What Does My Accountant Need To File Business Taxes?

Content

LLCs are pass through entities that reflect on your personal situation. That means other sources of income such as W-2 can play a big role in your overall tax strategy. What tax strategies are best for you will likely be completely different from lower income earners. If you are filing with a single status, you have to file taxes if your income exceeds $12,400 a year.

An accountant can help small business owners follow financial rules and regulations, explain financial statements, oversee payment processes, help them file their taxes correctly, and more. One of these tax credits is the Work Opportunity Tax Credit (WOTC). Certified business owners can claim the WOTC as a business credit against income taxes.

Should Your Business Hire An Accountant?

If you have outstanding invoices, for instance, you won’t pay taxes on this revenue until payment has been received. But that doesn’t necessarily mean that cash-basis accounting is the right choice for you. Accrual accounting may have tax implications, but it also has a host of other benefits, such as higher accuracy and better long-term cash flow tracking. If you’re unable to pay your tax bill, you shouldn’t avoid filing your taxes. Not only will you owe more in penalties and interest, but failing to pay or respond to the IRS could result in tax liens and wage garnishments.

- FreshBooks accounting software offers a wide range of accounting services so you can keep track of your own business expenses and profits.

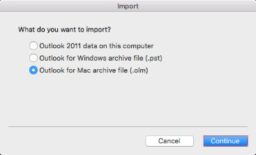

- Hiring an accountant will allow them access to all of their systems so they can handle everything from payroll processing to tax filings without you having to worry about key issues.

- Those who made just a few critical mistakes along the way and are just now reaching out for help.

- With the example above, the income from that project would be taxed in 2020 even though you won’t receive it until 2021 under the accrual method.

The pay of accountants might vary depending on location, industry and seniority. Bookkeepers keep track of all financial transactions within an organization so that everything can be accounted for accurately at all times. Chances are they’ve seen it before (and maybe even worse), and they’re excited to dig in and help solve your problems. So if you’re still asking yourself if you need an accountant or CPA for your small business, you might want to ask yourself if you can afford not to have one.

Estimated Taxes

Hiring an accountant part-time can save you some money, and it might be all you really need. Ever been in a meeting and someone said “how about we get the bean counters in here for their advice before we make a decision? When it comes to decisions involving the future of your small business, your accountant may sometimes be your best resource. Pricing of popular accounting software bookkeeping for llc typically ranges from $0 (free forever plan) to $30 per month. If you need help with accounting for your LLC, you can post your legal need on UpCounsel’s marketplace. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

- You can easily access transactions, separate business and personal expenses, and maintain accuracy when filing your tax return.

- Using tax advantaged retirement accounts like SEPs and Roth IRAs is a wonderful tax strategy, but unfortunately makes things more complicated.

- Ever been in a meeting and someone said “how about we get the bean counters in here for their advice before we make a decision?

- When your LLC starts becoming more profitable you should start pursuing a better tax strategy with an accountant.

- They don’t know if they’re actually “in business” because their business activity is fairly minimal at the get-go.

- Every small business owner gets to the point where they worry about the tax implications of their business, as well as having to handle accounting and other obligations.

She is the founder of the Small Business Bonfire, a community for entrepreneurs, and has authored more than 2,500 articles for The Balance and other popular small business websites. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. Help us to improve by providing some feedback on your experience today.

CPA vs. Accountant vs. Bookkeeper [Compared]

Chances are, you’ve got other things to focus on anyway, like selling your product or service. However, there are very user-friendly accounting software systems out there, which are meant for people without accounting experience. You want a program that can easily keep track of your invoices and expenses, as well as generate income statements and other reports.

Is an accountant necessary for a business?

You'll need an accountant to help with the finances

Small business accounting can quickly become complex if you do it on your own. If you feel you're losing control of who owes you money and how much, an accountant can help you get back on track.