popular enough to sync with most accounting software options.

Form W-2 lists the various types of income paid by the employer to the employee and the amounts of taxes withheld during the past calendar year. Why pay $200 a month to a payroll service company when you can spend only $139 a year for all your payroll needs? Most payroll services calculate employee pay and taxes automatically and send your payroll taxes and filings to the IRS and your state’s tax department for you. With a full-service provider like Square Payroll, you can even keep track of hours worked, import them directly to your payroll, and pay employees by direct deposit. Payroll Mate® allows the user to go back to the first of the year in order to recreate payroll. This will allow one to get up to date for tax filing and report generations. Therefore, if someone was to purchase this small business payroll solution in the middle of the user will be able to enter in all the checks created or written for employees.

Manage Expenses With Quickbooks Employee And Payroll Reports

When processing payroll for yourself vs employees, choosing the right business structure is key to minimizing taxes. Determining how much and how often to pay helps with managing profitability and cash flow, which is why setting up a self employed payroll system is important. Good payroll services make it easy and support employers with tax law compliance. Please contact us for more details (please remember that 1095-C reporting is mainly needed by employers with 50 or more full time employees). Employee data can be easily exported from Payroll Mate to 1095 Mate (the 1095-C / 1094-C system). Payroll Mate 2021 automatically calculates net pay, federal withholding tax, Social Security tax, Medicare, state and local payroll taxes. Payroll Mate also supports different types of payroll pay periods, prints checks, prepares payroll forms 941, 943, 944, 940, W2 and W3.